TSX Venture Exchange and Gold

While the Venture erased most of its previous week’s gains, falling 13 points to finish at 942, it continued to show impressive resilience in the face of weakness in Gold which can certainly be construed as a positive sign for both the junior resource market and bullion. At the moment, the Venture is trading between powerful support at its EMA(20), where it dipped below briefly Friday before staging a “hammer” reversal, and of course equally stiff resistance at the 970 level which it failed to push through during minor rallies in the spring. “Decision time” is fast approaching and one catalyst, of course, could be this week’s upcoming Fed meeting (Tuesday and Wednesday). Another line of strong defence for the Venture is around 925 where the rising 50-day SMA and the 100-day SMA, which has flattened out, intersect.

Results of a Wall Street Journal survey show that two-thirds of market participants expect the FOMC to announce tapering on Wednesday, likely by about $10 billion a month. Many observers are expecting Gold to weaken as a result, but that really doesn’t make sense. Expectations of Fed tapering by September have been one of the driving forces in pushing Gold down since the spring, so a “sell on rumor, buy on news” scenario is quite possibly in the cards. One must also keep in mind that while being hawkish in one way (reducing monthly bond purchases and starting the process of weaning the baby off the bottle), the Fed could be dovish in another in terms of its language. Don’t forget, U.S. labor growth is still far from robust. A slew of economic data released last week was also tepid at best – disappointing numbers for consumer sentiment, retail sales and business inventories. In fact, business inventories posted their largest increase in 6 months. The Fed also can’t ignore the potential impact of a stimulus withdrawal on emerging market economies, some of which are already feeling the pain (capital outflows) stemming from higher long-term interest rates in the U.S. So Ben Bernanke has quite a balancing act to perform, and his post-meeting news conference will be interesting to watch.

There’s also the possibility, of course, that the Fed will surprise the pundits and not proceed with tapering just yet – Gold would then pop significantly to the upside along with other commodities. The Fed wouldn’t mind to see inflation kick in a little bit. No matter if the Fed tapers or not, we like the odds of Gold pushing higher.

As we pointed out yesterday, over the last couple of weeks we’ve seen 3 major 1-day drops in Gold totaling more than $80 an ounce including a $45 plunge the other day (Thursday). Yet the Venture was actually up slightly on 2 of those days and declined just 4 points Thursday. That’s a pattern – the Venture shrugging off a more than 5% drop in Gold – that we just haven’t seen over the last 2+ years. Gold indeed is down 5% this month while the Venture is actually up 3 points. What the Venture appears to be telling us is that it’s not expecting Gold to fall out of bed again.

Some positive exploration news, of course, would also help build confidence in the Venture. In the current market environment, continue to focus on the 10% of Venture companies who have the working capital, the expertise, the properties and the drive to execute both on the ground and in the market, and make discoveries that majors may ultimately buy.

Below is John’s updated 3-month daily chart for the Venture. Again, notice the support the EMA(20) has been providing since early July. RSI(14) is flat and at previous support. This is a slow-moving train at the moment but the gradual improvement in the Venture’s technical posture leads us to believe that an important bottom was formed in late June and a major breakout above 970 could occur by the end of the month or very early in Q4. The market should let us know one way or the other very soon. Continue to keep a close eye on support and resistance levels.

The Seeds Have Been Planted (And Continue To Be Planted) For The Next Big Run In Gold Stocks

There’s no better cure for low prices than low prices. The great benefit of the collapse in Gold prices this year is that it forced producers to learn to become much more lean and mean in terms of their cost structures. Among many others, Barrick Gold (ABX, TSX), the world’s largest producer, said it may sell, close or curb output at 12 mines from Peru to Papua New Guinea where costs are higher. Producers, big and small, have started to make hard decisions in terms of costs, projects, and rationalizing their operating structures. Exploration budgets among both producers and juniors have also been cut sharply. In addition, government policies across much of the globe are making it more difficult (sometimes impossible) for mining companies to put Gold (or other) deposits into production, thanks to the ignorance of many politicians and the impact of radical and vocal environmentalists. Ultimately, all these factors are going to create a supply problem – think about it, where are the next major Gold deposits going to come from? On top of that, a recent Mineweb study shows grades have indeed fallen significantly just over the past decade. For instance, grades in the South African Gold sector fell from an average of 4.3 grams per metric ton in 2002 to an average of 2.8 grams per metric ton in 2011. It doesn’t take a rocket scientist to figure out that the next huge bull market in Gold stocks is just around the corner due to demand-supply dynamics, much leaner producers who will suddenly become earnings machines, and a junior market that will be healthier simply because a lot of the “lifestyle” companies sucking money out of investors will simply disappear or get taken over by individuals or groups who are actually competent and serious about building shareholder value. A healthy “cleansing” in the market has been taking place. As this continues, more and more seeds are being planted for an incredible future move in well-managed Gold producers and explorers that could make the dotcom bubble look like a tea party. As for the juniors, focus on the small universe of companies that have the ability to execute both on the ground and in the market – companies that have the cash, the expertise, the properties and the drive to make discoveries that majors will buy.

Gold

It was a rough week for Gold and some blame it on “manipulation”, and indeed that may have been part of the equation. Forces are certainly at work – there has been a significant shift in physical Gold from West to East in recent months. For the week, bullion was down $63 an ounce. But it found support at $1,300 and reversed intra-day Friday to finish the week at $1,328, just slightly above the bottom of the support band that runs from $1,320 to $1,350. The potential for an imminent scaling back of Q3 and the easing of tensions regarding Syria brought some selling into Gold last week, as did rumors that President Obama is about to nominate Larry Summers – his former economic adviser – as the new Fed Chairman (Bernanke’s term expires at the end of January). However, Obama’s nomination must be approved by the Senate where Summers is guaranteed to get a rough ride – especially considering some key Democrats have already indicated they will oppose his nomination. Summers is viewed as a confrontational figure in some circles in Washington. The market would prefer to see continuity at the Fed with Vice-Chair Janet Yellin, who has been a strong advocate of a dovish monetary policy, nominated to succeed Bernanke. Interestingly, no other Fed Vice-Chair has ever been promoted to Chairman. We’ll see what happens. Obama’s Presidency is weakening and he’ll definitely have a struggle on his hands if he chooses to nominate Summers.

Traditionally, September is bullion’s best month of the year, but a major turnaround during the last half of the month is going to have to occur in order for this trend to continue. If Gold does take off and close above resistance at $1,400 by month-end, many traders/investors may come to the conclusion that the nearly 40% drop in the Gold price between September 2011 and late June this year was a much-needed correction that has indeed run its course.

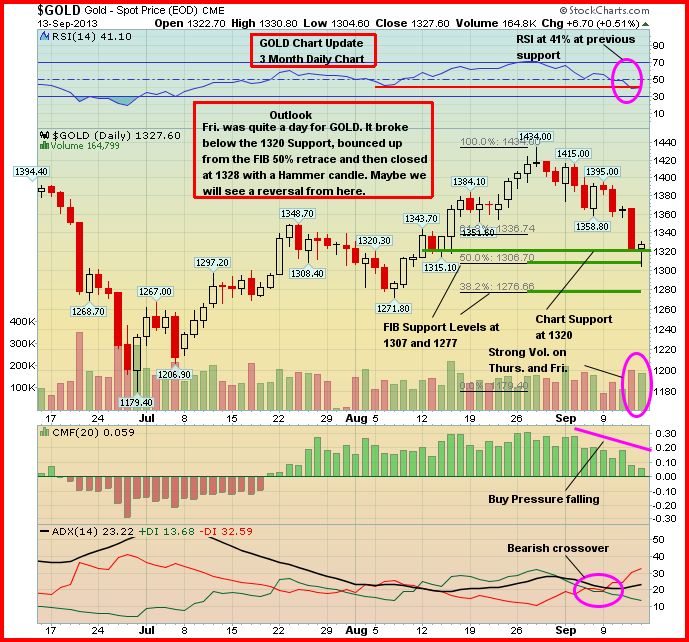

Below is a 3-month daily Gold chart from John. Chart support is at $1,320. Fib. support levels are at $1,307 (touched intra-day Friday) and $1,277. At 41%, RSI(14) is at previous support. We were expecting a possible “hammer” Friday and that’s exactly what occurred – an encouraging sign for a very critical upcoming week with more volatility expected.

Silver, which typically follows Gold’s price movements to a disproportionate extent, fell $1.57 an ounce or 6.6% last week to close at $22.27. Importantly, however, it held support at $22 (a significant support band exists between $22 and $23). John will have updated Silver charts as part of tomorrow’s Morning Musings. Copper fell 6 cents to $3.18. Crude Oil slipped $2.32 a barrel to $108.21, but WTIC still looks strong technically which is also positive for Gold. The U.S. Dollar Index climbed half a point to 82.15.

The “Big Picture” View Of Gold

As Frank Holmes so effectively illustrates at www.usfunds.com, the long-term bull market in Gold has been driven by both the Fear Trade and the Love Trade. The transfer of wealth from west to east, and the accumulation of wealth particularly in China and India, has had a huge impact on bullion. Despite this year’s drop, the fundamental long-term case for Gold remains incredibly strong – currency instability and an overall lack of confidence in fiat currencies, governments and world leaders in general, an environment of historically low interest rates, a Fed balance sheet now in excess of $3 trillion and expanding at $85 billion a month, money supply growth around the globe, massive government debt from the United States to Europe, central bank buying, flat mine supply, physical demand (especially from China), emerging market growth, geopolitical unrest and conflicts…the list goes on. However, deflation is prevailing over inflation in the world economy and this had a lot to do with Gold’s plunge during the spring below the technically and psychologically important $1,500 level, along with the strong performance of equities which drew money away from bullion. June’s low of $1,180 may have been the bottom for bullion – time will tell. We do, however, expect new all-time highs as the decade progresses. There are many reasons to believe that Gold’s long-term bull market is still intact despite this major correction from the 2011 all-time high of just above $1,900 an ounce.

9 Comments

http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2013/9/14_More_Fallout_-_Crushing_JPM_Gold_%26_Silver_Whistleblower_News.html

check this out guys and gals….

Check out GGI’s updated target area on their website dated Sept 10, 2013. looks like they are gearing up.

Garibaldi Resources -> Maps -> Canadian Projects Maps -> Grizzly Project -> Primary Target Areas

Good point, Dan. Missed that one, interesting. A signal that something’s up. If there’s more tomorrow, it’s game on I would think.

Jon,

Larry Summers, Obama’s choice to succeed Fed Chairman Bernanke, has withdrew his name for consideration for the job. Looks like Janet Yellen may be the leading candidate now to succeed Bernanke. What are your thought’s on what this does for gold and silver if anything?

The market was a little nervous about Summers, and rightly so. Confrontational, always the smartest one in the room. Not really the characteristics you would necessarily want in a Fed Chairman, but we’re dealing here with the questionable judgement of a very weak President. Summers, his former economic adviser, was apparently Obama’s preferred choice. But he just didn’t have the votes in the Senate; no use embarrassing the President by having the nomination rejected. At least he had the humility to withdraw his name as a potential candidate for nomination. Who will Obama turn to now? He may yet surprise us, but he may have no choice but Yellen, who is really the natural candidate. And she has been a leading advocate of dovish monetary policy. I think we’re in for a good week for Gold, and the greenback may get hurt – after Fed meeting which is crucial. Summers was viewed as potentially more hawkish on monetary policy.

A very interesting article on Robert Friedland and his thoughts on copper.

Robert Friedland

http://ceo.ca/billionaire-miner-robert-friedland-sounds-off/

“Confrontational, always the smartest one in the room” – I think you are confusing ‘corrupt’ for ‘smart’?

Perhaps, Hugh…the point was that he considers himself to always be the smartest one in the room…

Jon,

Interesting timing on RF’s copper comments .. azc