TSX Venture Exchange and Gold

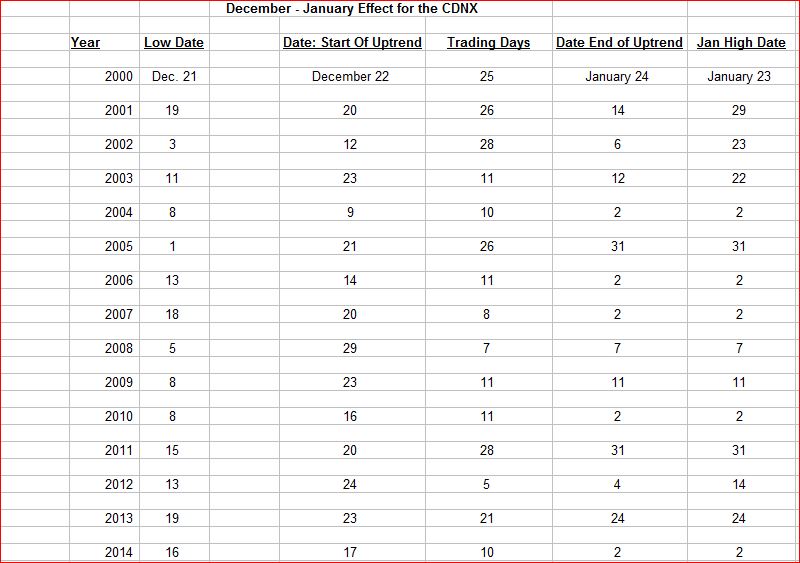

80% of the time over the last 15 years, the Venture’s December low has occurred by the 18th of the month (see table below). And in every case, this was followed by a significant reversal to the upside. In other words, it would be highly unusual if we don’t see the anticipated Venture turnaround begin this coming week which will be highlighted by a Fed policy statement Wednesday, one that’s expected to include the first interest rate hike in nearly a decade. The move will probably be wrapped within dovish language from Janet Yellen given nervous markets and Oil prices that are likely to continue to frustrate the Fed’s attempt to jump-start inflation in 2016. The technical posture of the U.S. Dollar Index is looking increasingly weak, an ominous sign that dollar bulls this Christmas may end up with coal in their stockings.

John’s Gold charting has been phenomenally accurate, and what his charts continue to tell us is that bullion has started a rally that is going to intensify in the weeks ahead – this is why we wisely went long on the HGU last month when the crowd was throwing Gold and Gold stocks overboard. The most efficient Gold producers are headed higher, along with quality juniors who are active on the ground and strong in all aspects of their business.

It’s important to point out that the Venture has recently decoupled from Crude Oil and is much more closely tracking Gold. Since the beginning of October, the Venture is off 4.4%, Gold has fallen 3.7%, Silver is down 4.3%, while Crude Oil has plummeted 21%. This is a significant development with regard to the Venture and reinforces our interpretation that the Index at a minimum will rally in a way that’s consistent with historical averages for December, January and February (the best 3 months of the year).

Last week, aided by Friday’s sharp drop, the Dow plunged 583 points or 3.2%. The TSX shed 569 points or 4.3%. Crude Oil collapsed 12%. Yet, the Venture comparatively held up well, declining just 2.9% to 502. The Index actually out-performed the broader markets and Oil during a peak period of seasonal weakness (tax-loss selling), an encouraging pattern that is seldom seen.

Volatile Week In The Works

We expect a volatile week in the markets (the Volatility Index – VIX – is certainly suggesting this), but that’s quite normal ahead of an important Fed meeting.

The Dow is resting just above its rising 500-day moving average. When it fell below that SMA in August for the first time in 4 years, a panic sell-off occurred that turned out to be a tremendous buying opportunity. We’ll either see this level hold in the coming days, or the “fear factor” will come into play again.

If the Venture decides to dip briefly below 500 in sympathy with the broader markets, so be it. The only investors who will lose will be the ones who panic and get emotional over it, while astute bargain hunters will profit. Stay focused on the seasonal strength trend and what’s developing on the Gold front and in Gold stocks.

The Venture’s 4-month daily chart shows every indicator in the position one would expect in advance of a pending reversal to the upside. As the month progresses, given historical patterns, the Index should overcome resistance at its EMA(8) and EMA(20) with those moving averages then turning higher to support a rally.

The Venture “December-January” Effect

Keep in mind, the Venture has posted average monthly gains for December, January and February of 4.5%, 4.3% and 4.4%, respectively, going back 15 years. There’s no better 3-month period for this Index, so now is the time to be positioned to take advantage of that seasonal strength.

The latest date ever for the December low has been the 21st. Last year, the low occurred on the 16th. Interestingly, the 16th this month falls on “Fed Day” this coming Wednesday.

U.S. Dollar Index

The Dollar Index closed the week below chart support at 98, quite a U-turn after the index just recently threatened to break out above the March high of 100.71. This could be the start of a consolidation period in the greenback that stretches well into the 1st quarter of next year. The Fed’s decision on Wednesday, and Yellen’s remarks, will set the tone for the dollar after its huge run since the summer of last year.

There’s no reason to expect the Dollar Index to “tank” – it has multiple layers of support, but the powerful momentum from mid-October was broken December 3 when the euro took off following an ECB policy decision that was more conservative than expected. The Dollar Index, in general, has been riding a speculative “wave” since the summer of last year with regard to the timing of the Fed’s first rate hike in almost a decade. Smart traders exited the Dollar Index at and above 100, getting out before the news.

Gold

Gold did some “backfilling” last week as we warned it likely would after the $25 single-day jump Friday, December 4. Support was strong around $1,065, as anticipated, and bullion finished the week down $12 an ounce at $1,074. We expect Gold to regain its momentum this coming week and, at the very least, confirm a breakout above Fib. resistance at $1,080.

Gold is in the midst of a recovery out of unusually oversold conditions in November that were brought on by the growing belief that the Fed will finally act on December 16 to raise interest rates. Given the “window” that Yellen now has, and the risk of losing all credibility in the markets, she almost must pull the trigger on Wednesday. This should actually be positive for Gold because it will remove one of the key factors – speculation of a Fed policy change – that has negatively impacted the entire commodity sector over the last year-and-a-half. It is safe to assume that virtually everyone who has wanted to sell Gold and commodities simply because the Fed is finally going to start raising interest rates (very modestly and gradually) has already done so. Sentiment toward the Gold sector remains very negative, and that represents future buying power.

This 6-month chart shows the next key levels for bullion – $1,080 and $1,100. Sell pressure (CMF) has declined considerably from where it was a month ago, while RSI(14) appears ready to continue its climb higher.

Gold 2.5-Year Weekly Chart

All signs (technical, sentiment, short positions, etc.) have been pointing toward a turnaround in Gold and Gold stocks, which is why we recently encouraged subscribers last month to go long on the double-leveraged HGU around the $3 level ($15 post-consolidation). The smart-money commercial traders gave a screaming buy signal on Gold by dramatically reducing their net short positions, while the metal the week before last also hit the bottom of a downsloping channel on this 2.5-year weekly chart – consistently a major buy signal since late 2013.

It’s certainly possible we haven’t yet seen the final low for Gold in this cycle. However, for now at least, short-term momentum is in bullion’s favor, and a test of chart resistance at $1,150 appears likely over the next month or two.

Note how each time Gold has hit the bottom of this downsloping channel since late 2013, a major rally has taken the metal back up to (or near) the top of the channel within about 3 months. Those moves have averaged about 15%.

We believe two short-term scenarios are possible – Gold challenges chart resistance at $1,150, but the rally stops there. Or, bullion surges to the top of the flag (just above $1,200). It will then either break out massively from there, for some reason unknown at this time (a “Black Sawn” event), or it will break down like it has before after hitting the top of the channel.

Silver fell 66 cents last week to close at $13.89. Copper had another positive week, adding 3 pennies to $2.13. Crude Oil plunged nearly $5 a barrel to close at $35.36, while the U.S. Dollar Index shed half a point to 97.63.

The “Big Picture” View Of Gold

As Frank Holmes so effectively illustrates at www.usfunds.com, the long-term bull market in Gold has been driven by both the Fear Trade and the Love Trade. The transfer of wealth from west to east, and the accumulation of wealth particularly in China and India, has had a huge impact on bullion and will continue to support prices. Despite Gold’s largest annual drop in 3 decades in 2013, and current weakness, the fundamental long-term case for the metal remains solidly intact based on the following factors (not necessarily in order of importance):

- Growing geopolitical tensions, fueled in part by the ISIS and al Qaeda, and a highly dangerous and expansionist Russia under Vladimir Putin, have put world security in the most precarious state since World War II;

- Weak leadership in the United States and Europe is emboldening enemies of the West;

- Currency instability and an overall lack of confidence in fiat currencies;

- Historically low interest rates/highly accommodating central banks around the world;

- Continued solid accumulation of Gold by China which intends to back up its currency with bullion;

- Massive government debt from the United States to Europe – a “day of reckoning” will come;

- Continued net buying of Gold by central banks around the world;

- Mine closings, a sharp reduction in exploration and a lack of major new discoveries – these factors should contribute to a noticeable tightening of supply over the next couple of years.

28 Comments

Jon – very interesting 1st paragraph on the week in review. I couldn’t agree more. this coming week will be the best time to pick quality stocks at their lows. Happens every year. 52 weeks in the year, and the best week to buy is disruptive with my move. After tomorrow I can only monitor by phone till about Wednesday. So I wanted to point out one particular stock. If EQT drops on the assay results, it would be foolish to panic and sell. My advice now is shave some if you are top heavy just in case. upon a drop to .08 or .09, buy it back. If it rises on news, then buy more on the rise.

Now, after just posting yesterday about believing what ya hear, I go ahead and post what I just said you shouldn’t do. BUT, this is how I will handle the situation for EQT.

Will the Fed raise rates next week?. The Feds balance sheet is sitting at over 4 trillion and change. That is a lot of liquidity that has to be soaked up before anyone will be willing to pay more for capital, and it certainly cannot be soaked up over night without crashing the bond markets. They have to start the process now, and move slowly. A 25 point basis hike is not an immediate target that can be met, but something to aim for as soon as possible. Federal Funds Rates, after all, are target rates. The Fed has stated that rate hikes will be very gradual. It will take the Fed some time to unwind their bond purchases enough to actually make rates rise. As they do this, they will at the same time support interest rates by putting a floor under them. The Fed will do this by basically giving the banks incentives not to undercut each other in their lending rates. Check out Gold321 on some excellent articles on how to understand this better. The point is, the biggest runs in gold history have come when gold has been at multi year lows, at the same time that interest rates start to go up by small increases slowly over time. I think that is why the commercial COT numbers are so bullish. They are not stupid. This is as good as it gets for gold, and beaten down gold stocks, if you look at history. Consider also that the next 3 months are historically bullish for gold, and tax loss season is already providing for some excellent bargains. Now is the time to buy. If I am wrong, I will take my losses, but seriously, I don’t see any downside left in a lot of gold stocks considering current world events.

Bang-on, DBReese. Gold stocks are in for a powerful move, for a variety of factors. More on this in our Sunday Sizzler Report.

I heard a rumour that GGI finally received the results from the lab….news soon.

That’s rather strange, DDD4…again, your unidentified source is rather unreliable. Yesterday, we got it straight from the horse’s mouth in a fresh interview with Regoci – NOTHING has been received from the lab yet. Broad element fire assaying is being carried out, and of course there’s always the possibility some automatic high-grade re-checks (anything above a certain threshold as instructed) are being completed without GGI even knowing. Anyway, Regoci says they’re eagerly and anxiously awaiting the first batch of results. You’re probably right about more news “soon” as Thursday’s news indicated – sounds like Regoci has even more to say about the Grizzly, and Rodadero.

Hole 5 look quite unique Jon, Did you get information on it?

You’re right, Martin, and hole 5 was drilled into a lower chargeability response and a known geochem anomaly, a set-up that geologists like in the district as an ideal porphyry host. Interesting core photo but Regoci wouldn’t elaborate, just referenced back to Thursday’s news. Based on the experience of Mexico, Regoci has shown previously that he also likes to hold back a few surprises and not telegraph the market on everything. That could be his strategy with hole 5, I don’t know.

I hope the results come out this week. The following week is a short week with Christmas Day on the Friday. I’d like everyone to be at their desks when the news comes out.

Jon, did Regoci say that the first 3 holes would be announced in one NR?

Tom, I’m in agreement with you on that, and DDD4 as well in the sense that it would be nice to see something by the end of this coming week given that the following week is the shortened Christmas week. Nothing yet though from the lab. Going by Thursday’s news, and our interview, I’m expecting 3 holes-in-one, pardon the pun. Could be different, depending on lab flow, but that’s what seems to be lining up.

I’m thinking after new years for assays on GGI. Doesn’t mean I’m right though.

Jon- How can you say that my source is unreliable? Do believe everything a CEO says? I learned the hard way and now never talk to a CEO as they’re very biased and there’s a lot of rotten apples in this sector so I prefer to avoid all of them to ensure my DD remains uninfluenced in every way. Do you know if the source is the same? Isn’t it better for a CEO to say “no we’re still waiting for the results” than to say “yes we have them” and have to deal with people asking for hints? This rumour seems credible based on the timing and time the results have been at the lab being processed. Unlike the previous rumour, I can’t trace the exact path this one took from the source to me and all the people in between.

I don’t make these things up and I’m just passing on what seems to be credible. If someone heard something credible about DBV (good or bad) I would like to be warned about it!

I wouldn’t say that my last tracable info that came from the Grizzly camp would be “unreliable”!

I still don’t anticipate the first batch of results to be anything that excites the market or like what I’ve read from posters here but I do think they’ll be a promising start. If they’re better than what I anticipate I have money on the sideline to buy in.

DDD4 – seems like you or your source are just guessing. I think I’ve preached this before, but apparently someone always knows someone that has an inside scoop. Unless the “source” can be identified there is absolutely no point in posting it. Just my opinion. Like everyone on stockhouse knows everything. Terrible.

DDD4, when you say a promising start, what sort of grades do you anticipate. Something along the lines of what PGX and DBV have come up with?

Dave, are you being influenced by EQT’s experience with assays when you suggest that GGI’s assays could not be released until January? Things certainly seem slow at the labs these days.

Sometimes sources of rumours just can’t be divuldged publicly. ….I have shared the source and info with close reliable contacts and I won’t post it publicly. On these forums you need to weed out the unreliable posters and trust those you know are reliable. Most publicly posted rumours are false but sometimes they’re actually true…..it’s up to you to determine what is correct.

Tom UK- not going to guess but I did hear that gold values will probably be higher than copper values though so thats a good sign imo…. hopefully they will be good enough and do realize that these are the first holes on a new property so if promising then they just need to home in on the source.

On that point we can agree, DDD4 – “Gold values will probably be higher than copper values though so thats a good sign imo”.

All the evidence suggests that GGI has hit 2 separate systems, and that’s what could redefine the entire Sheslay district. A high-grade Gold hit, an epithermal-style Gold deposit, adjacent to a porphyry system, would be a serious game-changer – not just for GGI, but for every company in the district. GGI has shown a unique ability to sniff out high-grade deposits in Mexico – and they took an approach with the Grizzly consistent with their style in Mexico, which could pay off spectacularly.

TomUK – it’s just me guessing Tom based off of years of seeing it happen. Results rarely come when they are anticipated and always seem to have delays. The Holiday is upon us almost and there will be a couple days lost there too. They may come in before Xmas, but I would be surprised if they did. No influence from EQT as theirs had a side twist to it with different procedures done that caused the delays.

George, rite on, it’s almost to a point that I look to see who the comment is coming from before I read it, his I don’t bother with anymore, it’s just a guess, jon’s are the most reliable, so most times I just skip rite to his comments.been in ggi since day one, don’t see any other Jr. Company as active as they are at this time, they are definitely heading in the rite direction.

Don’t get me wrong…..from what I heard I don’t expect the results to be disasterous and I never said they would be……I’m anticipating that they won’t be as good as some poster’s expectations so some will be disappointed. This market is hard to please and its even worse when expectations are high!

Jon- glad that we finally agree on something.

When to comes to rumours, insider information etc I have always gone by the old saying in the investment industry when it comes to insider information “those that know don’t say and those that say don’t know”.

I don’t feel as though GGI’s share price has been influenced by high expectations. I think it is still at the same level as before any core photos or NRs have been released regarding the drilling. This is a good thing IMO as a sell off would be more likely if it had increased on speculation and high expectation.

TomUK – You are so right, and this is what Kyler did not want to happen with EQT. He did not want to hype this thing so bad after .20 that it went to .40 or .50 and the results did not meet that price level expectation. I agree with you on where GGI share price is currently trading.

Danny – You are so right also. I am glad that no one knows what the assays are on EQT. Let the market decide and we go from there.

Dave- with today’s modern mining technology don’t you think that mining companies such as EQT and GGI have some sort of an idea what assay results could be -/+..???

they can have an idea, but they aren’t allowed to say so per the exchange , so we wait. exchange only allows lab assays

Jeff, GGI have an XRF analyser on site. ”Interesting readings” is how Regoci has described what they have seen.

Jeff – I agree with you on the modern equipment. They can have an idea, but assays can still come back different. The labs have also been known to make mistakes, especially with rush jobs. And we don’t know what Regotti is seeing with his xrf.

Seems to me that most are suspending judgement on GGI. High expectations? Low 0.10’s on low volume?