TSX Venture Exchange and Gold

Markets enjoyed a positive start to 2012 with the CDNX climbing 41 points or 2.8% to 1526 (the Dow was up 1.2%, the Nasdaq jumped 2.7% while the TSX gained 2%). The CDNX has some work to do, though, to return to a bullish state as the bear market that began last March continues. While there are some encouraging signs as John points out in the chart below, several bearish technical factors remain problematic for this Index at the moment. They include:

- A downward trend line;

- Immediate strong overhead resistance;

- Declining 50, 100, 200 and 300-day moving averages (SMA);

- Daily Slow Stochastics(14) indicator is currently at its April, July and November peaks which preceded sell-offs.

Rather than simply “guess” that the Index is about to take off to the upside (it could just as easily turn in the opposite direction starting tomorrow) based on encouraging signs since December 20, we’d prefer to wait until there is confirmation that something different and positive has truly taken hold. A confirmed break above the down trend line and the weekly EMA(20) would be necessary (that really doesn’t seem too likely right now, however).

The euro zone, some cracks in emerging markets, Iran, the U.S. political environment, a surging U.S. dollar and the real threat of even higher oil prices are all potential negative factors for equity markets at the moment, in particular the speculative and risk-oriented Venture Exchange. So we may have to wait a while yet before the real turnaround begins and a new bull market takes hold. In the meantime, there are still trading opportunities and some very attractive long-term possibilities in this market.

Gold

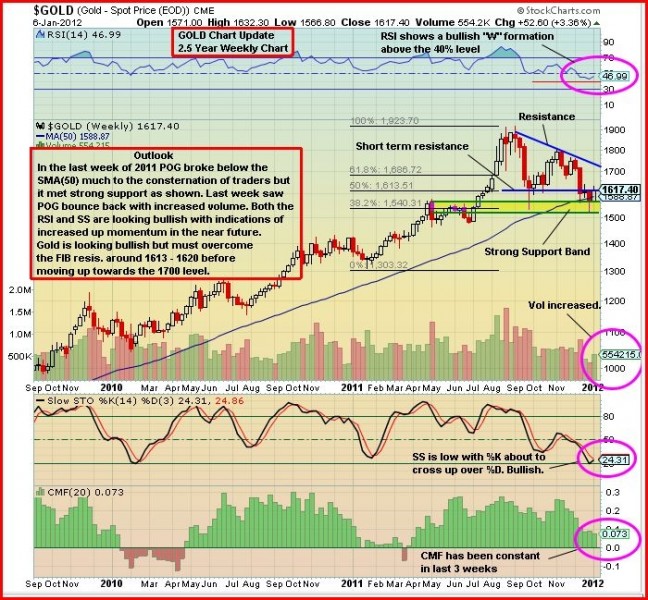

Gold found support just above $1,500 in late December and jumped $52 an ounce in the first week of January to close Friday at $1,617. The first BIG test for Gold in 2012 will be to move decisively through important resistance at $1,700 – failure to do so would greatly embolden the bears, at least for the short-term. Immediate Fibonacci resistance, as John shows below, is between $1,613 and $1,620.

Silver and Copper closed the week at $28.75 and $3.43, respectively, while Crude Oil finished at $101.56 and the U.S. Dollar Index at 81.26.

The “Big Picture” View Of Gold

As Frank Holmes so effectively illustrates at www.usfunds.com, Gold is being driven by both the Fear Trade and the Love Trade. The transfer of wealth from west to east, and the accumulation of wealth particularly in China and India, is having a huge impact on Gold.

The fundamental case for Gold remains incredibly strong – currency instability and an overall lack of confidence in fiat currencies, governments and world leaders in general, an environment of historically low interest rates and negative real interest rates (inflation is greater than the nominal interest rate even in parts of the world where rates are increasing), massive government debt from the United States to Europe, central bank buying, flat mine supply, physical demand, investment demand, emerging market growth, geopolitical unrest and conflicts, and inflation concerns…the list goes on. It’s hard to imagine Gold not performing well in this environment. The Middle East is being turned on its head and that could ultimately have major positive consequences for Gold.

2 Comments

You readers should have a look at Bob Moriarty’s comments on Trueclaim-TRM He’s been to their Arizona property, and very much likes what he has seen on the property. He feels their could be two company makers on this property alone! Then there’s Scadding. Some selling going on now, so a bonus to the buyers right now. Fundamentals look very strong for 2012. Moriarty will be doing an article on Trueclaim in his 321 gold website this month. Entry level price could not be better than right now.

Also a comment on the bullboards on stockhouse regarding Moriarty’s comments on Trueclaim – TRM. These are his first comments after the property visit, but an article will follow this month. BMR should check into John Carter’s Trueclaim!