(Originally posted July 29. Canadian markets are closed Monday due to a holiday. BMR postings resume Tuesday morning.)

It was a wild week on the markets. In fact, the Dow put in its worst weekly performance, a 4.2% loss, since June 2010. For the month of July, the Dow was off 2.2%, the Nasdaq declined just over one-half of 1%, the TSX dropped 2.7%, but…the star performer for July was the TSX Venture Exchange (CDNX) which enjoyed its second-best month of the year, climbing 3.9% or 75 points to 1979. That also slightly beat the TSX Gold Index which moved up 3% this month.

While the Venture certainly got a boost from Gold’s sharp increase in July, there’s no way this speculative market would have performed the way it did this month if some sort of disaster was looming for the broader markets and the financial world as a whole. The CDNX is an incredibly accurate leading indicator. Speculative money is the first to flee on any hint of major trouble ahead, so what this market seems to be saying is that we can all enjoy our weekend (Canadians have a long weekend with Monday being a holiday) as the United States will somehow manage to avoid economic “Armageddon” next week.

Bullish action in the Copper market is also problematic for the bears and fear mongers.

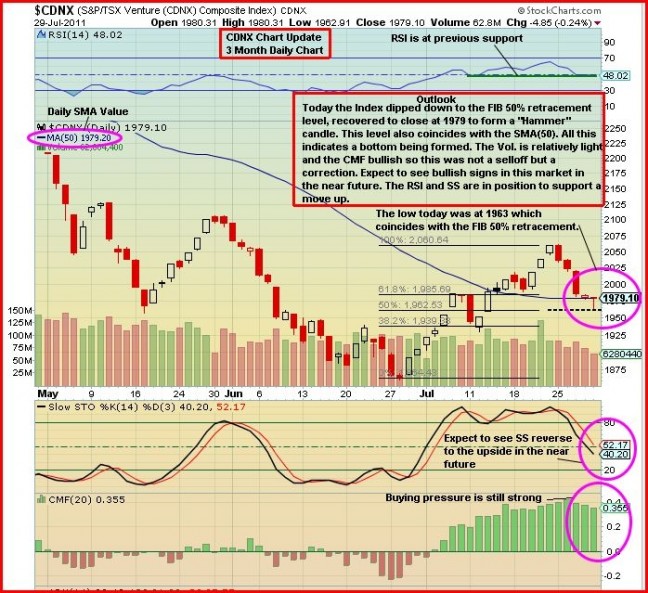

The CDNX ended a long correction June 28, jumped 199 points or nearly 11% in just 18 sessions, and today completed a 50% retracement of that advance. Very normal technical behavior in the early stages of a powerful new uptrend which we maintain the CDNX is in.

John updates the CDNX chart below:

3 Comments

Well it didn’t take long for uncertainty to creep in. It’s now the

U.S. Manufacturing Sector & then we have Main Street, who feel they

will be forced to pay for all the past misdeeds of the Banks, et al.

One of the few times since i have started to GAMBLE in this market,

that i feel down & even BMR charters have failed to life my spirits.

I have tried to put an optimistic view forward, but it’s difficult

to continue that, especially if you listen to some of the diarrhea

coming from those, who frequent the television stations.

R !

Bert

BMR – One can’t help but be impressed with the strength of the CDNX in July and its resiliency last week in the face of the Dow’s worst weekly performance in more than a year…

Bert – Maybe the CDNX did outperform the DOW in July, but is it a fair

comparsion, to compare the CDNX with the DOW, considering what

makes the DOW rise, don’t necessarily make the CDNX rise. We must

not lose track of the fact that the CDNX is down over 20% from the

last high of around 2430. I have mentioned in the past, that a stock

trading at 0.50, moves back to 0.20, then moves up by 2/3 pennies,

seems to get a very positive reaction & it appears to be forgotten

that the stock was trading & was bought at 0.50, not that long ago.

The brain is amazing, but it can fall prey to certain phrases. R !

Tomorrow’s trading will be interesting for the junior stocks… the overall market will be rising but not necessary the penny stocks… In my sixth sense thought… GBB will remain quiet … at 37 cents level… SFF will go down a couple of cents, BER will continue to close lower at 11.5 cents, SD no changes if no news to annouce … stay at 3.5 cents. My large lot at 3 cents still there guys…. . Large lot in my portfolio…. NAR, I am still collecting but I will wait for people to sell at 15.5 cents…. I may raise to 16.5 -17 cents …