Some unexpected and very nice Christmas gifts have arrived more than a week late but that’s perfectly okay. There’s no need to blame Canada Post. In this case you can actually thank certain investors who have been extremely generous as these gifts take the form of junior resource stocks that are being offered at significantly discounted prices after a 100-point drop in the CDNX since Tuesday.

The CDNX has declined from a high of 2312 Tuesday, the first trading day of the year, to a low of 2212 today- a drop of nearly 5% during a three-day period. If the CDNX were a grocery store, and prices were slashed 5% across the board, you’d see some very happy customers. So now is not a time to flinch and get scared – now is the ideal time, as it was in November as well as last summer, to embrace this weakness and load up the basket with some serious bargain-hunting.

John updates the CDNX chart for us and sees many reasons to view this pullback in a very bullish context:

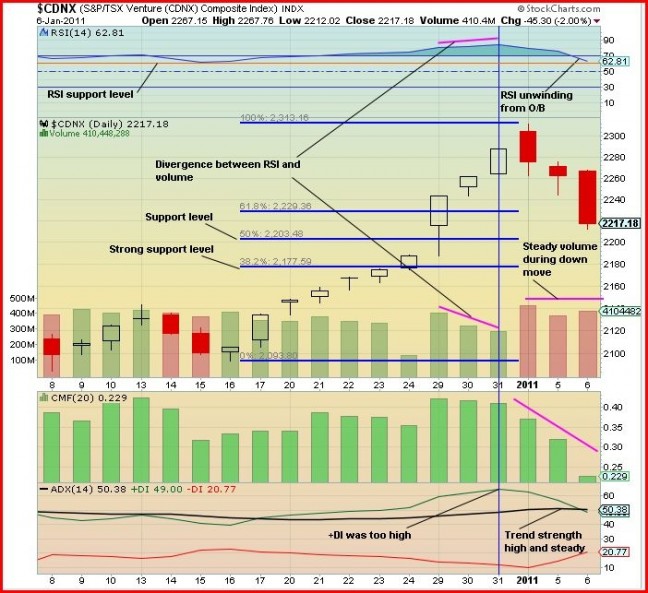

Today the CDNX opened at 2267, its high, then drifted lower during the day to a low of 2212 before closing at 2217 for a loss of 45 points (2.0%) on volume of 410 million shares.

Looking at the 1-month daily chart we see that the Index continued its down move that started 2 days ago from its high of 2312. This is a loss of nearly 100 points in just 3 days, but let us put this in proper perspective. First of all, there was a warning that the Index was temporarily topping out. The CDNX rose on December 29, 30 and 31 but on each consecutive day the volume declined (the increase on the 31st was the 10th consecutive winning session). This is a negative divergence. To sustain any uptrend an increase in volume is required. The volume increased on January 4 but on this day the bears were out in force so this was mainly down volume. It is important to note that the volume during the last 3 days (down days) has been pre-holiday average and constant, showing clearly that this is a correction and not a sell-off.

So, why a correction at this time you may ask? Well, this can be explained by looking at the RSI which was overbought and peaked on Dec 31, and by the very high value of the +DI of the ADX trend indicator. The last move up by the CDNX started on December 16 and lasted for 10 full sessions and took the Index from around 2100 to 2312.

The Fibonacci levels (blue) show that the retracement support levels are at 2203 (50%) and 2178 (61.8%) with the latter being particularly strong.

Looking at the indicators:

The RSI is unwinding from its overbought situation and is approaching a previous support level (orange horizontal line) which is between 55% and 60%.

The Chaikin Money Flow (CMF) indicator shows buying support has decreased during the last 3 days. Buyers are sitting back and accumulating cheap shares of sound companies.

The ADX trend indicator shows that the +DI (green line) had reached an unsustainable level of above 60 and is now down to the 49 level. The ADX (black line) trend strength indicator is steady and high at 50, showing the uptrend is still strong. The +DI, -DI and ADX lines are in bullish orientation.

Outlook: This minor correction is not expected to fall below the 2178 Fibonacci support level shown on the chart.

4 Comments

More gobbledegook! What are you guys into now? Throw some dried toads, bat’s ears and rabbit’s feet into the pot and give it a stir. You will be okay but it might take a while……..

I would suggest that you Black Bear should continue your pursuit of the CDNX on a different forum. John’s charts are always interesting and informative and if a little pull back like this upsets you so much maybe you shouldn’t bother with shares at all. That would suit me and the vast majority of the contributors just fine.

Patrick I would agree. BBears comments add nothing to any discussion and we all know where he should be. Thx for this Jon – appreciated.

Thanks to everyone at BMR for all thier work and analysis.

It is very easy to comment sitting on your couch. If you cant handle the fire then get out of the kitchen.