TSX Venture Exchange and Gold

After posting gains for seven consecutive weeks, the Venture Exchange gave up 11 points last week to close at 1654. The Dow suffered its worst trading session of the year Friday, falling 89 points, which contributed to weakness in other markets though the Venture rebounded somewhat from a 23-point intra-day loss Friday.

The “big picture” outlook remains extremely positive: Significant global growth in money supply, easing of liquidity pressures in the euro zone, encouraging economic data out of the United States, a very accommodating Federal Reserve and a determination by China to focus on growth in the year ahead are all important factors that should power markets (including commodities) higher in 2012. Add in the fact that there are still huge amounts of cash sitting on the sidelines – many retail investors remain scared and won’t jump in until later – and it’s not hard to come to the conclusion that now is the perfect time to get positioned in the best junior resource stocks in order to make potential fortunes over the next six to 12 months.

Ignore the noise from Greece – being defensive because of Greece was a winning strategy a year ago and even six months ago but not now. The euro zone will muddle through its problems. The trend is always your friend, and the primary trend with the Venture and markets in general is definitely up – perhaps a lot.

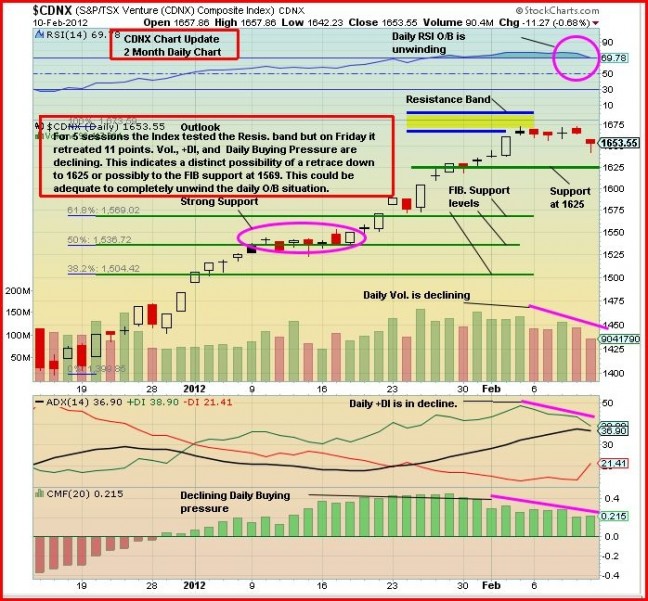

Having said that, a near-term 5 to 7% pullback in the Venture Exchange from current levels is very possible given current overbought conditions based on the daily chart. Should this happen, we would view such a situation as a last-chance buying opportunity before an explosive move to the upside that would take out resistance around 1675 and lead the Index much higher. Check out John’s chart below. There are three key support areas: 1625, 1569, and 1536. One of those support areas is expected to hold on any pullback. Then get ready for a major upside move as John’s recent long-term charts have shown.

Gold

Gold is in a similar technical situation as the Venture – an overbought technical condition (daily) may need to unwind a little more, so we just need to be patient. The overall picture remains very bullish. Gold was down for the second straight week but lost just a few dollars an ounce.

Silver, which gained over 20% in January, gave up 40 cents last week to close at $33.59. Copper fell 6 cents to $3.83. Crude Oil gained 83 cents a barrel to $98.67 while the U.S. Dollar Index finished essentially unchanged for the week at 79.00.

The “Big Picture” View Of Gold

As Frank Holmes so effectively illustrates at www.usfunds.com, Gold is being driven by both the Fear Trade and the Love Trade. The transfer of wealth from west to east, and the accumulation of wealth particularly in China and India, is having a huge impact on Gold.

The fundamental case for Gold remains incredibly strong – currency instability and an overall lack of confidence in fiat currencies, governments and world leaders in general, an environment of historically low interest rates and negative real interest rates that won’t end anytime soon (inflation is greater than the nominal interest rate even in parts of the world where rates are increasing), massive government debt from the United States to Europe, central bank buying, flat mine supply, physical demand, investment demand, emerging market growth, geopolitical unrest and conflicts, and inflation concerns…the list goes on. It’s hard to imagine Gold not performing well in this environment. The Middle East is being turned on its head and that could ultimately have major positive consequences for Gold.