Gold has traded between $1,364 and $1,377 so for today after breaking above critical resistance at $1,350 yesterday…as of 8:00 am Pacific, bullion is up $1 an ounce at $1,368…Silver is off 9 cents at $21.23…Copper is relatively unchanged at $2.95 (see chart below)…Crude Oil is up slightly at $98.15 while the U.S. Dollar Index has fallen one-quarter of a point to 79.39, closing in on critical support at 79…

UBS on Gold: “Concerns that current issues in China could morph into something more sinister for the economy and continued tensions between the West and Russia are helping Gold make the most of its role as an insurance against tail risks. Gold prices continue to head north in the slow and orderly fashion that has been evident so far this year.”

According to HSBC, Silver is likely to trade in a range between $17.75 and $22.75 for the rest of 2014 as the global Silver surplus widens to around 156 million oz this year…the group’s latest Silver outlook publication cites three main trends that are likely to drive the market this year: a) Supply remaining strong; b) Investment demand making a modest recovery; and c) Pick-up in demand from industry and jewellery…

Updated Gold Chart

Below is a 2-year weekly Gold chart update from John after yesterday’s important move…next major chart resistance is $1,400 while the next Fib. resistance level (38.2%) is $1,430…bullion recently broke above a short-term downtrend line which was bullish…take note of the long-term downtrend line on this chart going back to late 2012 – it appears Gold is ready to stage a confirmed breakout above this area which is significant…buy pressure is modest and there is strong support around $1,300 where the 50 and 200-day moving averages (SMA’s) coincide…

TSX Gold Index Chart Update

This 10-year monthly TSX Gold Index chart points to a probable reversal in the TSX Gold Index, not surprising given the fact that there is already a confirmed reversal in the Venture which historically makes critical moves prior to the Gold Index…the important level to watch with regard to the latter is 210…the Index is up a point at 208 as of 8:00 am Pacific…

Updated Copper Chart

The extent of the drop in Copper since last Friday has been somewhat perplexing, but very oversold conditions have clearly emerged…weakness in Copper started around mid-February and has coincided with a nearly 7% drop in China’s Shanghai Composite which has bounced off very strong support…Copper could be putting in an important bottom, and the Venture has shrugged off the plunge in this important metal which is encouraging…

Today’s Markets

Asia

China’s Shanghai Composite gained 21 points overnight to close at 2019 despite some weaker-than-expected economic data…the country’s combined industrial output for January and February rose 8.6% from the year ago period, below a Reuters’ forecast for a climb of 9.5%…meanwhile, combined retail sales for the period were up 11.8% on year, missing Reuters’ expectations for an increase of 13.5%…

Japan’s Nikkei was just down slightly overnight, closing at 14816…

Europe

European markets are mixed in late trading overseas…

North America

The Dow is down 44 points as of 8:00 am Pacific… first-time weekly jobless claims in the U.S. fell by 9,000 to a seasonally adjusted 315,000 during the week to Saturday, the Labor Department said this morning…the total was a three-month low and below consensus expectations that were for around 329,000 to 335,000…despite more cold weather, U.S. consumers managed to hit the malls in February, according to data from the U.S. Census Bureau…the bureau reported this morning that advanced February retail sales increased 0.3% on a seasonally adjusted basis, from January’s revised decrease of 0.6%…economists were generally forecasting an increase around 0.2%…February core retail sales – excluding autos – rose 0.3%, up from January’s flat reading of 0.0%…

The TSX has shed 23 points through the first 90 minutes of trading while the Venture is off 6 points at 1041, 6 points above its rising 10-day SMA which has been providing strong support…

“Hang On To Your Hat”: Doubleview Capital Corp. (DBV, TSX-V) Gears Up For More Drilling To Follow Up On Cu-Au Porphyry Discovery

With the clear potential for several major deposits over a very broad area, the Sheslay Valley in northwest British Columbia is an incredible geological story that the world is about to discover in the coming months as the most aggressive drilling ever is about to place there…this is Canada’s first significant area play following a horrendous 3-year bear market in the junior resource sector, and bolting out of the starting gate first on the drilling front in the immediate future is Doubleview Capital (DBV, TSX)…

Since any company is only as strong as the people behind it, it’s also critical to understand that the key reason the Sheslay Valley is emerging as B.C.’s next major mining camp is because of all the special individuals who are involved in this play and the unique skill sets they bring to the table…a prime example, without question, is Doubleview President and CEO Farshad Shirvani whose boldness, conviction, determination and courage have energized the entire camp to kick off 2014…his actions, and the results he has delivered, have understandably made believers out of many investors…this is an individual who overcame immense challenges last year to drill 11 holes at the Hat Property, several of which have “boxed” in a discovery area one km wide that holds tremendous potential for expansion laterally and at depth…

A “Hat Trick” Coming At The Hat? – A Minimum Of 3 Large Target Areas So Far

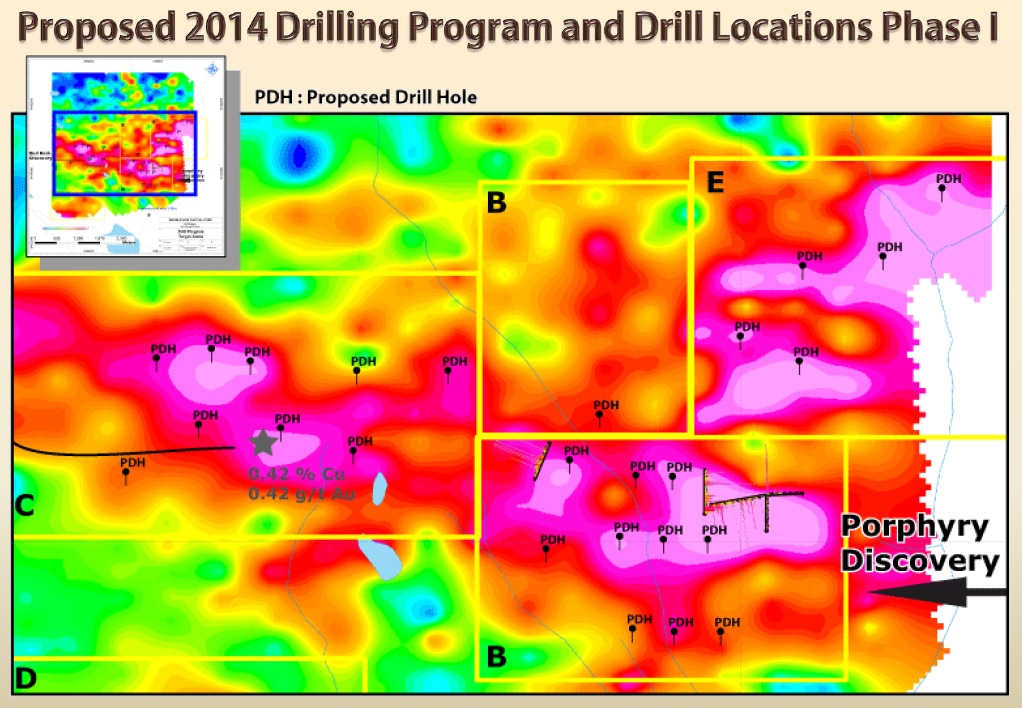

In the upcoming second part of our special report on Doubleview, we’ll examine in some detail the many targets at the Hat, and the opportunities and challenges for DBV, based on our discussions with several geologists and others…below is a map taken from DBV’s PowerPoint presentation on its web site, and you can see that there is no shortage of targets over a section of the property that covers approximately 12 sq. km…DBV’s immediate priority is to try to get a better understanding of the shape of this potential significant deposit, and initially they’ll be going after the area around discovery holes HAT-11 and Hat-08 at Anomaly “B” (hole #11, the last one drilled before extreme weather conditions forced crews off the site, intersected mineralization from the top of the hole to the bottom, 313 m grading 0.32% CuEq with higher grades at depth)…

Keep in mind that drill results at the Hat have shown steady improvement, always a positive sign, and one has to consider the prospects of immediate success in this upcoming third round of drilling to be very favorable given a greater understanding of this system that does exist after a careful review of all the data to date…Shirvani’s specialty is in modeling deposits, and he has the help of several very capable advisers including highly regarded veteran geologist Eric Ostensoe…DBV is showing both aggressiveness and astuteness on the ground – factors that are sure to keep interest in this play very high going forward with strong exploration upside potential in an emerging world class district…DBV is off a penny at 28 cents on light volume as of 8:30 am Pacific…

Ryan Gold Corp. (RYG, TSX-V) Updated Chart

Heavy accumulation continues in Ryan Gold (RYG, TSX-V) which finished 2013 with $21 million in cash and is looking for new opportunities after essentially pulling out of the Yukon…this is a solid-looking chart with strong support at 14 cents, half a penny above the rising 100-day SMA…big volume day yesterday as it closed up a penny-and-a-half at 16 cents…

Note: John and Jon both hold share positions in DBV.

42 Comments

Hi BMR,

Have you guys looked at V.NCG? They have 1.5mil oz gold grading 5,6 g/t. They look very intresting. Can you guys look into it and publish a technical chart?

Thanks in advance

Brgds

looks like AIX is going to slide back today

RYG.v luv the chart

clearly a cup & handle in the making

Aix’s price got ahead of itself. I am a buyer at 3 cents.

there seems to be support @.04 AIX

@Brian. My gut is telling me that it’s going to go below .04. There is still a lot of work to be done by AIX, therefore the smart investor/speculator is not going to jump in at this moment. They’ll wait it out and see how management proceeds. That’s the way I see it. But I’ll say this for them, they sure grabbed some great property.

With AIX Hacket North Project sitting right on Doubleview and the latter drilling soon then waiting for 3 cent AIX shares might not work ….

@Fred: You make a good point, but this is how I see things moving forward (By the way, I don’t want anybody taking what I write as investment advice) AIX is still a speculative play in my opinion; DBV is now an investment. Why put your money in AIX when you can put your money in DBV, which has proven what it has on its property. It’s a much safer investment, coupled with the fact that they will be drilling any day now, you will get a bang for your buck in a shorter timeframe. I believe that money will come out of AIX now and move into DBV. Also, if the situation in Ukraine and China gets out of hand, expect the stock market to move lower- keep that in mind. But I’m still keeping an open mind on your and Brian’s theory.

@Chris

well somebody is jumping in and buying a lot of AIX over the last week, must all be a bunch of dumb investors/speculators though, I find all of these people that bought into DBV early on at 5-6 cents think that was not risky as they all new DBV was going to hit… give me a break, all jrs are speculation period!!

good luck to everybody

Bert!! Where are you?? Nice move on Precipate, up 50%.. since you became AWOL!!

Greg- I guess i am one of those, refered to as…. dumb speculators/ investors.Time will tell!! Cheers. Bert.. Sorry..Precipitate.

GGI News on Stockwatch

Greg, yes Juniors at one point are all speculative but some have de-risked the investment (DBV) to some degree. Farshad is all in with this company and has only sold shares to bring money back into the company, he had and has only one focus and thats the Hat property. The only thing that concerns me about AIX is what exactly is their focus not too long ago (Nov2013) they were looking at getting involved in BITCOIN and then dropped it, now they pick up property along DBV and others in the area. A total of 7 million shares are held but all the insiders out of 50 million currently trading. There has been insider selling lately which further peeks some concern. It’s not to say that AIX wont move but at this point in my opinion there isnt a lot there to convince me to invest in AIX.Yes some are buying into AIX but that also happened with BKT, CKR, TAJ and other companies where millions of shares where traded and moved up a penny or two but eventually dropped back under a nickle, I’m not saying this is whats going on with AIX but to say some are picking up shares there better be more than that for logic in buying AIX. These are just my observations, at the end of the day I can gurantee you that DBV will be drilling can the same be said for AIX??

Garibaldi broadens mineralized corridor at Grizzly, prepares to accelerate 2014 exploration plans

PR Newswire Garibaldi Resources Corp. 1 hour ago

TSXV: GGI

OTC: GGIFF

Frankfurt: RQM

VANCOUVER, March 13, 2014 /PRNewswire/ – Garibaldi Resources Corp. (GGI.V) (the “Company” or “Garibaldi”) is pleased to report that recent reconnaissance work carried out over western portions of its Grizzly Property in the Sheslay Valley, northwest British Columbia, has identified a new zone of porphyry copper mineralization 3 km south of its Grizzly West porphyry target and 3 km west-southwest of Prosper Gold Corp.’s Pyrrhotite Creek prospect in an area referred to as West Kaketsa. Garibaldi is the largest landholder among juniors in the Sheslay district and controls approximately 26,200 hectares in claims. The results of this program suggests potential to significantly broaden a NW/SE trending corridor of porphyry targets that extends for over 30 km through the Sheslay Valley from the western end of the Grizzly Property through Grizzly Central to the recently announced Grizzly East expansion claims.

Given highly encouraging results in the western and central parts of the Grizzly Property, Garibaldi is accelerating its 2014 plans at the Grizzly by launching an aggressive Phase 1 exploration program to include detailed mapping, geochemistry, IP surveys and drilling. The initial stages of this work will commence in the next few weeks and the results will determine the scale of a planned Phase 2 program. Garibaldi is in a strong working capital position and is looking forward to advancing the Grizzly Project concurrently with its assets in Mexico.

“The importance of the discoveries recently announced by Prosper Gold and Doubleview Capital Corp., located approximately 10 km apart on properties within the Sheslay corridor, is the scale of mineralization over such wide distances. Confirmation of another significant porphyry target area several km south of Grizzly West underscores the world class potential of this growing mineralized Cu-Au porphyry corridor in the Sheslay Valley,” explained Steve Regoci, Garibaldi President and CEO. “Garibaldi has captured more than 50% of this very prospective corridor with multiple targets already identified from Grizzly West to Grizzly Central through geophysical and geochemical surveys. We’re very excited about advancing the Grizzly to a first-ever drilling stage.”

West Kaketsa Mineralization Similar To Grizzly West, Pyrrhotite Creek

The extent of the newly discovered mineralized area at West Kaketsa is yet to be determined but it’s located approximately 1 km north of the historic West Kaketsa prospect (B.C. Minfile # 104J-024) and appears to be related to a fault that extends at least 3 km to Pyrrhotite Creek on the eastern flank of Mount Kaketsa. Garibaldi’s upcoming program at the Grizzly Property includes plans to further define this new zone with IP surveys and identify potential drill targets.

Petrographic analysis of mineralization from both the West Kaketsa and Grizzly West prospects has confirmed that both areas exhibit classic porphyry-style copper-gold mineralization including hydraulic brecciation, disseminated chalcopyrite and intense alteration within a hydrothermal environment. Garibaldi’s reconnaissance work identified the new mineralized zone while following up on an encouraging airborne magnetic and radiometric survey completed last fall over western portions of the Grizzly Property.

The airborne survey confirmed that West Kaketsa, like Grizzly West, is in a region of strong magnetic activity and structure, the latter indicating faults and fractures in the intrusive bodies favorable for mineralizing fluids along the contact zones of the Mount Kaketsa monzonite granodiorite stock. Historic technical reports describe porphyry mineralization at West Kaketsa as being similar to mineralization observed at Pyrrhotite Creek. Prosper Gold has reported that Pyrrhotite Creek is a large mineralized zone with multiple porphyry targets located 3 km southwest of the Star porphyries in the SW corner of its Sheslay Property adjoining the Grizzly.

Grizzly West

Last fall’s airborne survey shows that Grizzly West is on the periphery of a large magnetic anomaly, in a similar setting to targets on the adjoining Sheslay Property. A soil geochemical survey has defined several strong copper anomalies open in multiple directions at Grizzly West with the grid covering an area approximately 1.5 km x 1.5 km. Fieldwork at this target has confirmed historical reports (Corona Resources) of mineralization with reported grades ranging from 0.20% Cu to 6.7% Cu in rock chip samples.

Maps – West Kaketsa & Grizzly West

Maps showing location, sampling areas and full results from recent work completed at West Kaketsa and Grizzly West are available on the Garibaldi web site…

To view a 2.5-minute video on the Grizzly Property and the Sheslay Valley, please visit the following URL: Garibaldi Resources -> Investors -> Media -> Why GGI? In 90 Seconds

Qualified Person

Carl von Einsiedel, P.Geo., a non-independent geological consultant and a Qualified Person as defined by NI-43-101 has reviewed this release and approved the content thereof.

We seek safe harbor.

GARIBALDI RESOURCES CORP.

Per: “Steve Regoci”

Steve Regoci, President

Neither the TSX Venture Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or the accuracy of this release.

Thoughts on Ggi news Jon. Sounds like they ready to strike while the irons hot!!! Should get exciting fairly quickly! And a new target as well

Hs, it’s obviously Game On at the Grizzly. Lots to digest here, we’ll sort through it for tomorrow morning. Some quick thoughts. #1 – They’re definitely getting aggressive. Detailed mapping, geochemistry, IP surveys and drilling for Phase 1 starting shortly—-that’s easily $1 million + for that kind of program, followed by Phase 2 which will likely be much bigger. #2 – They’ve broadened the corridor which is really important. There’s definitely a tie-in here between West Kaketsa and Pyrrhotite Creek, and there is plenty of geological evidence to suggest there’s a major discovery unfolding there. #3. I’m surprised they didn’t emphasize Grizzly West more, that’s looking like an exceptional and large porphyry target given the geochem anomaly they reported and the mag data to back it up. No details on Grizzly Central but I’m sure that’s a whole separate news release by itself. GGI is delivering on the Grizzly. I’m confident they’ll do the same on Mexico. With this plus DBV drilling shortly—-AIX on the hunt, Prosper getting fired up——-it’s all good for the entire area. Things are going to heat up.

@Greg: Where did you come up with the “dumb/speculators”? I never called anybody that. And for the record, I bought DBV at .045/.05 (100.000 shares, and still haven’t sold any)during the second drill campaign. AIX hasn’t drilled, and I believe they need to raise money(you guys can correct me if I am wrong on that). That is why it’s not a buy for me at this moment. No need to get defensive, Greg. I wish you luck in you investment.

Aix has a pp at five cents in the works. Not sure if they have drilling permit yet though

AIX: MONEY GOING TO BC PROPERTY! Alix Resources Corp (2) (C-AIX) – News Release

Alix Resources arranges $250,000 FT private placement

2014-03-13 12:47 ET – News Release

Shares issued 54,018,269

AIX Close 2014-03-12 C$ 0.05

Mr. Michael England reports

ALIX ANNOUNCES FLOW THROUGH FINANCING

Alix Resources Corp. has arranged a non-brokered flow-through private placement of up to five million flow-through units at a price of five cents per flow-through unit for total gross proceeds of $250,000. Each flow-through unit will comprise one common flow-through share and one share purchase warrant of the company. Each warrant entitles the holder to purchase an additional non-flow-through share at a price of 7.5 cents per share for a period of 18 months. Proceeds will be used for the spring and summer work programs on the company’s properties located in the Sheslay Valley district of northwest British Columbia.

I think ABR and AIX could both do very well with leaders in the area starting to get aggressive very shortly!

@Paul

Like I said it is very easy for you to say now how great an investment DBV is now but there is no way you knew that they were going to hit before it actually happened, the guys at BMR did not even think enough of them to inform their readers to take a look, you were mentioning them and congratulations for you, but all I am saying is all the DBV people that got in early are basically bashing everyone else in the Sheslay valley like DBV is the only company that is going to be successful, I am not asking you or anyone else to invest in any of the other companies, you believed in DBV before they were successful and others believe and speculate in other companies as well, wish you the best..

@ Chris

you said this above: Brian. My gut is telling me that it’s going to go below .04. There is still a lot of work to be done by AIX, therefore the smart investor/speculator is not going to jump in at this moment. They’ll wait it out and see how management proceeds. That’s the way I see it. But I’ll say this for them, they sure grabbed some great property.

Comment by Chris — March 13, 2014 @ 8:56 am

so the smart investor speculator will wait, so that makes me and everyone else including BMR dumb since we have already invested some of our money in AIX? To each his own… wish you and all of the DBV gang much success, BTW I do own some DBV I just was not smart enough to buy it earlier…

Greg you’re right I didnt know if they would hit but I did my dd and felt it was worth the risk. Trust me I have looked at aix but as I mentioned before in my opinion it hasn’t convinced me to buy. You’re also right, I did bring it up to the attention of BMR but I was dismissed but no big deal, it took a while but they figured things out. Greg you have to realize I’m not bashing aix I’m just providing my opinion on the property as much as you are about buying it. I’m my opinion right now DBV is leading this group, it was great to see ggi come out with news that they’re moving things forward which will add to the excitement in the area, personally I like to invest in companies that will actually drill and if you know aix mgmt they typically don’t go that far, the play the closeology game.

@Greg, further to my comments on Aix I see they just announced a pp for proceeds of 250,000 how much drilling do you think will get done for that, the money they are trying to raise is for the spring and summer, so that doesn’t say much of what will happen this year, but of course with Dbv, ggi and pgx drilling they may get some movement.

Paul. Where did you get that aix news about 250k pp. nr I’m reading says 500k

marketwired.com/press-release/alix-increases-land-position-at-sheslay-tsx-venture-aix-1879143.htm

Hs I read it on stockwatch, here’s the article

Alix Resources Corp (2)

Symbol C : AIX

Shares Issued 54,018,269

Close 2014-03-12 C$ 0.05

Recent Sedar Documents

View Original Document

Alix Resources arranges $250,000 FT private placement

2014-03-13 12:47 ET – News Release

Mr. Michael England reports

ALIX ANNOUNCES FLOW THROUGH FINANCING

Alix Resources Corp. has arranged a non-brokered flow-through private placement of up to five million flow-through units at a price of five cents per flow-through unit for total gross proceeds of $250,000. Each flow-through unit will comprise one common flow-through share and one share purchase warrant of the company. Each warrant entitles the holder to purchase an additional non-flow-through share at a price of 7.5 cents per share for a period of 18 months. Proceeds will be used for the spring and summer work programs on the company’s properties located in the Sheslay Valley district of northwest British Columbia.

The private placement is subject to TSX Venture Exchange acceptance. Finders’ fees may be payable on the private placement, subject to the policies of the TSX-V.

© 2014 Canjex Publishing Ltd. All rights reserved.

I think you have to take a shot at AIX/ABR which are cheap down here and have more upside going into Spring/Summer programs from these levels. If Aix was 20 cents already, then maybe it would have risk; but at under 5 cents, it makes sense that it can go up from here. Yes, I agree BMR missed DBV when it was cheap but I believe they did mention it around 10 cents(?), so you would have had a triple from there. BMR waited on DBV; they can see the potential with AIX/ABR this time at these cheap levels.

Hs it’s a bit confusing, but it appears they may have had a hard time getting the pp filled and had to change it to flow through financing, just a guess at his time based on you news release from 2014 feb 14.

Paul, I have a bit of a different take on this…the outlook has changed considerably for AIX since mid-February, particularly with the acquisition of the North Cap East and North Cap West claims, followed the other day by the claims acquisition contiguous to DBV. Doing a 10 million share financing at 5 cents would be quite dilutive, and probably not necessary at this point given the strength of this deal and how it is now being perceived as potentially playing out over the next number of months. Rumor on the street out here in Vancouver is that some heavy hitters have been lining up behind AIX, and there is evidence of that given the volumes in recent sessions – $250 K it appears is being committed right now in a flow-through financing, and because it’s flow-through it must be put into the ground. So, these investors are saying, here’s your first $250 K but it has to go all into the ground on the Sheslay properties. There are warrants at higher levels (around 10 cents) and that’s money that can be used for general corporate purposes, and for exploration, assuming they get exercised of course. At some point down the road, another PP would be done but theoretically at higher levels. So that’s what I’m guessing is happening. From both a geological and a market standpoint, this is a tremendously powerful play IMHO given the strategic holdings AIX has assembled and their total inventory (now 90 sq. km). Inventory in this district could be worth a fortune in just a few months.

Hs just checked Sedar and it’s showing 250,000 flow through financing. So I’m assuming this is in place of the finance announced Feb 14 2014?

Could be Jon, maybe someone can get clarification from the company.

Heavy hitters are lining up behing them, what kind of scenario could unfold here Jon?

note, They are looking for further acquisition.

It wouldn’t surprise me, Martin, if AIX were looking for more ground, but what they already have will give them all the power they need to run this race. Here’s the scenario: First, you have DBV drilling shortly and AIX has positioned itself contiguous to the east-northeast boundary of the Hat, along a NW/SE structural corridor; then you have drilling coming up by both Garibaldi and Prosper Gold. GGI’s news today shows a very sizable target at Grizzly West, and one can extrapolate that trend right onto AIX’s North Cap West claims; AIX also covers the entire northern border of Prosper’s Sheslay. As Prosper starts drilling to the north, and potentially hitting as they should, watch out. Plus of course Alix has the Sheslay South Fork Project. Then as all this unfolds, and the masses start figuring out just how big this all could be, the drill starts turning at North Cap West or North Cap East, or at Hackett North. So Alix is in a very favorable position. If you get that picture, you can’t help but be very bullish re the company-building opportunity for AIX.

Added to my position this morning, i am loaded now with AIX and ABR.

DBV is on fire this morning, new 52 week high (.335) … Drilling could happen as early as next week!!

Dbv is great for those who got in early and cheap but getting way ahead of itself now. IMO way too high to take a position now. But congrats to those already in

I’m not so sure about that, Hs…it’s reasonable to expect that speculation will intensify as drilling commences at the Hat…if you look at the drill hole sections on the DBV web site, they’ve boxed in a very interesting area and there are clearly some very obvious excellent targets right off the bat to begin this phase of drilling…they hit again, and DBV could easily double or triple or more from current levels…the masses haven’t picked up on this yet or the entire Sheslay Valley for that matter…DBV has also been weighed down by the warrant selling pressure…once that lifts, and it definitely appears to be easing, watch out…

@Hs: I’ve made it clear on this board what my position is on DBV. Now, about this morning’s action on DBV. Yes, it’s getting a little bit ahead of itself. But the stock has two things going for it: 1) the stock has a great share structure and is tightly held. 2) As Jon said, look at the maps on their site. There are excellent targets to choose from and with a high probability of hitting something unique. I wouldn’t be surprised if we find ourselves in the 40 cent range during the drilling.

@Greg: I would like to apologize to you and everybody else on this board if my remarks offended you. I just gave my opinion about AIX. Is all.

Chris I think your going to have to bite the bullet & buy AIX above the .03 mark CHEERS BRIAN

@Chris and Paul

no problems here at all I probably over reacted a bit, just seems like all the guys that got in early on DBV seem to think that it is the only horse in the race, and I just don’t see it that way, I do believe though/when DBV hits again AIX is going to fly, they have some great ground which will be worth more than the 2.2 million market cap they are trading at now… good luck to all

@Greg: There is no doubt in my mind that if DBV hits again that AIX will fly as well (the whole area will explode). Management has to get the drills moving as soon as possible. As I said in my prior post, they got some good property.

@Brian: I have a bid at .035 at this moment. If it gets filled, good. If it doesn’t, I don’t have a problem buying in at .04 or .045.

And as always, good luck to all.