CDNX

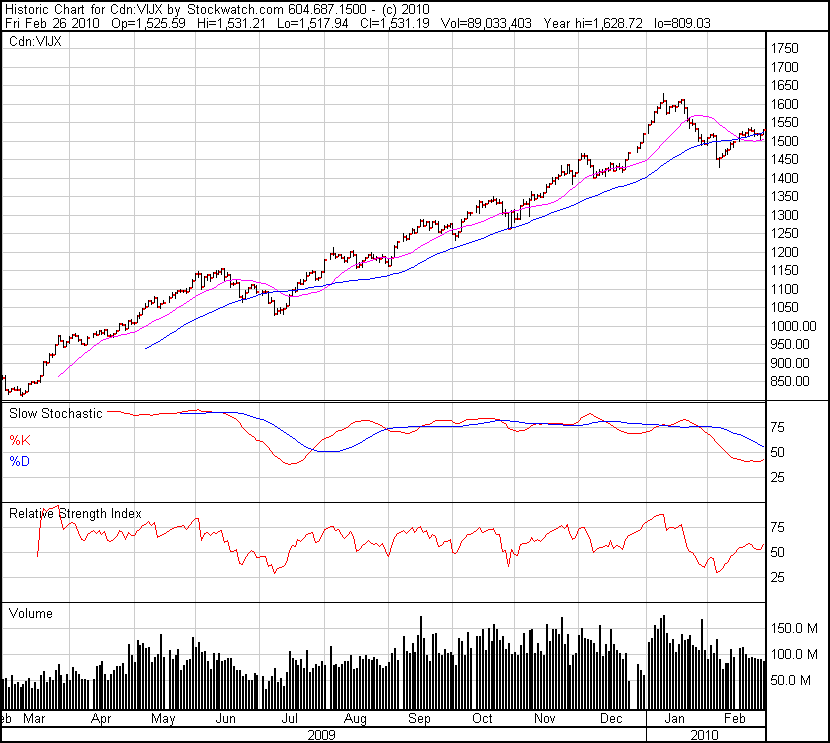

As the chart below indicates, now is certainly the time to be heavily invested in quality CDNX stocks as all signs are pointing to a very robust month of March. Not surprisingly, as we suggested could happen, the CDNX pulled back a little at the beginning of the week and decided to successfully re-test the 1,500 level. An intra-day turnaround Thursday mirrored gold’s performance and was quite significant as the Index actually fell 20 points below its 50-day moving average, hit the now rising 20-day moving average dead-on, and rebounded sharply by the end of the session to close just under the 50-day. That momentum carried into Friday’s trading and the CDNX jumped 13 points to close the week at 1,531, just 1 point below where it finished Feburary 19. So we saw some encouraging and bullish technical developments with the CDNX this past week including a reversal in its 20-day moving average.

As the chart shows, the market seems to be back in a position similar to mid-July last year – just before it staged a 14% move to the upside in less than a month. We could very easily see a repeat of that in March. The overbought conditions we saw in January (based on Stochastics and RSI) that are very evident on the chart have corrected, allowing for a fresh new advance in this market.

Gold continues to look strong and seems to be gearing up for an eventual assault on its December, 2009, high of $1,225. As predicted, gold broke through a bullish falling wedge pattern this past week and made a quick run to $1,130. It then then pulled back again but, importantly, remained above the top line of the falling wedge at around $1,085. Gold staged an intra-day reversal Thursday and closed the week at $1,118. Its 14-day moving average has swung positive and its important 30-day moving average will likely reverse this coming week after being in decline throughout all of January and February. Bottom line: Gold is ready for another run, which is exactly what the Venture Exchange has been telegraphing.

The BullMarketRun.com Portfolio

Gold Bullion Development Corporation (GBB, TSX-V)

The technicals and fundamentals are aligned perfectly right now with Gold Bullion which means we’re likely to see a major imminent move to the upside in this stock…we issued a new alert on GBB Friday morning, accompanied by a chart to better explain our rationale as far as the technical side of the equation is concerned…we have done an immense amount of research on the Granada Property and we’ve reached out to those who understand the geological make-up of that region and the prolific nature of the “Cadillac Trend”…which is why we can say with near-certainty that Gold Bullion is indeed on the verge of something very significant here in terms of a potential discovery of a large bulk tonnage, open-pit deposit…keep in mind, Gold Bullion’s drilling in December and January was the first drilling it has ever done at this property…GBB did conduct a very large bulk sample in 2007 and came up with an impressive average grade of 1.62 g/t Au…historically, previous operators drilled a total of nearly 500 holes at Granada but for some strange reason all those holes were located over a very small footprint near the original mine workings…they weren’t considering the “big picture” of what might possibly exist in the surrounding area…Gold Bullion’s drilling has already opened up the “blue sky” potential of Granada with the discovery of near-surface economic mineralization hundreds of metres to the east and northeast in holes 5 and 15 in particular…this “deposit” is open in all directions and we can’t wait to see what happens when Gold Bullion pushes further east and north…Osisko’s (OSK, TSX) massive Canadian Malartic Deposit is 40 miles to the east-southeast of Granada…Osisko’s deposit is unique among “Cadillac Trend” deposits in that it is at shallow depths…Gold Bullion closed the week at 11.5 cents, a half penny increase from February 19…a total of 2.6 million GBB shares traded this past week…we are eagerly awaiting new assay results which have the potential of blasting this stock through resistance at 12.5 cents to much higher levels…Gold Bullion’s current market cap is only $9.3 million…

Seafield Resources (SFF, TSX-V)

What a story Seafield has been for our readers…this stock is up nearly 500% from when we initiated coverage last summer…that is a phenomenal gain, and the type this site is designed to produce…there appear to be some very big power boys behind this play, which we’ve stated all along, and the appetitie for this stock by M Partners this past week was indeed interesting to watch…M Partners accumulated more than 2 million SFF shares this past week (they didn’t sell a single share) and house positions show (from Aug. 25, 2009, through Feb. 25, 2010) that M Partners is currently net 3,231,6000 SFF shares…CIBC, Octagon, and Fraser McKenzie have also been big buyers…Fraser McKenzie started buying in December…they have accumulated 1.2 million shares and haven’t sold a single one yet…the market is still waiting for news regarding Seafield’s Colombian property acquistions which could be coming soon based on the current trading activity…ultimately, we see the potential for Seafield to reach the $1.00 level or better…presently, it is in an overbought zone on the RSI where it has reacted before…12 million private placement shares at 12.5 cents are also free trading as of Monday which has the potential of bringing at least a little bit of selling into the market…there’s also the potential of another private placement if for no other reason than “positioning” purposes…any immediate pullback in Seafield, however, should be relatively mild and considered a buying opportunity…Seafield was up 6.5 cents on the week to 32.5 cents on massive volume of 9.3 million shares…

Kent Exploration (KEX, TSX-V)

Kent had a difficult February with only four “up” days and closed the month at 15.5 cents…now is not the time for investors to get frustrated with Kent and get out of it…now is the time to be aggressively adding to positions as these bargain-basement prices aren’t going to last much longer…Kent is oversold technically and has bottomed, in our view, at the 15 cent level, just above its rising 200-day moving average…this is one of the best-managed junior exploration companies we’ve ever come across, and Kent investors can expect plenty of news in March with drill campaigns slated to begin in both Australia and New Zealand…Kent’s Alexander River Property in New Zealand is the one, we suspect, that is really going to power this stock forward…Kent’s current market cap is just under $6 million – incredibly cheap for a company with future cash flow (Flagstaff barite) and highly prospective, advanced-staged gold properties such as Alexander River and Gnaweeda…rest assured, Kent – like Seafield and Gold Bullion – will have its day in the sun…

Greencastle Resources (VGN, TSX-V)

Greencastle, which is trading just above its cash value, has been quiet recently as investors wait for more news on the two wells it recently drilled in the Cabri-Boggy Lake area of southwestern Saskatchewan…we believe it’s also only a matter of time before the activity and excitement in Seafield spills over into Greencastle as Tony Roodenburg is the President and CEO of both companies…Greencastle, don’t forget, also held a substantial position (several million shares we suspect) in Seafield as of last fall before SFF really started to move…it’ll be very interesting to check out Greencastle’s year-end financials when they become available, probably toward the end of March…Greencastle continues to receive monthly royalties of greater than $100,000 from Primate in Saskatchewan…the company also has some quality gold properties in Nevada that warrant further exploration, a coal property in Manitoba near last year’s discovery by Westcore (WTR, TSX-V) and 7,000 hectares of shale gas interests in Quebec…if Greencastle attracts investors from Seafield, watch out…Greencastle finished February at just 15.5 cents and is at technically oversold levels from which it has rallied significantly before…

Richfield Ventures (RVC, TSX-V)

Not surprisingly, Richfield pulled back a little this past week after a huge gain the previous week…Richfield closed Friday at $1.48, down just 5 cents on the week…a 450,000 share Canaccord trade in the final five minutes Friday was certainly interesting…we expect a lot of fireworks with Richfield this coming spring as drilling starts up again at its very promissing Blackwater Project in the Interior of British Colombia…Blackwater has all the makings of a multi-million ounce bulk tonnage, open-pit deposit…25,000 metres of drilling is scheduled to start in April…with more drill results, a market cap of $250 million or better with Richfield is very possible which would mean a stock price four times where it is now…

Colombian Mines Corporation (CMJ, TSX-V)

We initiated coverage on CMJ in early December at 60 cents, and we consider the current share price of $1.00 to still be an attractive entry point for those who have not yet picked up on this story…Colombian is in the process of finalizing a $3 million private placement at 95 cents, so the stock is likely range-bound for a little while longer until the PP closes…CMJ has an incredible package of grass roots and some more advanced exploration properties in Colombia…we have no doubt this stock is ultimately headed much higher, especially with a bullish overall market…