Through shear grit and determination, technical expertise from distinguished mine-finders, and a little bit of luck which is always needed, Doubleview Capital Corp.’s (DBV, TSX-V) Hat Property is closing out the final quarter of 2014 with fresh momentum after the discovery of higher grades within the Sheslay “red stock” as reported by the company following today’s market close.

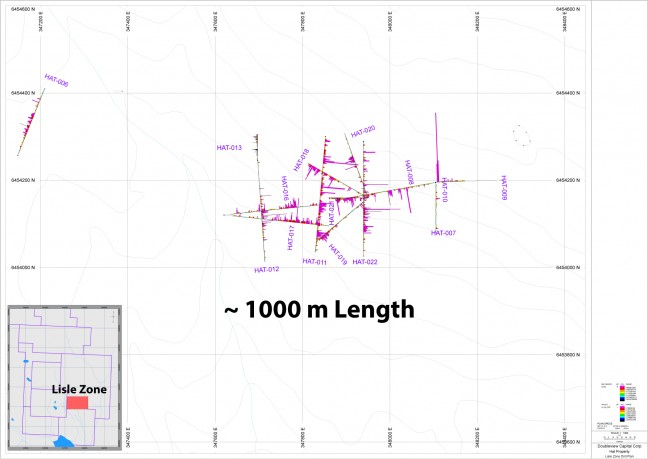

It’s important to point out that Doubleview has not been drilling a known deposit – this is a fresh, evolving discovery in the Sheslay district about 10 km southeast of the Star deposit. And it’s going to get a lot more interesting when the next round of drilling begins imminently, especially since the last hole (HAT-22) returned the best grades yet including a 118-m section of 0.55% Cu and 0.41 g/t Au (0.80% CuEq) within a broader interval of 404.2 m @ 0.40% CuEq. All 7 holes from this latest round of drilling “hit”, expanding the Lisle Zone to the north, the southwest and the east.

The “blue sky” over the Hat is as blue as ever – tonnage is building, grades are now trending higher (critical), and this system is wide-open in all directions. Yes, a massive amount of work is still required here – lots of heavy lifting to come – but the Doubleview team has already managed to get this far in a relatively short period. To use a football analogy, there’s every reason to believe they have what it takes to carry the ball into the end zone – wherever the “end” zone in this case might be because this field simply has no limits at the moment.

Keep in mind that less than a year-and-a-half ago, this property had never been previously drilled. To take the Hat from that grassroots stage to where it is now, after just 22 holes, is a major accomplishment, particularly considering the challenging market environment. Only a very dedicated, disciplined and talented team with immense faith in their project, and not afraid to take smart risks, could achieve that over these last 18 months. This is why we’re convinced there is so much potential upside to the Hat Property and Doubleview itself. President and CEO Farshad Shirvani, who has the likes of highly respected geologists Pat McAndless and Erik Ostensoe at his side, and others who are playing key roles, has shown the kind of courage and conviction required to give investors a legitimate shot at a huge win.

We’ve had our boots on the ground at the Hat – a site visit last April gave us the distinct sense that there is something special about this part of the Sheslay district. Cu-Au porphyry systems are never easy to figure out, but the possibility that the Lisle Zone connects with other well-defined targets throughout the project has to be considered very real. A broad range of data collected by Doubleview, combined with historical reports, are extremely encouraging for the discovery of a large-scale deposit. And somewhere in this cooked-up system, rich grades could exist as they do in the “red stock” at the Red Chris.

More tomorrow.

13 Comments

This can only be good for GGI, hopefully they will start drilling up there someday soon??

Have BMR spoken to any geologist/technical people who have done a quick calculation to get a rough estimate of tonnage so far? Pat and his team have done analysis and modelling work using the data they have so far. The last hole to be drilled was the best so I am hopeful that the next set of holes will have better grades, maybe hole 22 is going towards the source?

Hi Tom, we’re working on confirming that. Bringing up the grade of this deposit is key – tonnage I don’t think is going to be an issue – and the last hole is a good start in that direction. Where there’s smoke, there’s fire. All it takes is one hole that really hits the sweet spot, and look out. A lot ground to cover yet, a lot of targets.

As of early trading, people seem to be liking DBV’s results. No panic selling like last time. Let’s see if the buyers appear as the day progresses.

I agree, Chris, this looks encouraging.

With no high grades the market will yawn.

Let’s face it Jon, those were some good results. Grades are getting better and the tonnage is there. And most importantly they are going back to drill immediately. That’s crucial. DBV is the leader in the area and I expect money will be coming there way first.

Now, just need a push after one hour of trading! ABR looking stronger too…..

John – safe to say that the CDNX is not confirming a bottom in the PM’s???

Does this seem strange that we’ve had very little trading on DBV so far? I realize we haven’t had any panic selling – but should we be concerned about the lack of buying?

Kevin, the fact DBV is down marginally on LOW volume is a very positive sign, actually, especially given the current market environment…confident buyers I believe are waiting in the wings to scoop up any loose stock from nervous nellies…as the week progresses, my guess is you’ll see some strength come into this…

Thanks Jon – I have to admit – I’m a little shocked at how low the volume is so far. I’m hoping (like you said) that the confident buyers are going to line up and start picking up some cheap shares to rise this price up. I’m assuming a financing is coming down the pipe so hopefully it happens north of 20 cents.

Jeremy

The 860 Support is still intact