“You can’t connect the dots looking forward; you can only connect them looking backwards. So you have to trust that the dots will somehow connect in your future.”

– Steve Jobs

Following the wise words of a visionary like Jobs, before peering into the future and envisioning what could become an insatiable demand for Cobalt, we must look to the past.

What is Cobalt? And where did it come from?

According to Wikipedia, Cobalt is a chemical element with symbol “Co” and atomic number 27. Cobalt-based blue pigments (Cobalt blue) have been used since ancient times for jewelry and paints.

Like Nickel and Copper, Cobalt is found in the Earth’s crust only in chemically combined form, except for small deposits found in alloys of natural meteoric iron.

Known as just a Silver-gray metal since 1735, it wasn’t until the turn of the 20th century (1907 to 1913), thanks to the work of American inventor, metallurgist and automotive pioneer Elwood Haynes, that Cobalt started to be used as a suitable metal in the forming of Cobalt-chromium alloys. This important alloy was and is characterized by high strength and pronounced strain hardening.

By the 1930’s, Cobalt alloys were more widely used in construction because of excellent corrosion resistance.

Fast forwarding to today, over a period of nearly 300 years Cobalt has evolved from merely a metal into a “special and critical” metal required for manufacturing advanced technologies like jet engines and Lithium-ion batteries.

Recognizing a great opportunity (as our Cobalt story continues)…

Some people can and some people can’t.

Take Peter Buffett for example, Warren Buffett’s son.

When Peter was 19 Buffett blessed him with an inheritance in the form of Berkshire Hathaway (NYSE: BRK.A) stock, about $90,000 worth (or $250,000 inflation-adjusted). A good chunk of change by any measure.

At the time, Buffett said: “Here is what you are getting. You can do whatever you want with it but there’s not going to be any more.”

What do you think young Peter did when he got his hands on what would become the best performing stock of all time?

…go on, take a guess.

He sold it! And spent the cash on music equipment! Had Peter recognized the opportunity and held onto his Berkshire stock, $90,000 would have turned into more than $75 million, like magic!

But hindsight’s 20/20.

Perhaps Buffett should have given Peter more information about what the gift represented, but after reading his biography “The Snowball”, I know his parenting methods were, how should I say this – standoffish. Buffett would lock himself in the office for days at a time researching businesses and industries.

Bottom line, Buffett wasn’t the world’s most hands-on dad, but he did become known as the world’s greatest investor (which isn’t a bad consolation prize).

Ultimately, those thousands of hours spent studying and pondering helped him see things that others couldn’t see, and he capitalized on that vision.

I hope you didn’t mind that little story about Peter and Warren Buffett, but I wanted to share it with you because there are a few valuable lessons within it (one being the power of compound interest).

The billion dollar question is…

Could there be a Berkshire Hathaway-like opportunity buried within the “special and critical” metals industry just waiting to be discovered?

Heck, albeit we’d all be thrilled to uncover a stock that does a fraction of what Berkshire did.

Now I’m no Warren Buffett, but after locking myself in the office for many hours to read articles and academic journals, in addition to talking with industry experts, I’d like to think I’ve learned a few things about Cobalt. And I’m happy to share my findings with you. So if you’ve stuck with me this far, congratulations! Almost all the great stock pickers of the world have a voracious appetite for knowledge and a willingness to read. Therefore, if you wouldn’t consider yourself a great investor just yet, you’re definitely on the right track…so stay the course!

Getting back to the business of Cobalt, arguably the most important “special and critical” metal…

Five of my “Big Picture” findings regarding Cobalt…

1. By 2020, it’s expected that 75% of all Lithium-ion batteries will contain Cobalt. Why’s that? Because Cobalt is the most important metal for increasing the energy density of Lithium-ion cathodes.

2. The United States has depleted its stockpiles of Cobalt and is almost completely dependent on politically unstable countries such as the Democratic Republic of Congo for supplies. In fact, the entire world depends on politically unstable countries for more than half of its Cobalt needs.

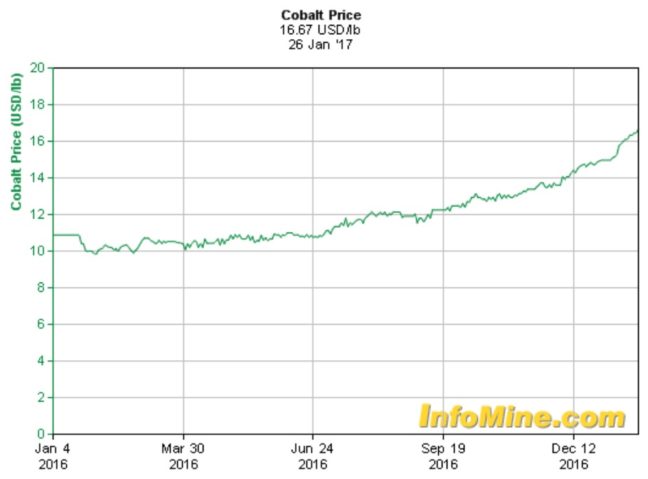

3. Cobalt prices increased 60% last year, from $10 to over $16 per pound. Strangely enough, this new bull market has received almost no coverage from the mainstream financial media.

4. A growing list of modern and advanced technologies rely on Cobalt, but as of now there is no great alternative.

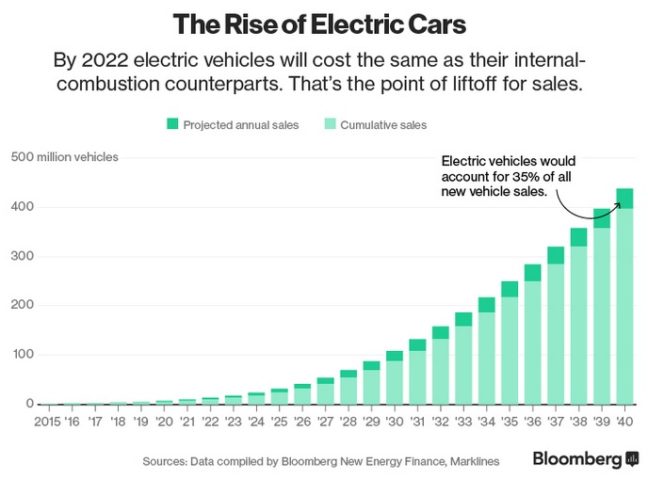

5. Approximately 22 kilograms of Cobalt are inside one “Tesla Model S”. Bloomberg’s New Energy Finance group forecasts more than 300 million electric vehicles (EV) will be on the road by 2037.

Assuming each EV needs 22 kilograms, like a Tesla Model S does, we would need 6.6 billion kilograms of Cobalt to be mined between now and then.

Herein, the question becomes…

Is there enough Cobalt to meet ever-increasing demand?…

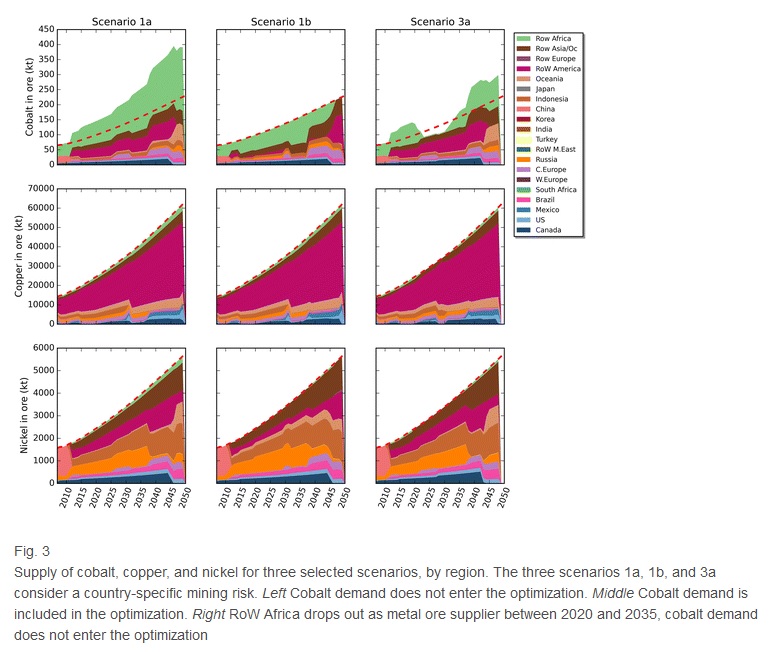

First off, it’s important to realize more than 90% of all Cobalt production is a byproduct of mining Nickel and Copper.

Therefore, the overall supply of Cobalt tends to rise and fall with the price of Nickel and Copper. When the price of those metals are up, miners extract as much as they can, and Cobalt production rises. Conversely, when the price of Nickel and Copper is low, miners extract less, and Cobalt production decreases.

The image below is very busy and quite honestly I had a difficult time interpreting the charts. However, it provides some insight into which countries are the dominant producers and how a shift in production affects the supply of Cobalt.

Image Courtesy of “The Journal of Economic Structures“.

As far as I can tell, from the image above, the supply of Cobalt changes significantly between the 3 scenarios with the different contributions from each region, but there isn’t much change in the regional pattern for Nickel and Copper supply.

According to the study referenced which you can read here, Cobalt recovery rates from Nickel and Copper production vary between 25% and 80% depending on deposit type. Assuming an average recovery rate of 60%, the authors theorize that Cobalt supply should be sufficient to meet demand going forward.

Is Mr. Market waking up to the fragile supply-demand situation for Cobalt?…

That said, supplies of this “special and critical” metal, a necessity for electric vehicles and Lithium-ion batteries, can be constrained for reasons such as political instability, anti-mining policies and trade restrictions. Additionally, supplies could be constrained by a lack of mineral resources and a mismatch between demand and available production capacities.

Image Courtesy of “Visual Capitalist“.

At any moment, a drop-out of one major African Cobalt supplier could swing the supply-demand equation into a deficit virtually overnight. Perhaps Mr. Market is waking up to this fragile situation and will continue bidding up the price of Cobalt. Historically speaking, the high is over $50 per pound, so while prices are up 60% year over year, at $16 they’re still closer to a valley than the peak.

Given the “need” for this “special and critical” metal required for jet engines, Lithium-ion batteries and electric vehicles, just to name 3 things that are kind of important, my gut tells me – you should be acquiring stocks that offer exposure to Cobalt. We’ve been saying that at BMR for the last 9 months or so.

In my view, savvy speculators will be overjoyed for the opportunity to buy the the best of the best Cobalt assets into any weakness for years to come.

In the 1,254 words above and 6 images above I hope to have provided you with a solid foundation of knowledge regarding Cobalt that you can build from.

In the rest of tonight’s subscriber piece, you’ll find 3 Cobalt related stocks you absolutely must check out. Borrowing part of a phrase from Buffett, you can do whatever you want with them!

Tomorrow in Morning Musings, we’ll share specific trading strategies and add in a few more Cobalt gems.

SAVE 25% on our January Special, which has been extended by a few more days due to reader requests and demand, with a risk-free BMR Basic, Gold or Pro Subscription TODAY – and we’ll show you our proprietary strategies that have delivered unbeatable documented triple-digit returns.

With an industry-leading 100% money-back satisfaction guarantee for new subscribers, you can enjoy unlimited access to all BMR content with a PRO membership.

Sign up NOW or login as a current subscriber with your username and password.

5 Comments

Jon, keep an eye out on CPO. They have great Cobalt properties and a tight share structure!

CUZ as well!

Daniel – MITK had news this morning on it’s first quarter results. Revenue up 25% year over year but stock trading down. Perhaps Mr. Market takes a day or two for this to sink in? Nice piece on cobalt.

Thanks Vepper. MITK has a conference call at 8 PT. I will be listening to that and note key takeaways in the Morning Musings. Mitek’s deal with MoneyGram is a big one. You’re right though, Mr. Market doesn’t seem to care at the moment. Maybe the CEO will have something good to say in the CC!

MITK – Daniel, a disappointing day for MITK. What was your take away from the CC?