TSX Venture Exchange and Gold

The Venture was under some mild selling pressure through most of the week, as expected given the technical posture of the Index after January 23, but critical support held and a recovery began intra-day Thursday – despite a sell-off in the Gold market – after the Index touched 662. This reversal carried into Friday when the Venture enjoyed its best day of the month since January 2 with a gain of 10 points on increased volume to close at 678. Gold quickly regained its lost ground from Thursday and shot up $25 an ounce.

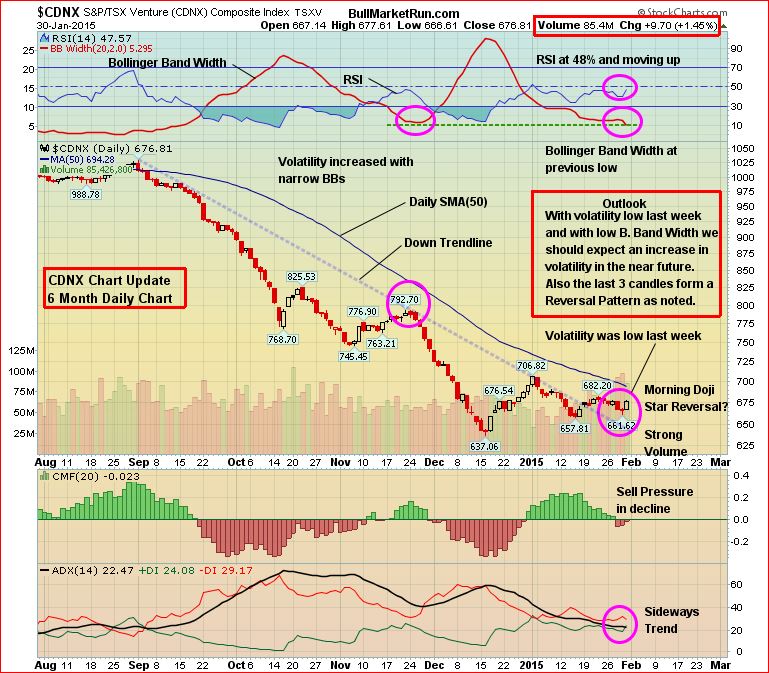

Sell pressure (CMF indicator) is showing signs of reversing, and the Venture is now looking a lot healthier from a short-term technical standpoint than it did a week ago. Key resistance is still 680. The odds have increased that this level will be overcome during this first week of February. Higher Gold prices could be the catalyst, and Oil would help if it were to show further signs of stabilizing (at least for now).

Historically, February tends to be a favorable month for the Venture. With some success stories on the exploration front, and a further jump in Gold, the Index would have an excellent chance for a significant breakout above its still-declining 50-day moving average (SMA) currently at 694.

Importantly, during the last half of January the Index did manage to push above a downtrend line in place since last September. This does set the stage, potentially, for a much stronger February.

Venture 2-Month Daily Chart

What we see in this 2-month daily chart, including a bullish +DI/-DI crossover, gives us added encouragement. The last +DI/-DI crossover came during the reversal in mid-December.

The Seeds Have Been Planted (And Continue To Be Planted) For The Next Big Run In Gold Stocks

There’s no better cure for low prices than low prices. The great benefit of the collapse in Gold prices in 2013 is that it forced producers (at least most of them) to start to become much more lean in terms of their cost structures. Producers, big and small, have started to make hard decisions in terms of costs, projects, and rationalizing their their overall operations. Exploration budgets among both producers and juniors have also been cut sharply. In addition, government policies across much of the globe are making it more difficult (sometimes impossible) for mining companies to carry out exploration or put Gold (or other) deposits into production, thanks to the ignorance of many politicians and the impact of radical and vocal environmentalists (technology has made it easier for groups opposing mining projects to organize and disseminate information, even in remote areas around the globe). Ultimately, all of these factors are going to eventually create a supply problem and therefore great opportunities in Gold and quality Gold stocks. Think about it, where are the next major Gold deposits going to come from? On top of that, grades have fallen significantly just over the past decade.

Gold

Gold became a little overbought on a short-term basis going into last week, so a healthy pullback to very strong support between $1,240 and $1,260 was probably just what it needed to get revved up for February. Sure enough, after some profit taking Thursday that shook some loose apples off the tree, bullion roared back on Friday and climbed $25 an ounce to close at $1,283. For the month, Gold soared $100 an ounce or 8.5%. What’s even more impressive is that this occurred against the backdrop of a rising U.S. dollar.

The credibility of central banks took a hit in January with the surprise Swiss decision to end the cap on the franc-euro rate. Currency wars have erupted all over the globe, and of course the euro zone has finally succumbed to the QE drug. Increasingly, central banks are starting to look desperate. It seems the Fed would like to raise interest rates for the first time in nearly a decade at some point during the second half of the year, but will they actually get the chance?

Temporarily overbought RSI(14) conditions have quickly reversed on this 6-month daily chart, and up momentum is clearly evident again. Gold appears to be gearing up for a test of resistance around $1,340.

Silver fell by over $1 an ounce last week to close the month at $17.22, but it was still a strong January for Silver with a gain of better than 10%. Copper closed a penny higher for the week at $2.50, Crude Oil rallied by nearly $3 a barrel to finish at $48.24, while the U.S. Dollar Index was relatively unchanged at 94.85.

The “Big Picture” View Of Gold

As Frank Holmes so effectively illustrates at www.usfunds.com, the long-term bull market in Gold has been driven by both the Fear Trade and the Love Trade. The transfer of wealth from west to east, and the accumulation of wealth particularly in China and India, has had a huge impact on bullion and will continue to support prices. Despite Gold’s largest annual drop in three decades in 2013, the fundamental long-term case for the metal remains solidly intact based on the following factors:

- Growing geopolitical tensions, fueled in part by the ISIS and al Qaeda, and a highly dangerous and expansionist Russia under Vladimir Putin, have put world security in the most precarious state since World War II;

- Weak leadership in the United States and Europe is emboldening enemies of the West;

- Currency instability and an overall lack of confidence in fiat currencies;

- Historically low interest rates;

- Continued strong accumulation of Gold by China which intends to back up its currency with bullion;

- Massive government debt from the United States to Europe – a “day of reckoning” will come;

- Continued net buying of Gold by central banks around the world;

- Mine closings, a sharp reduction in exploration and a lack of major new discoveries – this these factors should contribute to a noticeable tightening of supply over the next couple of years.

5 Comments

Re GGI: The more I think about the lack of news from GGI and really not much being said from the BMR guys either, the more it concerns me, no more results from Rodadero, nothing but wait and see, I find it very hard to believe that if GGI was in talks with a Major silver producer about either a JV or flat out buy out that there would not be some leaks somewhere and you would see some volume and the stock going up not down.Then on the other hand the only thing that gives me hope that they may really be in talks IS the lack of news and the last PR stating the money raised would be spent on the Sheslay not Mexico. Either there is something wrong or they are really good at keeping things quiet, just is hard to believe the latter… trying to keep the faith but been disappointed way too many times over the last few yrs……

You’re dealing with a very professional group in GGI, Greg, that doesn’t allow leaks, you just need to look back at the quiet activity right before last May’s surprise announcement on the hit at Rodadero. So over time I’ve learned with GGI that the “quieter” it seems to be, that’s the more suspicious we should be that something quite significant is probably in the works.

Enjoy the Super Bowl, everyone. Go Seahawks!

BMR – Weak leadership in the United States

Bert -The U.S. being one of the few economies doing well & may i add,

under Pres. O’bama.

Wars’ concluded in Iraq & Afghanistan under Pres. Obama.

The question now is – Do anyone think that any American parents

want to see their sons’ or daughters’ killed, while fighting another

war, enough already, they say.

If we have to have a war to move Gold up, i say, may Gold stay in the

dumps, as well as stocks’.

I say Pres. Obama is strong to resist the temptation of starting a war

with Russia.

I say President Obama is strong to resist the temptation of sending ground

troops to Syria &/or Iraq.

I say President is strong to be the first black President of the United States,

especially being able to overlook all the slurs directed his way, especially from

North Korea, didn’t they portray him as a monkey. ?

It turns my stomach & i am Canadian.

Jon,

last May is a totally different deal, that was just GGI and their employees that they had to worry about, GGI may have control of their employees, but how many employees does a major producer have? and how does GGI control them? Its just hard to imagine that we are trading at the level we are and that there is some huge announcement coming?? Volume usually precedes news and price moving up and we have neither in GGI. Maybe you are so confident because you have some inside info and have signed an NDA who knows and if that is the situation shouldn’t you inform your readers?….

NEWS….C.BLO

Please Read at Stockwatch website