Garibaldi Resources (GGI, TSX-V) has winterized its camp, meaning things are getting very serious and even more promising on the ground as a first-ever drill program continues at Grizzly Central. The company clearly has a “tiger by the tail” and an apparent exciting new discovery in the works in northwest British Columbia’s emerging world class Sheslay district.

With Doubleview Capital (DBV, TSX-V) gearing up to return to the Hat deposit 10 km to the east, where a major expansion of that system could prove to be just a few holes away, the Sheslay district could soon light up like a Christmas tree. Just in time to give the beaten-down junior resource market new hope and a boost of confidence entering 2016.

We’re seeing ample evidence of why the Association For Mineral Exploration British Columbia now refers to the Sheslay region as the province’s premier greenfield district.

Hole 4 Step-Out Hits Dark Pyrite-Magnetite Unit Intersected In GC-15-03

After what appears to be a stellar 3rd hole (GC-15-03), as reported November 10, Garibaldi confidently stepped out 600 m to the west-southwest and hit the same favorable pyrite-magnetite unit beginning just 36 m deeper (at 139.8 m) in GC-15-04 and extending right through the remainder of the hole.

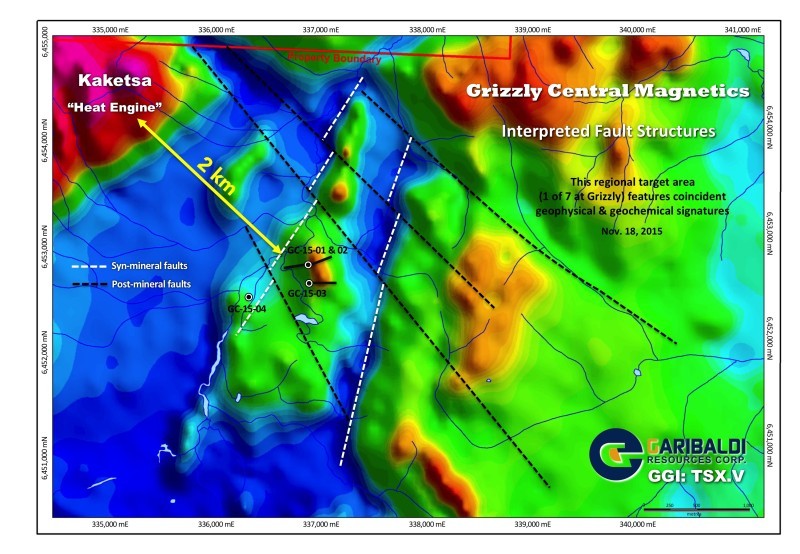

Hole 4, as you can see in the map below, was drilled immediately adjacent to a fault in an area of strong but more moderate mag and chargeability responses than observed around the earlier holes. While Grizzly Central is mostly covered by a thin to variable glacial till, outcrop discovered adjacent to hole 4 displayed intense potassic alteration and quartz veining containing chalcopyrite with traces of malachite and bornite.

After just 14.5 m of overburden, GC-15-04 immediately entered an intense silica chlorite-sericite breccia for 22 m. This was followed by a 103-m interval with sections of finely disseminated chalcopyrite and pyrite stringers in andesitic volcanoclastic rocks consistently chlorite-sericite altered, featuring approximately 5 to 15% quartz veins.

“These widely spaced initial holes at Grizzly Central…clearly offer the potential for yet another new discovery in this still very underexplored district,” commented Garibaldi President and CEO Steve Regoci.

Assays, of course, will be the final determination of how significant this discovery is, but there’s no question Garibaldi is oozing in confidence at the moment. This is a company with a proven track record of discoveries in Mexico, and they’ve obviously made highly-effective use of technology to find quick success over a land package at Grizzly that encompasses a whopping 286 sq. km.

This is the kind of drill core, shown on the GGI website, that gets us very encouraged regarding the Gold potential disseminated in the cooked-up rocks at Grizzly Central.

More in today’s Morning Musings, and over the weekend at BMR.

52 Comments

Jon

this is really big, they winterized the camp so they must really really like what they are seeing….this is going to be really really fun to watch unfold!

Greg, they’ve learned through experiences in Mexico how to handle large land packages like this, and they’ve handled the situation at Grizzly superbly.

Jon, that is amazing news that they have now winterized the camp!!

Are you expecting any news from their Mexico properties??

Great news but I’d like to know:

1) How deep is hole 4?

2) What direction was it drilled?

3) Where is hole 5 situated?

Looks to me like a vertical hole, Tom, based on the map, which makes this even more interesting. I guess we’ll find out about hole 5 shortly, and other details. This has got discovery marked all over it, and there is extent to it, headed toward the heat engine at Kaketsa.

How are they going to pay for winter drilling? I thought they only had enough $ for this drilling campaign? Maybe sell one of their mexico properties to fund this winter drilling?

KSK, GGI – Would you sell KSK.v to buy GGi.v? I bought KSK at $0.025? Any thoughts?

GGI – fwiw, GGI suggested that the holes were approx. 60 degree angle, but didn’t say it w a lot of conviction, but also didn’t say vertical. we’ll see

$1MM worth of 30 cent wts is the hope for now I suspect. some big pocketed eyes waiting on the results who don’t have skin in the game, yet

Whoever posted about PE – answer is no on holding .50

I posted a week or so ago it was in trouble, you could have sold at .58 then.

Which map are you referring to Jon, I cannot see any reference to hole 5.

A vertical hole sounds interesting as they will get to some depth quite quickly. I wonder if we get some assay results next week, they will update us again on what they are drilling.

Financing after assays are released is my guess, maybe they have an investor lined up already? Sale of La Patilla is a possibility, I don’t think they will sell Rodadero yet as they could add value there with minimal drilling.

The one on the GGI website, we put it on our report this morning. You’ll see just a dot at hole 4. The other lines were horizontal. That’s why I’m thinking this was vertical, which is interesting.

The dark pyrite, magnetite mafic unit could very easily run with gold numbers not yet seen in the district (within the boundaries of the Grizzly, Hat and Star). And it has been intersected over a strike length of three-quarters of a km. Think about it. Certainly looks like more than just a porphyry system here. Kaketsa has cooked up something special.

GGI- What could the market cap on this look like if lab results are positive?

If all of this GGI news is so good, why aren’t we seeing it reflected in the stock price? When DBV hit in 2014 the stock ran up fast and hard.

GGI has been one of the top-performers on the entire Venture recently, LAJ, and keep in mind the Index is way down from where it was at the beginning of 2014. I was looking yesterday, GGI and DBV in fact are among the very small percentage of Venture companies currently within 30% of their yearly highs.

As this continues to heat up, and especially if GGI has hit some high-grade if confirmed by the lab assays, then it will take on a life of its own, and the entire district will be in the spotlight.

Dave: regarding PE, don’t want to sell, I want to buy… I’ll keep watching for now.

Tennis ball-sized diamond for LUC in Botswana. Would be nice if a Canadian play could pull that off.

LAJ , that was 2014 , the overall market has changed with the CDNX and its exploration companies getting hit hard.

Thanks Jon, you are probably right. I assumed that they would have drilled in a direction back towards holes 1-3. Maybe hole 5 will be in this area and will hopefully show continuity between hole 4 and the first 3. I really hope the assays come out next week and do indeed surpass anything reported previously at the Sheslay. Could hole 4 have reached a depth of 400m?

A NR from DBV next week regarding hole 23 and the fact that they have re-started their drill program would be very welcome.

Ya Jon, preferably NAR.

rgiroux – PE is still dumping a ton of warrants. My guess is we see mid 30’s by middle of Dec. Watch for PI on the sell dumping odd lots. That’s the U.S. dumping.

I know its the GGI spotlight day today on bmr, but further on the PE.

It has heavy resistance at .52 and its next support level is .45 and it is a weak support level.

We made reference to the fact a little while ago (with a chart) that this time PE have trouble holding that 50-cent support…we’ll see.

EQT – needs some rumours, leaks, family buying, again

Hey guys. Keep an eye on FNC.v (currently at 2 cents). They just issued a couple good nr. First…. “Remarkably, and unexpected, were outcomes of the slag testing, which resulted in an almost pure TiO2 product grading 99 per cent TiO2.” Think about how much Ti02 slag is out in the world?? This could be huge.

stockwatch.com/News/Item.aspx?bid=Z-C%3aFNC-2324980&symbol=FNC®ion=C

Second Nr; Fancamp samples zinc value of 25% in Harriman fault

…”A grab sample from this zone returned a zinc value of 25 per cent. In addition, immediately to the west of this occurrence in the trench, the host siltstone contains 30 to 40 per cent sulphide, bearing quartz veinlets. Further assays are awaited….”

stockwatch.com/News/Item.aspx?bid=Z-C%3aFNC-2327272&symbol=FNC®ion=C

Would anyone bother selling KSK at these levels to pick up more GGI?

What I don’t understand in Sheslay is the inertia of PGX

Dave – Where do you see PHM headed in the short?

Two good cdn diamond plays with potential MPV and KDI

Yes Guy , it’s been awfully quiet at PGX for a long time . With them being right in the thick of things one would think something has to be cooking.

PHM meets resitance at .70 – I mentioned 7 trading days ago about the double bottom. That was the time to hit it. I would be careful now. It should/could correct after touching .70 – same on cxv, may correct the day after phm.

EQT – yes, very quiet.

PE – once again careful on this one. .52 now heavy resistance. 62k on offer there.

FAN – it can run to around .78 or so. – .60 is now strong support.

AOT – one to watch. double bottom right at a buck. Thats not a bad hit on assays today.

I guess you can tell that my ex-wife is watching my daughter today, hah, gives me time to watch market.

Forget about SLC, they rejected the takeover bid, looks like its going to open way low.

KSK property butts up to GGI’s Red Lion property. When is TCK going to drill again on KSK property?

and GGI is in the red… try and figure that one out.

Interesting , 101,000 ask @ .15 has disappeared. DBV.

GGI – GMP , an institutional or wealthy individual broker, has dumped over 300K in the past 2.5 wks. maybe when they are done, and I don’t think its soon, we can see 20?

AOT – needs a couple million $$ more at least for a payment due end of year. PP coming ?

It’s a tough market right now. For GGI I think we are going to have to wait for assays to really give this a sustained push up. Would have been nice to run a bit on speculation but it doesn’t look like the market wants to speculate. And so…we wait

Still very early…only on the fifth hole now. I forget which hole was a discovery hole for DBV…thinking it was hole #8, but I could be wrong…to tired to check, just woke up from night shifts. Anyone confirm?

You can not compare DBV had nothing for the first 6 holes !

People – GGI is coming down because GMP is letting go and ITG was before that. Its coming down because the chart and TA dictate this. Now, you can call me crazy and do your bashing and give your direct qoutes of this and that. You buy and sell off of the charts and TA. Yes, a news release can upset that but it has to be a powerful news release. Pics of core 4 holes in a row aint gonna get it. The market wants assays. By the way, I love GGI, nothing personal.

Still have this entrevu planned Jon?

entrevu, Martin? Sorry, my French isn’t that good!

interview sorry

What do you think of the first to zone 22m and 103m as mention in the news, could they be high grade?

Martin, the first part of the hole certainly looks interesting…but let’s deal with the facts that can be easily discerned, and that is that this hole hit the same system as the last hole, 600 meters to the west-northwest, in terms of the intriguing dark pyrite-magnetite mafic unit (this was also intersected in hole 1, 200 m north of hole 3)…this is a thick unit and it could contain some robust numbers in terms of mineralization if you look at different evidence including regional comparative data…that would translate obviously into volume given the step-out distance here, so that’s the significance…

Plus, it ended in mineralization!

Assays will determine that, Martin, but I would say there’s a very good chance that such is indeed the case given the iron enrichment and the look of the core.

Hey Jon…..do we have any idea where drill hole 5 will be located for GGI?

The chart for GGI still looks fantastic. Looks like we are back down to the bottom of our uptrend channel. We should be heading higher next week. Patience is a virtue and I think that will hold true for GGI. Hold tight, hold strong and let this thing play out!