Gold is trying to rebound today after a $50+ slide this week…as of 7:30 am Pacific, bullion is up $7 an ounce at $1,336…Silver is up 7 cents at $20.34…Copper is 2 cents higher at $2.95…Crude Oil has added 57 cents and sits at $99.47 while the U.S. Dollar Index has fallen one-tenth of a point to 80.09…

Gold is headed for its first weekly loss since January after Federal Reserve Chair Janet Yellen said Wednesday that interest rates could rise “around six months” after asset purchases end (perhaps a poor choice of words, rookie mistake by Yellen?) which is expected later this year…the Fed cut monthly bond-buying by another $10 billion at the conclusion of their two-day meeting, leaving purchases at $55 billion…several factors are still underpinning bullion, however, including tensions over Russia’s annexation of Crimea and what may possibly yet unfold (what’s Putin’s next move?) in that geopolitical hotspot…

Bank of America Merrill Lynch has raised its outlook on Gold in a report released yesterday. “We note that the recent rally was largely driven by investors in Europe and the U.S., while physical buyers in large parts of Asia have remained on the sidelines,” BAML said. “Acknowledging also that a few of the recent bullish macro-economic price drivers may normalize, we see a risk that Gold may give back some of its recent gains through 2Q14. Yet, at the same token, we continue to believe that Gold prices will bottom out in 2014, reflected in an increase of our average price forecast by 13% to $1,300/oz.”

Meanwhile, Goldman Sachs has reiterated its call for Gold to fall to around $1,050 an ounce by year-end due to a recovering U.S. economy…

Today’s Markets

Asia

Gains in the real estate sector lifted the Shanghai Composite nearly 3% higher overnight with a 54-point advance…attention now turns to the release of HSBC’s March China Purchasing Managers’ Index for manufacturing, due Monday…we’ll see if the trend of weak economic data continues…

Europe

European markets are mixed in late trading overseas, though Russia’s stock market (not surprisingly) was under pressure today – down about 2%…

North America

The Dow is up 75 points as of 7:30 am Pacific…the TSX has gained 9 points while the Venture is up a point at 1036…

U.S. Dollar Index Chart Update

A weakening U.S. Dollar Index is often bullish for the Venture as you can see in the 4-month Dollar Index below with a CDNX comparative near the bottom…the Venture now has a rising 200-day moving average (SMA); the Dollar Index is fighting a declining 200-day SMA, now at 81.04 where there is very stiff resistance…the Dollar Index has strengthened this week but a strong test of critical support at 79 has still not occurred since the confirmed downtrend in the greenback began last September – we expect to see that test at 79 at some point in the near future…there are many dollar bulls who are calling for a significantly higher greenback – that doesn’t match with the Venture and Gold trends we’re seeing, however…

Sheslay Valley Update – GGI Interview (Part 2) and ABR’s Hackett Property

“There are still a lot of investors and analysts who are just beginning to learn how prolific the Sheslay Valley is emerging,” Garibaldi Resources Corp. (GGI, TSX-V) President and CEO Steve Regoci told us the other day in an exclusive interview with BMR…that’s great news, in our view, for those who are positioned now in several of these exciting plays as the masses have yet to pile in…all the facts to date (drill hole results, geochemical and geophysical signatures, classic Stikine Arch terrane, the “cooked up” rocks and overwhelming evidence of a robust hydrothermal system) point toward the strong probability of the discovery of multiple deposits over a broad mineralized NW/SE trending corridor, the scale of which is massive – 22 km from the Grizzly West porphyry target to the Doubleview Capital Corp’s (DBV, TSX-V) Hat discovery along a corridor that is also broadening out as reported by GGI last week…

Regoci points toward some simple facts that are highly unusual in exploration – three Cu-Au porphyry discoveries (Star, Pyrrhotite Creek and the Hat) over wide distances in a previously under-explored district on just 49 drill holes (32 historical, 17 recent) with a superb “hit rate”…(Click on the forward arrow to listen to this 4-minute excerpt of the Regoci interview (part 2) – requires Adobe Flash Player version 9 or above):

[audio:https://bullmarketrun.com/wp-content/uploads/2014/03/Regocci-GGI-clip-2.mp3|titles=Regocci GGI clip 2]Ashburton Ventures Inc. (ABR, TSX-V)

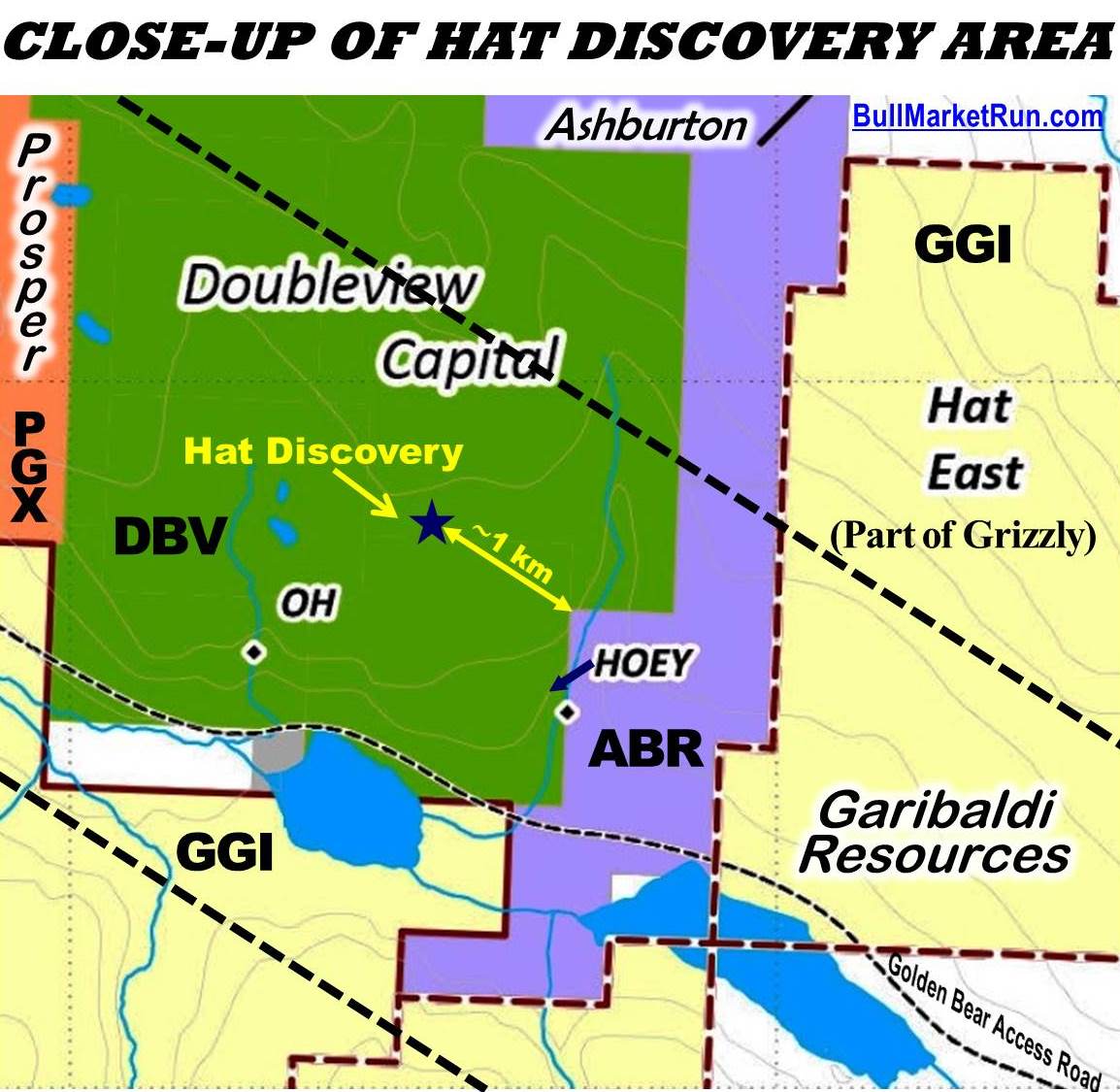

Some of the most astute staking/acquisition moves in the Sheslay Valley over the past 10 months, and in recent weeks, have come from Mike England who learned from his experience at Blackwater in 2011 that even a relatively small parcel of land (in that case just 15 sq km) in a hot area can turn out to be worth many millions of dollars (his Geo Minerals got taken out by New Gold Inc. – NGD, TSX – for $23 million)…since February, England has assembled a highly strategic land position for upstart Alix Resources Corp. (AIX, TSX-V) in the Sheslay Valley that holds company-changing possibilities as AIX now controls a 16 km-wide stretch contiguous to the entire northern border of Prosper Gold Corp.’s (PGX, TSX-V) Sheslay Project (North Cap East) and adjoining much of the northwestern border of Garibaldi’s Grizzly (North Cap West)…England also picked up ground for AIX contiguous to the northeastern boundary of Doubleview Capital Corp.’s (DBV, TSX-V) Hat Property…we’ll explore those moves in more detail in the near future…this morning we’re going to focus on the 900-hectare Hackett Property, claims that England staked in May of last year contiguous to much of the eastern border of the Hat…

Many geologists we’ve spoken to now believe the Hackett may represent an extension of any deposit at the Hat given the known southeast-trending nature of mineralization in the district, and historical reports (“Hoey showing”) confirming that mineralization does indeed extend to the east of Doubleview discovery holes HAT-08 and HAT-11…those holes are just 1,000 metres west of the Hackett border…the general market has been slow in picking up on the significance of the Hackett, but ABR could literally explode overnight on more good drill results from the Hat where crews are now mobilizing for the start of drilling almost any day now…ABR closed at just 5.5 cents yesterday, and also holds some high-grade Platinum prospects northwest of Whitehorse near the Wellgreen deposit…

According to geologist Eric Ostensoe’s NI-43-101 technical report on the Hat, the “Hoey stock” is a monzonite/gabbro variation intrusion in the southeastern part of the Hat (straddling the Hackett border)…the Hoey features strongly sheared mafic rich formations with pyrite, bornite, chalcopyrite and traces of molybdenite in association with crystalline carbonate…Gold values up to 1 oz/t (31 g/t) were reported by prospector Frank Hoey in the 1960’s – following that, areas proximal to the Hoey have assayed several g/t Au…grab samples have also assayed Cu as high as 2.2%…the area is strongly gossaned and one theory, as mentioned in the technical report, is that it may represent a “cap” area that overlies a zone of precious metal enrichment…PGM’s have never been investigated…

Several geologists we’ve spoken to are very bullish regarding the potential of the Hackett as it has never been systematically explored, and of course it’s right on trend with the DBV discovery and the Hoey showing…Ashburton reported last month that it will be commencing an early work program including sampling and mapping to prioritize potential drill targets at the property…historical aeromagnetics for the Hackett identified a magnetic high on the southern portion of the claims…

Below is a close-up view of the Hat discovery area…the Hat is surrounded on all sides by claims held by Ashburton, Garibaldi, Alix, Prosper and Romios Gold (RG, TSX-V)…

ABR Updated Chart

Below is an updated ABR 2.5-year chart from John…notice the immediate reversal from sell pressure to buy pressure in ABR almost immediately after the discovery reported by Doubleview January 20…”smart money” has been accumulating ABR since that time…RSI(14) is at support, the ADX indicator shows a very bullish trend, and the rising 50-day SMA is at 5.5 cents…

Highbank Resources Ltd. (HBK, TSX-V) Update

Lots happening in British Columbia, from the Sheslay Valley to the Port of Prince Rupert and beyond…aggregate rock may sound boring, but it’s a much-needed resource for looming LNG projects in the province as well as the expansion of the Port of Prince Rupert…earlier this week, Highbank Resources (HBK, TSX-V) received its Notice of Work permit for its Swamp Point North aggregate project which has an impressive NI-43-101 resource of 72 million tons of measured and indicated aggregate rock…the key, however, is the deposit’s proximity to tidal waters (it sits on the edge of the Portland Canal) which gives HBK an advantage over competitors who have to move material by truck over significant distances…with the permit now in hand to proceed to production, HBK is in a position to be able to raise the money it requires but putting an aggregate deposit into production is far cheaper and easier than starting a Gold mine…as the saying goes, location, location, location – Highbank has it with Swamp Point North and an excellent opportunity to exploit that resource…

Technically, HBK has broken out above long-term resistance at 15 cents which was support up until late 2009 as you can see in this 10-year monthly chart from John…HBK is up half a penny at 16.5 cents as of 7:30 am Pacific…

Balmoral Resources Ltd. (BAR, TSX)

Keep an eye on Balmoral Resources (BAR, TSX) which has resumed drilling at its Grassett Ni-Cu-PGM discovery (refer to yesterday’s news release and March 5 NR) located at the eastern end of the company’s Detour Trend Gold Project in Quebec…an extensive zone of Nickel-Platinum-Palladium (plus or minus Copper) mineralization has been intersected over a 700-m strike length in broadly spaced drilling and remains open in all directions…BAR also holds a wide assortment of advanced and early stage Gold exploration throughout the prolific Abitibi greenstone belt…

A 1-year weekly chart for BAR is showing a confirmed breakout…BAR is 3 cents higher at 73 cents as of 7:30 am Pacific…

Goldeye Explorations Ltd. (GGY, TSX-V)

Goldeye Explorations (GGY, TSX-V) has climbed about 50% since we introduced it to our readers in late February based on favorable geology at the company’s Weebigee Project in northwestern Ontario…since then, GGY has reported some high-grade intersections from both the Knoll zone (open in all directions) and the RvG4 zone on strike 500 m to the NW…drilling continues…still very speculative at this early stage, but results to date are highly encouraging…

The 2-year weekly chart shows an unconfirmed breakout above Fib. resistance at 16 cents, so today’s trading will be important…sell pressure was dominant for the past two years until late February…

Note: John and Jon both hold share positions in GGI, DBV, AIX and ABR. Jon also holds a share position in PGX.

13 Comments

”the Hoey features strongly sheared mafic rich formations with pyrite, bornite, chalcopyrite and traces of molybdenite in association with crystalline carbonate…Gold values up to 1 oz/t (31 g/t)” could that be the description of a starter pit, maybe 🙂

From our research, Martin, there appears to be something different going on in the SE corner of the Hat, perhaps extending onto the Hackett, not sure what this all means, but we’ll have a better idea I think in the near future…this is like a novel that gets more fascinating by the day…there are numerous intriguing areas over very wide distances in the Sheslay Valley…somewhere along the trend, at least one of the companies is sitting on a high-grade starter area IMHO…too much evidence of very strong hydrothermal activity, faulting, etc….I also believe at some point we’ll see more than just Cu-Au-Ag…..

Jon- nice couple of write- ups regarding Highbank! This company could be generating some serious revenue as early as July. thank-you!!

Thanks, Greg, another illustration of how busy things are in B.C. I had a very good chat with Gary from Highbank the other day, and I encourage any readers who are interested in performing their own DD on this one to contact Gary at (604) 683-6648. Not only do they have a large NI-43-101 resource, but the location of it is key, right near tidewater. Much more cost effective to move material by barge than by truck. They do have to raise some money but it’s the typical chicken before the egg story – they needed the permit from the Ministry to proceed to production, which they now have, and bid on projects, which obviously is the catalyst to raise the required capital. LNG projects and the expansion of the Port of Prince Rupert are two key investment themes right now in the province – demand for aggregate rock should be strong. HBK is in a good position to undercut competitors given the location of its deposit, and still make healthy margins. Gotta like the chart – breakout above resistance that has been in place for more than 4 years. Simple story, easy to understand.

Jon

I realize the Sheslay has been the focus as of late, but have you heard anything at all from George at GMZ?

Thanks

Jon- any idea what happened to Stan Hunt-Smartstox? He seems to have disappeared from the ” scene” TIA.

Hi Greg, I do not know what Stanlie is up to these days—I’ve not spoken with him for several months. With regard to George, it seems he not only has his hands full with GMZ but also with Dolly Varden (he went from being a director to President and CEO of DV Feb. 28), so that frankly concerns me. Too much on his plate perhaps? DV is a major undertaking.

Jon: you might want to put this map out again as i only saw it aftermarket hours! Wow, ABR is really close! Lots of focus on this area if DBV gets some early indications of mineralization,etc sooon! Also, alot of heavy volume in the agricu/marijuana,etc lifting alot of deadboats finally on the venture with heavy volumes, so, it’s all good for liquidity on the venture once again!

Hi Jon, is there any historical work reference done on the north cap? i have read Ostensoe reppport, impressive. All the work was done on the hat side. The high copper samples where on hat if we refer to ABR fact sheet.

Hi Martin, AIX has been conducting some extensive research into North Cap West and North Cap East, as one can gleam from their recent news releases. My opinion only – I suspect we’re going to see some really interesting information emerge from both areas, which only makes sense if you look at the geochemical and geophysical evidence in the northwestern part of the Grizzly and over much of the Sheslay. As far as North Cap East is concerned, just follow the trend from the Hat area to the northwest and you’ll see that it heads directly to the NW part of North Cap East – obvious initial target area.

Ok i get your point on north cap east plus there is a fracture going SW to NE in this area. They seems to be area of focus just like big creek and Hoey creek.(Hat and Hackett). VVN is pretty intriguing to.

VVN has very intriguing ground, Martin, but unfortunately an extremely weak management group not capable of taking advantage of this—-a lifestyle company going nowhere but a good income source for a couple of individuals – $30,000 in management “services” Oct., Nov. and Dec., a disgrace.

I think Alix as there thing carefully assemble looking at the big picture