TSX Venture Exchange and Gold

It’s revealing that since the beginning of September last year, when the Venture’s dive began, for every 1% gain in the U.S. Dollar Index, the Venture has fallen 1.7%. So keep this formula in mind: Plus 1 = Minus 1.7.

Last week, the ratio between the 2 remained consistent as the Dollar Index gained 2.5%, for its first close above 100 since April 2003, while the Venture fell 3.5%, losing 24 points to close at 665. When the greenback is strong, the Venture and commodities in general are under pressure. When the Dollar is weak, consolidating or in a holding pattern, the Venture and commodities will behave much better.

Historically, the Venture and the Dollar Index have moved in opposite directions which is why it’s so important for the latter to cool off. Just wishing that the greenback will slow down, however, doesn’t make it happen. It has momentum on its side and has broken out of a long-term downtrend. Next measured Fib. resistance is 106, and perhaps at that point the Fed will say enough is enough – at least for now. There are some advantages to the U.S. in having a strong currency; however, at the moment the powerful greenback is moving the Fed further away from its goal of kick-starting inflation.

This will be an important week as the Fed gathers Tuesday and Wednesday. Will it strike a hawkish tone or a dovish tone, or something in between, with regard to a potential rate hike in its fresh policy statement Wednesday? We’ll have to wait and see. One thing is certain – markets are typically volatile around Fed meetings and we’ve certainly seen increased volatility recently with 5 triple digit moves in the Dow over the last 6 trading sessions. More triple-digit sessions are on the way.

Markets often move on anticipation and mystery. Fed Chair Janet Yellen, not likely by design, has managed to create a lot of anticipation and mystery around a possible rate hike – an event that many current traders/investors haven’t yet seen in their careers. Once the Fed gets this rate hike out of the way, whenever that may be, that’s when the Dollar Index will likely begin to correct in a major way. That’s one school of thought, at least. The savvy Ben Bernanke was able to keep the dollar in check. Yellen hasn’t been able to do the same.

The Venture’s immediate challenge is to stay within a cluster of Fib. support, shown in John’s 4-month daily chart, that begins in the low 650’s. The Index was not able to overcome resistance at 707, and the short-term moving averages (SMA’s) have turned negative after 8 down days out of 10 this month. Crude Oil is threatening to hit new lows which is not helpful for the Venture either. A turnaround could come mid-week if the Fed surprises the markets and traders suddenly flee the crowded dollar trade, if only temporarily.

Venture 4-Month Daily Chart

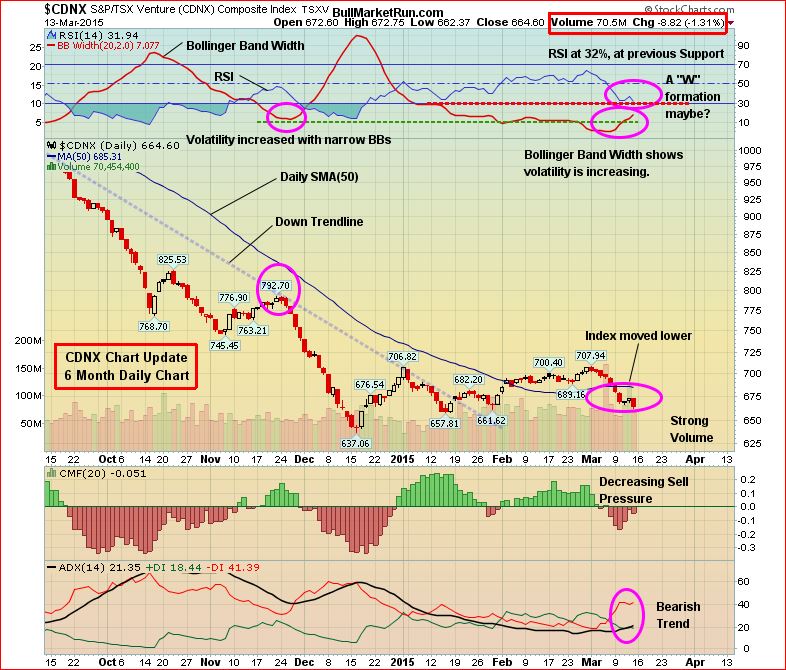

Venture 6-Month Daily Chart

This 6-month Venture chart shows how the Index has recently fallen below its 50-day SMA, currently 685, with the 50-day now starting to reverse to the downside. That’s usually not a good sign. On the positive side, sell pressure has backed off somewhat while RSI(14) is in a support area with the potential for a “W” formation. Volatility is increasing, as demonstrated by BB Width, so the probability of a near-term sharp move in either direction has increased.

The coming week will be very important.

The Seeds Have Been Planted (And Continue To Be Planted) For The Next Big Run In Gold Stocks

There’s no better cure for low prices than low prices. The great benefit of the collapse in Gold prices in 2013 is that it forced producers (at least most of them) to start to become much more lean in terms of their cost structures. Producers, big and small, have started to make hard decisions in terms of costs, projects, and rationalizing their their overall operations. Exploration budgets among both producers and juniors have also been cut sharply. In addition, government policies across much of the globe are making it more difficult (sometimes impossible) for mining companies to carry out exploration or put Gold (or other) deposits into production, thanks to the ignorance of many politicians and the impact of radical and vocal environmentalists (technology has made it easier for groups opposing mining projects to organize and disseminate information, even in remote areas around the globe). Ultimately, all of these factors are going to eventually create a supply problem and therefore great opportunities in Gold and quality Gold stocks. Think about it, where are the next major Gold deposits going to come from? On top of that, grades have fallen significantly just over the past decade.

Gold 2.5-Year Weekly Chart

Gold briefly fell below $1,150 last week but support at the level held and bullion closed Friday at $1,158, a decline of $6 an ounce from the previous Friday.

What comes out of the FOMC meeting will be crucial in terms of determining whether Gold can reverse its current downtrend or falls further to test support as low as $1,100, the bottom of the downsloping flag. Note that the RSI(14) on this 2.5-year weekly chart has bounced around within a 30% to 60% channel for the past year, and is currently at 38%.

Silver fell 29 cents last week to close at $15.64. Copper added 4 cents to $2.66. Crude Oil tumbled nearly $5 a barrel to $44.84, its lowest close since January 28, on more over-supply concerns, while the Dollar Index jumped by more than 2 points for the second straight week to finish at a new 12-year high of 100.18.

The “Big Picture” View Of Gold

As Frank Holmes so effectively illustrates at www.usfunds.com, the long-term bull market in Gold has been driven by both the Fear Trade and the Love Trade. The transfer of wealth from west to east, and the accumulation of wealth particularly in China and India, has had a huge impact on bullion and will continue to support prices. Despite Gold’s largest annual drop in three decades in 2013, the fundamental long-term case for the metal remains solidly intact based on the following factors:

- Growing geopolitical tensions, fueled in part by the ISIS and al Qaeda, and a highly dangerous and expansionist Russia under Vladimir Putin, have put world security in the most precarious state since World War II;

- Weak leadership in the United States and Europe is emboldening enemies of the West;

- Currency instability and an overall lack of confidence in fiat currencies, except King Dollar at the moment;

- Historically low interest rates;

- Continued strong accumulation of Gold by China which intends to back up its currency with bullion;

- Massive government debt from the United States to Europe – a “day of reckoning” will come;

- Continued net buying of Gold by central banks around the world;

- The continued Oil price decline which may cause destabilization of certain Oil-dependent economies;

- Mine closings, a sharp reduction in exploration and a lack of major new discoveries – these factors should contribute to a noticeable tightening of supply over the next couple of years.

13 Comments

BMR – Plus 1 = Minus 1.7.

Bert – The above noted is beyond the realm of possibility… plus 1 equals plus 1, period.

Any part of that 1, if taken away leaves it unequal. (joking)

I heard on sat that if India and China I think it was, would lift all restrictions on imports of gold it would be around 5 k an ounce, bit of a stretch, but wouldn’t that be nice to see happen.

*GBB*

What is your take on the permitting problem for GBB? I thought Quebec was a safe jurisdiction. The permitting process started almost a year ago and still no permit for a rolling start. Even Frank Basa seems to be dejected if you read the GBB forum. Very frustrating for us long shareholders.

Jon with respect to your comments regarding GBB in the March 13 musings, I would add that the bashers have come out in droves, declaring the death spiral amongst other ludicrous projections. Frank acknowledges his frustration but appears to be cautious in not pissing off the government agency. He has declared his confidence that GBB will eventually get the C of A, but has shared little on how to expedite this process. Are you aware of any external forces that could be brought to bear on the government agency to speed up the process? Have there been many other mines suffering a similar fate? Thanks

Ted, all interactions with a government agency can be frustrating. The permitting process as it relates to the mining industry often takes longer than expected. In Quebec, though it has moved up in the Fraser rankings to 6th overall in the entire world, there are nonetheless still weaknesses in the bureaucracy in terms of staffing levels and skill, much of that brought about I believe by the separatists and socialists who were last in power. With the current Liberal government, Quebec is very much a friendly mining jurisdiction and improvements continue to take place.

In reference to an earlier comment by someone, Frank is not dejected, let me be clear about that (again, be careful about judging emotions or attitudes based on text comments in a forum or an email). He’s a bulldog, he’s enthused, and he’s working hard at getting this final permit ASAP. Given the experience of another company in Quebec that was looking for a permit, and did receive it within a year, sometimes the “squeaky wheel” gets the attention and you have to adjust certain tactics and strategies along the way. This is business – you can’t be afraid to get your elbows up on occasion if necessary.

Keep in mind, however, GBB has already received 25 of the 26 permits it needs, and IAMGOLD also received its amended CofA to process Granada ore. So it’s really just a matter of when, not if. Granada was an operating mine before and it will be again, rest assured.

There are many reasons for encouragement with this project at this stage of the game. To use a football analogy, GBB is getting very close to the goal line and a touchdown, so now is the time in our view to be optimistic, not pessimistic.

On a very specific note, the historical drill data being added to the equation in my view should greatly improve the stripping ratio and therefore the already strong economics of stage 1 production, in addition to increasing the total ounces at Granada. This rolling start can be extremely robust – almost immediate commencement upon final permitting, nice grades, very low CAPEX, high IRR, excellent cash flow generation – a real company builder. Low loonie and low Oil prices help tremendously. At a market cap of $12 million, very compelling.

Keep an eye on VGD, this week, awaiting lab results (hopefully Tues) on some very promising property(167) in Northern Quebec….

Yes, Brillo2, we all will…really hoping they hit huge as this would certainly be helpful for the Venture…spoke to Martin at PDAC, he’s done a terrific job putting this package together and deserves a lot of credit and a big win for that…he has an excellent team…there are near-term risks, however, given expectations and the already $16 million market cap…no doubt about the promising nature of this very large package, and the story will continue throughout the year and beyond…plenty of volatility likely.

FOOTBALL STATISTICS: shares = yards

GGI – 13,200

DBV – 20,000

GBB – 915,000 (only 39,700 on Thursday)

MMJ – 2,344,000

YFI – 11,765,000

NPH – 10,877,000

Who was it that said: If you want to make money, you follow the money.

just being humorous Jon.

Anybody know when WRR might start drilling?

There’s nothing holding them back from getting on the property very soon, Steven, with the financing completed. I’m hoping the company this week will follow up on the news of the completion of the financing with an update on Nevada and a road map for investors on the immediate game plan at Lapon Canyon.

YFI is turning into a monster. When they announce how much they got from apple on just one of thier 25 patents, and if cisco, google, or samsung gets involved, this stock could be $3 easy

YFI – CEO is in China now. I possibly see a bidding war between Apple, google, and samsung setting up. May the deepest pockets win.

YFI – Desi really loading up now. Maybe .22 close today and .25 to .30 by Friday