Gold has hovered between $1,236 and $1,246 so far today…as of 7:30 am Pacific, the yellow metal is flat at $1,242…Silver is off a nickel to $20.15…Copper has shed a penny to $3.34…Crude Oil is down slightly to $94.06 while the U.S. Dollar Index is off one-tenth of a point to 80.96…

2014 is considered the year of the horse in China, and horse-related Golden products are apparently posting massive sales in China before the start of the Lunar New Year on January 31…according to Mineweb’s Shivom Seth, in an article posted this morning (www.mineweb.com), Chinese language newspaper Beijing News has reported that Gold sales had surpassed 10 million yuan ($1.7 million) per hour in China, after Cai Bai jewellers in Beijing opened to a scintillating start on January 1, setting a new record…Cai Bai is touted as one of the largest Gold jewellery chain stores in Beijing…it reported sales of 200 million yuan (about $33 million) on December 31, 2013, while China Gold’s flagship store at Jiang Zhaikou sold more than 150 kilograms of Gold on the same day…Sun Gold Jewellers noted that since Gold prices slid in December, sales have grown significantly at its many stores…sales surged by at least 30% in December 2013 from a month earlier, and were up by 25% as compared to the same period in 2012, the retailer stated…

Today’s Markets

Asian markets were mixed overnight…China’s Shanghai Composite finished relatively unchanged at 2024, while Japan’s Nikkei average slipped 62 points despite some upbeat economic data…European shares are mixed in late trading overseas…

In North America, the Dow is off 43 points through the first hour of trading after jumping more than 100 points in each of the past two days…the Federal Reserve said in its Beige Book published late yesterday that the U.S. economy continued to grow at a moderate pace from late November to the end of 2013, with some regions of the country expecting a pick-up in growth…

The TSX is down 18 points as of 7:30 am Pacific while the Venture has slid 3 points to 973…

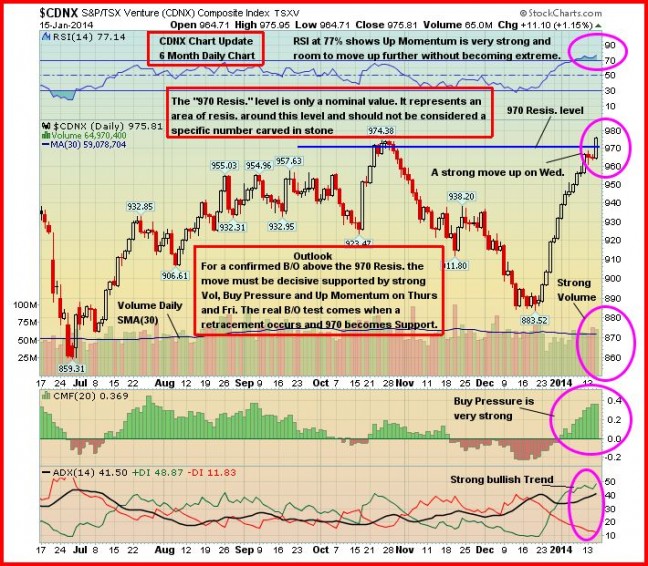

Venture Chart Update

The Venture is on the cusp of a major technical breakout after yesterday’s 11-point gain to close at 976…confirmation of a breakout, however, is still required, and there are several factors that are part of that equation as John outlines in this 6-month daily chart…tomorrow’s weekly close will be important – it would be encouraging and very bullish to see a decisive move through the 970’s on increased volume to finish the week…we’ll let the market speak and tell us what it wants to do…investor patience, as always, is critical…

Other signs that are encouraging – two companies announced major financings yesterday…Simon Ridgway’s Cordoba Minerals Corp. (CDB, TSX-V), in the process of closing a key Colombian acquisition, has engaged a syndicate of agents, co-led by GMP Securities LP, Dundee Securities Ltd., BMO Capital Markets and including Clarus Securities Inc., to complete a $12 million financing at 50 cents…meanwhile, Nicorp Developments Ltd. (NB, TSX-V) has arranged a non-brokered private placement of up to 50 million common shares of the company at a price of 20 cents per share to raise gross proceeds of up to $10-million…the funds will be used to conduct further exploration and development of the company’s Elk Creek Niobium Project in Nebraska…

Big North Graphite Corp. (NRT, TSX-V) Updated Chart

Big North Graphite (NRT, TSX-V) is raising money and ramping up its activity on the graphite front in Mexico, so this is certainly a play to watch closely as 2014 unfolds…the stock staged an important breakout above resistance at 6 cents at the end of December and soared as high as 10 cents (resistance) January 3…since then, it has staged a normal retracement with strong new support between 6 and 7 cents…below is an updated 2.5-year weekly chart from John…

Fission Uranium Corp. (FCU, TSX-V) Updated Chart

Fission Uranium (FCU, TSX-V) rose 4 cents yesterday on its best volume day since October after the company released results from six more holes covering two high- grade zones (R390E and R780E) that remain open in all directions at its Patterson Lake South discovery…with 100% ownership of PLS, FCU is primed for an eventual takeover which is why investors should remain patient with this opportunity…support around $1 has held nicely, while FCU should gain some immediate momentum if it can overcome near-term resistance at $1.15…below is an updated 6-month daily chart from John…buy pressure has picked up this month as shown by the CMF indicator…FCU is up another 4 cents to $1.12 as of 7:30 am Pacific…

Critical Elements Corp. (CRE, TSX-V) Updated Chart

Further to John’s most recent chart (Jan. 8), Critical Elements Corp. (CRE, TSX-V) is picking up steam…as stated Jan. 8, “Technically, the key for CRE is to push above a stiff resistance band between 24 and 25 cents…the RSI(14) and other indicators on this 2.5-year weekly chart suggest an attempt will be made to overcome that resistance”…indeed, that’s exactly what’s unfolding as CRE is up half a penny to 23.5 cents through the first hour of trading today…there’s quite a bit on the offer at 24 and 25 cents, underscoring the stiff resistance in the mid-20’s…CRE continues to develop its Rose Tantalum-Lithium Project in Quebec, and recently reported improved recoveries of tantalum in metallurgical testing are highly encouraging…as always, perform your own due diligence…

Platinum Group Metals Ltd. (PTM, TSX)

Platinum is expected to be a hot commodity in 2014, and one company in that space which is very worthy of our readers’ due diligence is Platinum Group Metals (PTM, TSX)…the company completed a monster financing ($175 million) at $1.18 per share to finish 2013, just a few weeks after reporting impressive assay results from drilling at its Waterburg Extension Project in the prolific Bushveld Complex (South Africa)…

Below is a 3.5-year weekly PTM chart from John…note the very impressive long-term rising RSI trendline…the key “breakout” area to keep an eye on is in the mid-$1.40’s…excellent possibilities for 2014, geologically and market-wise…PTM is down a penny at $1.28 in early trading today…

Note: John, Jon and Terry do not hold share positions in FCU, NRT, CRE or PTM.

6 Comments

ggi news out

Glad I bought ggi at 11cents a few days ago

Gil, just what we were all hoping for and even better at this point with GGI – this is going to run as January progresses and the drill keeps turning. Action and plenty of room for speculation/anticipation. Second paragraph is the most interesting: “Each of the holes has cut significant intervals of quartz veining similar to that which yielded gold values of as much as 28.4 g/t over 1.3 m and 7.5 g/t over 6.4 m in channel sampling recently carried out by Garibaldi. Core samples have been sent to the laboratory and results are pending.” More in the AM.

DBV has been halted!

Indeed, Paul, we’re slightly delaying Morning Musings as a result to check into this, but we strongly suspect they’ve got a “hit” up at the Sheslay…this could really light a fire under GGI and PGX, and cast a whole lot more eyes on the Sheslay area…

pst and ggi moving….don’t forget about ‘abr’ if dbv hits…abr is right next door!