The move we’ve seen in the CDNX since late 2008 has a lot of similarities to the action we saw in the early part of the decade when the Venture began a five-year run in late 2002 that took it from just under 900 to nearly 3,400 by May of 2007. That very profitable “bull market run” was interrupted by three major and painful corrections of 20% or more leading to the May ’07 high – one each year during 2004, 2005 and 2006. History tells us, then, that we can expect a major CDNX correction sometime this year (there wasn’t one in 2009). We’re not saying this to scare anyone – it’s just the law of averages and the way bull markets work, especially with the CDNX. An occasional good shakeout and “cleansing” is necessary for the long-term sustainability of a junior resource bull market and can be a great money-making opportunity if you’re prepared.

The good news is, we believe the current market will move higher (just how high remains to be seen) before the 2010 correction hits (and we’re sure there will be one). We say that because the CDNX continues to show momentum and tremendous resilience as it outperforms both gold and the TSX Gold Index. When the Venture starts to underperform, that’s when we have to very concerned – July, 2008, was a great example.

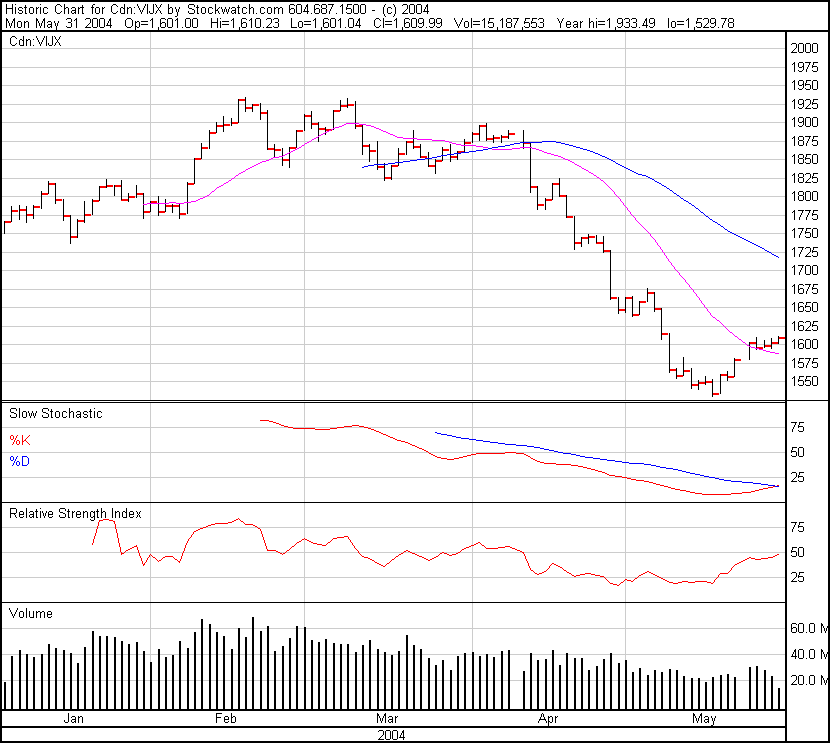

The chart below shows the CDNX between January 1, 2004, and May 31, 2004. You’ll notice the market ran to a high of about 1935 in mid-February. It pulled back 5%, then made another attempt in March and again in April to break through the February high. Those attempts failed, and you’ll also notice the declining volume through March and April as well which was not a good sign. The light blue line is the 20-day SMA while the dark blue represents the 50-day SMA. As soon as the two were declining in tandem, it was game over for the immediate short term and the CDNX plunged several hundred points before the bull market resumed its upward journey. We can expect the same thing again at some point in the near future.

In the current context, we believe there’s an excellent chance the CDNX is going to take a run at its January high during the month of April as we suggested yesterday. This will be a critical moment for the market and we’ll be watching the action very closely to determine if it’s time to take profits off the table and exit or stay in and keep buying.

There are many ways to view an individual stock and the market in general from a technical analysis standpoint. Sometimes, though, simple is better. The key short-term guage with the CDNX we believe is its 20-day SMA (the RSI or Relative Strength Index is also very reliable). History has shown that you want to be in this market on a rising 20-day moving average, and out on a declining one, when there is also the support of rising longer-term moving averages (100 and 200 day) which confirm the ongoing overall bull market.

The CDNX’s 20-day SMA continues to rise and the market could get some additional technical support next week with another potential reversal in the 50-day SMA. The 50-day recently started to decline but will advance again at the beginning of next week if the CDNX stays above support at 1550. This would be a bullish development and would clearly suggest an assault on the January high is imminent.