TSX Venture Exchange And Gold

While volumes are still low and the Venture Exchange has been trading in a fairly narrow range in recent weeks, this Index continues to hold above its June 28 low of 1154 and has the look and feel of a market crawling along the bottom in advance of what could be a sudden breakout to the upside at some point in the near future (within a few weeks). There are many potential catalysts for this: 1) Fresh discoveries – some companies, like GoldQuest, Unigold, ATAC and Canamex Resources, reported market-moving drill results last week; 2) Increased takeover activity; 3) Higher Gold and Silver prices; 4) Clear signs of a pick-up in economic growth in China; and 5) QE3 and additional global stimulus measures. There is too much bearish sentiment at the moment in the junior exploration market, and plenty of cash on the sidelines. So the conditions are just right for a big move up during this third quarter.

The Venture gained 9 points last week to close at 1196. Whole volume was weak Friday (on all markets actually), it was encouraging to see the Venture close as its high for the day while Toronto was down and the Dow suffered a triple digit loss.

From a technical perspective, the key event we have to watch for as investors is when (not “if” in our view but “when”) the Venture Exchange and Gold both break above their 20-day EMA’s. Interestingly, the EMA-20 for each has served as stiff resistance since the spring. Below is John’s updated 3-month daily chart for the Venture. The EMA-20 is currently at 1203. We could continue to see more basing for a little while, and then “kaboom” – some investors will be caught sleeping while the Index suddenly breaks above this resistance and begins what could be a powerful new uptrend (on John’s Gold chart, you’ll see the same thing with the EMA-20).

Gold

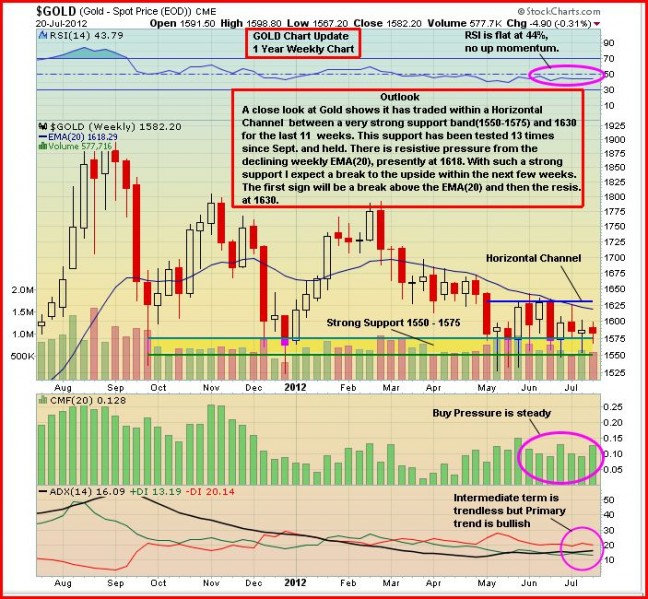

Gold was down $5 for the week but had an interesting day Friday as it fell as low as $1,572 but rallied modestly and closed at $1,584, despite a sharp advance in the U.S. Dollar. The hot-money crowd has lost interest in Gold for the time being (that’s actually a good thing – they will chase the yellow metal at higher levels), but the value-based crowd is apparently accumulating Gold at these levels which is why we’re seeing such strong support on pullbacks. Swap dealers, a category of relatively large traders and big banks, are currently (and unusually) net longs in Gold, and that’s definitely a bullish sign.

Below is John’s a 1-year weekly Gold chart – just like with the Venture, the EMA-20 has been the key resistance since the spring. It’s currently at $1,618.

Silver, which has an extremely bullish COT structure as we’ve been pointing out recently, was relatively unchanged last week at $27.33. Copper backed off from resistance at $3.50 and closed at $3.43, down 6 cents for the week. Crude Oil continues to move higher, mostly on heightened geopolitical tensions, and gained $4.73 last week to close at $91.83. The U.S. Dollar Index was up one-fifth of a point last week to 83.50.

New Gold Discoveries Lagging Behind What is Being Mined

The latest analysis of Gold exploration by the well-respected Halifax-based minerals-focused research organization, Metals Economics Group, suggests that despite a huge focus by global miners and explorers on precious metals exploration over the past few years, the rate of new Gold resource discovery is substantially lagging behind resource depletion (bullish for the long-term Gold price). The group’s latest study, “Strategies for Gold Reserves Replacement: The Costs of Finding and Acquiring Gold,” reports that Gold discoveries of at least 2 million ounces over the past 14 years could only replace around 56% of the estimated amount of Gold mined over the same period, and this is only if these same discoveries prove to be economically minable.

China To Introduce Interbank Gold Trading System

China is preparing to introduce an interbank Gold-trading system, a move that may enable domestic banks to treat the precious metal as a more liquid asset and increase holdings. China has been the world’s largest Gold producer since 2007. An interbank Gold-trading system would be part of a set of broader reforms that Beijing aims to introduce to make the financial sector more market-driven. Traders note that China is already very important in terms of Gold production and consumption, and if a new interbank system really does flourish, it could put the Chinese market in the mainstream.

Redefining Gold As A Tier 1 Asset

As Julian Phillips of the Gold and Silver Forecaster recently noted on Mineweb, monetary authorities and the banks are ill-prepared to take five more years of what has happened in the last five years. The entire subject of Gold being mobilized in the developed world’s monetary system is now firmly center stage as commentary on re-defining Gold from a Tier II asset to a Tier I asset has been called for by the Federal Reserve in the U.S. at the same time it is being proposed to the Basel III Committee on monetary reform. If it is so redefined, this will mean that 100% of its value can be attributed to a bank’s balance sheet as required assets, up from the current 50%. The Basel Committee’s proposed effective date of January 1 could be the most significant step in the re-monetization of Gold since it was written out of the global monetary system back in 1971. Redefining Gold as a Tier I asset would advance bullion’s desirability enormously next year. Expect to see concerted efforts from the banking system to harness this private Gold.

The “Big Picture” View Of Gold

As Frank Holmes so effectively illustrates at www.usfunds.com, Gold is being driven by both the Fear Trade and the Love Trade. The transfer of wealth from west to east, and the accumulation of wealth particularly in China and India, is having a huge impact on Gold.

The fundamental case for Gold remains incredibly strong – currency instability and an overall lack of confidence in fiat currencies, governments and world leaders in general, an environment of historically low interest rates and negative real interest rates that won’t end anytime soon (inflation is greater than the nominal interest rate even in parts of the world where rates are increasing), money supply growth, massive government debt from the United States to Europe, central bank buying, flat mine supply, physical demand, investment demand, emerging market growth, geopolitical unrest and conflicts, and inflation concerns…the list goes on. Massive central bank intervention appears increasingly likely to prevent a breakup of the euro zone and to kick-start the global economy. It’s hard to imagine Gold not performing well in this environment.

4 Comments

A Newfoundlander is drinking in a Toronto bar when he gets a call on his cell phone.

He orders drinks for everybody in the bar, as he announces, his wife has just produced

a typical Newfoundland baby boy weighing 25 pounds.

Nobody can believe that any new baby can weigh in at 25 pounds, but the Newfoundlander

just shrugs, “That’s about average down East, folks…like I said – my boy’s a typical

Newfoundland baby boy.”

Two weeks later the Newfoundlander returns to the bar. The bartender says, “Say, you’re

the father of that typical Newfoundland baby that weighed 25 pounds at birth, aren’t you?

Everybody’s been making’ bets about how big he’d be in two weeks. ….so how much does he

weigh now?”

“The proud father answers, “Seventeen pounds.”The bartender is puzzled, and concerned.

“What happened? He was 25 pounds the day he was born.” The Newfoundland father takes a

slow swig from his beer, wipes his lips on his shirt sleeve, leans into the bartender and

proudly says,”had him circumcised”.

A very interesting article from Pinnacle Digest, enjoy !

The summer doldrums have officially arrived. It’s late July and there is no better time to spend with family and relax. The summer is also a great time to evaluate your portfolio and look for opportunity while many professional investors are vacationing.

Thanks to the lack of participation (seen every year at this time) and the general uncertainty in the world economy, it’s easy to forget about the market. If you are vested in fundamentally sound deals, well positioned, with cash in the bank, forgetting about the market is somewhat relaxing in itself. Although many investors will opt to wait until September, October or even November to re-enter the market, our team believes this ‘laissez faire’ approach may prove costly.

While valuations and volume continue to hit extreme lows on the TSX Venture, our team believes a positive rebound, following Labor Day weekend when participants re-enter the market, will occur.

Volume Has Been Turned Down

Stock market volume is down significantly. Nowhere is the lack of volume more exaggerated or prevalent than on the TSX Venture. In the last 30 days, the Venture has failed to trade more than 100 million shares in a single trading day. Back in 2011, over the same 30 day period, from June 20th to July 20th, there were 4 days when the Venture traded more than 100 million shares and 8 days which saw more than 90 million shares traded (one year ago the TSX Venture was also in an extreme bearish trend yet buyers stayed in the game).

In the past 30 days, the Venture has failed to post a single day over 90 million shares traded. Even factoring in the seasonality, these low volumes are unprecedented. When you look back to 2007 and 2008 pre-crash, the volume was similar to today. 50-75 million shares traded (daily) on the Venture, but the exchange was worth more than twice its current value! So the volume was more than double what it is today (in dollar value). We’ve seen market participation vanish.

There is only one year, in respect to value of volume (in the same 30 day period), comparable to the TSX Venture of today. It was the summer of 2009. The Venture was slowly emerging from its most crushing bear market in its short history. Investors were still devastated and thought the markets would never be the same. The Venture had been decimated and many had denounced investing in the exchange forever. As we all know, the Venture ultimately proved to be the best performing exchange in North America in the 1.5 years following the 2008 crash.

That 2009 desperation and hopelessness is back, which is why we are here to tell you it will not and cannot last.

On July 20th 2009 the Venture closed at 1,118.09.

On July 20th 2012 the Venture closed at 1,196.19.

Less than one hundred points separate the July 20th 2009 value from the July 20th 2012 value for the Venture. The volume on July 20th of 2009 was just over 80 million total shares, whereas Friday’s volume was a shockingly low 44 million shares.

The TSX Venture market is running out of sellers. This is by far the longest bear market (16 months) the TSX Venture has ever experienced and thousands of investors, coast to coast, have thrown in the towel. The vast majority of investors still in the game are not selling nor are they buying much. The Venture could, without question, lose another 20% from here, but that would be extreme and we believe further downside from there to be unlikely.

Other North American exchanges are not as fortunate. Although they have enjoyed greater stability in recent years, they are now top heavy and present significant downside risk. The Dow, and to some degree even the TSX, have rebounded and seen multi-year highs over the past 16 months, whereas the Venture has been pummelled month after month over the same time period.

If you have lost money or made no money over the past 1.5 years and are looking for upside potential, where are you going to find it?

The Dow?

The TSX?

The TSX is at 11,600. The Dow is at 12,800. From a percentage standpoint, these exchanges offer little upside in our view (particularly the Dow). The headwinds are plentiful and these markets are due for a correction. The Venture may correct further, but let’s be honest, 80% of the stocks on this exchange are down 50%-70% year over year. Are they going to lose another 50%? Highly unlikely. Again, who is left to sell? Volume on the Venture is at multi-year lows.

With seller exhaustion evident in these summer doldrum months, our team believes it will not take much volume to move the Venture up 40% – 50% from these levels. Can you see that kind of opportunity for any other exchange? It is not unrealistic to think the Venture could increase in value to 1700 or 1800 in a span of 12 months from today. 1700 – 1800 on the Venture is not exactly a historically high level for the exchange, yet it would create extreme profits from these levels. The Dow would have to hit higher than 18,000 for those same gains to be realized – a level never seen before in its history. All the TSX Venture has to do is increase slightly higher than where it was in March of this year for those gains to be realized. Realistic? Absolutely.

The Venture exchange is not going to dissolve. The buyers are going to come back at some point. As we’ve previously stated eventually the fear, driven by distaste for any risk, will turn to greed as sound companies with money continue to execute their goals.

The due diligence one must practice to excel in this market has to be thorough, but great opportunities are plentiful. Companies on the TSX Venture will provide returns other exchanges simply cannot compete with. Naturally, with great upside comes a certain degree of risk. With that said, the risk in the TSX Venture has shrunken remarkably from 12 months ago. Our team is using this time to closely analyze the broader fundamental movements in the market, knowing that the Dow and other large exchanges have plenty of room for corrections; whereas the Venture, in our opinion, does not.

On a closing note: In many ways the Venture’s fate, which is primarily commodity based, rests with the continued decline of the US dollar. The debt super-cycle is far from over. If you have any doubts, just pick up a paper, it really doesn’t matter which country you live in. The US dollar is the world’s largest debtor nation and debtors benefit from inflation. Inflation is the only way out for the US. Inflation will allow the country to repay its debts with money of less value. Inflation will also allow the US to expand its tax base, and create phony higher GDP numbers in a last ditch attempt to pay its creditors and stimulate its economy. Inflation is coming and when it creeps in, rest assured, the TSX Venture will directly benefit.

All the best with your investments,

I was seldom able to see an opportunity until it had ceased to be one.

– Mark Twain

For what it is worth & not that anyone cares, i will state, that i intend

to be out of this market by the time the U.S. election takes place. No matter

who wins, we will be in for some troubling times, in particular, since both

sides have shown they are unwilling to compromise, instead, enjoy beating up

on each order & leaves me to ask, HOW ABOUT YOUR COUNTRY BOYS ? R !

Put your blinders on, it’s not looking good.