TSX Venture Exchange and Gold

In a shortened trading week, the Venture fell 17 points or 2.9% to close at 577 as broader equity markets and commodities also struggled (the Dow is on its longest daily losing skid since the summer of 2011). Gold was steady last week but Crude Oil, which holds a strong influence over the Venture, tumbled 6.4%.

Venture 8-Month Daily Chart

The Venture continues to be constrained by declining short-term moving averages with minor relief rallies since June unable to push above the 10 or 20-day SMA’s. The first sign of a potential turnaround in this market will come when the Index climbs above those resistance levels, preferably on stronger volume than what we’re seeing now.

A key breakdown for the Venture came in late June when support at the uptrend line from the December low was breached. Important Fib. support between the high 620′s and the mid-640‘s also gave way. With the drop to 575 during Friday’s session, the Venture has lost a whopping 1890 points or nearly 77% of its value following its early 2011 post-Crash high of 2465, very similar to the drop (73.5%) in the TSX Gold Index.

The just-completed month was also the 2nd-worst July in Venture history with a tumble of 11.5%. Only the July 2008 collapse of nearly 16% was more intense. Interestingly, following the 2 previous major July swoons (2008 and 2002), the market continued to trend lower but dramatic reversals occurred late each year, within 3-5 months, launching powerful bull phases. Investors need to prepare for a possible repeat of that pattern in 2015.

Venture support at 580 was tested several times over 8 trading sessions between July 27 and last Thursday before a breakdown Friday which requires confirmation Monday. If we don’t see a reversal Monday and it’s another “down” day, the next estimated Fib. support is 547.

The Index is in unchartered territory. RSI levels are quite extreme – similar to the situation last December – but could become even more extreme, leading to a potential important Venture low.

Commodity Pressure On The Venture

While a Gold rally could quickly develop, based on technical factors as well as the current highly favorable COT structure (the “smart money” commercial traders have cut their net short positions to extreme levels), Crude Oil, Copper and other commodities are looking weak with the CRB Index now at a post-Crash low and critical support.

Global deflationary pressures, driven in part by the collapse in Oil prices as well as the China growth “engine” slowing down significantly, are likely to put even more pressure on the commodities sector before the summer is over. The CRB appears destined to test support at 180, almost 10% below where it closed Friday. Such a development would obviously impact the Venture, though keep in mind that the Venture reversed a few months prior to the CRB following the 2008 Crash.

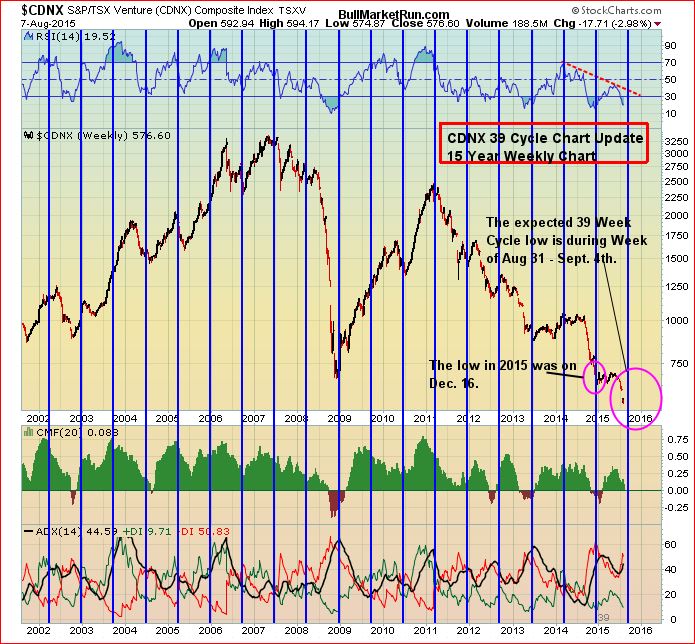

Hope In The Form Of The Venture’s 39-Week “Cycle”

We do see a good possibility of a significant turnaround commencing on the Venture within the next month or so, simply based on its 39-week “cycle”. Interestingly, this also fits within the timeline of the Fed’s next meeting in mid-September – a crucial one, indeed (we doubt the central bank has the courage to pull the trigger on its 1st rate hike in 9 years given the global growth problem and deflationary concerns).

Strangely enough, over the last 15 years, there has been a consistent pattern of trend reversals around the end of each 39-week period on the Venture – you can see it quite clearly on the fresh version below, through Friday, which is important to look at and understand.

What this chart suggests is that a cycle low will occur around the end of August into the beginning of September – that’s when the current 39-week period expires.

The vertical blue lines separate each 39-week period.

The Seeds Have Been Planted (And Continue To Be Planted) For The Next Big Run In Gold Stocks

There’s no better cure for low prices than low prices. The great benefit of the collapse in Gold prices in 2013, and recent weakness with the drop below $1,100, is that it has forced producers to become much more lean in terms of their cost structures. Producers, big and small, continue to make hard decisions in terms of costs, projects, and rationalizing their overall operations. Exploration budgets among both producers and juniors have also been cut sharply. In addition, government policies across much of the globe are making it more difficult (sometimes impossible) for mining companies to carry out exploration or put Gold (or other) deposits into production, thanks to the ignorance of many politicians and the impact of radical and vocal environmentalists (technology has made it easier for groups opposing mining projects to organize and disseminate information, even in remote areas around the globe). Ultimately, all of these factors are going to eventually create a supply problem and therefore great opportunities in Gold and quality Gold stocks. Think about it, where are the next major Gold deposits going to come from? On top of that, grades have fallen significantly just over the past decade.

U.S. Dollar Index Update

Our contention for the last several months is that the Dollar Index put in its high for the year during March-April based on what has proven to be, so far at least, a very reliable 9-month daily chart. Fundamentally, a runaway dollar would not be healthy for the U.S. or global economies, so one can be certain the Fed is keeping a close eye on movements in the greenback.

What to watch for this coming week is a potential breakdown in the RSI(14) below the uptrend line from the rebound that started in mid-May. Friday’s intra-day reversal following the jobs report was a bearish end to the week for the Dollar Index. There are still many bulls in this crowded camp but some will start to flee if the current RSI(14) and price uptrend lines are broken, as we suspect could occur in the near future. It’ll be an important week for the greenback.

Gold

The fear of a continued immediate decline in Gold straight down to $1,000 doesn’t hold water with us given the current technical posture of our very reliable 2.5-year weekly chart, plus the fact commercial traders have dramatically reduced their net short positions. It’s never very wise to go against the commercial traders who now appear to be of the opinion that a rally is in the works for bullion.

Gold has been consolidating within a downsloping flag for more than 2 years. Consistently, it has tested the top of that flag (resistance) and the bottom of it (support). Recently, Gold has again touched the bottom of that flag while RSI(14) has also landed at previous support going back to the end of 2014. Perhaps this is why commercial traders have decided now’s not a wise time to be short.

The $1,100 level is certainly a barrier that bullion must overcome in order to rally higher and challenge significant new resistance around $1,150. Gold could certainly still test the $1,000 level this year, but the immediate path of least resistance (which would take many by surprise) is probably a rally to the upside, not a further plunge toward $1,000.

For the week, Gold was essentially unchanged at $1,094 after showing some modest strength Friday.

Silver added a modest 2 pennies last week to $14.81 but that was still the metal’s 2nd straight weekly advance. Crude Oil, under continued pressure, fell $3 a barrel to $43.75. Copper slid 3 pennies to $2.34 while the U.S. Dollar Index gained one-third of a point to 97.56.

The “Big Picture” View Of Gold

As Frank Holmes so effectively illustrates at www.usfunds.com, the long-term bull market in Gold has been driven by both the Fear Trade and the Love Trade. The transfer of wealth from west to east, and the accumulation of wealth particularly in China and India, has had a huge impact on bullion and will continue to support prices. Despite Gold’s largest annual drop in 3 decades in 2013, and fresh weakness now, the fundamental long-term case for the metal remains solidly intact based on the following factors (not necessarily in order of importance).

- Growing geopolitical tensions, fueled in part by the ISIS and al Qaeda, and a highly dangerous and expansionist Russia under Vladimir Putin, have put world security in the most precarious state since World War II;

- Weak leadership in the United States and Europe is emboldening enemies of the West;

- Currency instability and an overall lack of confidence in fiat currencies;

- Historically low interest rates/highly accommodating central banks around the world;

- Continued solid accumulation of Gold by China which intends to back up its currency with bullion;

- Massive government debt from the United States to Europe – a “day of reckoning” will come;

- Continued net buying of Gold by central banks around the world;

- Mine closings, a sharp reduction in exploration and a lack of major new discoveries – these factors should contribute to a noticeable tightening of supply over the next couple of years.

4 Comments

Jon any chance Farshad gives his shareholders an update before the snow hits? It’s also ridiculous how he has been so quite since the blockade occurred.

Greg, with all due respect, my morning “rant”.

I would emphasize that it’s not fair to say it’s “ridiculous” that DBV has been so quiet since the blockade occurred. I believe we can all be certain there has been an awful lot going on behind the scenes, and the fact an “economic terrorist” has taken this district hostage has made it very difficult for these companies – DBV plus GGI and PGX – to say anything, up to this point at least. Extraordinary, almost unprecedented situation when an entire district – the #1 greenfield project in the province as described by AME BC – is literally taken “hostage”. It’s an outrage on every level, started by a 28-year fresh out of university who didn’t even complete his Law Degree. I’m certain this has gone to the highest levels of government. We’ll be commenting more on everything over the next few days.

I can only conclude that DBV and the others are acting in the best interests of shareholders and when they are in a position to say the right thing, they will say it.

It’s critical that these companies work together closely and cooperatively. That’s what we want to see, that’s what must occur, and if there’s anything we have stressed to them, it’s that. Enormously important. I’m confident they understand how critical that is to weather this storm and thrive. They will be measured soon by their ability to deal with this situation skillfully, wisely, and in unison with each other.

I also believe the companies do hold the upper hand right now, and for that reason there could be some significant things in the works. Keep in mind, not only do they have legal multi-year drill permits in hand, but these projects all fall under a recent and landmark Land Use Plan with another First Nation. Legal documents give these companies the absolute full authority to proceed immediately and aggressively with the exploration and development of these properties within the prescribed regulatory framework.

If the province wants to hand over compensation to these companies for this legal authority being expropriated as if we were in Ecuador, then put $100 million on the table right now, Premier Clark, to cover what has been invested to date by these companies, and lost opportunity. We’ve all seen the video – words straight from the Premier’s mouth, the Land Use Plan will bring investors “certainty”. The government is potentially hugely liable here, then of course there’s the issue of Chad Day’s actions, public comments and media misinformation campaign.

Stay tuned – I really do believe this whole situation is much more in the companies’ favor right now and hopefully we may get an indication of that within the coming week.

Keep the faith – the Hat, the Grizzly, the entire district – they’re all more valuable today IMHO than they were just a few months ago (pre-May 21).

Thank you for your comments above Jon as they are appreciated. As I mentioned previously, I will keep my remaining GGI shares for a bit longer to see if things get resolved in the companies favour and Garibaldi fortunately has the Mexico properties. There is no doubt that legally the companies have the right to proceed and I wish they would but we all know this histories of when politicians are involved. Let’s hope for the best in any event.

I did dispose of 2/3 of my holdings and added the proceeds to http://novoresources.com (TSX-V: NVO). They will likely be in production within one year, low cost gravity only operation in Australia with no Native issues at all. No chemicals equal an approximate 3 month approval process. Cash flow from this production (30,000 oz minimum IMO) will most likely cut-out any future dilution to shareholders.

I think it will not happen much before September, otherwise Chad Day would show to all that it is only a whirlwind to get money even if it is probably the case, he will win the credibility pending a couple of months.

My disappointment is not going to DBV but the B.C. government, it is him who signed the agreement with the First Nation !