TSX Venture Exchange and Gold

The Venture turnaround gained momentum last week with the CDNX climbing another 22 points to finish at 967. Remarkably, the Index has posted 13 consecutive daily gains – better than any winning streak put together during the 2009-2011 bull market, though on less volume of course. Expect trading activity to ramp up significantly on a confirmed breakout above critical resistance in the 970’s. This could occur as early as next week, or perhaps we’ll need to be patient and wait a little longer. In our view it’s only a question of when, not if, The Great Wall in the 970’s will come crumbling down.

Quite simply, the bears have lost control over this market, and the 3 charts below are proof of that. Realizing this seismic shift now, ahead of the “herd”, will give you the opportunity to make bucket loads of money over the next 12 months as there are some incredibly cheap valuations at the moment despite the 13% move off last June’s Venture bottom. Selectivity, of course, will be critical as a rising tide is not going to lift all boats (some boats are still destined to sink).

Its current wining streak is impressive, but what excites us the most about the Venture are some of the dramatic technical shifts that have occurred in recent months beginning with the breakout in October above a long-term downtrend line in place since 2011 on the 3-year weekly chart. Importantly, through November and December, that downtrend line was repeatedly tested and held as support. Starting just a couple of days before Christmas, following the end of tax-loss selling, the Venture took the path of least resistance and began to move powerfully north of the downtrend line.

We’ve been tracking that 3-year weekly chart consistently for the benefit of our readers and we’ll be posting an interesting updated version Monday morning. Strikingly, RSI(14) – now at 55% – has broken decisively above 50 for the first time since the bear market began in early 2011.

Indeed, something very important is brewing. Not only has the Venture pushed above its 200-day moving average (SMA) for the first time since 2011, but this 13-year monthly chart from John shows how the MACD has finally turned upward after a decline that started during the first half of 2011.

13-Year Venture Monthly Chart

More Evidence Of A Major Technical Shift

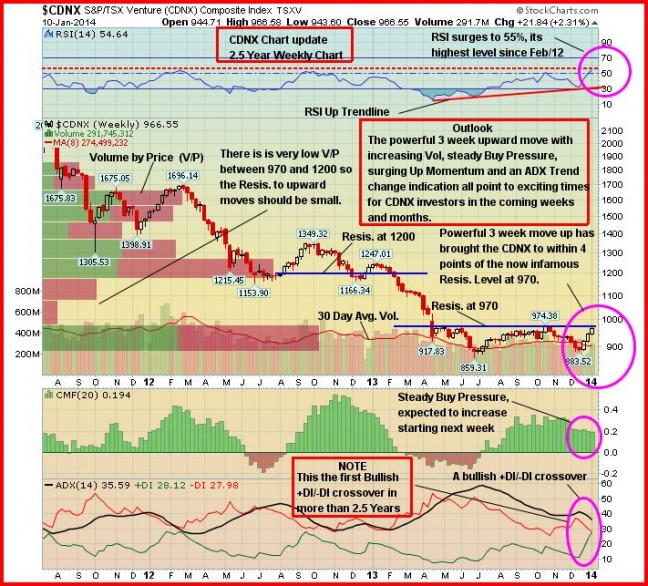

This 2.5-year weekly chart shows another hugely significant development – the first bullish +DI/-DI crossover in the ADX indicator (on the longer-term weekly chart) since the bear market began in early 2011.

Updated Venture 9-Month Daily Chart

This updated 9-month chart from John shows how the Venture has overcome resistance around 940 and 958. Now comes the test (yet again) of the 970 resistance. There is certainly room for the RSI(14) on this daily chart to push higher, and we expect that it will.

The Seeds Have Been Planted (And Continue To Be Planted) For The Next Big Run In Gold Stocks

There’s no better cure for low prices than low prices. The great benefit of the collapse in Gold prices in 2013 is that it forced producers (at least most of them) to start to become much more lean in terms of their cost structures. Producers, big and small, have started to make hard decisions in terms of costs, projects, and rationalizing their their overall operations. Exploration budgets among both producers and juniors have also been cut sharply. In addition, government policies across much of the globe are making it more difficult (sometimes impossible) for mining companies to put Gold (or other) deposits into production, thanks to the ignorance of many politicians and the impact of radical and vocal environmentalists (technology has made it easier for groups opposing mining projects to organize and disseminate information, even in remote areas around the globe). Ultimately, all of these factors are going to create a supply problem – think about it, where are the next major Gold deposits going to come from? On top of that, grades have fallen significantly just over the past decade.

It doesn’t take a rocket scientist to figure out that the next huge bull market in Gold stocks is just around the corner due to demand-supply dynamics, much leaner producers who will suddenly become earnings machines, and a junior market that will be healthier simply because a lot of the “lifestyle” companies sucking money out of investors will simply disappear or get taken over by individuals or groups who are actually competent and serious about building shareholder value. A healthy “cleansing” in the market has been taking place. As this continues, more and more seeds are being planted for an incredible future move in well-managed Gold producers and explorers that could make the dotcom bubble look like a tea party. As for the juniors, focus on the small universe of companies that have the ability to execute both on the ground and in the market. Companies that are strong financially, have superior exploration prospects, competent management and clean share structures.

As Frank Holmes pointed out last night in his weekly Investor Alert at www.usfunds.com, “Valuations of Gold miners are approaching their cheapest relative to book value in at least two decades, precisely at the time when free cash flow generation has bottomed and cost reductions are kicking in. The current valuations present opportunities for junior miners to acquire mining assets, just like Northern Star Resources did by purchasing the Plutonic mine from Barrick, based solely on the value of the proven and probable reserves.”

Gold

Gold and commodities in general responded well to Friday’s weak U.S. jobs report (employers hired the fewest workers in almost 3 years in December) with bullion jumping $21 an ounce to finish up $11 for the week at $1,249. It appears Gold is ready to challenge resistance around $1,275.

According to Bloomberg, Gold analysts are the most bullish in a year on speculation that investors are covering near-record short positions. Following the first annual decline in 13 years, 15 analysts surveyed by Bloomberg expect Gold to rise this coming week, while 2 are bearish and 4 are neutral.

John’s 9-month daily chart shows that Gold may have formed a bullish technical double bottom. If Gold can overcome resistance at $1,275, its next major challenge will be to push above the downsloping wedge.

Silver soared 63 cents Friday but finished the week up just 2 cents at $20.17. Copper lost a penny to $3.32. Crude Oil hit an 8-month low of $91.24 Thursday and closed Friday at $92.72, down $2.72 a barrel for the week (U.S. Crude Oil production is now at a 25-year high). The U.S. Dollar Index is still finding very stiff resistance around 81 and closed the week down one-quarter of a point at 80.63, thanks to Friday’s weak jobs report.

The “Big Picture” View Of Gold

As Frank Holmes so effectively illustrates at www.usfunds.com, the long-term bull market in Gold has been driven by both the Fear Trade and the Love Trade. The transfer of wealth from west to east, and the accumulation of wealth particularly in China and India, has had a huge impact on bullion. Despite this year’s drop, the fundamental long-term case for Gold remains incredibly strong – currency instability and an overall lack of confidence in fiat currencies, governments and world leaders in general, an environment of historically low interest rates, a Fed balance sheet now at $4 trillion and still expanding, money supply growth around the globe, massive government debt from the United States to Europe, central bank buying, flat mine supply, physical demand (especially from China), emerging market growth, geopolitical unrest and conflicts…the list goes on. However, deflationary concerns around the globe and the prospect of Fed tapering had a lot to do with Gold’s plunge during the spring below the technically and psychologically important $1,500 level, along with the strong performance of equities which drew money away from bullion. June’s low of $1,179 may have been the bottom for bullion – only time will tell. Given the high level of bearishness that exists in this market at the moment, it’s probably safe to say that if Gold hasn’t seen its low yet, it’s at least very close to a bottom (within 10% to 15%). We do, however, expect new all-time highs as the decade progresses and inflationary pressures finally kick in around the globe after years of ultra-loose monetary policy. There are many reasons to believe that Gold’s long-term bull market is still intact despite this major correction from the 2011 all-time high of just above $1,900 an ounce.

17 Comments

THANKS FOR THIS REPORT! LOVE THE 9 MONTH VENTURE CHART (3RD CHART ABOVE)!!! FINALLY, HAVE SOME HOPE AGAIN!!! IF IT’S GOING TO BREAK THRU 970, IT’S GONNA BE VERY SOON!

BMR,

Do you expect that the Ventures will continue its upward trajectory even if the USD continues its upward trend as a result of the FED scaling down on its QE program? I think there have been signals that the US economy is improving as of late and will continue to reduce its asset purchases in the coming months. I can’t see gold outperforming until the final leg downward occurs and absolutely everyone loses faith in the yellow metal. Unfortunately, I think goldman sachs will be correct that there is still another leg downward (between 1000-1100) which we will have to endure before we end up going up. The good news is, most stocks valuations are becoming expensive and investors are now looking to commodities since they are so undervalued. I see uranium and graphite stock outperforming throughout the year along with rare earths. Oil and gas stocks should also start to perform well.

Until the final downleg in gold happens (which I’m expecting will occur in the next couple months – probably spike down in March-June timeframe) we won’t see outperformance in gold or silver stocks. My advice is to fade this Venture rally and take your profits to buy later when these stocks are least wanted.

My recommendation would be to buy high quality stocks that are in a mature junior exploration or production phases with proven reserves when gold spikes down such as ATC, KAM, WS, GPR, MAY, SPA, AGE, CXO, GQC, GCU, SGC, GIX, MRO, VIT, and WRN. FYI – I hold positions in all of these stocks because they are at all time low valuations.

Good luck.

Andrew, first off, is the U.S. Dollar really on an upward trend? Interestingly, as we’ve pointed out, the Venture broke above its long-term downtrend line in October, just a few weeks after the Dollar Index broke below an important uptrend line on the weekly chart. The Dollar Index 200-day SMA is now declining, and the Index is facing very stiff resistance around the 81 level. The Venture’s 200-day SMA is ready to reverse to the upside, perhaps within a month. Critical support for the Dollar Index is at 79. Expect that to be tested.

The Venture topped out 6 months before Gold did in 2011. It will always move ahead of Gold, one way or the other. So if you think that the Venture hasn’t hit bottom because Gold may not have hit bottom yet, that’s a false premise.

Funny how one’s mind works. Take Friday for example, for most

of the day LXV was trading as if there were only a handful of

traders watching. Opened at 0.41 & traded in low 40’s for

most of the day, with a volume of 500k, not a lot for this stock.

All of a sudden, things started to happen, which prompted me

to start looking for the news & there it was & there were the

traders, piling in. We ended up with a close of 0.57, the high

for the day & on the Venture exchange alone, a volume of 3.6

million, for a total on all Canadian exchanges of 5..5 million.

Where did all the traders come from ? of course, they were there

all the time, looking for a winner & they found it in LXV. This

leads me to believe that a few more stocks like LXV, will lead

the Venture to higher levels. R !

p.s. Feeling better Natalie

holy f**k is PGX ever going to go up

bert cool comments haha! love to visit newfoundland

GGI presentation is very impressive. Good job BMR people. The coming few weeks should make for plenty of action on the venture exchange. Good luck to us all. Richard l

FROM THE GOLDANDGUY.COM: Gold and gold stocks crashed last year in the summer. They have since been going through a stage one base. This suggests that 2014 will mark the start of a new bull market for gold, gold mining stocks and commodities. The commodity sector as a hole should be your focus in the coming months if you want to be able to invest in something for longer than a few days or weeks and make a huge amount of money be sure to check out my gold newsletter.

FROM PINNACLE DIGEST: Since releasing our report on December 22nd, the TSX Venture has increased in value every single trading day thus far. In fact, since December 22nd, the Venture exchange is up an impressive 8.8% – making it the number one performing index in North America for that time period. Take a look at the one month chart below:

TSX Venture One Month Chart

For thirteen straight trading days the TSX Venture has gone up in value, one of its best runs in recent history.

13 Trading Days In a Row of Gains for the Venture:

From zero to hero, the TSX Venture has quickly turned the tide and is North America’s hottest index at the moment. As we’ve always said, the TSX Venture is influenced by seasonality factors that are predictable and happen year in and year out. It just so happens that until the end of February, we are, according to historical statistics, in the most bullish period for Venture stocks.

BASED ON THE ABOVE REPORTS, FINALLY, LOTS OF POTENTIAL FOR THE VENTURE!!!

Every time i hear the company name Garibaldi, it reminds me of the time i

made 50K on ATC. Those were the days my friends, i thought they would

never end. Anyway back to Garibaldi, Medium share structure, deduct what

managements owns & we have a low share structure. They have property here

& they have property there, they are drilling here & they are drilling there,

they have a cash flow & soon will have a news flow. Their story is frequenting

my computer, i think about the possibilities on a daily basis, i lay in bed

& imagine another good payday. My wife says, what’s on your mind today Bert ?

I reply Garibaldi, she replies, who is Gari & why are worrying about him going

bald ? Enough said. Good night ! R !

pitiful, comeback venture on monday!

Looking forward to this week. Time to top up on my DYG

Andrew I will track and report on your stock picks if that is ok with you

Retired for the night with gold up 4:30, up this morning to

find gold down 1:70. With 21/2 hours left before market opens,

lets up it turns up. Stock i am watching this morning has to

be LXV…… GGI’s turn will come/ R !

Correction post # 14, should read “lets hope it

turns around”…Might as well state that Gold is

only down 0.50 now, with 11/2 hours left before

market. I promise to reread my posts before

submitting in the future. This is becoming

troublesome. Have a good day. R !

GOLDCORP NEWS: Goldcorp offers to buy Osisko for $2.6-billion (U.S.)…THATS ‘OSK’….

LXV, i am still watching, watching it go down that is.

So there you go. The same guarantee in life is still

guaranteed, that is, death & taxes. R !