TSX Venture Exchange and Gold

After a couple of weeks of encouraging signs, the CDNX suddenly reversed course again last week as Gold fell below $1,600 an ounce and the Dow experienced its worst week of 2012 – pressured by news of JP Morgan’s trading loss and amid ongoing worries over the euro zone.

Will 2012 turn out to be a repeat of 2005 for the Venture Exchange? We can only hope so. Back in 2005, the Venture climbed steadily through January and February before beginning a nasty 22% correction in early March that lasted until the middle of May. Then the Index surged 40% higher by the end of the year.

Ironically, so far at least, we’ve seen the exact same pattern with the CDNX through the first four-and-a-half months of this year. Tuesday’s 59-point drop was followed by an additional 15-point intra-day sell-off Wednesday (before the market reversed), sending the Index to a low of 1323 – a 22% correction from the February 29 high of 1696. The Venture closed at 1346 Friday for a weekly loss of 4% or 59 points.

Below is John’s updated CDNX chart which gives us confidence that the 1300 support area should hold, especially given the extent of current oversold conditions as shown by the various indicators. With a chart like this, now is the time to take advantage of the “fear factor”. We suspect a lot of stock moved from weak hands into strong hands last week.

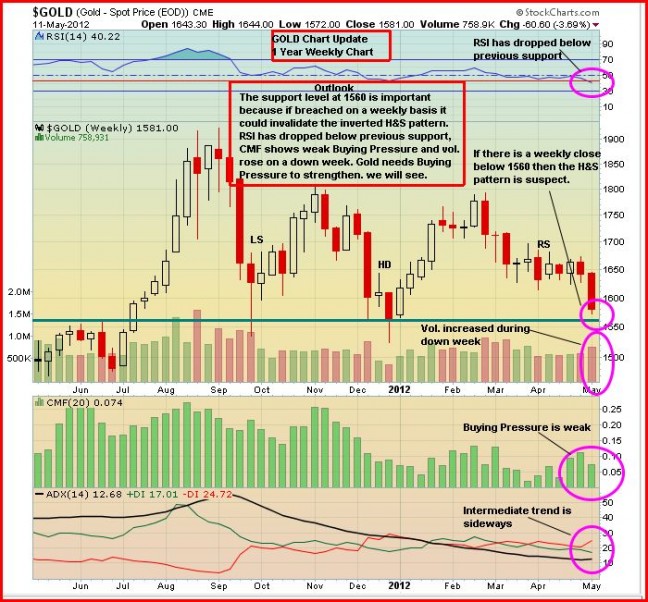

Gold

It was a rough week for bullion as the price fell as low as $1,571 after breaching technical support in the low $1,600’s. For the week, Gold was down $62 after closing at $1,580. The bullish inverted head-and-shoulders pattern, however, is still intact – albeit barely – as John outlines below.

Silver lost $1.45 an ounce to $28.89. Copper tumbled 19 cents to $3.67. Crude Oil lost another $2.36 to close at $96.13 while the U.S. Dollar Index gained nearly a full point to 80.30.

Shanghai Silver Futures Start Trading

The Shanghai Futures Exchange started trading silver futures this week. Liberalization of precious metal trading in China has been a big driver of Gold over the last decade and China has been a net importer of Silver for investment and fabrication demand. Given that Silver is a much smaller market than Gold, any pick-up in demand could prove to have quite a substantial price impact. China is a country which has a long association with the metal, having had a Silver-related currency standard up until the 1930’s.

Gold – 3 Straight Monthly Declines

Three consecutive months of falling Gold prices is rare, however you count it. Between March, 2001, and April, 2012, the price of Gold never fell for three months in succession. Since 1957, in fact, this has occurred only 65 times out of a total of 661 3-month periods. Three-month declines don’t necessarily signal a bear trend. The S&P 500 suffered such falls in each of July, August and September last year, only to roar back beginning in October.

Revival In Gold Demand Coming From India?

The Indian government caved to pressure from local Gold retailers which had been on strike and decided to withdraw the levy of 1% excise duty that it had imposed. With this move, Gold is set to become cheaper for consumers in India and traders expect a revival in demand in the coming crucial months. Particularly, June and July are the important months for weddings and also for rural India as the monsoon rolls in across the country and cash crops are harvested. Importantly, the government has also decided to raise the threshold limit for cash purchases of jewelry whereby purchases below this level do not require the buyer to cite their income tax related PAN number.

China Takes More Steps To Boost Growth

China’s central bank cut the amount of cash that banks must hold as reserves this weekend, pumping out more funds that could be used for lending to head off sharper slowdown in the world’s second-largest economy. The People’s Bank of China delivered a 50-basis-point cut in banks’ reserve requirement ratio (RRR), effective from May 18. This should be positive for Gold and commodities in general.

The latest RRR cut – the third in six months – came a day after a flurry of data showed that the world’s second-largest economy was slowing faster than expected, with industrial production weakening sharply in April and investment slowing to its lowest level in nearly a decade.

Meanwhile, China’s annual inflation rate for April moderated to 3.4% from 3.6% in March.

The cut in bank reserves also comes as bank lending in April came in at a disappointing 681.8 billion yuan ($108.04 billion), lower than the 800 billion forecast, which raised doubts on whether Beijing has money supply settings sufficiently loose to keep the economy on an even keel.

The cut of RRR to 20.0 percent from 20.5% for big banks releases an estimated 400 billion yuan ($63.5 billion) that could be used for bank lending. Analysts reckon another 800 billion yuan’s worth of cuts has been earmarked for the rest of the year.

The central bank announced its first cut in RRR in three years on November 30 last year. That move took the rate down from a record 21.5%. The second cut in this easing cycle was delivered in February.

Lowering RRR for banks helps China offset sluggish capital inflows that have been hit by skittish investors wary of investing their funds in higher-risk emerging markets at a time of global economic uncertainty driven mainly by Europe’s festering debt crisis.

Crucially, an RRR cut would help Beijing meet its target of growing money supply by 14% in 2012.

The “Big Picture” View Of Gold

As Frank Holmes so effectively illustrates at www.usfunds.com, Gold is being driven by both the Fear Trade and the Love Trade. The transfer of wealth from west to east, and the accumulation of wealth particularly in China and India, is having a huge impact on Gold.

The fundamental case for Gold remains incredibly strong – currency instability and an overall lack of confidence in fiat currencies, governments and world leaders in general, an environment of historically low interest rates and negative real interest rates that won’t end anytime soon (inflation is greater than the nominal interest rate even in parts of the world where rates are increasing), money supply growth, massive government debt from the United States to Europe, central bank buying, flat mine supply, physical demand, investment demand, emerging market growth, geopolitical unrest and conflicts, and inflation concerns…the list goes on. It’s hard to imagine Gold not performing well in this environment. The Middle East is being turned on its head and that could ultimately have major positive consequences for Gold.

1 Comment

My favorite stocks in the week ahead:

TYP – have good potential to go back to 35 cents – 38 cents, expects to see some turnover back

MTU – closed at 20 cents too low at this price, 25 cents level is more acceptable

GBB – will hit 52 week low at 9 cents but will stay at 9.5 cents level, in light trading

SFF – will hit 10 cents mark but will close at 11 cents, turnover is low