Markets have been in the red all day, though Gold has bounced back from a low of $1,622 to a current price (as of 12:10 pm Pacific) of $1,637 – a loss of $5 an ounce on the day.

The already oversold CDNX has become even more oversold today and is currently down 30 points to 1368 with 50 minutes left in the trading session – it’s still within the support band outlined in John’s chart Saturday.

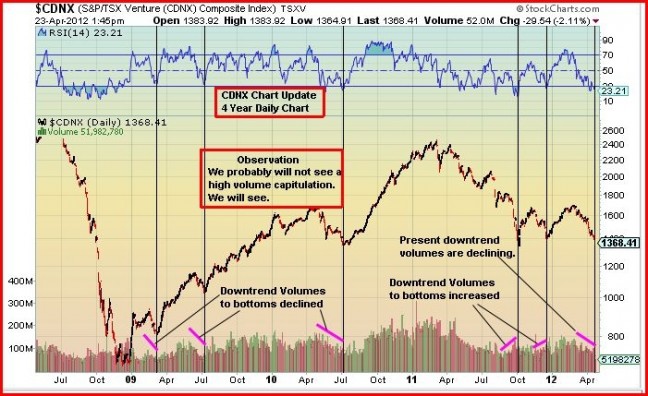

Some investors assume that a market bottom will be accompanied by high volume – historically with the CDNX, that has often occurred but not always. Most recently, the CDNX declined from a high in the first quarter of 2011 to a low in October and then retraced again to a low after a bounce. Each of those lows did have a high volume “capitulation”, so at this point it’s possible that most of the weak shares may already have been sold off. Hence the declining volumes lately toward a low.

One thing is certain – it makes a lot more sense to be a buyer right now than a seller. Greed enters the picture at both ends of a market – near a top, when investors want to hang on for just a little longer to squeeze out more profits, and near a bottom when savvy investors know it’s likely a good time to buy but they want to wait to get in at the very bottom which of course is virtually impossible. If you think this market is within less than 10% of an important low, as we do, then now’s the time to be jumping in. One of the recipes for investor success is getting out within 10% of a market top or getting in within 10% of a market bottom – easier said than done given our fear and greed emotions.

The FMOC meets tomorrow and Wednesday which could be a defining moment for the markets this week.

6 Comments

link to video GBB made by EuroSwiss delegation on their visit last:

“Miningscout.de – Highlights Site-Visit 2012 at GBB`s Granada Property”… Youtube

I appreciate the above noted comments, especially since i was thinking along

the same lines today, after being reminded by a friend a couple of weeks ago,

that the time will come, when the selling will dry up, thus lower volumes. Now

we wait for the volume to increase on the positive side, thus preventing Jeremy

from pining away. Sorry Jeremy but i have to try all tactics to get you back on

track. R !

can anyone shed light on VGD? it’s been taking a s#*% kicking!

Slow Stochastic

I find that when the slow stochastic %K rises above the %D below 20, is a good indication

that a stock or an indices is on the verge of turning up. This is what happened today

on the Venture, so it’s another indication that we may be on the verge, whether it be

short term or not. R !

NICE READING! IT’S GOOD TO SEE YOU GUYS POSITIVE DESPITE THIS DOWNTURN WHICH HOPEFULLY IS OVER VERY SOON!

Bert …. funny … 🙂 and I just sent an email to a buddy of mineabout volume, and we need it to capitulate… timing eh!!:) … Bert I am no diffreent than 80-90% of the investing public, except I am not really acting on it.. I have got myself in a cash position by selling some dogs, and portions of others over the past week… before you suggested that.. which gave me hope that I am not a moron!!:) and the sells were not at market which is another good thing…

As John believes that the FOMC will be a market maker, it can be wither way… and thats where the capitulation may come from..???

and Bert .. keep working on me mate!!! if I represent the normalacy of the retail investor, then if I feel scared, or confident, then it could be said that the herd would be feeling similar!!:) and right now I am not as ‘scared’ as I was… but no where near confident..:)

hhmmmmmmmmmmmmmmmmm maybe I can be a leading indicator!!:) LOL