BullMarketRun.com Special Report

Today we begin a series on the “Drone Revolution” and how North America’s only publicly traded company with a service-based drone business focused on the agricultural sector could soon be flying high with investors.

Deveron UAS, currently completing its listing application with the Canadian Stock Exchange (CSE) after deciding to switch from the Venture following a change of business announced late last year, sees an enormous opportunity to drive change in the Canadian agricultural sector in ways that have proven highly successful in France and other parts of the world as the global Agtech industry rapidly gains momentum. In fact, Deveron’s business model is already being embraced by farmers in Ontario where the company commenced revenue generating flights last month and is aiming to gain a slice of the 7 million acre cash crop market in that province before rolling out its services on a national scale.

Deveron has armed itself with expertise in both the agricultural and tech sectors including Norm Lamothe (pictured), the original owner and developer of UAS business Eagle Scout acquired by Deveron. The company has developed key relationships over the past year, from large provincial co-ops to the brightest software minds in Silicon Valley, and has also caught the attention of well-known Toronto small-cap fund manager Roger Dent who will be joining the Deveron board.

Deveron could quickly turn into a market darling given the public’s growing fascination with drones and the potential of its common sense business plan.

The possibilities in this sector are mind-boggling when one considers not only the nearly 90 million acres of cash crop just in Canada, but how farmers in this country – like elsewhere on the continent and around the world – are looking for efficient solutions to various problems including this: rates of yield increases for major crops have been trending negatively on a 10-year curve at the very time that global forces of population growth, prosperity and globalization are putting basic supply-and-demand pressure on our agricultural system.

The best drones, sensors and software can go a long way toward helping farmers improve yields, reduce costs, identify problem areas before they can be naturally seen with the eye, and conduct important research. But farmers want to farm, and managing the capital costs and the complexities of owning their own drones and acquiring the proper data is simply not practical for most. That’s where Deveron enters the picture as a full-service solution that focuses on delivering the entire work flow that allows farmers to seamlessly integrate high resolution imagery into their decision making.

“There are so many opportunities to apply technology to the 88 million acres of farmland in Canada, and our UAV service delivers data analytics and solutions while saving the farmer the additional burden of owning hardware, interpreting data, planning flights and dealing with the regulatory system,” explained Lamothe.

DEVERON UAS – Growing Anticipation Regarding CSE Debut

David MacMillan, Deveron’s VP of corporate development whose knowledge of the drone space is probably unparalleled on Bay Street, added: “As we focus on building credibility, relationships and growing our footprint in Ontario, it is encouraging to see such excitement from the agricultural community with respect to our service offering. Our first assignment was completed in conjunction with one of Ontario’s largest farming co-operatives, and we look forward to building this relationship as the premier supplier of drone imagery services for agriculture in the region.”

“TRANSFORMATIONAL” – MacMillan On The Exploding Drone Industry & Deveron’s Niche

Click on the arrow to listen to the first short BMR interview clip with MacMillan as he discusses with Jon the “Big Picture” of drones and how Deveron could flourish as a data analytics provider in the agricultural sector:

Click here for a fascinating Part 2 of our interview with MacMillan as part of our Morning Musings.

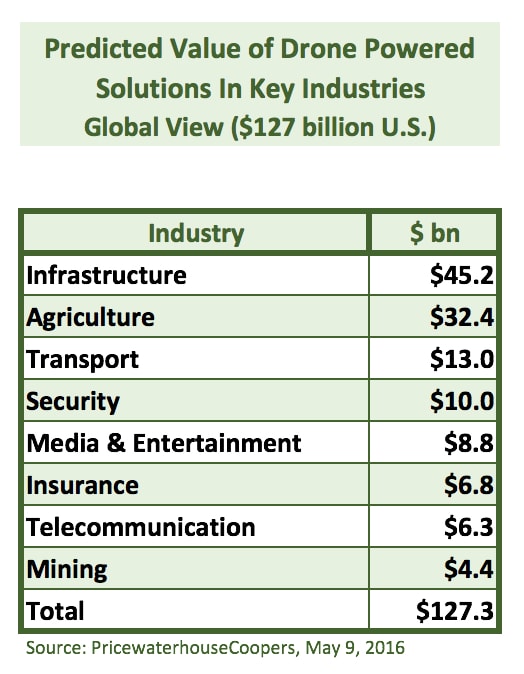

Deveron UAS, with less than 20 million shares outstanding and just 3 million or so in the public float once it commences trading on the CSE, has a chance to soar higher than its drones if it can capture even just a fraction of PricewaterhouseCoppers’ predicted value of drone powered solutions in the agricultural industry. Shareholders will win and so will farmers as Deveron integrates disruptive technologies in ways that allow farmers to save money while optimizing field efficiencies.

Note: The writer holds a share position in Deveron UAS.

Disclaimer

BullMarketRun.com (BMR) is reader-funded as a subscriber service and completely independent from any companies it covers. We accept no advertising either. No compensation was paid by Deveron UAS for the above article or its distribution. Our stock coverage is for informational and entertainment purposes only and must not be viewed or interpreted as “buy”, “sell” or “hold” recommendations. No investment opinion or other advice is being rendered on any stock or company. We strongly recommend that you consult with a qualified investment adviser, one licensed by appropriate regulatory agencies in your legal jurisdiction, and do your own due diligence and research before making any investment decisions. The stocks we cover, by definition, are highly speculative and potentially very volatile. Investors are cautioned that they may lose all or a portion of their investment if they make a purchase or short sale in these speculative stocks. We are not Registered Securities Advisers. Our opinions can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Adviser operating in accordance with the appropriate regulation in your area of jurisdiction. It should be assumed that BMR personnel, writers and their associates may hold or dispose of or trade in positions in any securities mentioned herein at any time. Owner/Publisher of BullMarketRun.com is Terry Dyer of Langley, British Columbia.

Forward Looking Statements:

All statements in BMR’s reports, other than statements of historical fact, may be forward-looking statements. These statements relate to future events or future performance. Forward-looking statements are often but not always identified by the use of words such a “seek”, “anticipate”, “plan”, “continue”, “estimate”, “expect”, “may”, “will”, “project”, “predict”, “potential”, “targeting”, “intend”, “could”, “might”, “should”, “believe” and similar expressions.

2 Comments

Volume picking up on BRM.. this morning!! Has been very quiet the last few weeks. Nice to ser!!

Yes, nice Q1 performance and Q2 should be even better…we have an update in today’s Morning Musings…