TSX Venture Exchange and Gold

The Venture posted its 3rd consecutive weekly advance as a summer rally starts to gain traction. The Venture climbed 22 points last week to finish at 920, putting the Index at its 50-day moving average (SMA) for the first time in 5 months. Whether the Venture will immediately push higher or temporarily pause at this level, where there is resistance, is anyone’s guess, but the big picture for this 3rd quarter is looking quite positive. Extreme oversold conditions emerged during the April-May-June period. The Index tested important support at 860 and a recovery process is now underway. A 20% rally to the 200-day moving average (SMA) around 1100 over the next 2-3 months cannot be ruled out, and in that kind of environment astute traders/investors can profit handsomely. The Venture has out-performed the TSX Gold Index in each of the last 3 quarters and the Gold Index is also due for a sharp rally that could easily take it to the 210 area, nearly 20% higher than it is now. This is also a period of seasonal strength for Gold and Gold stocks.

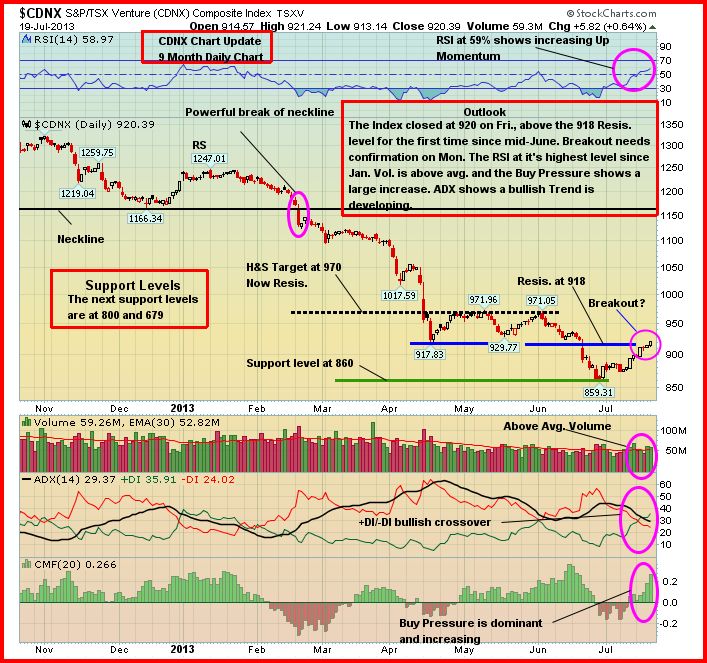

So let’s take a look at John’s latest CDNX chart (9-month daily). What’s particularly interesting is that there has been a bullish +DI/-DI crossover in the ADX trend indicator. There was a bearish crossover at the end of February, and we all know what happened after that. A bullish trend, therefore, is beginning to take shape, and for the first time in 5 months the Venture’s 20-day moving average (SMA) is also rising. If this rally is for real, then it will find support at the 10 or 20-day SMA’s which are currently at 898 and 887, respectively. On Friday, the Index closed 2 points above the 918 resistance. This “breakout” requires confirmation Monday. Either that will occur, or the Index will need to pause and catch its breath before garnering the strength to bust through this level. Of course a major resistance area is 970 – a move above 970 would signal that it’s “game on” for a major rally.

Exploration results and the Gold price, of course, will be the key catalysts for the Venture this summer. This market needs more success stories to increase investor confidence. The opportunities for that do exist.

Gold

Gold flirted with the $1,300 level last week and closed Friday at $1,297. John’s 2-year weekly chart offers some hope. Sell pressure is declining rapidly, and the bearish trend is weakening. There is a strong resistance band between $1,320 and $1,350, and that’s an area we believe Gold may test in the near-term. Patience is critical. Gold has suffered a lot of technical damage in recent months and the climb back up won’t be easy. There will be a strong focus on demand/supply factors in the coming weeks and months, but that should be positive for Gold at current levels. The best cure for low prices is low prices.

John has updated charts for Silver in Monday’s Morning Musings. Silver closed Friday at $19.53. Crude Oil (WTIC) soared to a new 16-month high, closing the week at $108.05. Copper finished at $3.13 while the U.S. Dollar Index closed at 82.62.

The “Big Picture” View Of Gold

As Frank Holmes so effectively illustrates at www.usfunds.com, the long-term bull market in Gold has been driven by both the Fear Trade and the Love Trade. The transfer of wealth from west to east, and the accumulation of wealth particularly in China and India, has had a huge impact on bullion. Despite its current weakness, the fundamental long-term case for Gold remains incredibly strong – currency instability and an overall lack of confidence in fiat currencies, governments and world leaders in general, an environment of historically low interest rates, a Fed balance sheet now in excess of $3 trillion and expanding at $85 billion a month, money supply growth around the globe, massive government debt from the United States to Europe, central bank buying, flat mine supply, physical demand, emerging market growth, geopolitical unrest and conflicts…the list goes on. However, deflation is prevailing over inflation in the world economy and this had a lot to do with Gold’s recent plunge below the technically and psychologically important $1,500 level, along with the strong performance of equities which are drawing money away from bullion. Where and when Gold bottoms out in this cyclical correction is anyone’s guess, but we do expect new all-time highs later in the decade. There are many reasons to believe that Gold’s long-term bull market is still intact despite a major correction from the 2011 all-time high of just above $1,900 an ounce.

1 Comment

Gold finally cracks 1300.00!