8:30 pm Pacific

(Exclusive to BMR Pro Subscribers – Not for Distribution or Posting on any Board!)

The Emerging North American Salt War

Key Takeaway

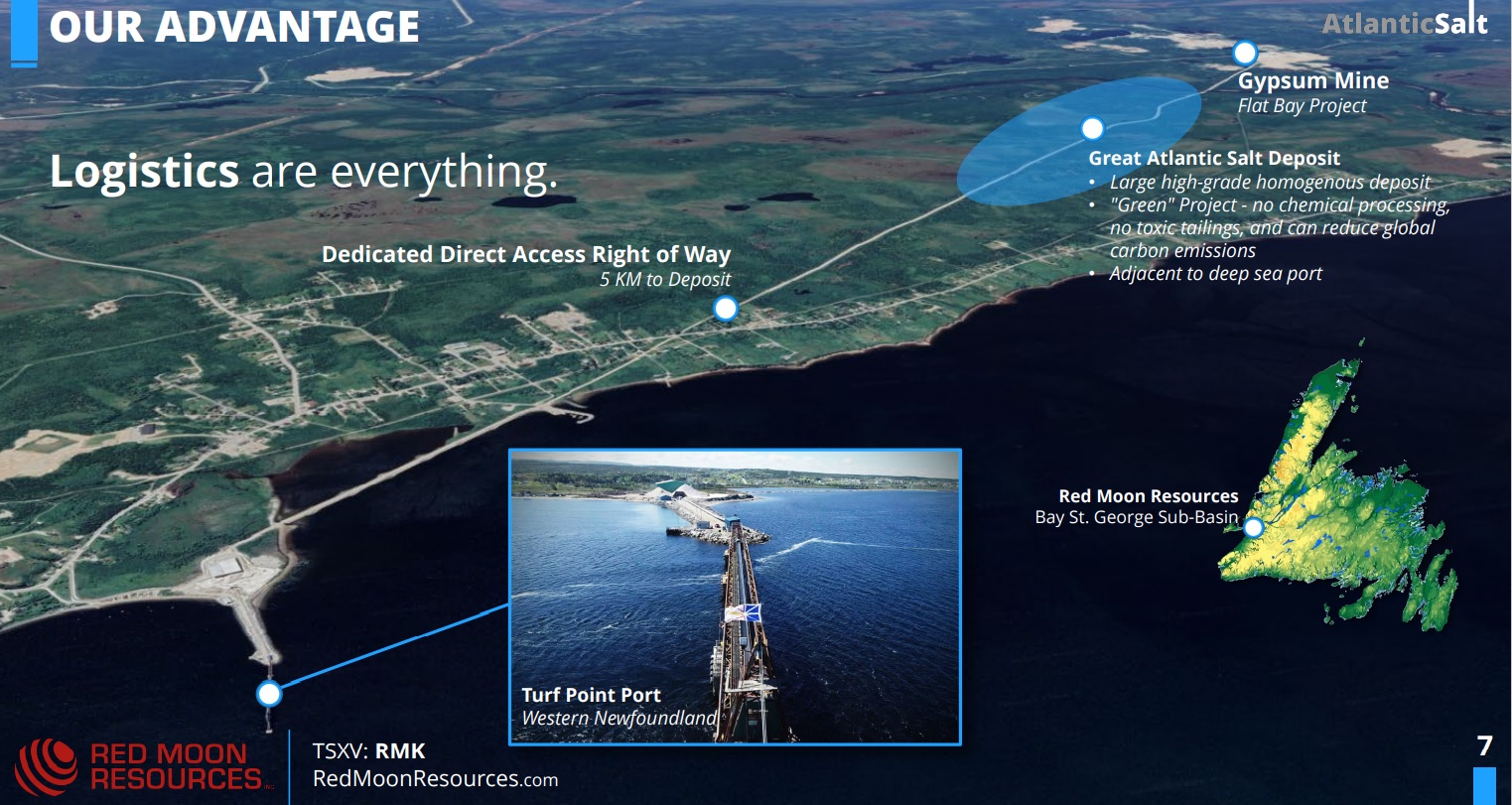

RMK’s Great Atlantic salt deposit is well beyond the discovery phase – geologically and logistically, Great Atlantic is the most attractive undeveloped salt resource in all of eastern North America, ideally positioned to serve the continent’s most important regional market for road salt deicing where significant overseas imports are required to meet demand.

In addition, parts of the 1.4 billion tonne NI-43–101 resource are of such high purity (98-99% NaCl) that Great Atlantic could also serve the chemical market.

Stone Canyon/Kissner vs. Compass, With Great Atlantic In The Middle!

More than $5 billion (U.S.) in recent acquisitions by privately held Stone Canyon now puts this aggressive Los Angeles-based industrial conglomerate on an equal footing with NYSE-listed Compass Minerals (CMP, NYSE) in the North American salt market, assuming near-term antitrust approval of the Stone Canyon/Kissner Group $3.2 billion purchase of the K+S Americas operating unit (Stone Canyon’s first purchase, its $2 billion acquisition of Kissner, is already official). Meanwhile, Compass is now gearing up for battle with 2 important announcements in the past 10 days.

Important Background Info

RMK has an asset that Stone Canyon/Kissner and Compass reportedly covet, and both entities are intimately familiar with RMK director and technical adviser Rowland Howe who is arguably “Mr. Salt” in North America. Howe grew Compass‘ Goderich mine into the largest underground salt mine in the world in the years following the company’s IPO in late 2003. Ironically, he was recruited to North America from the UK (International Chemical Industries) in 1996 by none other than Mark Demetree when the latter was running Goderich as President of North American Salt, a forerunner of Compass. Demetree left the Goderich operation before the Compass IPO, and Howe stayed on, with Demetree later becoming the Executive Chairman and CEO of Kissner, his current position (in some ways this is a very small world – you can imagine where this is headed!). Demetree is a very driven entrepreneur, determined to dominate the North American salt market to the greatest extent possible.

What all of the above means, essentially, is that RMK shareholders stand to win BIG with the wheels in motion for Great Atlantic to be acquired by either Stone Canyon/Kissner or Compass, though it’s important to keep in mind that Howe would also have the financial backing to put Great Atlantic into production through Red Moon. As the newest mine in the business, essentially a state-of-the-art low-cost Salt Factory utilizing the latest in “continuous mining” technology, it doesn’t take a rocket scientist to figure out that Red Moon is crazily undervalued at current prices. Some investors we’ve spoken to in recent weeks, ones who have started to accumulate major positions in RMK, say they’re staying in until at least $5 a share. Even that estimate could be low. The next mineral producer in Newfoundland is Marathon Gold (MOZ, TSX) which just released results of a Feasibility Study and is currently commanding a market cap in excess of half a billion dollars. It’s easy to predict that Great Atlantic is going to drive a lot of free cash flow, for a very long period of time, and RMK also has other blue sky potential catalysts that could be spun out as big deals including an underground energy storage play and a nepheline discovery targeting the solar industry.

In the words of Rowland Howe, RMK’s Great Atlantic has “the same bones, the same DNA”, as Compass‘ Goderich, the world’s largest underground salt mine which is the cornerstone asset underpinning Compass‘ $2.2 billion (U.S.) market cap.

Great Atlantic’s geology (large shallow high-grade homogenous deposit) and logistics combine to make it a very advantaged asset, and the just-launched Feasibility Study should definitely confirm that.

Salt Is Big Business

Do not underestimate the salt business, it is BIG. Historically, nations have even gone to war over this commodity which has been the engine of empires and revolutions.

Salt is truly a magical substance. Without it, we would die: The human body can’t make sodium, but our nerves and muscles don’t work without it.

Salt keeps us alive in more ways than one: Statistics show that road deicing salt reduces collisions by up to 88% and injuries by 85%, though over 1,300 people in America still die every year in car accidents due to snowy, icy conditions, with another 117,000 injured. Studies show that deicing salt pays for itself within the first 25 minutes after it is spread. Roughly 40% of U.S. domestic salt, produced largely from mining, is used not for food or chemicals, but for deicing, and no cost-effective alternative exists for keeping our roads, highways, sidewalks and parking lots safe.

Alternative energy can also develop into a promising niche for salt. Sodium chloride-run batteries are now in active development. If successful, this could also become a long-term market driver.

Notably, North America imports 8 to 10 million tonnes of road deicing salt every year from places such as Chile, Morocco and Egypt at a time when shipping costs are increasing while the world is also focused on reducing global carbon emissions.

In the 30-year period ending in 2016, salt production in the United States increased at an average rate of only 1% per year, while salt prices increased at a rate of 3–4% per year, according to the U.S. Geological Survey. No new salt mines have come on stream in the U.S. or Canada in the past 20 years, but that’s about to change – and it has put RMK in the middle of an emerging salt war between Stone Canyon/Kissner and Compass.

This salt war will make fortunes for investors in Red Moon, and the time to act is NOW.

Over the past 10 days, Compass has made 2 important announcements demonstrating how they are doubling down on their Goderich operation (historic 5-year labor agreement at Goderich plus the selling of non-core assets), essentially declaring how they’re ready to “battle it out” with Stone Canyon/Kissner to grow volume in North America. Besides improving volumes and operating margins at Goderich, a Compass acquisition of Red Moon would give the company a foothold in markets it doesn’t currently serve (the Martimes and Quebec) with the opportunity to easily ship more product into the U.S. Northeast. Stone Canyon/Kissner, on the other hand, could use Great Atlantic to replace its 2 aging higher-cost mines in Quebec (Seleine) and Nova Scotia (Pugwash) – following antitrust approvals – or perhaps continue to fill Martime/Quebec demand and use Great Atlantic to replace overseas imports and target Compass‘ markets in the the U.S. Northeast as a “swing” producer.

No matter how it plays out, Great Atlantic is the up-and-coming “disrupter” in the equation, and that’s great news for RMK shareholders. Accumulate aggressively around current levels – RMK has recently raised $4.2 million without saying hardly a thing. It’s likely they will soon add some fuel to the growing fire, further whetting the appetites of Stone Canyon/Kissner and Compass.

https://tradevistas.org/grains-of-global-salt-trade/

RMK Short-Term Chart

- A breakout above the flag and Fib. resistance in the mid-50’s is imminent (RSI-14 has already broken out above its short-term downtrend line).

- Next measured Fib. resistance is 81 cents followed by $1.25.

- The rising EMA-50 is cutting through the low 40’s while the ADX indicator confirms a bullish trend

- Strong immediate buy, especially ahead of marketing initiatives the company is likely to launch as per the company’s March 5 news release.

Four Other Stocks In Solid Uptrends

Updates on 4 stocks (we’ll have more in the coming days), besides RMK and others we’ve written about recently, that have highly favorable technical patterns at the moment, underpinned by strong fundamentals.

Golden Lake Exploration (GLM, CSE)

- Excellent stock to accumulate around current levels ahead of a major new phase of drilling at Jewel Ridge in Nevada

- $10 million 45-cent PP led by Eric Sprott was completed just over a month ago

- GLM exploded from 15 cents to 70 cents over 2 trading sessions in late February on a discovery hole before a healthy retreat to strong support in the low 30’s

- Pullback has cleansed temporarily overbought RSI(14) conditions

- Closed Friday at 39.5 cents

- Only 59 million shares O/S

- Stock should firm up nicely going into May drilling with another challenge of measured Fib. at 70 cents very possible this quarter

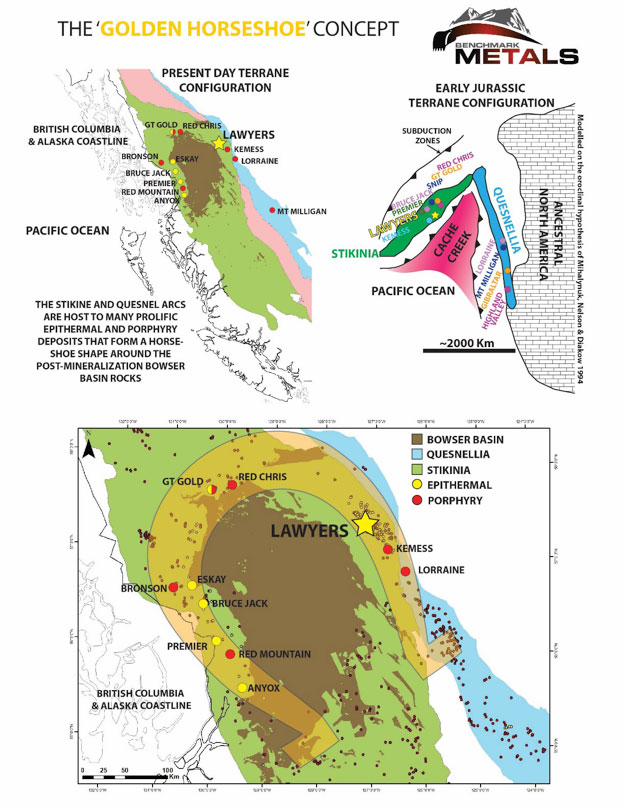

Benchmark Metals (BNCH, TSX-V)

- Exciting, compelling story brewing at the company’s Lawyers Gold-Silver Project in north-central B.C.

- 20+ km mineralized trend with multi-million ounce Gold potential

- 60% of 140 sq. km land package remains unexplored/under-explored

- Near-surface epithermal Au-Ag system with possible link to deeper porphyry system

- Past producer with $50 million in existing infrastructure within the proven Toodoggone mining district

- Maiden bulk tonnage resource estimate due soon

- Well funded for much more drilling

- Recent intercepts include 4.8 m @ 20.4 g/t AuEq; 10.4 m @ 13.95 g/t AuEq; 38.05 m @ 5.8 g/t AuEq; 52.91 m @ 7.6 g/t AuEq; 66.2 m @ 3 g/t AuEq; 122 m @ 1.7 g/t AuEq; 186 m @ 1.7 g/t AuEq

- 156 million shares O/S

BNCH Long-Term Chart

- Bullish “W” in the RSI(14)

- Breakout above measured Fib. at $1.37 (new support)

- Rising 200-day SMA at $1.18 on this monthly chart

- %K on the rise

- ADX indicator confirms continuation of strong bullish trend

- Next measured Fib is $2.13 (stock closed Friday at $1.54)

TraceSafe (TSF, CSE)

There’s a lot to like about this company and stock. TraceSafe (TSF, CSE) went on a tear in December, January and February, thanks in large part to a steady stream of excellent news, and we see no reason why the good news won’t keep coming through the balance of 2021. The stock surged to a high of $1.90 in February before gradually retracing to its rising 100-day SMA and its rising 200-day EMA, support it bounced off from last week. Only 40 million shares outstanding.

Last Wednesday the company announced that in partnership with Telus, it will provide contact tracing and quarantine solutions during the Women’s World Hockey Championship in Halifax and Truro, N.S., from May 6 to 16, 2021.

After the cancellation of the tournament in 2020 and a postponement of the 2021 event from March to May, over 500 team and crew members will be wearing TraceSafe products as part of a comprehensive health and safety plan. Hockey Canada, in conjunction with the IIHF, has worked diligently with government officials and all parties to ensure a safe Women’s World Hockey Championships.

TraceSafe is a full suite of real-time location management services and contact tracing solutions enabled through advanced low-power Bluetooth beacons and enterprise cloud management. TraceSafe’s leading cloud management solution ensures both user privacy and comprehensive administrative control. Its patented contact tracing bracelet has already been deployed in mission-critical quarantine applications around the world in partnership with leading governments. In addition to government contracts, TraceSafe is developing leading-edge solutions for Enterprise, Health Care, Education, and large-scale venue management.

EnWave (ENW, TSX-V)

EnWave (ENW, TSX-V) is starting to pick up steam after Daniel’s initial recommendation at $1.30 just over 4 months ago.

ENW is an equipment manufacturer and royalty company with a bite. Really and truly, it’s an awesome business model. EnWave’s technology was born out of the University of British Columbia. In less than a decade the corporation has grown from nothing ($500,000 sales in 2013) to something quite major ($30 million and growing) operating in 20 countries.

A disruptor.

EnWave has shown itself capable of disrupting the snack food industry. Licensees include PepsiCo, Nippon, and Calbee. Moon Cheese, EnWave‘s 100%- owned brand, can be found in 20,000+ stores such as Costco and Starbucks. REV (Radiant Energy Dehydration) technology is making inroads within the cannabis and pharma industry too, each representing multi-billion dollar addressable markets.

ENW Long-Term Chart

- EnWave is riding a wave to the upside that should ultimately take the stock to the $3.50 area (see the channel and the recent reversal to the upside in the 500-day EMA, EMA-25 on this monthly chart)

- ADX indicator confirms this bullish move is still in it relatively early stages

- Stock closed at $1.64 Friday for a market cap of $183 million (111.5 million shares outstanding)

Note: John, Jon and Daniel hold share positions in RMK. Daniel also holds a share position in ENW. Jon also holds share positions in GLM and TSF.

4 Comments

Is Vulcan Minerals still a legit way to buy Red Moon? None of my U.S. brokers will allow me to buy Red Moon. You haven’t mentioned that option in a while.

Nothing like having the main horse, Twaver, but VUL is a solid opportunity at current levels given the trajectory for RMK, for sure…

Hi guys, any thoughts on Sona’s recent nr’s?

No, not really, Labrador, they continue to be moving slowly, and of course we all know about the incompetence of Health Canada…better opportunities out there, until we see something dramatic from SONA…