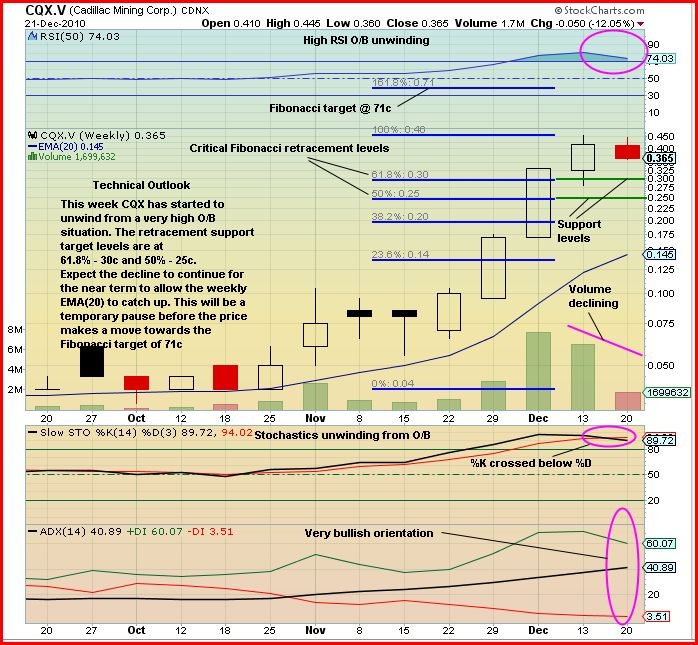

Cadillac Mining (CQX, TSX-V) has indeed turned out to be a tremendous discovery which doesn’t really surprise us as we were so excited with this company and its potential when we presented it to BMR readers December 9. The stock is already up 72% since we added it to the BMR Portfolio two weeks ago. There are many powerful factors driving this story, from the share structure to potential new acquisitions and the company’s “Wasa” claims which adjoin Richmont’s Wasamac Property where aggressive drilling continues to return excellent results (more results and a resource estimate coming in January). In addition to its 100% owned and very strategic Wasa claims, Cadillac just recently partnered with Visible Gold on over 200 claims and 7,000 hectares west of Gold Bullion’s Granada Property. The volume surge in Cadillac, which started last May shortly after Richmont commenced drilling at Wasamac, clearly demonstrates that something big is up with this company – record volumes in a stock that’s moving higher and breaking out is extremely bullish. We saw it with GBB and others. CQX experienced a healthy pullback the last couple of days, falling by as much as 27.5% from its recent high of 45.5 cents, but today’s intra-day reversal was very bullish. After opening at 36 cents and dropping to 33 cents, Cadillac quickly bounced back and closed the day at its high of 39.5 cents for a 3-cent gain. John’s weekly chart below is from Tuesday, suggesting a possible pullback to 30 cents, which may prove to be just three cents off the mark. Note his next Fibonacci upside target (not a BMR price target as we don’t give price targets but a theoretical Fibonacci target based on technical analysis) of 71 cents. From a fundamental standpoint, Cadillac’s current market cap – even after today’s 3-cent advance – is still only $10 million which is the lowest of any company in the BMR Portfolio. The outlook for Cadillac is very positive going into 2011 – all things considered here, this does have the “look and feel” of a potential huge winner. We’re impressed with the company’s management – strong geological and mining backgrounds, significant share positions (20% of the stock) and a determination to move this company forward in a major way.

Add A Comment