TSX Venture Exchange and Gold

Happy Thanksgiving to our Canadian readers! We hope you’re enjoying a pleasant long weekend with friends and loved ones. Despite frustrating markets, we do have much to be grateful for. Canadian markets are closed Monday for Thanksgiving, so there will be no postings tomorrow. Morning Musings returns Tuesday with a pre-market posting at approximately 4:00 am Pacific. Tomorrow is Columbus Day for our friends in the United States but stock markets there remain open (Treasury market is closed).

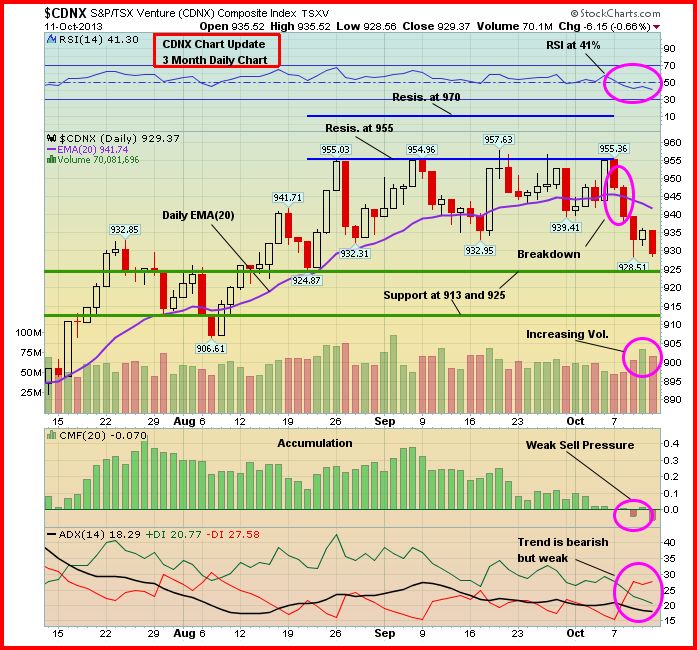

The Venture declined in 4 out of 5 sessions last week after touching resistance at the end of the previous week at 955. As we noted, buy pressure needed to increase in order for the 955 wall to come down, on yet another attempt, but this did not occur. The Index fell in lockstep with Gold, declining 26 points (2.7%) to finish at 929 – right at its 100-day moving average (SMA) which has flattened out (this SMA has provided support since late August while the 50-day continues to rise which is positive). Gold, by comparison, lost 2.9% last week. The TSX Gold Index slid 3.9%, while both the TSX Composite and the Dow each finished a volatile week up about 1% – a particularly impressive performance by the TSX given the weakness in commodities.

So where do things stand with the Venture? The Index did suffer some technical damage last week and the EMA(20) is now in decline. Strong support exists from the early August low of 907 to Friday’s 929 close. Gold’s direction will be key – bullion is at important support and could go one way or the other, depending of course on political developments in Washington with regard to the debt ceiling issue. So far, Gold doesn’t seem to be taking a potential U.S. default very seriously given its $63 loss over the last 2 weeks – we’ll see if that changes over the next few days. And it didn’t help last week when Goldman Sachs came out and said Gold is a “slam dunk sell”. Keep in mind, though, that Goldman Sachs’ 2nd-quarter regulatory disclosure showed the addition of a significant portion of Gold to its holdings – rather strange (or maybe not) when their research analysts keep telling investors that Gold is headed south.

Below is a 3-month daily Venture chart from John. There have been 4 failed attempts since August to push through resistance at 955. Interestingly, while the Venture has outperformed Gold over the past couple of months, it’s up 8.1% from its late June low of 859 while bullion is up 8% from its low at the same time of $1,179. The TSX Gold Index is up 5.8% from its low.

Two things that would benefit the Venture immediately – higher Gold prices and a stunning drill hole from somewhere.

The Seeds Have Been Planted (And Continue To Be Planted) For The Next Big Run In Gold Stocks

There’s no better cure for low prices than low prices. The great benefit of the collapse in Gold prices this year is that it forced producers (at least most of them) to start to become much more lean and mean in terms of their cost structures. Among many others, Barrick Gold (ABX, TSX), the world’s largest producer, said it may sell, close or curb output at 12 mines from Peru to Papua New Guinea where costs are higher. Producers, big and small, have started to make hard decisions in terms of costs, projects, and rationalizing their operating structures. Exploration budgets among both producers and juniors have also been cut sharply. In addition, government policies across much of the globe are making it more difficult (sometimes impossible) for mining companies to put Gold (or other) deposits into production, thanks to the ignorance of many politicians and the impact of radical and vocal environmentalists. Ultimately, all these factors are going to create a supply problem – think about it, where are the next major Gold deposits going to come from? On top of that, a recent Mineweb study shows grades have indeed fallen significantly just over the past decade. For instance, grades in the South African Gold sector fell from an average of 4.3 grams per metric ton in 2002 to an average of 2.8 grams per metric ton in 2011. It doesn’t take a rocket scientist to figure out that the next huge bull market in Gold stocks is just around the corner due to demand-supply dynamics, much leaner producers who will suddenly become earnings machines, and a junior market that will be healthier simply because a lot of the “lifestyle” companies sucking money out of investors will simply disappear or get taken over by individuals or groups who are actually competent and serious about building shareholder value. A healthy “cleansing” in the market has been taking place. As this continues, more and more seeds are being planted for an incredible future move in well-managed Gold producers and explorers that could make the dotcom bubble look like a tea party. As for the juniors, focus on the small universe of companies that have the ability to execute both on the ground and in the market – companies that have the cash, the expertise, the properties and the drive to make discoveries that majors will buy.

Gold

Bullion is at critical support on a short-term basis, and it will be fascinating to see what unfolds this coming week. It seems we’re either going to have a pre-Halloween scare, or a pleasant sharp reversal to the upside. John’s 6-month daily chart shows the bearish trend has been gaining strength this month. The bullish trend started at the end of June, after Gold touched $1,179, and momentum continued until it peaked in late August. So far, we’ve seen a normal retracement in the $250 move to the upside from late June to late August. But that changes if Gold can’t hold Fibonacci support in the $1,270’s and chart support around $1,270. Gold closed Friday at $1,273, down $38 for the week.

Thursday saw the SPDR Gold Trust – the world’s largest ETF by value in late 2011 – shed a further 1.8 tonnes, taking the volume of Gold bullion needed to back its shares to a new 57-month low beneath 897 tonnes.

Silver fared a little better than Gold last week, losing 44 cents or 2% to close at $21.34 (John will have updated Silver charts Tuesday morning). Copper fell 2 pennies to $3.26. Crude Oil slipped $1.82 a barrel to close at $102.02 while the U.S. Dollar Index gained a quarter of a point to 80.41.

The “Big Picture” View Of Gold

As Frank Holmes so effectively illustrates at www.usfunds.com, the long-term bull market in Gold has been driven by both the Fear Trade and the Love Trade. The transfer of wealth from west to east, and the accumulation of wealth particularly in China and India, has had a huge impact on bullion. Despite this year’s drop, the fundamental long-term case for Gold remains incredibly strong – currency instability and an overall lack of confidence in fiat currencies, governments and world leaders in general, an environment of historically low interest rates, a Fed balance sheet now in excess of $3.5 trillion and expanding at $85 billion a month, money supply growth around the globe, massive government debt from the United States to Europe, central bank buying, flat mine supply, physical demand (especially from China), emerging market growth, geopolitical unrest and conflicts…the list goes on. However, deflationary concerns around the globe and the prospect of Fed tapering by the end of the year had a lot to do with Gold’s plunge during the spring below the technically and psychologically important $1,500 level, along with the strong performance of equities which drew money away from bullion. June’s low of $1,179 may have been the bottom for bullion – time will tell. We do, however, expect new all-time highs as the decade progresses. There are many reasons to believe that Gold’s long-term bull market is still intact despite this major correction from the 2011 all-time high of just above $1,900 an ounce.

12 Comments

Any news from RBW, their website is down?

Their site is working fine – RainbowResourcesRBW.com. I imagine there will be news when they complete their financing.

If you want to know what is happening to the Venture, go to

today’s edition of The Equedia Letter.. The writer seems to

know what he is talking about. R !

Bert

The article by Ivan Lo makes a lot of sense, the banks as we all know are a bunch of crooks and until the CEO’s of the mining companies stand up to them it will never end.

The quietness out there tells you the market is very nervous.Grab your profits when you can.Will that 590 metre hole even make a dent in PGX’s share price?That will be interesting to watch,because DBV is about to announce their own drill program into the heart of their anomoly,so seeing PGX get a lift might carry DBV along with it to start things off.

The scenario I hope to see is:

1- DBV announces they have completed their IP survey and expect great things in their drilling when it begins.

2-PGX announces their results,and the stock jumps.

3-DBV announces drilling will begin this week

I hope that causes a run on DBV stock.

DBV/PGX/GGI, and any others out there need to get attention soon to the area play that is developing! Like Jon/John said, this has all the potential to be a huge area play soon!

ABR is another name investors need to have on their radar as they have picked up 852 hectares adjacent to the DBV HAT ppty…fyi…

ashburtonventures.com/index.php?page=projects&project=116

ashburtonventures.com/index.php?page=projects&project=116

zippy: ABR looks great as it is attached to the DBV ground which could be drilling very shortly!….ABR has Uranium, Graphite,etc as well….It is a tight structure! Thanks for the map!

Gold under pressure again this morning and looks like the US is going to have a deal so more gold selling. And unfortunately, this will affect the venture which, imo, broken. There is no more money flowing towards the venture, (hense why we haven’t been able to break above 955). Seriously, when was the last time the venture stayed range bound at these levels???

Patience, and stay calm. This will be an interesting week, and Gold could shoot either way. The Venture has built up a lot of support over the last few months, and has also outperformed Gold since August.

Wow gold has climbed all the way back to being up a buck…