Hope As The Venture Enters A Fresh “Cycle”

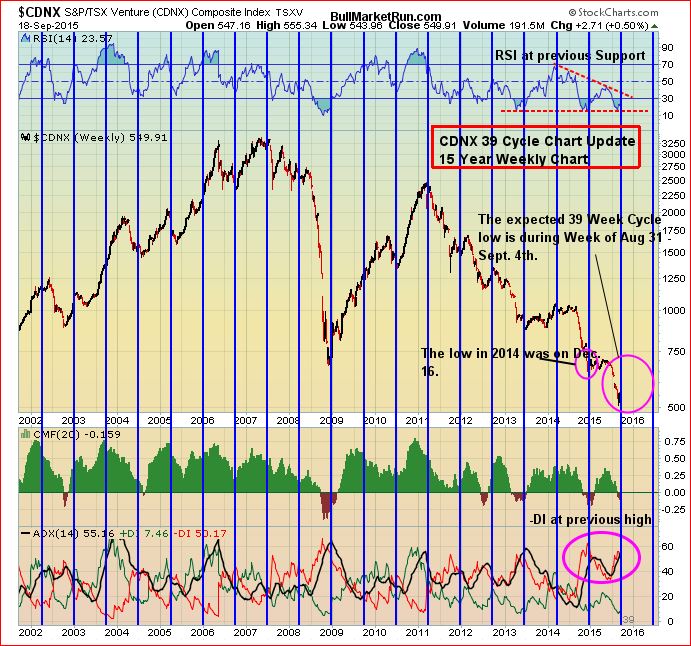

John’s 39-week cycle chart going back 15 years has been a very useful guide that prevented us and many of our readers from pushing the “panic button” while the market was taking a beating in July and August. This chart gave us confidence that relief was on the way around the end of August – perhaps even a final capitulation, or at least a stabilization or the beginning of a strong rally. August 24 may have been a defining date.

As odd as it may seem, consistently over the last 15 years a Venture pattern change (short-term or longer-term) has occurred around the end of each 39-week period. Why that is, we can only speculate. However, facts are facts. The last 5 cycle periods, including the one just completed (each cycle is indicated by a vertical blue line), have also ended with RSI(14) lows or highs (kind of like magnetic lows and highs – they carry significance). As well, +DI has turned upward after hitting a low not witnessed since the 2008 Crash.

Yes, interestingly, this latest cycle period ended in similar fashion to the one in 2008. Also noteworthy is the fact that the Venture this summer experienced its second worst July in 14 years. Only July 2008, with a tumble of just under 16%, was worse than the July 2015 decline of 11.5% going back to 2002 in this market.

Curiously, following both previous July swoons in 2008 and 2002, the Venture commenced a new bull market within 5 months. Will history repeat itself?

While stranger things have happened, like anti-Oil radicals and tax-hiking socialists sweeping into power in Alberta, it’s certainly premature at this point to suggest the Venture is about to enter a new bull phase, especially given the economic slowdown and uncertainty in China which consumes so much of the world’s commodities. However, July and August this year for the Venture were very different than those same months last year, and September is unfolding in a different manner as well. It’s reasonable to believe – based on all the technical evidence at least – that the final 3-and-a-half months of 2015 for the Venture will give investors some reasons to cheer, unlike the situation from September to mid-December 2014.

One thing to watch for during this new Venture cycle period is a breakout above the RSI(14) downtrend line. The best 39-week cycles for the Venture tend to correlate with weakness in the U.S. dollar.

8 Comments

Jon: do you see a stock market crash coming up in October as some people have said? Not that those people have always been right, but i have been reading more and more about this ‘crash coming’,etc….Love to hear your insights….

The more you read about a “pending” Crash, Steven, the less likely it usually becomes. These things typically catch people by surprise. I’ll say this – the Venture’s behavior over the past month certainly doesn’t suggest that a “Crash” is on the way in the broader markets during the final quarter of the year. Let’s see how the Venture closes September, that will tell a lot. But look at John’s Venture cycle chart. It suggests we’re coming OUT of a down period, at least for the next several months, not about to slip back into a deeper one.

I believe what we saw in July with the Venture was a warning that the broader markets were going to have some trouble in August, and indeed they did. But the resiliency of the Venture vs. the broader markets recently has been impressive, as we saw Friday. The Dow and TSX have held important support levels. If those levels are broken – we know what to look for – then risks will increase, but at this point it seems Aug. 24 was a defining date for the markets this year. Could be a different story at some point in 2016 but it’s easier to take things a quarter at a time.

WRR drills start turning this week. Should see more strength in the share price. I believe this is a ground floor opportunity.

As predicted, Tsipras wins the Greek elections. He’s going to continue the current coalition. All eyes on China, ECB, FED.

In China as you know the PBOC cut interest rates so many times that mortgage rates have dropped to a mere 5 percent, this will temporarily unsustainably boost the Chinese housing market for like six mos to a year. But China’s got an aging population (Japan 2.0), a massive credit bubble, a recovering housing market in the near term which could collapse in a few years.

Is it too risky to raise interest rates? Are we going to see negative rates from the FED?

good morning bmr boys I bring you the latest news from heron resources(her texch) sept 20 2015 KATE LENS DEFINITION DRILLING CONTINUES TO IMPRESS regards walter emond

I think the shareholders in Sheslay are not angry to see the autumn arrived!

JON: following that logic, then one would say that since the Venture has gone down 75% since 2011, then the DOW should have gone down with it but it actually more than doubled????

Not really, Steven…the plunge in the Venture since 2011 has correlated almost precisely with the drop in the TSX Gold Index, and closely with commodities in general…there are times, however, when the Venture can be a good indicator of trouble ahead in the broader equity markets, and the severity of the tumble in the Venture in July was one of those moments I think…look again at the 39 week cycle chart…it’s in a much safer position at the moment, not consistent with a “looming crash”…if the Venture didn’t recover rather sharply as it did at the end of August, and was continuing to be weak at the moment and under-performing the broader markets, I’d be more concerned about the health of the broader markets as we progress through the upcoming 4th quarter…