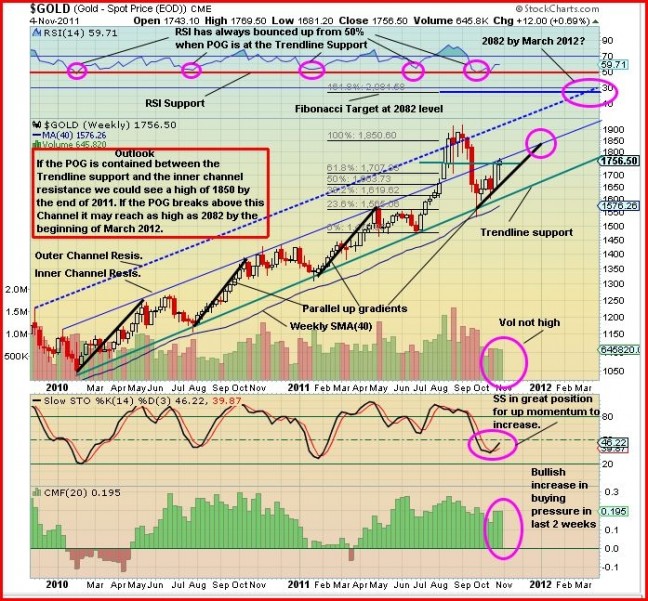

Gold enjoyed a solid week. It pulled back at the beginning of the week, as expected, to test an important support area just below $1,700. It then powered higher and closed Friday at $1,754 for a weekly gain of $11. John’s updated chart shows we can expect Gold to continue to rise in a determined but orderly fashion that should take the yellow metal to new all-time highs by no later than the first quarter of 2012.

4 Comments

As per the 26 September PR, Visible Gold Mines had no debt and its current cash liquidity was approximately $3.7 million .

As per the 4 November PR, Visible Gold Mines had no debt and its current cash liquidity was approximately $2.5 million .

Burn rate $1.2m in 6 weeks.

VGD is obviously drilling aggresively, no complaints there. Also, they are paying an in-house staff of thirty-two. This is a major operation and money is obviously required. We need to expect multiple financings along the way, which will not be a problem if continuing drill results can strenghten the share price exponentially.

VGD also said that no financing would be required this year and they get the credit from the Quebec Government next year. The drill results submitted at the same time as LBWC-11-03 must be available by now? My guess is they are poor and will be interpreted with the first drill results from Joutel. They did more drilling than planned at Wasa Creek and Wasa East following the first hole and it’s probably upset the cash flow. However, it’s a Private Placement, with a hefty commission, dreaded flow through units (large share dilution when fully exercised along with warrants and 5% additional shares to Industrial Alliance Securities) – they may as well have gone to Mineralfields. It’s bad news and poor management in my opinion. If Wasa Creek looked as if it was going to be one of two flagship properties they would have had a cash investor – but then again they would have released the results to add value. Maybe John will have an updated chart in the coming week – the volume has not been bad but obviously the selling pressure has been increasing. As things are this looks like an investment that’s going to lose value in the short term at least and probably beyond on that even if there is a decent news release as Industrial Alliance will play the Mineralfields game. Sheldon Inwentash was the smart insider in September, and perhaps we should sell when insiders do?

Ivan Lo’s Weekly Letter is very interesting this week – lots of info relevant to junior explorers: mining, grades, 43-101, management etc. Equedia.com