TSX Venture Exchange and Gold & Silver

Over the last 30 sessions, going back to June 22, the Venture Exchange has traded in a narrow range between a low of 1154 and a high of 1242. The EMA-20, currently at 1189, has provided stiff resistance for several months since the downtrend started in March. All things considered, including the anticipation of major moves by both the ECB and the Federal Reserve by September, the Venture appears ready to finally bust out of this downtrend as early as next week.

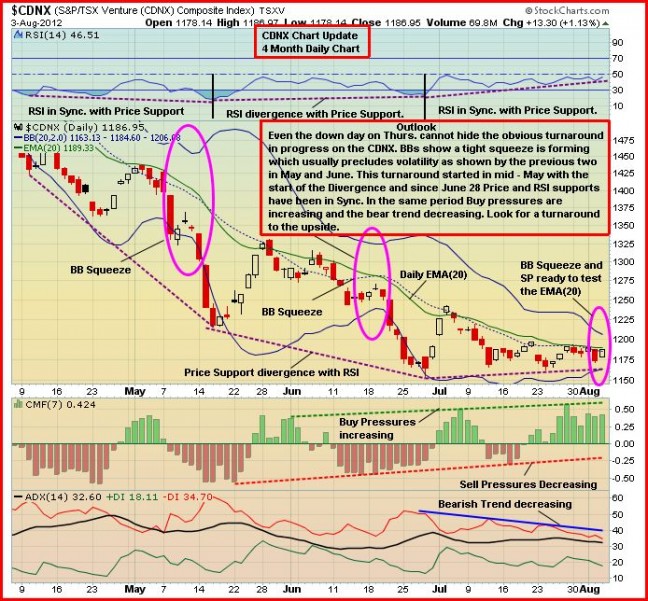

Below is an updated CDNX chart from John that makes the technical case for a near-term turnaround as the Index continues to gather internal strength. There are several indicators of importance – the Bollinger Band squeeze, RSI(14), increased buying pressure since late July, and a general weakening of the bearish trend. The Venture has been “crawling along a bottom” for well over a month which has been an ideal time to accumulate positions in quality situations for what could turn into a very strong move in the coming weeks. Several companies have also been reporting excellent exploration results, and more should be expected which will add fresh fuel to the market. Historically, the CDNX has shown the tendency to suddenly reverse violently in one direction or the other. With sentiment having been so negative since the spring, the conditions are ideal for such an event to the upside very soon that could surprise many investors.

The CDNX gained 13 points Friday on increased volume – impressive going into a holiday long weekend – and finished the week down 4 points at 1187, just two points below the EMA-20 resistance.

While Friday’s U.S. jobs data was better than expected in terms of the number of new jobs created (163,000 in July vs. an expected 100,000), the report wasn’t strong enough to dramatically alter the Federal Reserve’s view that the economy is growing too slowly to register meaningful improvement in the unemployment rate (in fact, the unemployment rate actually rose one-tenth of a point in July to 8.3%). That rate hasn’t come down since the beginning of the year, keeping it well above almost any definition of maximum sustainable employment, which is half the mandate Congress has given the central bank. That leaves the door open to new moves by the Fed to help the economy.

Meanwhile, the European Central Bank seems determined to step in aggressively to ease the euro zone debt crisis. The market didn’t get all the immediate action it was hoping for Thursday from ECB President Mario Draghi, but the direction the central bank is going seems quite clear. That’s bullish for stocks and commodities and should help foster a “risk-on” environment, at least going into the end of this third quarter.

Gold

As you can see in John’s chart below, Gold’s drop Wednesday and Thursday was very normal from a technical perspective as bullion simply tested support at the neckline. Resistance is currently between $1,620 and $1,640 an ounce which we expect Gold will overcome within the next few weeks. The yellow metal was off $20 for the week, closing Friday at $1,604.

Central bank buying of Gold continues to be a strong theme. This past week, the Bank of Korea, which has the world’s seventh biggest foreign exchange reserves, announced it had purchased 16 metric tons of Gold last month, increasing reserves to 70.4 tons. Central banks and the International Monetary Fund (IMF) are the largest bullion owners with 29,500 tons at the end of last year, or 17% of all mined metal, World Gold Council data shows. Central banks have been net buyers for two straight years, the Council said. Purchases this year will probably exceed the 456 tons added in 2011, the Council estimates.

Silver bounced around but finished the week essentially unchanged at $27.79. Copper fell 6 cents to $3.37. Crude Oil, after a big jump Friday, closed the week up 27 cents at $91.40 while the U.S. Dollar Index full a full point Friday and closed the week down one-third of a point at 82.31. The Dollar Index appears to have put in at least a temporary high around 84 which is bullish for commodities and the Venture Exchange.

Looking ahead to the coming week, performance bonds needed to trade Silver and the platinum group metals will be lowered, the CME Group said late Thursday. That may help to attract more activity to those markets as the lower performance bonds, also known as margins, means traders need to put up less money for collateral in order to trade those markets.

The “Big Picture” View Of Gold

As Frank Holmes so effectively illustrates at www.usfunds.com, Gold is being driven by both the Fear Trade and the Love Trade. The transfer of wealth from west to east, and the accumulation of wealth particularly in China and India, is having a huge impact on Gold.

The fundamental case for Gold remains incredibly strong – currency instability and an overall lack of confidence in fiat currencies, governments and world leaders in general, an environment of historically low interest rates and negative real interest rates that won’t end anytime soon (inflation is greater than the nominal interest rate even in parts of the world where rates are increasing), money supply growth, massive government debt from the United States to Europe, central bank buying, flat mine supply, physical demand, investment demand, emerging market growth, geopolitical unrest and conflicts, and inflation concerns…the list goes on. Massive central bank intervention appears increasingly likely to prevent a breakup of the euro zone and to kick-start the global economy. It’s hard to imagine Gold not performing well in this environment.

12 Comments

Thx guys!!!:) nice work JOhn! …. we can only hope that this brutal year and a half will finally start to dissipate, and some upward movement be evident… staying positive yes:)??

Jon – Be positive, Bert,

Bert – I am trying Jon, i am trying.

Now where was i at ? Oh yes RBW continued-

I was stating that RBW has an Excellent Management team, an Excellent board

& Excellent projects, but there are some out there who may say, the 3 E’s may

not be enough, if they don’t have it the ground. My response, remember while

we were waiting for the permit(s), what do you think the boys’ were doing ?

they were on their property with a portable drill & other gadgets, snooping

here & snooping there . I now feel confident, they have a darn good idea where

to place the drill bit in that mound, which resembles Jon’s silvery hair.

Surely you can visualize Jon standing on top of that mound, with calculator

in hand, honing in on his potential profit. They have a good idea they are going

to strike something & all that’s required is to bring something exciting to the

market. You do realize what happens when the market gets excited, need i state

more ? Some may be concerned about the financing, that’s normal, but if they

strike & the excitement surrounds us, the money pockets will come knocking at

their door. R !

Bert

you crack me up, this board would not be the same with out you. Actually it would be very boring, so please do not take things so personal, one thing I have learned since investing in these jr resource stocks is patience, and a sense of humor… the patience thing I have learned the hard way since I sold CQX before it had its big run and also GQC before its big run, thats where the sense of humor came in, instead of crying and whining like I used to do, all I could do is laugh and think ok it is now my time and turn to have a winner here in RBW… hope I haven’t scared anyone off…lol…

Greg

Thank you for that! As for CQX & GQC, i also sold early. I think it’s mostly about

mistrust in the plays we play with, after we have had a stock for a period of time.

We usually buy on promotion, when stocks are at their highs’ & watch them pine away

to nothing & i bet most every soul on this board have thought to themselves, one time

or another, if only i can get my money back, i am gone, overlooking the fact, what may

have driven the stock back up again. It’s doesn’t seem to be in the cards for me to

strike it rich on any given play, although i did do well with ATC. Anyway. The long

& the short of it all is my buddy, if you made a profit, you didn’t lose & you don’t

lose if you don’t sell, phrases coined to pacify folks like you & me. Although i have

shown my frustration with RBW, i actually am very positive, this stock is well

positioned to have a run, although it may not make us rich, it will make us some profit.

Often i make $100.00 or $150.00 per trading day & i have come to look at it as not being

that much, until i think of the farm workers nearby, toiling in the sun for 8 hours per

day, for a total of, at minimum wage, $80.00., which prompts me to tally my profits,

market hours 61/2 divided into $125.00 equals roughly $21.50/hour, twice that made by

the farm workers & the only strain on my body is sitting on my arse. R !

Richmont is up by over 7% on the US exchange. Maybe the bad news are behind. Let us hope for good volume. There is something going with the management, as there was no mention of Monique and Cripple Creek in their recent news.

if i hold evr and they get taken out,what would the shares be worth.ie.abx g. should i get out?or hang on,is it worth it?fairly new at this.

Bored today so i checked out RBW (RIINF)… up 1.5c on us markets today to 21.5

I know this question is cliche, but any serious guesses as to where RBW’s s/p may end up once all the dust has settled? Are there any other companies which we can compare them to?

Thanks in advance.

Tony- im sure some will disagree with me and i doubt international can match exactly what treasure mtn did for HDA.V but that’s one i like to use for a comparison. Roughly the same share structure huldra a had a nice run when they first starting exploring treasure mtn. Nevada and our granite play will add an extra wild card to RBW..

Graphite sorry, damn spellcheck

Thanks DB. I’d be a happy camper even if RBW only reached 60% of hda.v

It may take a little while longer, but you all know that things are looking up on

the Venture. We continue to read on a daily basis, about some company, coming out

with good, if not excellent results. Keep your chins up. Good night ! R !