Iskut, British Columbia – 4:40 am Pacific

Greetings again from Iskut, British Columbia, where Colorado Resources (CXO, TSX-V) is getting set for a major round of new drilling at the province’s newest Copper-Gold discovery, while Victory Ventures (VVN, TSX-V) is hoping for a discovery of its own in a similar fault setting to the east at its Copau Property…other companies are busy preparing for drill programs around here including West Cirque Resources (WCQ, TSX-V), a very promising deal that has been flying under most investors’ radar screens…

Gold has traded in a range between $1,383 and $1,393 so far today…as of 4:45 am Pacific, the yellow metal is down $3 an ounce at $1,385…Silver is up 3 cents to $21.81…Copper is a penny lower at $3.21…Crude Oil has retreated 38 cents to $95.50 while the U.S. Dollar Index hit a new 4-month low and is currently off one-tenth of a point at 80.74…

Gold has traded in a range between $1,383 and $1,393 so far today…as of 4:45 am Pacific, the yellow metal is down $3 an ounce at $1,385…Silver is up 3 cents to $21.81…Copper is a penny lower at $3.21…Crude Oil has retreated 38 cents to $95.50 while the U.S. Dollar Index hit a new 4-month low and is currently off one-tenth of a point at 80.74…

Today’s Markets

Japan’s Nikkei average tumbled 844 points or 6.4% overnight to close at 12445, a whopping 21% drop from last month’s 5.5-year high of nearly 16000…the steeper the climb, the harder the fall…in response to the plunge, Bank of Japan Governor Haruhiko Kuroda was quoted by the Nikkei business daily as saying that the Japanese economy is on a steady path to recovery and that financial markets will calm down over time…the Nikkei is now at levels not seen since the BOJ launched its massive stimulus program April 3…markets in China re-opened after the 3-day “Dragon Boat” holiday and the Shanghai slipped 3% to finish at 2148, below the support of the old downsloping channel…more weakness in the Shanghai is likely on the way…European shares are off their lows of the day but still down moderately while stock index futures in New York are pointing to a slightly negative open on Wall Street – nothing approaching the steep losses in Asia…the TSX will try to get back on track today after declining in 8 out of the last 9 sessions…the Venture has fallen 23 points or 2.4% this week (vs. a 2.1% drop in the TSX and a 2.5% drop in the TSX Gold Index)…

The Son Or Maybe The Big Daddy Of Red Chris?

As we speculated in yesterday’s Morning Musings, given intense activity we’ve witnessed both on the ground and in the air, Colorado Resources is ready to re-start drilling at North ROK and they are going after some juicy targets as announced after yesterday’s close…meanwhile, 10 km to the east, we saw some happy faces at the Copau Property which is being drilled for the first time ever after very promising geophysics data…we begin with North ROK…don’t let last week’s sell-off fool you…at this early stage it clearly has the potential to be just as big if not bigger, than the Red Chris 15 km to the southeast (301.5 million proven and probable tonnes of 0.36% Cu and 0.27 g/t Au)…

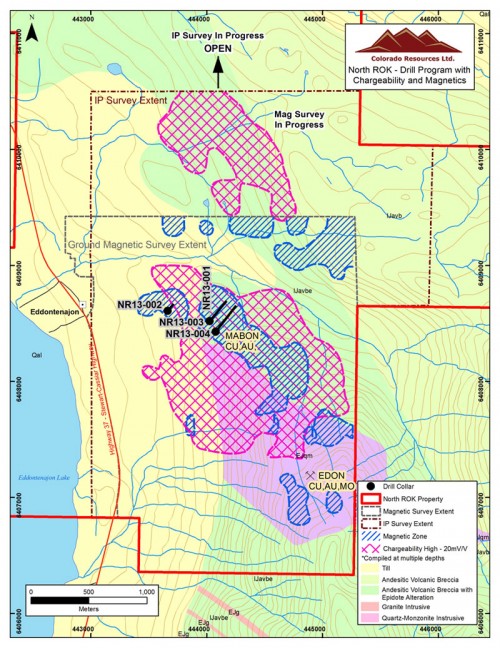

Below is the latest map from Colorado showing the full extent of the Mabon chargeability high which now measures more than 1300 metres x 2000 metres, cored by a continuous magnetic high 300 metres to 400 metres wide x 1200 metres long trending southeast…CXO will be targeting that “core” with a 5,000-metre drill program beginning next week…as you can see from the map, the coincident chargeability and magnetic anomaly has only been drill tested on its far northern end over a 100-metre x 300-metre area…it has demonstrated a very strong correlation with well-mineralized Copper-Gold drill intercepts…

As President and CEO Adam Travis stated in yesterday’s news release, “Where we have intersected the magnetic high feature in 3 drill holes, over 694 metres of cumulative length our average grade is 0.40% Cu and 0.60 g/t Au”…those numbers compare extremely favorably to Red Chris…

Keep in mind that the East and Main zones at Red Chris occur in a 200 to 500-metre wide x 1,500 metre long zone…there are satellite zones at Red Chris, just like their appears to be strong potential for satellite zones at North ROK to the north and south of the discovery hole…

Interestingly, CXO has discovered a strong chargeability anomaly 1 km north of the discovery hole – 500 to 800 metres wide, 1300 metres long, and open to the north…so they have a massive prospective area to explore that currently extends more than 3 km north-south…ultimately, hundreds of holes will likely be drilled at North ROK in an effort to prove up a world class deposit…CXO cutting a deal with a major before year-end is certainly a distinct possibility…

As one highly respected geologist from the Yukon told us the other day, ”Historically, this whole region has been poorly mapped and under-explored…that leaves open a lot of possibilities”…

Which brings us back to Victory Ventures at Copau…

Victory Ventures (VVN, TSX-V) Aims For The Sweet Spot – First Hole Success Like Colorado?

Significantly, perhaps, Victory’s Copau Property lies at the intersection of 2 major regional faults…some extensive work started a couple of years ago at Copau on the belief that this area about 10 km north of the Red Chris had been overlooked after an initial surface discovery (“B31” Cu showing) by the B.C. Geological Survey…a ground magnetic survey was carried out in 2011 and located a pronounced northwest-southeast linear-trending anomaly throughout much of the claim area, and this was followed up by an IP survey last summer after Victory optioned the property from geologist Robin Day…the IP survey confirmed the need to drill some holes into Copau – a strong chargeability response (intensifying with depth) is interpreted as being caused by increasing sulphide content within a southwest-dipping body of syenite rock… rock outcrop samples containing traces of pyrite, chalcopyrite and magnetite in syenite were found, and their locations coincide with underlying IP chargeability responses…the present known extent of the anomaly at Copau varies between approximately 300 and 400 metres wide (east-west) and 1200 metres long (north-south)…it appears open to both the west and the south and at depth…we suspect they took direct aim at the heart of the IP in the very first hole…

We’re impressed with the property’s easy access as a logging road just off Highway 37 cuts through the southernmost portion of it…Victory’s drill program was launched June 2, with the rig set up right at the edge of the road as you can see in our picture below…

Given the success Colorado has had from interpretation of encouraging geophysical data, there are good reasons to be optimistic regarding Victory’s chances with Copau…exploration is always a risky business and you never know for sure what you’re going to hit, which makes it particularly interesting…the potential leverage for an investor is huge…Colorado made a 10-fold jump over about 20 trading days after announcing its discovery…with a current market cap of less than $3 million and a tight float, all Victory needs is a sniff of something significant and it’s off to the races…

West Cirque Resources (WCQ, TSX-V)

A company with important holdings in the Iskut River area that has been overlooked by most investors since the announcement of Colorado’s discovery is West Cirque Resources (WCQ, TSX-V)…they didn’t go unnoticed by Freeport McMoRan (FCX, NYSE), however, as the Canadian division of one of the world’s largest Copper and Gold producers cut a deal a few months ago with West Cirque for exploration of WCQ’s Castle, Tanzilla and Pliny properties…Freeport can earn an initial 51% interest in the properties by financing cumulative expenditures of $8 million over 4 years…West Cirque will remain the operator during the earn-in, meaning they will also have control over the news flow which is important…the property with perhaps the most potential is Castle which is situated about 15 kilometres west of North ROK (25 km northwest of Red Chris)…WCQ drilled half a dozen holes at Castle last year and 5 of them intersected broad zones of Gold-Copper mineralization in monzodiorite porphyry over a strike length of 1 kilometre…the system is open in all directions and features a 5.5 km alteration zone with high-grade Gold at surface (historic samples up to 138 g/t Au, 434 g/t Ag)…so this has big potential in our view, and Freeport obviously agrees…

West Cirque also has other properties in B.C. including its 100%-owned Aspen Grove Gold-Copper-Silver Project halfway between Merritt and Princeton, not far from Huldra Silver’s (HDA, TSX-V) mill site…there are 2 mines currently producing in that belt – New Afton (85 km to the north) and Copper Mountain (45 km to the south)…earlier this week, WCQ reported very encouraging results from a reconnaissance scale mapping and sampling program that focused on 6 significant Copper-Gold-Silver occurrences at Aspen Grove including 3 separate porphyry systems…

WCQ had $1.5 million in working capital as of the end of March with only 26.5 million shares outstanding…of course it won’t have to spend a nickel on its Iskut River properties as extensive exploration on those this summer will be funded by Freeport…WCQ closed yesterday at 30 cents…volume in the stock is gradually beginning to pick up…the 3-year chart shows plenty of upside potential with support solid as a rock at 20 cents…

Probe Mines (PRB, TSX-V)

One of our favorite exploration projects continue to be Probe Mines‘ (PRB, TSX-V) Borden Lake Property in northern Ontario, and just recently Agnico Eagle Mines Ltd. (AEM, TSX) grabbed a 9.94% stake in Probe on a non-diluted basis…below is an updated PRB chart after the stock got through resistance yesterday at $1.55…PRB is now above its 100-day moving average (SMA) for the first time since mid-January…

Yamana Gold (YRI, TSX) Chart Update

Yamana Gold’s (YRI, TSX) chart is giving us encouragement that despite some recent weakness, the Gold stocks will hold important support in the days ahead…below is John’s 9-month daily chart for YRI which climbed 34 cents yesterday to close at $11.48…its 20-day moving average (SMA) has flattened out and appears ready to reverse to the upside…yesterday’s candle also completed a Bullish Engulfing at the base…

Note: John, Jon and Terry do not hold positions in PRB or YRI. John and Jon hold share positions in VVN and Jon also holds share positions in CXO and WCQ.

16 Comments

great report and great photos of the area! thanks guys!

WCQ has a surge of sudden interest today, share price is up 42% so far and the Ask has no shares until you reach the $0.495 mark. Great write-up Gents.

Awesome work

Jon wish you guys would keep quiet about the venture. 100% of time you say it’s Gona run or showing encouraging signs it sinks like a rock. All other markets green and venture red. What’s that tell ya. Venture drop another three or four hundred points before its done

Jon

any news on GMZ and the permits or financing being completed?

thanks

News just out, oversubscribed financing completed, about $750 K in total. Impressive in these markets and I don’t believe this would have been oversubscribed if the Alabama project wasn’t a certainty in terms of state approval. On another note, rumors flying around like crazy up here at Iskut – re: CXO, VVN and now DBV……tomorrow could be interesting.

Rumors is all they are Jon. Keep trying. You’ve got a long way to go to make up for your rbw debacle.

Thanks Jon

Global Met closes $374,000 final tranche of financing

2013-06-13 19:06 ET – News Release

Mr. George Heard reports

GLOBAL MET COAL CLOSES FINAL TRANCHE OF PRIVATE PLACEMENT

Global Met Coal Corp. has closed the final tranche of its private placement previously announced on May 3 and May 8, 2013. The company has raised an additional $374,000 through the issuance of 7.48 million units at a price of five cents per unit. Each unit consists of one common share and one non-transferable share purchase warrant. Each warrant entitles the holder thereof to acquire one common share at a price of 10 cents for a period of two years expiring on June 13, 2015.

The company paid finders’ fees of $12,960, issued 159,200 broker warrants at a price of 10 cents for a period of two years expiring June 13, 2015, and issued 90,400 compensation options. Each compensation option comprises one common share and one non-transferable share purchase warrant, with each warrant entitling the finder to acquire a warrant share exercisable at a price of 10 cents and expiring on June 13, 2015. All securities are subject to a four-month hold period expiring Oct. 14, 2013. The company intends to use the proceeds from the private placement to fund continuing development of the Black Creek coal project in Jefferson county, Alabama, and for general working capital.

The company also announces that it will not be tabling the resolution for the share consolidation at the coming annual and special meeting to be held on June 27, 2103.

U.S. coal producers shipments fell 31% in April from the prior month, driven largely by an oversupply in Asia for metallurgical coal.

This still concerns me:

The company also announces that it will not be tabling the resolution for the share consolidation at the coming annual and special meeting to be held on June 27, 2103.

Why does that still concern you?

An oversupply of met coal concerns me.

I enjoy your write up, especially your comments on the Iskut play — keep up the good work — lets hope for a good venture market this summer — CXO should be the leader — Ronald

Global Met Coal is also promoted, for a fee, by Junior Gold Report.

Jon

how many times have you seen management say one thing and do another, once passed they can do a roll back anytime they want. Been Burned too many times…I have always said if management would just do what is right and focus on building the company the share price would take care of itself..