3:00 pm Pacific

(Exclusive to BMR Pro Subscribers – Not for Distribution or Posting on any Board!)

In today’s report…

1. Prepare now for the next leg up in the Newfoundland Gold Rush…

2. Bitcoin races toward a new all-time high – a strong stock in this space that broke out powerfully last week…

3. How Dr. John Boone could put dollars per share on IZO…

4. How TAAT is thinking BIG (and succeeding)…

5. A Copper stock that’s like the Energizer Bunny – keeps on going…

The Newfoundland Gold Rush

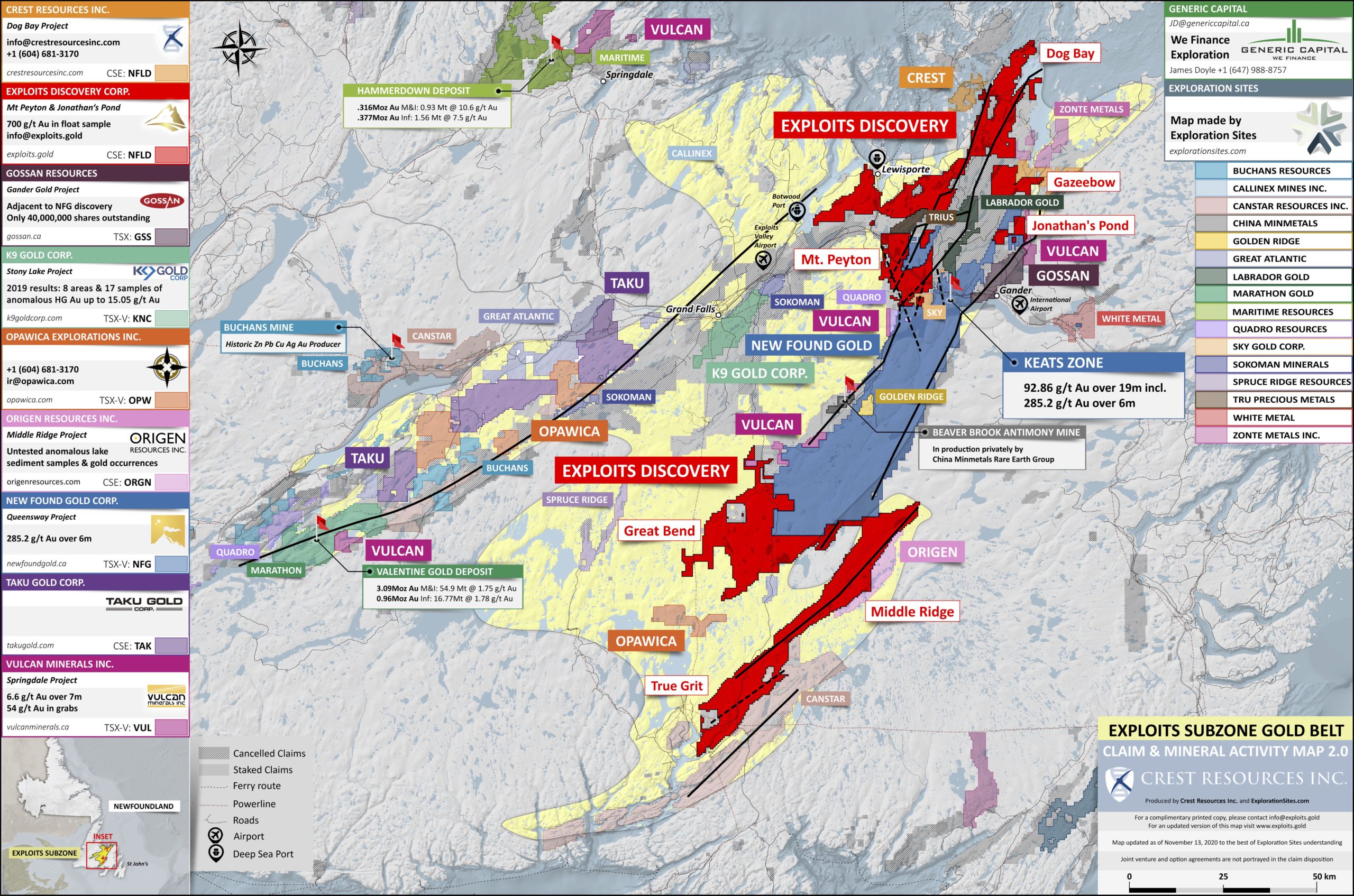

The prolific Newfoundland region, like the Eskay Camp with all of its riches, has been squarely in our focus the last several years, and we encourage subscribers who still aren’t positioned in some Newfoundland resource stocks to do so as quickly as possible – do not procrastinate, your “window” of opportunity is NOW before the anticipated post-Christmas surge.

In today’s Sizzler we have some specific money-making strategies for subscribers. It’s best to own a small basket of juniors plus at least 1 of the “thoroughbreds”, meaning either the more speculative New Found Gold (NFG, TSX-V) or rapidly emerging producer Marathon Gold (MOZ, TSX) which still has considerable exploration upside at Valentine Lake.

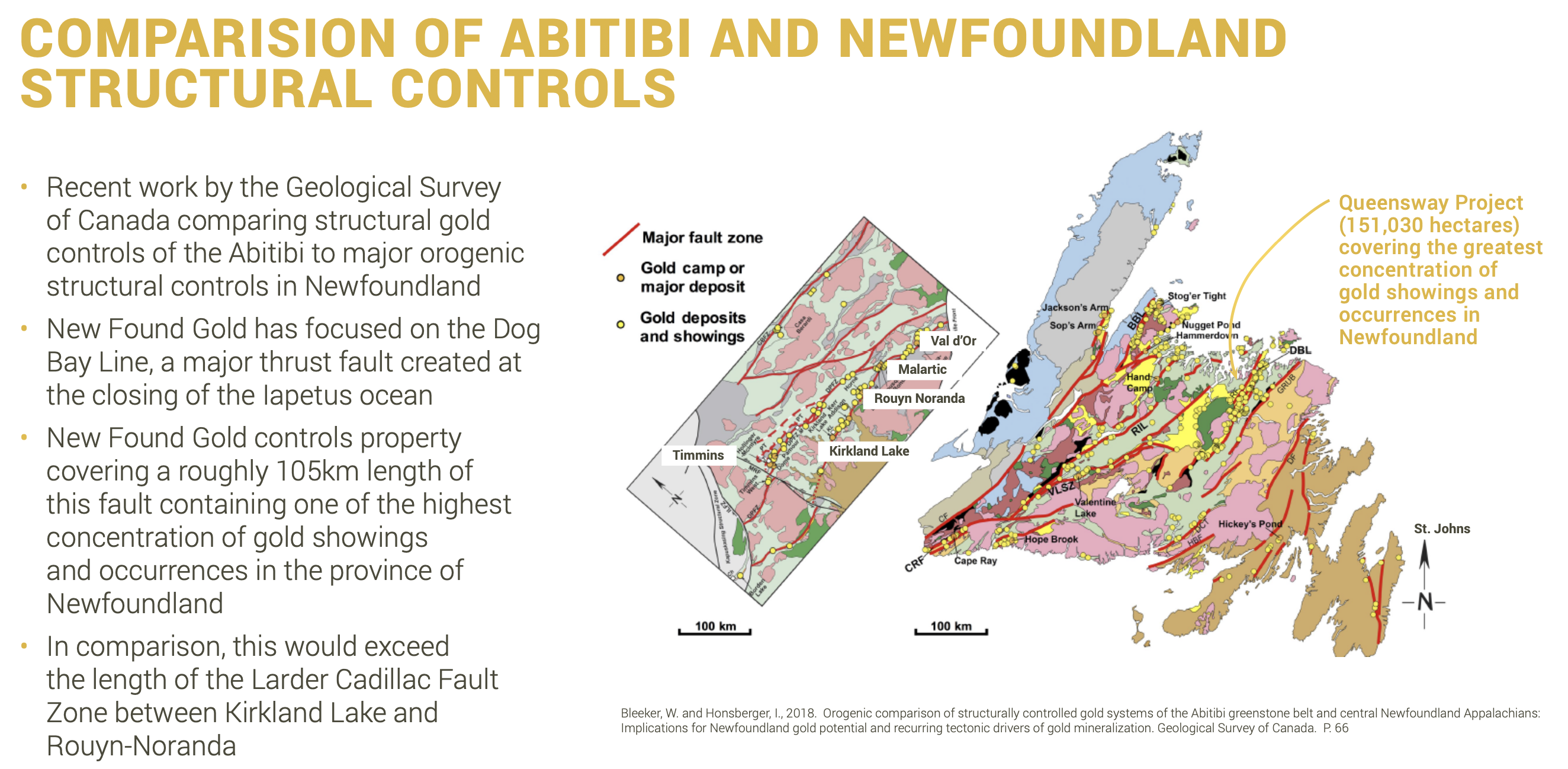

First, some context. At a time when not 1 Canadian jurisdiction ranks in the Global Top 10 for “investment attractiveness” when it comes to mining and exploration, according to the Fraser Institute’s latest survey (the first time in a decade this has occurred, thanks to our inept federal government), Newfoundland and Labrador (28th out of 76) is nonetheless ahead of Alberta, Manitoba, the Northwest Territories, Nova Scotia and New Brunswick, and the expectation is that Newfoundland and Labrador will move higher in the next set of rankings (Saskatchewan is 11th, Ontario 16th, Quebec 18th, B.C. 19th, and Yukon 23rd). A genuine Gold rush has broken out in Newfoundland, staking has been incredible and some huge exploration programs are being carried out. As the saying goes, follow the money! Many more millions of ounces of Gold will be found over the next few years, and just about every other metal is being searched for there as well. It’s a big, big jewelry box, and the welcome mat is out for mining and exploration companies.

In 2016, when Daniel first joined BMR, one of his first featured junior resource companies was Marathon Gold. Daniel really opened everyone’s eyes to this region, and Marathon (a struggling 20-cent stock in early 2016!), now commands a market cap of half a billion dollars thanks to a multi-million ounce resource. New Found Gold, which we encouraged subscribers to buy the moment it started trading a few months ago, now commands a $630 million market cap thanks to a series of very high-grade hits at its Queensway Project near Gander.

More than 2 dozen companies are active in this region and more discoveries are going to be made in the year ahead. In fact, a rip-roaring, old-fashioned Canadian area play could ignite very soon under the right conditions, so that’s why investors need to be engaged with this story. Plant your seeds now if you haven’t already, and reap a mighty harvest in 2021.

New Found Gold (NFG, TSX-V)

New Found Gold is in the early stages of a 100,000-m drill program, following up on 2019 discovery hole NFGC-19–01 at the Keats Zone that returned a staggering 93 g/t Au over 19 m. They are stepping out very gradually from that hole and continue to hit impressive intersections as evidenced last week with drill hole NFGC-20–26 (a 60-m step-out) which returned 44.5 g/t Au over 6.85 m within a longer interval of 11.8 g/t Au over 29.15 m, starting just 45 m downhole (true width estimated at 70% to 80%).

Keep in mind, for scale purposes, NFG on October 2 announced a high-grade hit at the Lotto Zone situated along a secondary structure occurring along the east side of the Appleton Fault approximately 2 km north of the Keats Zone. NFGC-20–17, the first hole targeting this zone, returned 41.2 g/t Au over 4.75 m starting 35 m downhole, in addition to 25.4 g/t Au over 5.15 m beginning 57 m downhole. Similar to Keats, the high-grade Gold mineralization at Lotto displays characteristics suggestive of an epizonal orogenic depositional environment.

Denis Laviolette President of New Found, stated in last Monday’s news release: “Historic work and more recent drilling at Keats have demonstrated Gold mineralization over at least 300 m of strike and the Keats target remains open in each direction along strike and to depth. We are continuing to drill on grid lines at 50 m spacing to the north and south of NFGC-19–01 and anticipate further results from this drilling in the next several weeks. In addition, the closer-spaced drilling around NFGC-19–01 is yielding outstanding results and giving us valuable information about the spatial distribution and geometry of the high-grade Gold mineralization. Our recent hole at Lotto Zone 2 km north of Keats has confirmed the potential for multiple high-grade zones along the 5 km of the Appleton Fault Zone that will be grid drilled in our current 100,000 m program.”

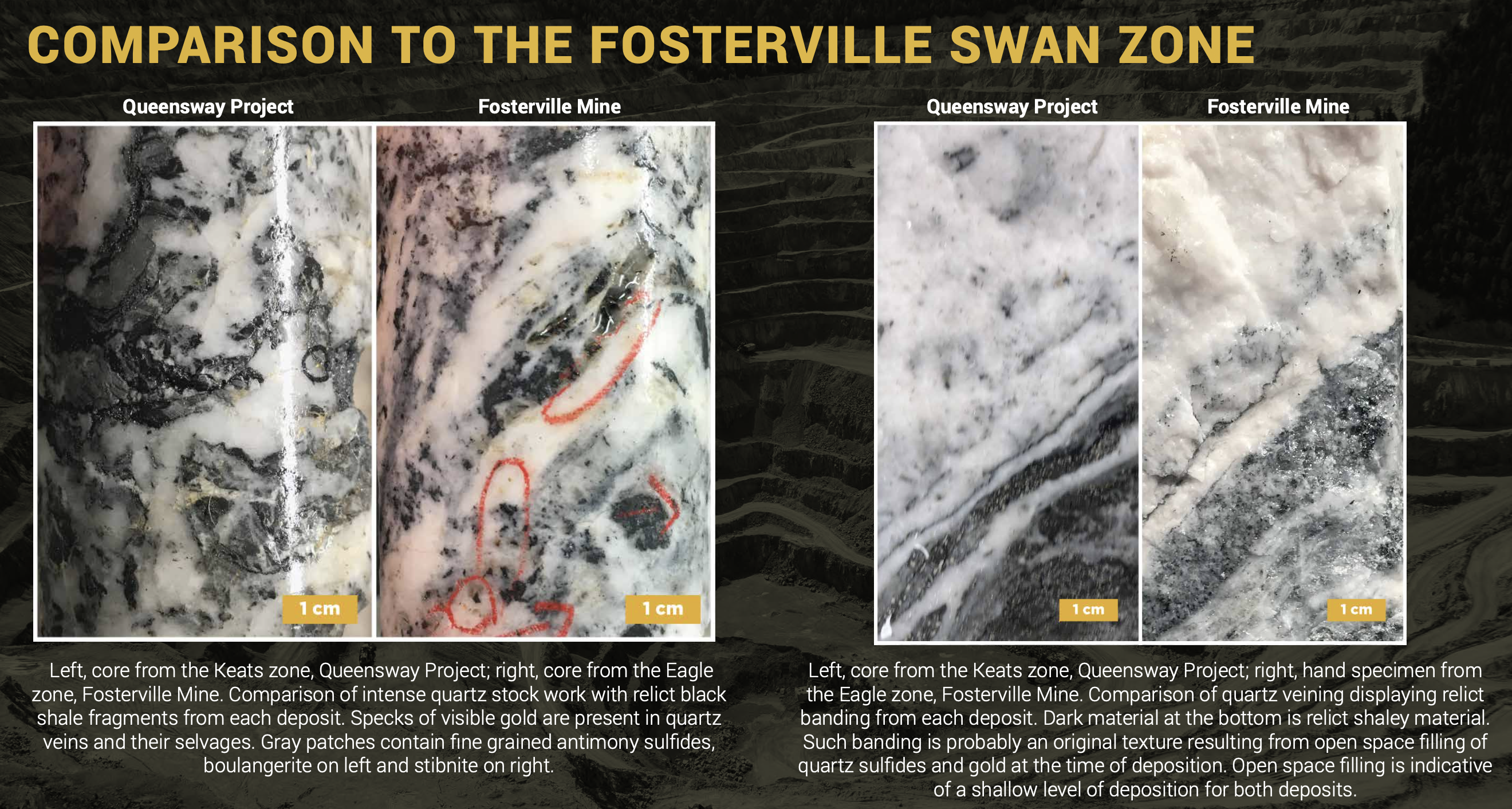

NFG closed at $4.39 Friday. Below is John’s late October chart for NFG that showed the breakout above the short-term downtrend line and the $2.96 Fib. level. The stock climbed as high as $4.90 (nearest Fib. resistance is $5.04). Watch for strong support in the $3.70’s. Ultimately there’s no reason the $5 resistance won’t be taken out – rest assured, this will become a multi-billion dollar deal if Queensway turns into another Fosterville.

Queensway Highlights

- A very under-explored district scale 1,500 sq. km land package within the highly prospective Central Newfoundland Gold Belt

- Similar geologic setting to Kirkland Lake’s (KL, TSX, NYSE) Fosterville mine in Victoria, Australia

- 105 km of untested strike length with multiple targets

- NFG’s 1st drill hole intersected 93 g/t Au over 19 m including 285 g/t Au over 6 m, starting just 96 m downhole (Jan. 2020 NR)

- 100,000 m of drilling is planned in 2 phases

- Excellent access to infrastructure – located 12 km West of Gander and is bisected by the Trans Canada Highway

- Proven leadership team and strong shareholder base – “Dream Team” led by the likes of Collin Kettell, Eric Sprott, Rob McEwen, Cal Everett, Paul Matysek and Quentin Hennigh

Four Other “Priority” Newfoundland Juniors

Labrador Gold (LAB, TSX-V)

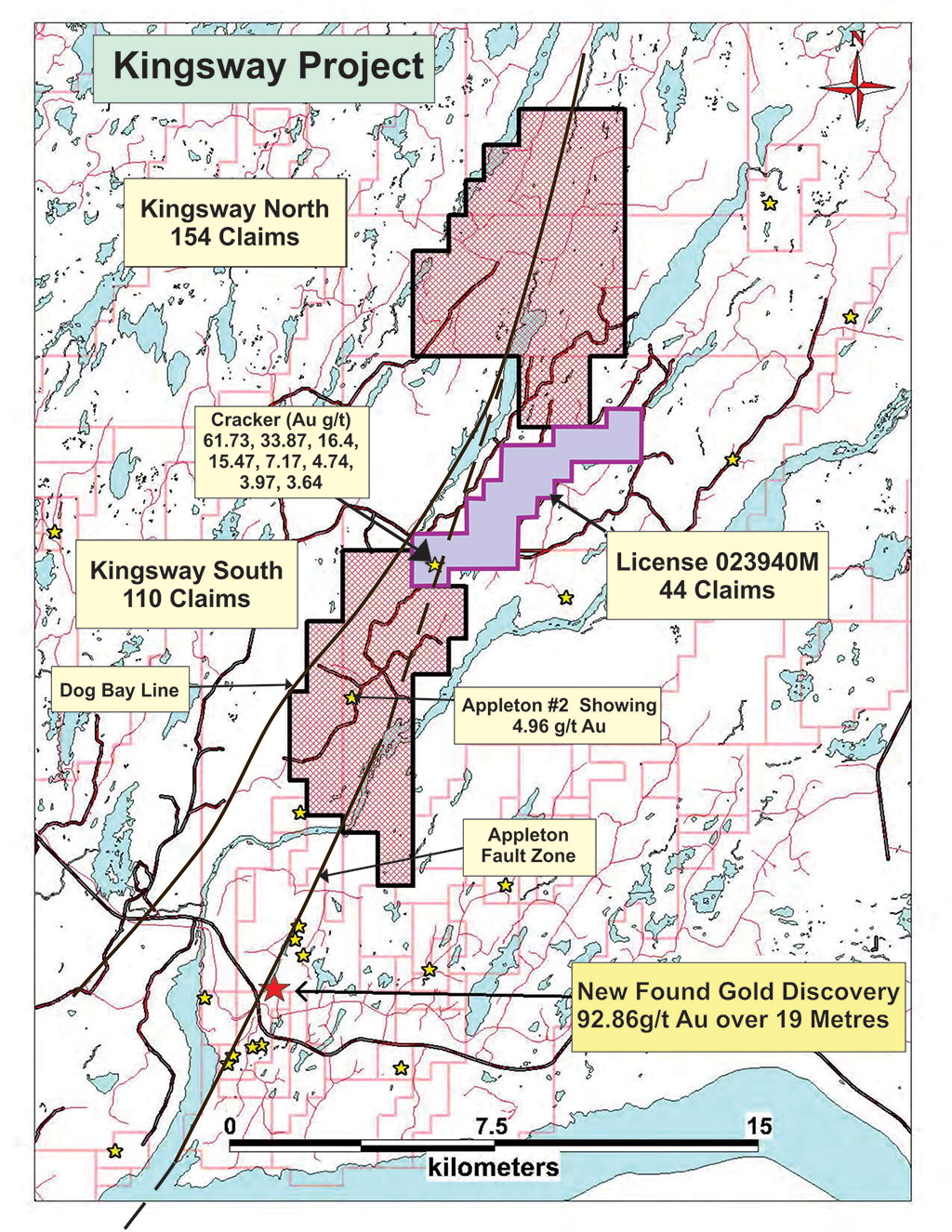

Labrador Gold (LAB, TSX-V) is unquestionably well-positioned with its 77 sq. km Kingsway Project, contiguous with Queensway to the south, and is currently a strong buy given the stock’s pullback over the last 6 sessions from a multi-year high of 63 cents to Friday’s 46.5-cent close. Drilling commenced at Kingsway in October, the first drilling at this property since the 1990’s.

LAB Long-Term Chart

Beautiful chart pattern. The stock was wrestling with 45-cent resistance through most of September and October before breaking out October 30. The initial run on that breakout was to a multi-year high of 63 cents November 11, followed by a pullback to retest previous resistance as potential new support. What’s likely to unfold in 2021 in our view is a massive breakout above the broader multi-year uptrend wedge.

Note the rising 200-day SMA (MA-10 on this monthly chart) in the mid-30’s, so downside is quite limited from current levels. The company is cashed up with a current modest market cap of approximately $47 million.

Kingsway Highlights

- Consists of 3 claim blocks covering 77 sq. km

- Kingsway South block is contiguous with New Found Gold’s Queensway Project to the south and is located approximately 2.5 km northeast of their recent high-grade discovery at Lotto

- Claim blocks cover approximately 22 km of strike length of crustal scale faults, including the Dog Bay Line and the Appleton Fault zone

- 3 years of recent exploration show Gold anomalies in till, vegetation and soil associated with the fault zone on the Kingsway claim blocks.

- Exploration covered an area of 675 sq. km and successfully reduced the area to the most prospective 77 sq. km

- Excellent infrastructure – 18 km from Gander, road accessible, nearby electricity, rail and plentiful water

Labrador Gold is the brainchild of GroundTruth founder and prolific Yukon explorer Shawn Ryan. Three years of recent exploration work on LabGold’s Kingsway Project outlined a very large Gold anomaly in till, vegetation and soil associated with the same fault zone structure that contains the NFG discovery. His theory that Newfoundland was grossly under-explored and contained rich precious metals deposits was certainly validated when NFG drilled its 93 g/t discovery hole.

Outcrop is very limited at Kingsway (and elsewhere in this region), so LAB’s news a couple of weeks ago regrading the discovery of VG in quartz vein outcrop and sub-outcrop was very significant. Notably, LAB’s quartz vein VG has similar characteristics to the VG in drill core at NFG’s Queensway Project. The northeast-trending quartz veining has been traced over 550 m in an unidentified part of LAB’s property (staking in the general area is extremely competitive, so it’s not surprising they haven’t disclosed the exact location).

“While 9-m-wide blowouts of the quartz vein are seen sporadically along this corridor, contacts between the vein and host rock have not yet been adequately exposed to determine the true thickness of the vein over its length,” LAB’s news release stated.

This past week LAB announced very encouraging soil sampling results (keep in mind that in Newfoundland anything around 20 ppb Au in soils is considered very good and 50 to 100 ppb Au gets geologists really fired up). Shawn Ryan commented, “Finally we see the results of a quality deep soil sampling program over the Kingsway Project, something I expected from my 2015 soil research program. While soil sampling is not new, taking great care in gathering a sample was not the norm. Now, with low assay detection limits, taking thousands of quality samples one can start to see mineralized trends and patterns even as low as 10–20 ppb Au. So the results described here are exceptional. LabGold’s aggressive soil sampling program covering 16 Grids gives the company a good probability of finding new mineralized structures. I look forward to seeing the final results of the completed surveys.”

Gold values in the soils ranged from below detection (<0.5 ppb) to 9,946 ppb (9.9 g/t Au) with 3 other samples assaying greater than 1,000 ppb (1 g/t Au) and 19 samples assaying greater than 100 ppb (0.10 g/t Au). The 4 highest Gold values occurred between 100 and 300 m to the southwest of the visible Gold locations and suggest the potential for additional Gold mineralization in this area.

Exploits Discovery (NFLD, CSE)

Exploits Discovery (NFLD, CSE) is another must-own Gander Gold belt junior given its large overall land position (2,100 sq. km) and attractive share structure (~60 million outstanding, tightly held). The stock closed Friday at 74 cents.

Last week the company provided an encouraging update on its Jonathan’s Pond target.

Highlights

- The Jonathan’s Pond Project hosts visible Gold-bearing quartz veins which assay up to 28 g/t Au

- Outcrop stripping has extended the strike length of the JP vein to 250 m and is open in all directions

- Nine preliminary grab samples taken from the silicified ultramafic host rock in contact with the quartz vein returned values up to 14.4 g/t Au which demonstrates that the Gold mineralization is not constrained to the primary quartz veins

- To date the company has completed 350 m of trenching at Jonathan’s Pond and is currently channel sampling the full extent of trenched bedrock in 4 new trenches with results to be expected before Christmas

- Company geologists believe the GRUB line, and Jonathan’s Pond in particular, has similar Gold potential to that seen on the Appleton Fault Zone which lies to the west in the core of the Exploits subzone Gold belt

President and CEO Michael Collins commented, “These results clearly merit further work at the Jonathan’s Pond property. This work also validates the company’s thesis that the Gold potential of the Exploits subzone extends out from the Appleton Fault Zone to other deep-seated regional structures including the GRUB line and the Dog Bay line. Exploits has built a significant portfolio of projects that target all 3 regional structures, and we look forward to demonstrating their value to the market.”

NFLD Short-Term Chart

NFLD is trading near the top of its current uptrend channel, with next measured Fib. resistance at 84 cents, so look for an opportunity to accumulate in the “sweet zone” from the low 70’s to the low 60’s. The stock has closely tracked its EMA-8 and EMA-20, so use those exponential moving averages as buy points. Support should be very strong at 60 cents (Fib. plus the bottom of the uptrend channel).

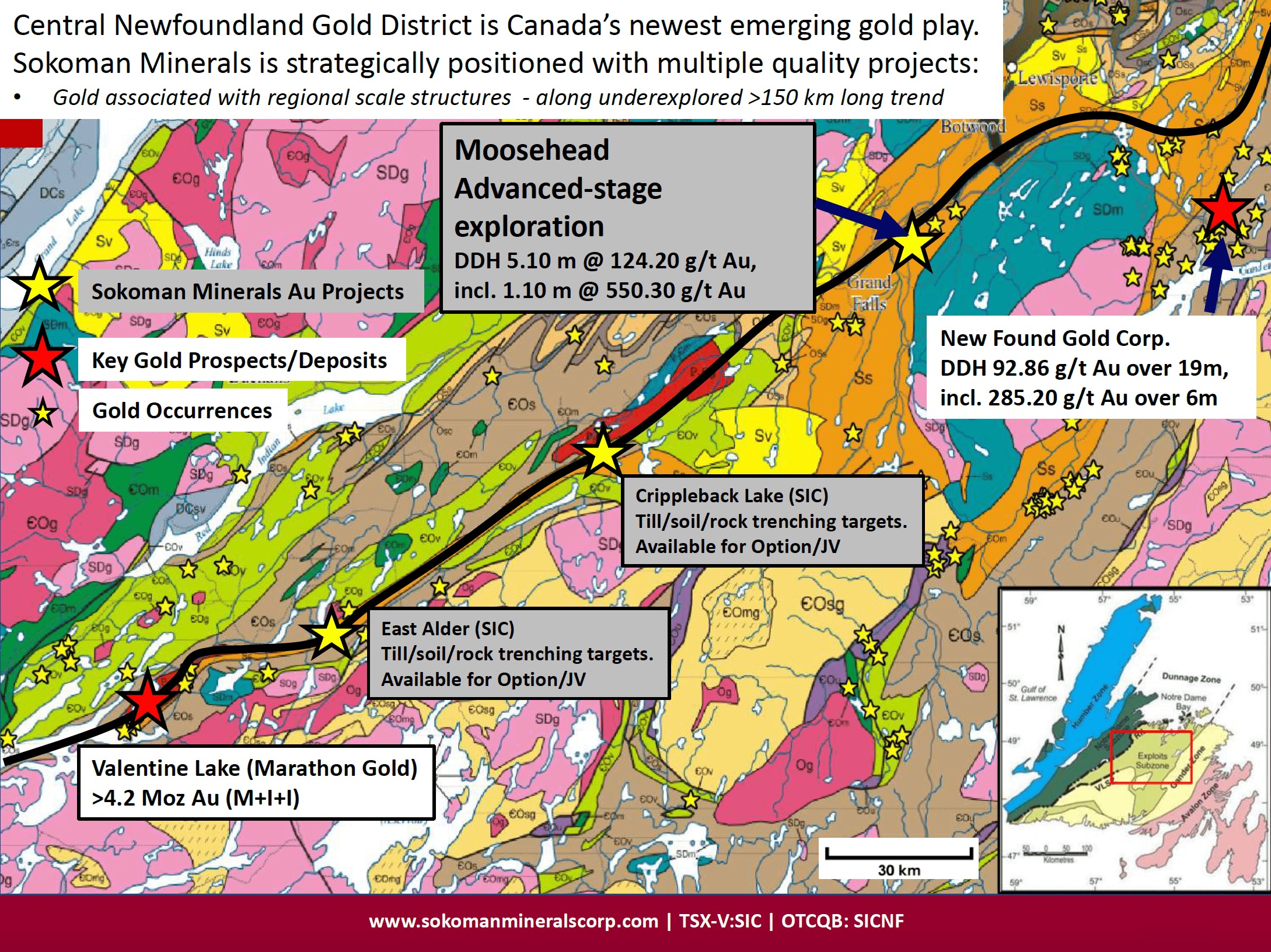

Sokoman Minerals (SIC, TSX-V)

Sokoman Minerals (SIC, TSX-V) came to life again last week with its heaviest trading since early 2019, climbing as high as 22.5 cents intra-day Thursday following news of some fresh high-grade hits at the company’s Moosehead Property on another prolific fault structure in central Newfoundland. This play initially erupted in the spring of 2018 and quickly became a 10-bagger on a very astute call by Daniel (5 cents to 50 cents in a couple of weeks!). Eric Sprott jumped in, but Sokoman has yet to realize its full potential. In light of overall developments in Newfoundland, and the state of the current market, we suggest accumulating Sokoman around current levels in anticipation of potential new all-time highs in 2021 as drilling at Moosehead continues.

Despite Thursday’s encouraging news, Sokoman gained only 2 pennies last week after closing Friday at 18 cents. Keep in mind, though, that some selling of flow-through paper was likely holding the stock down as nearly 13 million FT shares at 11.5 cents from an early summer financing became free-trading in late October (2.6 million of those, however, went to Eric Sprott who owns about 14% of Sokoman).

Robust results from MH-20–115 last week were as follows:

- Upper interval of 47.2 g/t Au over 4.6 m from 64 m downhole

- Lower interval of 68.7 g/t Au over 8.1 m from 111.20 m downhole

The upper intervals in MH-20–115 and 116 (11.85 g/t Au over 1.8 m from 54.5 m downhole) are interpreted to occur in a footwall splay off the main Eastern Trend. The splay is modelled as a northwesterly trending structure with a shallow 30-degree dip to the north. The location of the splay merger with the north-trending Eastern Trend could influence and focus high-grade Gold in this area. The splay is open to the south and west, and due to its orientation was not targeted in earlier drilling campaigns. Further modelling of these intercepts will take place before additional drilling is proposed for this highly prospective area. Similar high-grade splays are associated with the high-grade Swan zone at the Fosterville Gold mine in Australia.

President and CEO Tim Froude commented, “The drill results continue to demonstrate the high-grade nature of the Gold mineralization at the Moosehead Project. They also reinforce the importance of tighter drill hole spacing in these Fosterville-style Gold systems which provide key insights into high-grade Gold variability and orientation. The Phase 6 program is continuing with 1 drill due to limited equipment availability given the high level of exploration in the province. As a result, we will be testing high-priority targets defined by till and magnetic surveys while we wait for all the pending assay results. We expect the drilling to continue into 2021, since several targets require winter conditions to allow access and we are also applying for permits for ice-based drilling in the winter.”

Sokoman has completed 5 phases of drilling (23,378 m in 106 holes with the only “deep” hole – MH-03–15 – intersecting 278 g/t Au over 0.45 m). The Eastern Trend discovery is 500 m in length (open), 250 m down dip (open) and up to 10 m thick. The structure/geology/mineralization has similarities to a Fosterville-type deposit.

Moosehead History

A total of 111 diamond drill holes were completed on the property between 1990 to 2004, though only a small percentage of those holes were drilled to a vertical depth >100 m.

Mapping of the recently exposed bedrock and mineralized veins indicated that the controlling Au-bearing structures are orientated E-W and WNW, whereas the majority of historic drill holes targeted N-S structures.

SIC Long-Term Chart

This pattern argues for a near/short-term major breakout above key resistance in the low 20’s. There’s a good chance this could occur anytime within the coming weeks, certainly by the end of December.

The EMA-20 (currently 17 cents) on the short-term chart has been great support for Sokoman since the Corona Crash, so the stock is at a level (upper teens) where subscribers should be accumulating.

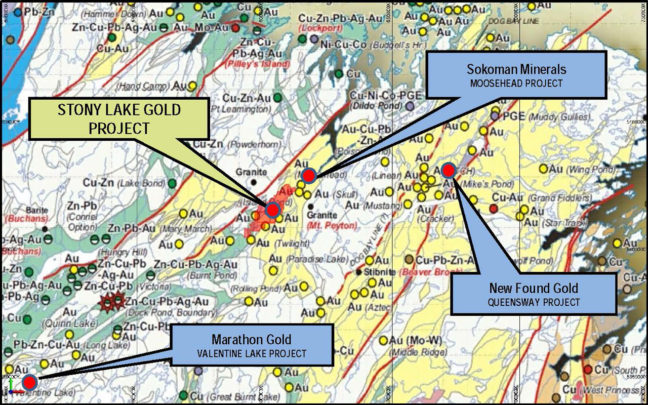

K9 Gold (KNC, TSX-V)

We liked K9 Gold (KNC, TSX-V) a lot a few weeks ago after some extensive due diligence. We like it even more now!

KNC perked up last last week in sympathy with Sokoman, climbing as high as 44 cents and closing Friday at 42.5 cents.

We’ve confirmed that Sokoman’s high-grade hit in MH-20–115 is just 1 km from the border with K9.

K9 Gold, with its 130 sq. km Stony Lake Project, is an emerging undervalued Newfoundland Gold play and a strong buy in the 40’s. The company is gearing up for winter drilling after carrying out a program of till sampling, mapping, orthophotos, LiDAR and VTEM airborne geophysics. We’re hearing that initial till sampling and VTEM results could come by month-end.

- Very favorable share structure (just 32 million outstanding!)

- Cashed up – KNC has raised $3.5 million

- Location, location, location!

- Record trading volume recently

- Strong support around 40 cents

KNC Long-Term Chart

KNC briefly traded as high as $1 in August before a healthy retracement to the Fib. 50% level in the mid-30’s – great buying opportunity!

With positive results we see a path on this chart to #2 measured Fib. at $1.39 during the 1st half of next year.

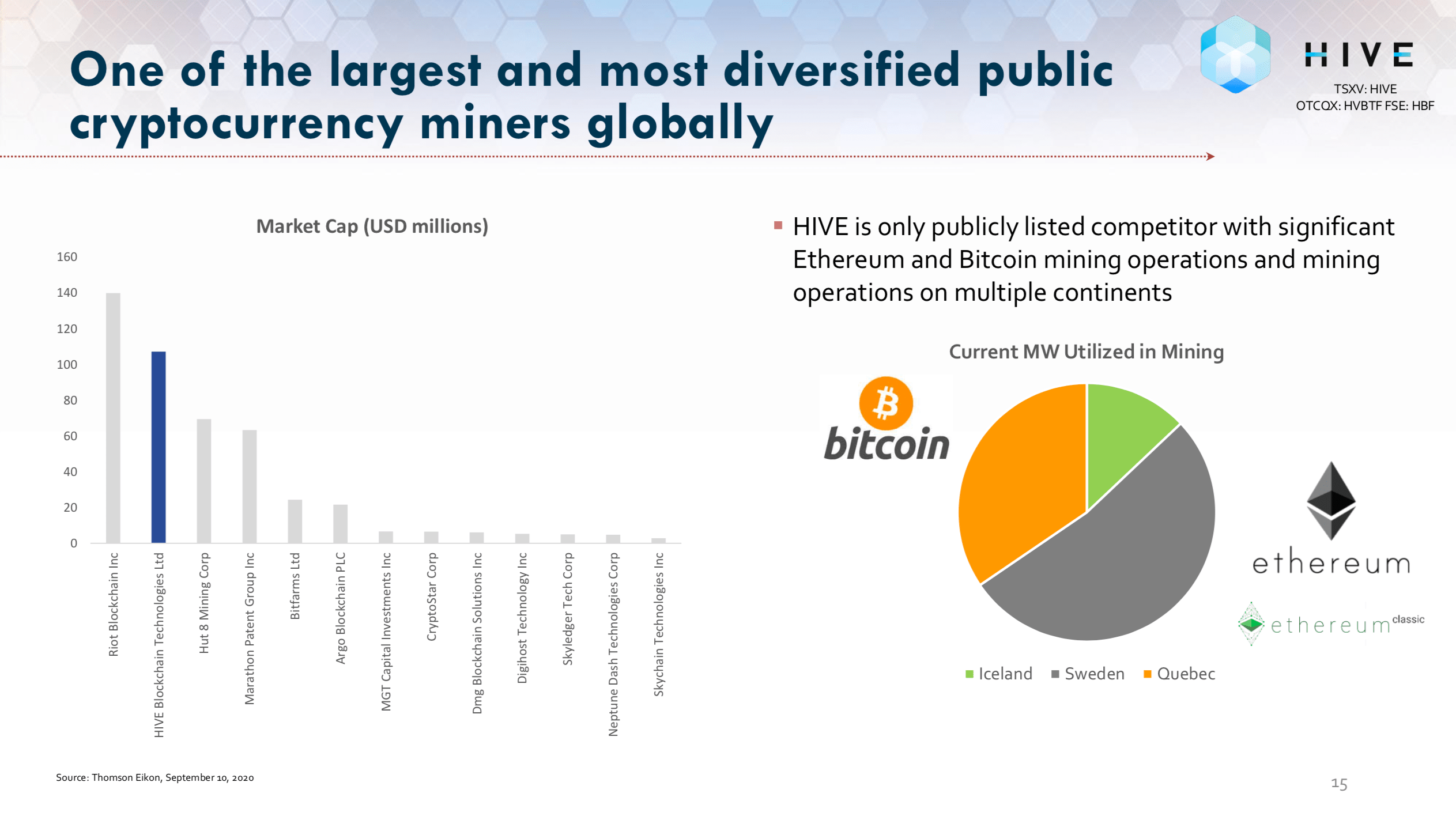

Hive Blockchain Technologies (HIVE, TSX-V)

Bitcoin is on fire, closing in on its all-time high, and other cryptocurrencies are joining the parade.

It’s hard not to like Bitcoin in the era that we’re in – it’s digital, durable, accessible, divisible and verifiable. In short, it’s an appealing alternative to central bank-controlled fiat money.

One stock in the crypto space we’ve done very well with previously (2017), and we’re recommending again to subscribers, is HIVE Blockchain Technologies (HIVE, TSX-V) which closed Friday at 72 cents. An important technical breakout (see chart below) above the mid-50’s occurred last week.

HIVE’s operations are situated in cool and politically stable jurisdictions (Canada, Sweden & Iceland) with access to low cost green/renewable energy.

- Low working capital requirements – does not require immediate sale of mined coins and allows HIVE to strategically sell coins to maximize profit

- First publicly listed blockchain infrastructure company that bridges blockchain and cryptocurrencies to traditional capital markets

- Providing a pure play blockchain investment for the capital markets while creating long term shareholder value

- Bitcoin and blockchain are seeing worldwide adoption across a wide variety of industries, including finance, healthcare, government, and supply chain

HIVE mined more than 32,000 Ethereum in the quarter from July 1 to September 30 based on the company’s preliminary unaudited results. This represents a significant sequential increase from the approximately 25,000 Ethereum mined in HIVE’s 1st fiscal quarter ended June 30, 2020, and a >50% increase compared with the same period last year.

The increase has been driven by the massive demand for transactions on Ethereum, including by stablecoins and DeFi applications, which have resulted in record highs in Ethereum transaction fees paid to miners. Many investors are using smart contracts to perform DeFi actions such as staking, pooling and lending, and such investors have been paying higher costs to make sure their transactions go through.

The 2nd-largest cryptocurrency by market value, Ether crossed above $500 (U.S.) last week to reach its highest level in more than 2 years. The move happened alongside Bitcoin’s rise to 35-month highs above $18,400.

HIVE Long-Term Chart

Technically, plenty of room for this stock to head a lot higher over the next few months given the major breakout above key resistance in the mid-50’s. A band of resistance exists between 71 cents and 85 cents, but after that it’s wide open with next Fib. at $1.32.

Two Other Non-Resource Plays In Major Uptrends

TAAT Lifestyle & Wellness (TAAT, CSE)

Taat Lifestyle & Wellness (TAAT, CSE) enjoyed a spectacular week, gaining $1.18 a share or 42% to close at a new all-time closing high of $4.00.

TAAT is rapidly approaching product launch in Ohio. News flow is strong with the company firing on all cylinders.

This is a simple story to understand, a key reason for the stock’s success.

TAAT announced post-market Friday that it has started placing in-store promotional graphics at select Ohio points-of-sale in preparation for the official launch of its Beyond Tobacco cigarettes set to take place next month. The company has secured distributorship with ADCO Distributors, a large Ohio tobacco wholesaler which has access to more than 5,000 tobacco points-of-sale in the state through direct and indirect relationships. ADCO is a distributor of tobacco products for some of the world’s largest tobacco companies including the following:

- Altria Group (parent company of several tobacco market leaders in the U.S. including Philip Morris whose brands such as Marlboro had a 49.7% cigarette market share in the U.S. last year);

- ITG Brands (3rd-largest tobacco company in the U.S., part of Imperial Brands; brand portfolio includes Winston, Kool, Salem and Maverick);

- RJ Reynolds Tobacco Company (subsidiary of British American Tobacco, 2nd-largest tobacco company in the U.S. with 3 of the top 5 cigarette brands in the U.S., including Newport, Camel and Pall Mall, which, in 2017, had a combined U.S. market share of 30%).

TAAT has first-mover advantage as it has figured out how to take hemp and make it taste like tobacco. Ohio will be a key test, but they certainly appear to be on track to become a disruptive player in a massive tobacco market dominated by The Big 5 (Philip Morris International, Altria, British American Tobacco, Imperial Brands, and Japan Tobacco).

CEO Setti Coscarella recently left his position as a lead strategist at Philip Morris to join TAAT as the company prepares for its launch of Beyond Tobacco cigarettes.

With a highly skilled management team led by Coscarella and Chief Revenue Officer Tim Corkum (another former Philip Morris executive), TAAT could easily turn into an ATM machine for investors even if it captures only a tiny fraction of the traditional cigarette market.

Having the right people is always the key in any business, and TAAT definitely has the right people!

Three more key points:

1. With no tobacco or nicotine in its cigarettes, and much less sugar, TAAT’s product is a healthier choice for consumers vs. traditional cigarettes

2. No tobacco or nicotine means limited taxes for TAAT – its product can therefore be sold at a much lower price point while still providing very high margins

3. The secret sauce of Beyond Tobacco cigarettes, which could make them the product of choice for many current tobacco smokers, is the refinement process of the base cigarette material which causes it to impart a taste and scent that closely resembles tobacco when ignited

TAAT Short-Term Chart

Technically, extreme RSI(14) conditions during September unwound during October and November with the stock consolidating below $3.

Note the recent breakout above both the flag and the $2.72 Fib. resistance, followed by last week’s move above $3.86 Fib. resistance. It’s possible the stock may need a little more time to really bust out above $4, but take advantage of any weakness because we see the possibility of another 50% gain in this play by January.

Buy pressure has been increasing steadily during this last half of November – new highs in the stock appear likely (next measured Fib. after $3.86 is $5.71).

Izotropic (IZO, CSE)

Izotropic (IZO, CSE) is on its way to becoming a MEGA deal, a multi-bagger from current levels. Technically, we’re seeing the same pattern now that played out very bullishly in October – a breakout above a flag formation with the EMA-20 and EMA-50 acting as the supporting moving averages.

Once Fib. resistance at $1.23 is conquered, IZO could quickly make a run toward the $2 level.

It’s a very rare occasion in the market when you come across a stock that you just know is going to become a huge winner, a 10-bagger or better.

Izotropic, a company we started researching during the early summer, is our next huge home run in the health care sector. And don’t think for a minute you’re late on this one because you aren’t, despite the move from 30 cents in July. Jon took a large position in the private placement at 55 cents and added another 100,000 shares in the open market recently when the stock briefly pulled back to $1.

IZO closed Friday at $1.14, another immediate buying opportunity following the modest pullback from $1.27.

You’re in on the “ground floor” with IZO anywhere up to $1.50 a share, which is equivalent in terms of market cap to SONA when it could still be bought for a buck in the spring.

As an emerging disrupter in the breast imaging space, and with 2 industry superstars on its team including Dr. John Boone pictured to the left, IZO has a direct path to the $5 level over the coming months, and we’d be shocked if it doesn’t ultimately command a market cap >$500 million. This company is going to create a tremendous amount of excitement as it seeks to grab a share of the huge and growing breast cancer imaging market with technology developed in the United States that could turn mammography, still the main go-to method for detecting a range of breast cancers, into the horse and buggy.

To show how much on the mark our research team is, we performed due diligence on multiple deals in the health care/life sciences space in recent months, searching for the next home run opportunity like SONA, CloudMD (DOC, TSX-V) or Teladoc (TDOC, NYSE), and we narrowed them down to just 2 – the “best of the best”, in other words. One was actually a private telehealth company out of Nova Scotia that was supposed to become a quick IPO, but at the last minute it got gobbled up by CloudMD (see September 14, 2020, DOC news release!). Yes, CloudMD took the rug out from underneath us! But that was okay. Izotropic is even better, and it’ll have our full attention as our #1 new pick in the health care space.

According to Goldman Sachs, health care stocks are the “best value sector to buy right now” (and they’re also calling for $2,300 Gold next year!).

IZO’s market cap is only about $40 million. Think about DOC or SONA when their market caps were only $40 million, and you’ll understand why we’re so excited about this latest new WEALTH BUILDER.

Do not procrastinate – back up the truck and load up now before you’re chasing IZO above $1.50 or $2 share.

IZO just recently raised $4 million, so what investors can expect now is the start of news flow and marketing efforts that should ramp up significantly over the coming weeks. NOW is the time to accumulate because by the end of the year – just 39 days away – this stock could easily be trading at the $2+ level, ready to launch like a rocket ship during Q1.

- Initial clinical trials have demonstrated that IZO’s “breast computed tomography” (BCT) can identify early stage indicators in breast tissue and more accurately determine tumor size, shape, and location. Trials have also demonstrated fast and efficient detection and diagnosis of both benign and cancer-causing lesions in the 3–5 mm range, which is less than half the current average size mammogram image, with a comparable radiation dose;

- Unlike the current “best of care” breast imaging devices in use, IZO’s superior 3D imaging system provides very high resolution imaging with 360° view acquisition. Imaging time is remarkably fast, taking only 10 seconds per breast with no discomfort, as breast compression is not required;

- In short, IZO’s Breast CT Imaging System provides a disruptive solution to the shortcomings and inefficiencies of current imaging modalities (mammography, tomosynthesis, ultrasound, MRI) and care paths to breast cancer diagnosis.

Just a few other highlights regarding Izotropic:

- It already has the attention of the FDA;

- IZO has high American content as its technology was developed by Dr. John Boone at UC Davis;

- Boone, a director of IZO, is widely regarded as one of the top radiologists in the United States;

- FDA commissioner Stephen Hahn is a radiologist, well aware of Boone’s work;

- Dr. Anita Nosratieh, an advisor for IZO, was a lead reviewer with the FDA where she worked with companies seeking approval of breast cancer screening and diagnostic devices. As lead reviewer she gained first-hand knowledge of the standards and practices companies need to make it through the early stage development process to regulatory approval;

- Dr. John McGraw, a true “rock star” in his field, is IZO’s Executive VP of Commercial Operations – 2 public companies he was recently heavily involved in got bought out for $700 million (U.S.) and $1.2 billion (CDN);

- IZO is perfectly positioned to become a favorite of insurance companies because they see IZO’s technology as a way to save them massive amounts of money;

- IZO has a beautiful share structure with less than 40 million shares outstanding while management/close associates own >30%;

- IZO has major marketing power behind it and a growing war chest;

- With McGraw and Boone at the forefront, IZO has instant credibility and a winning game plan. Milestones will be met, and the stock will roar.

Copper Mountain Mining (CMMC, TSX)

Copper Mountain Mining (CMMC, TSX) remains our favorite Copper stock and continues to perform exceptionally well, having more than doubled in price from our initial recommendation during Q2 when it was trading in the low 50’s.

Notably, CMMC is currently in the middle of its uptrend channel that goes back to late March. The stock closed Friday at $1.31 and we have every expectation it’ll soon reach the $1.58 measured Fib.

This is such an incredible chart we have to point it out yet again!

Copper prices have higher to go. CMMC is coming off a great Q3, triggering a $15 million bought deal at $1.15, and Q4 will also be stellar.

Note: Jon holds share positions in MOZ, CMMC, KNC, SIC, IZO and TAAT. John also holds a share position in KNC.

3 Comments

https://izocorp.com/wp-content/uploads/2020/08/Aug-2020_Investor-Presentation.pdf

Just read IZOTROPIC investors deck and the team (like bmr states) is incredible

Absolutely a no brainer …..

The IZO team is incredible. People will look back in a few months and wonder why they didn’t load up.

Lots of financial press articles and analysts calling for “the end of the cyclical gold bull market” and “bitcoin is the new gold.” Their reasoning is basically vaccines will return the economy to normal…yeah whatever. The democrats will have the Senate votes to pass a massive fiscal stimulus package. The dems have minimum 48 seats (potentially more after the Georgia runoffs), the Vice Presidential tie-breaker, and RINO Senators Murkowski, Collins, Romney, and possibly Toomey. At least two of those RINOs will vote for stimulus “to save the economy”, Kamala will break the tie, the DXY will tank into the 80s overnight, and gold will shine!