As John’s chart showed yesterday, the Venture Exchange is showing clear signs of a pending turnaround – we’re convinced now that next week the CDNX will finally push through its EMA-20 which has provided key resistance during the downtrend that started in March. Gold and Silver are looking technically strong as well.

At BMR, we’ve been following several “hot” situations recently including of course GoldQuest Mining (GQC, TSX-V) which is looking better than ever (we’ve been covering this story aggressively since Day 1) after a “monster” hole (LTP-93) was reported Monday (258 metres grading 4.5 g/t Au and 1.3% Cu). GQC’s Romero discovery in the Dominican Republic is still in the very early stages, but this stock is a “keeper” in our view given the early indications of a potential world class deposit. The fact Dundee Securities jumped all over a financing immediately after the release of last Monday’s results is a very bullish sign. Dundee has some excellent mining analysts and they’re seldom wrong in these situations.

The mineralization-rich DR is getting more attention than ever now, so, as we’ve been mentioning, it’s also an excellent time to be looking at the only other juniors in this mining-friendly jurisdiction – Unigold Inc. (UGD) and Everton Resources (EVR, TSX-V). UGD gained 29% last week, closing Friday at 49 cents, while Everton inched up to close the week at 9.5 cents. Recently, we interviewed EVR President and CEO Andre Audet and we’ll be posting that interview as soon as possible. UGD is getting very encouraging drill results from its Candelones Project approximately 40 kilometres north of GQC’s Romero discovery, while Everton is looking to joint-venture its promising land package contiguous to the massive Barrick-Goldcorp Pueblo-Viejo deposit where mining operations are expected to commence this month.

In British Columbia, Rainbow Resources (RBW, TSX-V) has mobilized a drill rig to its International Silver Property in the West Kootenays. Drilling is expected to start by the end of next week, and initial shallow holes will be testing for high-grade mineralization along an exposed structure. Rainbow has some fabulous targets to drill, and several years of work has gone into pinpointing the best locations for the first-ever holes drilled at this promising property. Yes, there are never any guarantees in this business and this is a speculative play just like GoldQuest was (and still is). But based on all the historical information known about this property, several geological reports over the last few years, Braveheart’s work starting in 2007 which was followed up by Rainbow beginning last year when it took over the private company, and our own site visit which included conversations with geologists and prospectors, we believe the odds of a discovery at the International are unusually high. It seems investors are starting to catch on to that with RBW closing above important resistance at 20 cents this past week. There aren’t many companies on the Venture with a chart so favorable as Rainbow’s, and we believe those bullish technicals are reflecting underlying confidence in the prospects for this very active young company.

The last company we aggressively followed with properties in British Columbia was Richfield Ventures which became a 10-bagger for some of our readers after a major Gold-silver discovery in the Blackwater district in the central part of the province. Richfield was taken out by New Gold Inc. last year at around $10 a share.

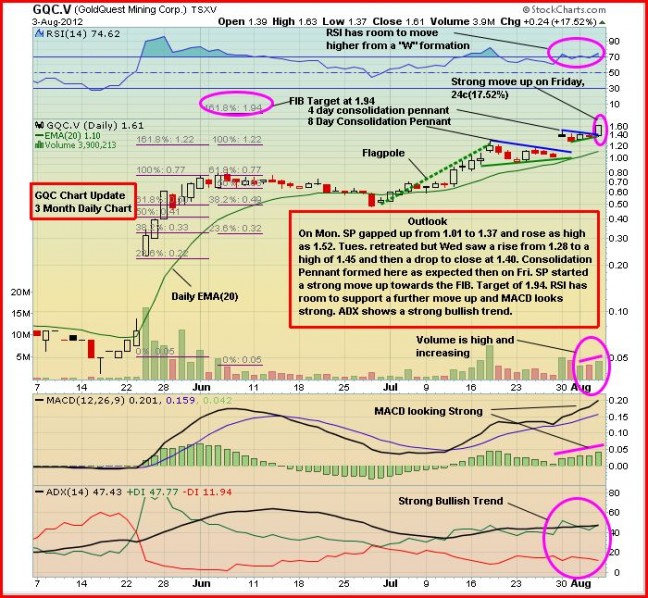

Below are chart updates for GoldQuest, Unigold and Rainbow. There are of course other opportunities we’re looking at (Comstock Metals – CSL, TSX-V – had a very good week), and we’ll be reviewing them in the coming days.

GoldQuest Mining (GQC, TSX-V)

Unigold Inc. (UGD, TSX-V)

Rainbow Resources (RBW, TSX-V)

Note: Both John and Jon hold share positions in RBW with Jon increasing his position yesterday. Jon also holds a share position in GQC.

5 Comments

Jon – Be positive, Bert,

Bert – I will try Jon, i will try.

RBW – A relatively new company & would you believe, it hasn’t as yet had a run &

every company is expected to have at least one run. It only has 35 million shares

outstanding & only trading at 0.20, with lots of room to move, up that is. It has

been suggested that this play is a win-win situation & no where to go but up. An

excellent Management team, who have surrounded themselves with an excellent board,

with vast experiences in all phases of mining. The Management team have built a

strong foundation with different projects & whatever, it will only be as good as

it’s foundation. One of their projects’, in particular, has figuratively speaking,

silver ozzing from the ground. With permits in hand & a drill idling, they just

can’t wait to get going, in fact, they are overlooking the fact that this is a

long weekend, instead, you will find them at their site, sleeves rolled & ready

to go. A company, holding all excellent projects in it’s hands & ready to go.

To be continued ….

Hi @BMR!

Could you please take a look at the chart of Anatolia Energy, an oil & gas company in Turkey, and perhaps tell me how it looks. My understanding and knowledge of reading technical charts is limited. I would appriciate if you do, but I also understand if it doesn’t interest you or if you guys just don’t have the time. Keep up the good work with this site. Enjoying your info! Hope that rbw starts to fly soon!

Good post Bert! Doesnt it feel good being positive? 😉

from SH … evidently was posted on 126 boards by the same guy…. but some good stuff here

Try to imagine a country full of gold hot spots and only 3 small gold juniors companies each allowed a maximum of 74000 acres by the local Government to dig up that gold. There is starting to be a lot of action in the Dominican Republic. It started big time with ABX and GG building a huge complex there. They are now ready to start producing within a few months. But the big upside in stock price will be with the three penny stock entities Unigold,Goldquest,and Everton. Of course Goldquest is leading the pack at the moment going from .05 to over 1.00. Very quickly. Next is Unigold which also went from about .05 to over .40. And last but certainly not least we have Everton which is starting to move from .05 to .09 so far. Everton has a lot of property in the DR next to Barrick and Goldcorps multi billion joint venture. All of these tiny three will no doubt continue to rise simply because there seems to be millions and millions of gold ozs ready to be discovered in this area. I’ve got stock in two of the three and intend to buy more when finances allow it. I am pumping this stock because I believe in it and I know it will make us money so lets just get that straight up front. Everybody loves Raymond and Everybody loves money! There’s no question Everton is going to benefit from the success of GoldQuest and Unigold, and what we see unfolding for EVR is a joint-venture deal(s) – possibly with a major –that will allow for exploration and drilling to resume on its promising land package…just a dozen holes have been drilled at EVR’s APV Property next to Pueblo-Viejo –only anomalous results were returned (albeit some of them encouraging), but 90% of that property is still wide open. Buy or don’t buy but just keep your eye on the three little jewels. From this point EVR.V definitely seems the best Risk/Reward. Latest update on EVR.V—Closed Friday 8/3/12 at .095 on fairly heavy volume of 678,000. This ones going all the way! All three of these small juniors in the Dominican Republic will make big money with big share prices. Goldquest,Unigold,and Everton all up over 10% friday. Lots of gold there.

also… had not heard of this site.. and not sure what the numbers mean but… maybe Jon can help us understand some of these metrics..????

http://miningalmanac.com/stock/Everton-Resources-Inc-EVR-ERV