TSX Venture Exchange and Gold

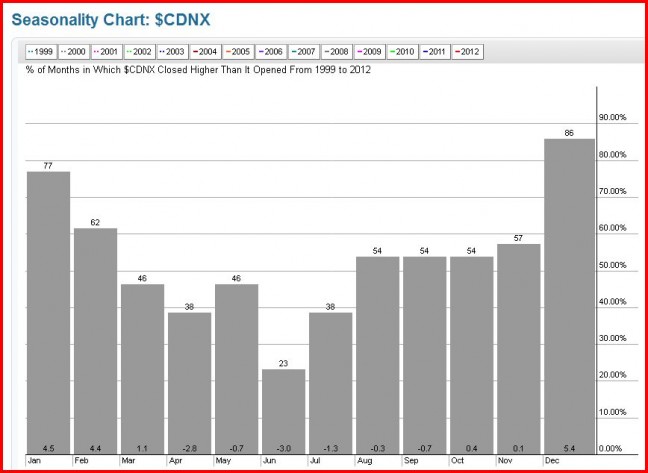

It was a very normal first week of December for the Venture which fell 18 points to close at 917, a 1.9% drop which was in line with the 2% average decline in the Index during December’s first five trading days over the last five years. Historically, December is actually the Venture’s best month of the year as the chart below shows – so the first week or two of this month, given seasonality patterns, is the time to be thinking about accumulating high quality plays on any weakness. Especially since what we see developing as the month progresses is a powerful rally that will finally allow the Venture to break past critical resistance in the 970’s and start the New Year on a much more positive note. There is plenty of technical evidence to support that bullish outlook.

If the Venture were to experience an “average” December, we can expect the Index to close the year at 985 (nearly 90% of the time since 1999, the Venture has closed higher in December than November with an average gain of 5.4%). That would set the tone for a strong start to the New Year.

The Venture’s 1.9% slide last week compared to a 1% loss for the TSX and a 6.8% fall in the struggling TSX Gold Index which is now down a whopping 50% for the year vs. a 25% drop in the Venture. So the Venture, despite all its issues, has actually been a safer environment than the Gold Index featuring producers.

Below is an updated 3-month daily chart from John. Venture support in the low 900’s remains very strong, and a rising 100-day moving average (SMA) seems likely to hold (John has important Venture charts that we’ll be posting Monday morning that clearly show a turnaround forming). Expect more choppiness in the coming week, followed by a sentiment change kicking in by the week of the 16th which interestingly corresponds with the next Federal Reserve meeting.

CRB Index Chart Update

The CRB Index is showing signs of staging a year-end rally which lends further support to our bullish forecast for the Venture. The CRB appears to be a similar position to where it was near the end of June, just prior to a strong advance that it took from a low of 275 to a high of 296 in late August.

The Seeds Have Been Planted (And Continue To Be Planted) For The Next Big Run In Gold Stocks

There’s no better cure for low prices than low prices. The great benefit of the collapse in Gold prices this year is that it forced producers (at least most of them) to start to become much more lean and mean in terms of their cost structures. Producers, big and small, have started to make hard decisions in terms of costs, projects, and rationalizing their operating structures. Exploration budgets among both producers and juniors have also been cut sharply. In addition, government policies across much of the globe are making it more difficult (sometimes impossible) for mining companies to put Gold (or other) deposits into production, thanks to the ignorance of many politicians and the impact of radical and vocal environmentalists. Ultimately, all these factors are going to create a supply problem – think about it, where are the next major Gold deposits going to come from? On top of that, grades have fallen significantly just over the past decade.

It doesn’t take a rocket scientist to figure out that the next huge bull market in Gold stocks is just around the corner due to demand-supply dynamics, much leaner producers who will suddenly become earnings machines, and a junior market that will be healthier simply because a lot of the “lifestyle” companies sucking money out of investors will simply disappear or get taken over by individuals or groups who are actually competent and serious about building shareholder value. A healthy “cleansing” in the market has been taking place. As this continues, more and more seeds are being planted for an incredible future move in well-managed Gold producers and explorers that could make the dotcom bubble look like a tea party. As for the juniors, focus on the small universe of companies that have the ability to execute both on the ground and in the market. Companies that are strong financially, have superior exploration prospects, competent management and clean share structures.

Gold

Gold traded down to a support band between $1,200 and $1,215 last week but didn’t drop lower than $1,210, recovering marginally to close Friday at $1,231 which was a loss of $20 for the week. Bullion is basing around these levels which could be a set-up for a potential rally. Encouragingly, Gold has broken above an RSI(14) downtrend line on this 9-month daily chart and sell pressure is weakening.

Silver lost 39 cents last week to close at $19.54 (John will have updated Silver charts as usual Monday morning). Copper gained 2 pennies to finish at $3.21. Crude Oil staged its strongest rally since July, jumping nearly $5 a barrel to close at $97.65. The U.S. Dollar Index, meanwhile, continues to struggle as it fell more than one-third of a point to close at 80.26.

The “Big Picture” View Of Gold

As Frank Holmes so effectively illustrates at www.usfunds.com, the long-term bull market in Gold has been driven by both the Fear Trade and the Love Trade. The transfer of wealth from west to east, and the accumulation of wealth particularly in China and India, has had a huge impact on bullion. Despite this year’s drop, the fundamental long-term case for Gold remains incredibly strong – currency instability and an overall lack of confidence in fiat currencies, governments and world leaders in general, an environment of historically low interest rates, a Fed balance sheet now in excess of $3.5 trillion and expanding at $85 billion a month, money supply growth around the globe, massive government debt from the United States to Europe, central bank buying, flat mine supply, physical demand (especially from China), emerging market growth, geopolitical unrest and conflicts…the list goes on. However, deflationary concerns around the globe and the prospect of Fed tapering by the end of the year (not likely now) had a lot to do with Gold’s plunge during the spring below the technically and psychologically important $1,500 level, along with the strong performance of equities which drew money away from bullion. June’s low of $1,179 may have been the bottom for bullion – time will tell. We do, however, expect new all-time highs as the decade progresses. There are many reasons to believe that Gold’s long-term bull market is still intact despite this major correction from the 2011 all-time high of just above $1,900 an ounce.

12 Comments

Sounds good guys! Unfortunately we have to go down so many points before going back up! But it makes good sense from what you are saying!

Hi Jon,

Does RBW still qualify as a junior, member of that “small universe of companies that have the ability to execute both on the ground and in the market. Companies that are strong financially, have superior exploration prospects, competent management and clean share structures.”?

You presented a very very strong argument in April 2012 that Rainbow Resource had the following attributes:

1. Rainbow is coming out next week with a short but powerful corporate video – the reason I know is that I was asked by company President David W. Johnston yesterday to handle the voice-over…I told him I would be honored to do so;

2. Everything is on track and going exactly as planned in terms of upcoming exploration and drilling at RBW’s flagship Big Strike Project in the Kootenays…there aren’t many companies who can claim they have three past high-grade producers that have never been previously drilled but Rainbow can (International, Gold Viking, Ottawa);

3. Gold Viking will be drilled first, followed by the very promising International which is at higher elevations with slower snow melt as a result…other major priorities are Ottawa and the Referendum (the Referendum could be a “sleeper” in the Rainbow package)…an intense prospecting campaign will commence throughout the Big Strike Project as soon as weather conditions allow – this will contribute a lot to news flow;

4. Johnston loves the chances for a potential major discovery in the Kootenays…he was also very encouraged with his visit to Nevada a couple of weeks ago and the company’s recently-optioned Jewel Ridge Property…”It’s a dandy“, Johnston told me…former open-pits…near-surface mineralization…along strike and contiguous to Barrick’s Ruby Hill Mine to the north and Timberline’s advanced-staged Lookout Mountain Project to the south…great former drill result to follow up on – 2.1 g/t Au over 39.6 metres…Jewel Ridge has all the ingredients to deliver some big-time exploration results for Rainbow…news coming out soon regarding Jewel Ridge I suspect – early field exploration results?…exact timing for the start of drilling at Jewel Ridge in 2012 is uncertain but the company is trying hard to fast-track the process;

5. Rainbow has been consistent, accurate and timely in meeting all of its stated objectives so far in 2012…given that, plus the “blue sky” potential of the Big Strike and Jewel Ridge Projects, I’ve taken advantage of the recent pullback in the share price to add significantly to my already substantial position (as a matter of disclosure) including 30,000+ more shares Thursday…I’m not in this for pennies;

6. The Rainbow chart is still very strong and the pullback has come on relatively low volume in a typical consolidation pattern;

7. The CDNX has corrected a whopping 20% since the end of February…this is not a time to panic or worry about a stock retracing – a correction like we’ve just seen in the overall market opens up huge money-making opportunities for those investors who are patient and jump in at the right time on quality plays…understanding and managing volatility is not always easy but it’s one of the tricks of being a successful investor…Rainbow has made truly impressive steps in its development over the last few months – this is a young company with a very bright future…

And since then, RBW has become a triple play by having staked a claim adjacent to the only Graphite mine in north western North America.

The question is, is this a good time to accumulate shares in RBW to lower a very high average cost?

Alexandre, while RBW has some excellent properties – the most prospective one at this point being Gold Viking where they hit a multiple vein system with good grades a year ago with no follow-up yet – they have so far been unable to raise the money they need to proceed with drilling. They will require a little more time for these markets to heal and complete a financing (on the right terms) and get back on track, IMHO. They have the people behind them with the tenacity to survive. In the meantime, there are clearly better short-term (3 months) opportunities out there. In part they were victims of bad timing last year when they produced some interesting results at Jewel Ridge and Gold Viking, and then literally the overall market sank at exactly that time. It cost them a proper financing.

Alexandre

In your post # 2, you are quoting RBW hyberbole, maybe not meant to

intentionally deceive others, but hyberbole just the same. Why do i

come to that conclusion ? elementary my friend, it now appears obvious

that those, who could have financed them, were not convinced, otherwise

they would have been able to raise the required cash, even in those bad

market conditions, everyone loves a winner. It is now my opinion that

RBW is to be included with the other losers out there, but i hope i am

wrong.

I have read closely the answers given to past RBW queries & the responses

has led me to believe that BMR have severed their relationship with RBW or

vice versa & if so, BMR may not be in the know now anyway.

I realize i am somewhat outspoken these days & for that, i am somewhat sorry,

but how my mind reacts to what i read at times, do require me to respond. I

do appreciate one of our freedoms, that is to have my say, but i will always

try to be respectful. R !

My 3 possible winners today are: LXV, BG & a stock that i had promised not

to mention again, unless it was taken out. Have a good day. R !

Do you guys think tax loss selling should be over with by this week sometime and then we reverse on the CDNX upwards? I do agree we have been in the strong support zone of the 900’s but it will be interesting when we get to 970+ zone in December!?

Depressing indeed, is it not Bert!

Steven

No doubt, any selling can be used for tax purposes, but who

really knows why people are actually selling. Is it for tax

selling purposes, in particular, or is it because of lack of

confidence in the Venture exchange, after all, this has been

going on for a couple of years or more & no doubt the downturn

has given traders an accumulation of losses. I don’t expect

anything to happen in December, but all things are possible. I

am thinking we must take advantage of the New Year Wish, that is,

to wish for an upturn in the Venture. Not that our wishes will

be granted but here’s hoping. Through it all, there are still

some small companies making moves. Take LXV & BG for example,

they have made it interesting, while we wait for the activity

to rub off. R !

I have read articles, where the writers have stated that investors

should sell their losers & buy good solid companies. Those same

writers, were writing positive articles on those losers, mostly all

the way down. Would you believe that 79% & i repeat, 79% of Venture

stocks, are trading at a dime or lower & may i also add, some of

them have consolidated, so my question to those writers remain,

how can one gain by selling something worth nothing ? I felt that

i have somewhat of a clue regarding the market, but i have to admit,

the market is the winner this time around. R !

Bert I looked at a chart on lxv and xme on a one and two year chart there is no contest lxv by far is the best .But on a six month three month one month chart xme wins hands down check it out

Gil

I don’t pay attention to long term charts, one or two days at a time

only my buddy. I realize the last couple of days have been down for

LXV., but this company seems to have a frequent news release plan & that

comforts me. They have signed many different personalities & have

recently announced a vip to it’s board, so i will be giving them

some slack for awhile longer. Thanks for reminding me though. R !

BMR, i would love to see a return from some of your stock picks. People might start taking this site more seriously if they could actually see results. Take PGX and RBW, are you still in these plays or have you sold? These are two dead companies that you guys touted for months and months, then nothing, notta. As said, do you still hold these companies or have you redeployed money elsewhere. I think with this sort of service you provide that info might be helpful to some of your followers

Gbb Gold Bullion Development Corp – breaking new ground in Junior fund-raising………

Sector NewswireTM

Sector: Mining – Metals and Minerals :

News Release – December 6, 2013 4:34 PM ET

Gold Bullion Development Corp. announces Gold Royalty Shares

NEW YORK, NY, December 6, 2013 /Sector Newswire/ – Gold Bullion Development Corp. (TSX-V: GBB) (US Listing: GBBFF) (Frankfurt: B6D) this week announced initial details regarding the possible issuance of Gold royalty shares being considered to raising capital for an onsite mill production scenario at its Granada Mine, located along the prolific Cadillac Trend in Quebec. The proposed Gold royalty shares are an innovative product, certainly one whose time has come, and possibly the first of what may become a more common way for how Gold mining companies of the future finance through to production. Conceptually, the royalty share holder will have the rights to a NSR on GBB.V’s gold for the life of the mine, inherent in the vehicle is limited-risk, and the share would be tradable on the open market. Exchange approval would be required, however Sector Newswire sees no reason why such a vehicle, with the appropriate verbiage, would not be granted approval. With a prefeasibility study on the Granada Mine expected to be delivered shortly it appears management of GBB.V are forward thinking on how to maximize shareholder value; the proposed Gold royalty shares issued directly by GBB.V would facilitate the required capital to take the project to production, in-part or in-whole, and allow GBB.V the ability to avoid royalty stream companies which in the end often act as a noose.

Excerpt from December 4, 2013 release