Gold has traded between $1,285 and $1,307 so far today…as of 10:15 am Pacific, bullion is up $5 an ounce at $1,301 after some volatile trading overnight following a Brexit ruling from the UK High Court as referenced in 7 @ 7:00…Silver is off its lows but down 13 cents to $18.32…Copper has added 2 pennies to $2.24…Crude Oil has slipped another 81 cents a barrel to $44.53 while the U.S. Dollar Index is off one-quarter of a point to 97.14…

It’s “Jobs Friday” tomorrow and market expectations are that 175,000 U.S. jobs were added in October, according to the median estimate of 106 economists polled by Reuters…106 economists picked by Reuters may prove as accurate as the latest Reuters/Ipsos U.S. election tracking poll released yesterday that showed Hillary Clinton leading Donald Trump by 6 points…

It’s “Jobs Friday” tomorrow and market expectations are that 175,000 U.S. jobs were added in October, according to the median estimate of 106 economists polled by Reuters…106 economists picked by Reuters may prove as accurate as the latest Reuters/Ipsos U.S. election tracking poll released yesterday that showed Hillary Clinton leading Donald Trump by 6 points…

The Institute for Supply Management said today that its headline index for the service sector fell to 54.8% in October (below expectations) from 57.1% in September…in other economic data released this morning, new orders for U.S. factory goods rose for a 3rd straight month in September but a further decline in order books suggested the manufacturing sector will struggle to emerge from a prolonged slump…meanwhile, U.S. worker productivity increased at its fastest pace in 2 years in the 3rd quarter, helping to curb growth in labor costs, but the trend remained weak…

Brazilian Robbers Steal 2 Million Ounces Of Gold From Jacobina Mine

The Globe and Mail reported this morning that armed robbers stole around 2,000 ounces of Gold worth $2.6-million (U.S.) from Yamana Gold’s (YRI, TSX) Jacobina mine in northeast Brazil last month…the mine had disclosed the robbery last month but did not say at the time how much Gold had been stolen…a group of heavily armed men stormed the Gold mine in the early hours of October 17 and fatally shot a security guard…local media reported that the robbers had blown the mine’s safe open with explosives…Yamana declined to comment on specifics, saying a police investigation continued. “The amount of Gold that was stolen is modest as material is kept in inventory only briefly after a Gold pour pending transport,” Yamana said in a statement…the company has insurance to fully cover the theft…

The Markets & Tuesday’s Elections

Epic Battle: Clinton vs. Trump

U.S. equity markets have not enjoyed an “up” day since news of the FBI re-opening its investigation of Hillary Clinton and her private email server broke during the trading session last Friday…a Clinton victory next Tuesday, assuming Democrats do not seize control of Congress which seems highly improbable at this point, would likely produce a “relief” rally on Wall Street…a Trump win, growing increasingly possible due in part to the intensity and enthusiasm of his supporters, is almost sure to be initially negative for stocks given how it would produce fresh uncertainty and a massive shock to the “status quo” and the establishment including much of the mainstream media…odds of a December rate hike by the Fed would plunge on a Trump victory while traders would also be speculating on the future of Fed Chair Janet Yellen who has been publicly criticized by the Republican nominee…however, a V-shaped recovery move in equities could unfold as Wall Street reflects later on very positive tax and regulatory changes that Trump supports…one important market sector that would clearly benefit from a Trump victory is Oil and Gas…

Potential Gold Impact

As for Gold, a Trump win would likely quickly drive the yellow metal to a new yearly high above $1,400 on safe haven buying…the self-proclaimed “King of Debt” is going to significantly cut taxes, boost infrastructure spending (Daniel recommended some good plays in that space recently) and sharply increase military spending while Congress will likely avoid touching entitlements, at least for now…that’s a recipe for higher deficits and debt during the first part of a Trump term, a fact Gold bugs will like a lot…over time, the argument goes, a private sector freed from the shackles of Obama’s over-regulation and over-taxation will ignite substantially higher economic growth, allowing the government to tackle the debt problem…

Polls Tighten But How Accurate Are They?

Billboard on Vancouver, B.C., Skytrain route.

The final polling averages in the 1980, 2000 and 2012 elections were off by 3 percentage points or more versus the actual voting results…the current FiveThirtyEight national polls popular vote gap between the candidates is 3.2 percentage points…based on those polls, and its polls-plus formula, FiveThirtyEight is giving Clinton a 67% chance of winning the Electoral College and the presidency vs. a 33% chance for Trump, but those odds for Trump have risen dramatically in recent days…we’ve also argued that Trump’s support has been underestimated in most of the polls…in addition, there’s a strong anti-establishment undercurrent in the American body politic at the moment, a fact reflected by the strength of the insurgent candidates in the primaries…Trump as the “change maker” is in a far better position to win than the polls and the mainstream media are suggesting, and the markets have only started to recognize that reality…most foreigners, the majority of whom have have little understanding of American politics and history, likely can’t imagine Clinton not becoming President based on the distorted media portrayal of Trump and the countless polls that have consistently put Clinton ahead since the start of this race…if they thought Brexit was a surprise, they would be astounded to see a “Revolt of the Deplorables” next Tuesday that carries Trump into the White House…

4 Critical States

No one has been elected President since 1960 without carrying two of the key swing states, Florida, Ohio and Pennsylvania…and this year, North Carolina has been added to the mix…all 4 of these critical states remain very close entering the final days but late momentum appears to be swinging in Trump’s favor…if he wins Florida, Ohio and either North Carolina or Pennsylvania, it’s game over for Hillary but at least she won’t become the first President or President-elect to be indicted…

Clinton Could Win Battle But Lose War

Even if Clinton manages to stagger across the finish line next Tuesday, even tougher battles will lie ahead for her with the FBI and Congress over her private email server scheme and improper handling of classified information as Secretary of State…as if that’s not bad enough, the FBI’s investigation into the Clinton Foundation that has been going on for more than a year has now taken a “very high priority”, separate sources with intimate knowledge of the probe have told Fox News as reported by the network yesterday…FBI agents have interviewed and re-interviewed multiple people on the foundation case which is looking into possible “pay for play” interaction between then-Secretary of State Clinton and the Clinton Foundation…the FBI’s White Collar Crime Division is handling the investigation…even before the WikiLeaks’ dumps of alleged emails linked to the Clinton campaign, FBI agents had collected a great deal of evidence, according to Fox News’ law enforcement sources…“an avalance of new information is coming in every day”…a huge dark cloud of scandal hangs over Hillary, just as it has in general with the Clintons for 3 decades…

It’s wise to expect the unexpected on Tuesday…after all, the Chicago Cubs came from behind 3-games-to-1 to win their first World Series in 108 years last night…

The Emerging Volatility Spike

The single leverage VIIX (VelocityShares Daily Long VIX Short-Term ETN) trading on the NASDAQ, is an ETN that’s linked to the CBOE short-term VIX futures…there’s also a double-leveraged version – TVIX – as we outlined in our most recent Sunday Sizzler when we examined some immediate tactical trading options for experienced investors looking for a hedge…the VIIX is up 11.3% since last Friday while the TVIX has jumped 23.5%…they are set to climb higher…

The current technical posture of the VIIX does support the contention that overall market volatility is set to increase in the days ahead…note the breakout above the downtrend line in place since June when the VIIX last spiked thanks to the Brexit vote…RSI(14) is headed straight toward overbought territory while the next Fib. resistance is $13.32…

The VIIX is up 44 cents at $12.58 as of 10:15 am Pacific…

In Today’s Morning Musings…

1. More than just an interesting technical drilling discovery for Teuton Resources (TUO, TSX-V) at Del Norte Property adjacent to IDM’s Red Mountain? – assays pending…

2. Updated Venture chart as Index tries to hold support…

3. Sokoman Iron (SIC, TSX-V) erupts…

4. Updates on Lico Energy Metals (LIC, TSX-V) and WPC Resources (WPQ, TSX-V)…

Plus more…click here to read the rest of today’s Morning Musings and all BMR exclusive content, through a risk-free Pro, Gold or Basic package, or login with your username and password…

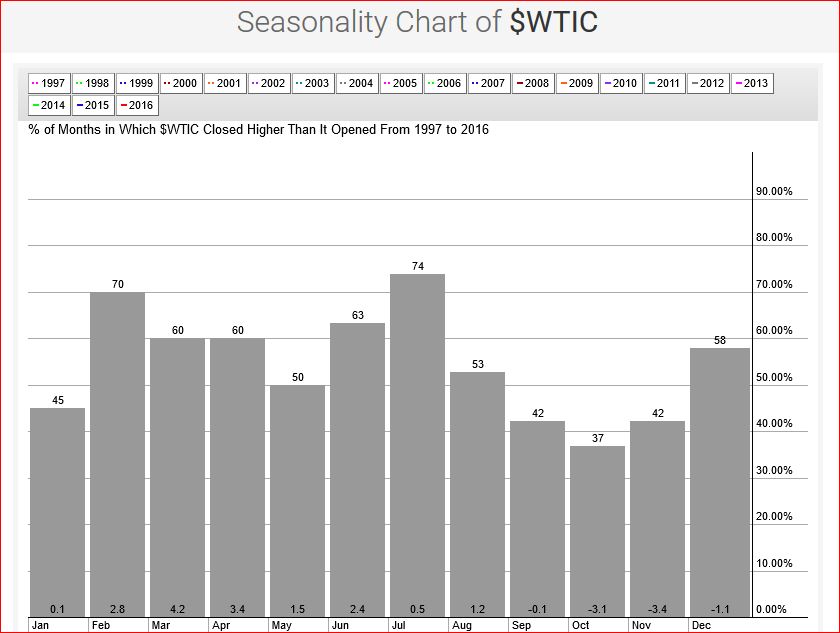

Anticipation of a March interest rate hike in the U.S. has put Gold on track for its biggest weekly loss in 4 months this week, but we’ve seen that movie before in the lead-up to the only 2 Fed meetings in the last decade that have resulted in rate increases…Gold has actually been more resilient this time around, so how March finishes for Gold could be quite different from how it has played out so far…

Anticipation of a March interest rate hike in the U.S. has put Gold on track for its biggest weekly loss in 4 months this week, but we’ve seen that movie before in the lead-up to the only 2 Fed meetings in the last decade that have resulted in rate increases…Gold has actually been more resilient this time around, so how March finishes for Gold could be quite different from how it has played out so far…

BullMarketRun.com

BullMarketRun.com

It’s “Jobs Friday” tomorrow and market expectations are that 175,000 U.S. jobs were added in October, according to the median estimate of 106 economists polled by Reuters…106 economists picked by Reuters may prove as accurate as the latest Reuters/Ipsos U.S. election tracking poll released yesterday that showed Hillary Clinton leading Donald Trump by 6 points…

It’s “Jobs Friday” tomorrow and market expectations are that 175,000 U.S. jobs were added in October, according to the median estimate of 106 economists polled by Reuters…106 economists picked by Reuters may prove as accurate as the latest Reuters/Ipsos U.S. election tracking poll released yesterday that showed Hillary Clinton leading Donald Trump by 6 points…