TSX Venture Exchange and Gold

Some cracks are beginning to appear in the CDNX rally since October 4 and the critical support area is 1575-1600. The Index got as high as 1675 Tuesday, a 28% gain from the October 4 low of 1306 (just 28 trading sessions), and closed Friday at 1641 for a weekly loss of 9 points. The Index continues to trade within a resistance band between 1600 and 1700, and just above that 1700 level is a declining 100-day moving average (SMA) which will be very difficult to overcome – not impossible, but certainly a formidable challenge.

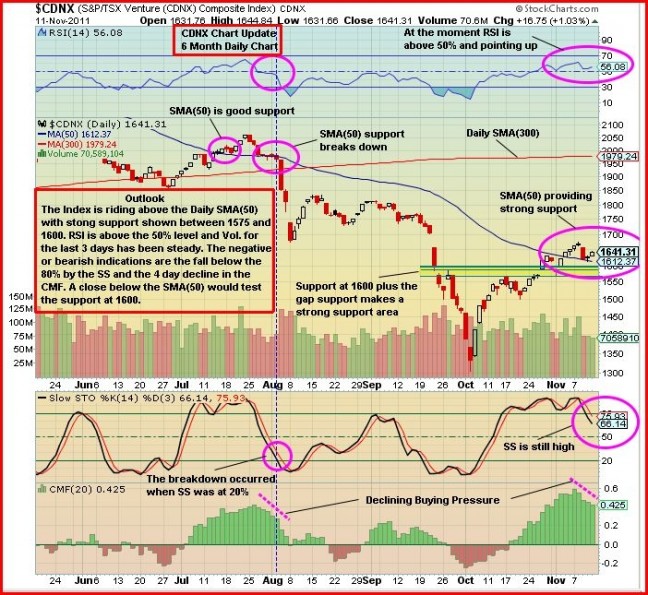

John’s updated chart, immediately below, shows some strong support that must hold. The race is now on to see which technical event occurs first – a reversal to the upside in the 50-day SMA, or a reversal to the downside in the 300-day SMA. The next two or three weeks are going to be critical for the CDNX. Given the number of individual stocks whose 300-day moving averages are now in decline (Canaco being an excellent example), the risk of a plunge from current levels has to be considered significant. Our “big picture” view is that the CDNX has been in a bear market since March which means the move since early October on lackluster volume has likely been a trap. If we’re wrong, there will still be time to load up on certain opportunities and ride the wave higher. So for now we remain on the sidelines. Cash remains King at the moment. The drop in the Slow Stochastics and the decline in buying pressure are warnings of potential trouble ahead for this market and the broader markets as the CDNX has proven to be a highly reliable leading indicator.

Gold

It was another solid week for Gold which held support at $1,750 on a closing basis and finished Friday at $1,789 for a weekly gain of $35. The yellow metal met resistance as expected at $1,800 but it’s likely just a matter of time before it pushes through. The only apparent risk with Gold is an overall market crash that could lead to a sell-off in all asset classes, and no one can predict that. Even then, Gold’s drop would likely only be temporary as was the case in 2008.

Silver gained 53 cents for the week to $34.66, Copper fell 11 cents to $3.47, Crude Oil jumped $4.73 or a whopping 5% to $98.99 (more on Oil by tomorrow), while the U.S. Dollar Index was unchanged at 76.91.

The “Big Picture” View Of Gold

As Frank Holmes so effectively illustrates at www.usfunds.com, Gold is being driven by both the Fear Trade and the Love Trade. The transfer of wealth from west to east, and the accumulation of wealth particularly in China and India, is having a huge impact on Gold.

The fundamental case for Gold remains incredibly strong – currency instability and an overall lack of confidence in fiat currencies, governments and world leaders in general, an environment of historically low interest rates and negative real interest rates (inflation is greater than the nominal interest rate even in parts of the world where rates are increasing), massive government debt from the United States to Europe, central bank buying, flat mine supply, physical demand, investment demand, emerging market growth, geopolitical unrest and conflicts, and inflation concerns…the list goes on. It’s hard to imagine Gold not performing well in this environment. The Middle East is being turned on its head and that could ultimately have major positive consequences for Gold.

What’s also driving Gold is the weakness of the United States, brought on in no small part by one of the most ineffectual Presidents the nation has ever been saddled with. America has lost its way and the recent S&P downgrade is both a real and a symbolic reflection of that. Since the summer of 2009, the U.S. economy has produced a net total of just two million jobs while federal spending has gone through the roof. Throughout its incredible history, the United States has demonstrated an amazing resiliency and the ability to bounce back from major economic, social and political troubles. It will do so again but this will take time and a real Commander-in-Chief in the White House by November, 2012. By then Gold will have climbed another 50% or more.

4 Comments

what do you think of SFF it is almost a year now,i know i should ad left the boat but i am still in it,waiting and waiting.I am not the only one i hope.

Claudette, it is not ONLY SFF that is at yearly lows or close to it, ALL of BMR’s picks are at LOWS!!! GBB??? LOL VGD??? LOL and these were TOUTED by BMR as the NEXT stocks to take off in share price…..OOPS!!!

If VGN proves up gold in blackwater New Gold are just going to eat them up. They want the entire blackwater deposit. Odds of that happening are stacked in our favour. CDNX is not kind to companies with slow news flows right now. GBB included. Things are looking brighter for GBB now given the change of consultants. They are back on track.

So does anyone have any interest with what has and will happen to Sidon Resources? Has any one contacted them? or is it time to just wipe our u know whats and throw away 50K? as in my case !! What bull!! Was it all a scam?