TSX Venture Exchange and Gold

The Venture Exchange has now declined 9 weeks in a row, an unprecedented event at this time of the year. Evidence suggests, though, that last week may have marked a selling climax – not necessarily the ultimate bottom, but a low (for now at least) from which a significant rally could ensue. Gold stocks got pummeled Monday through early Thursday as the Dow hit a new all-time high and bullion fell as much as $60 an ounce from its closing price the previous week, just before Easter. Importantly, Gold rallied intra-day Thursday to hold support on a closing basis at $1,550, and then it surged $29 Friday after a much weaker-than-expected U.S. jobs report. John’s charts showed that the Venture, Gold and Silver had all become extremely oversold, so the conditions were ideal for a near-term reversal. The question is, will we see just a weak bounce or a reversal that actually has some strength behind it? The latter, we believe, is more likely, but we’ll be watching closely for confirming evidence in the coming days.

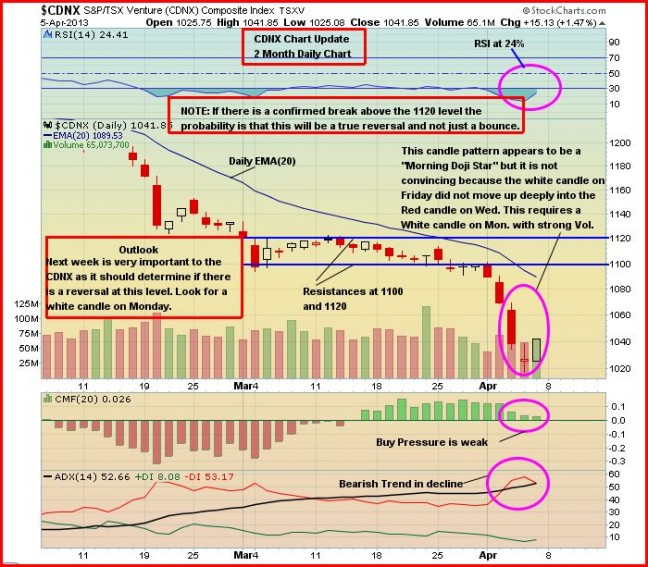

Despite Friday’s 15-point gain, albeit on light volume, the Venture still finished the week with a whopping 57-point or 5.2% loss at it closed at 1042. Intra-day Thursday, the Index fell as low as 1018 before recovering to finish the day exactly at Fibonacci support at 1027 (this was important). Since its 9-week losing skid started at the beginning of February, the Venture is off 15.2% – almost matching the loss of the TSX Gold Index which is down 15.7% during the same period.

The Venture must show some “follow through” in the coming days after the action Thursday and Friday. A “white candle” Monday is what John is looking for to help confirm a reversal. What was particularly noteworthy about Friday was that the Venture decoupled from the broader equity markets which were quite weak, especially early in the day. This, of course, had a lot to do with Gold but it was a positive sign that we haven’t seen for a while.

Gold

Gold’s impressive performance Friday limited the week’s loss to just $16 an ounce. Strong physical buying out of Asia, in particular India, helped keep bullion above $1,550 on a closing basis through Thursday, and a wave of short covering entered the market Friday after a disappointing March jobs report sent equity markets and the U.S. Dollar Index lower.

There are three important resistance levels to watch closely as shown in the 2-month daily chart below: $1,590 (the EMA-20), $1,600 and $1,617. For Gold to generate some serious momentum in the coming days and weeks, it must break out into the $1,620’s. What the catalyst will be for that is anyone’s guess.

Silver rallied sharply as well on Friday but still finished down 95 cents for the week at $28.30. Copper was off 4 pennies at $3.36. Crude Oil ended a 4-week winning streak as it fell $4.53 a barrel to $92.70. The U.S. Dollar Index, meanwhile, lost nearly half a point to 82.57. Record short positions in the greenback by commercial traders suggests the Dollar Index won’t be able to bust through the resistance band between 83 and 84, and that short-term weakness is likely. This helps strengthen the argument for higher Gold prices and a stabilization/upward bias in the Venture.

The “Big Picture” View Of Gold

As Frank Holmes so effectively illustrates at www.usfunds.com, Gold is being driven by both the Fear Trade and the Love Trade. The transfer of wealth from west to east, and the accumulation of wealth particularly in China and India, is having a huge impact on Gold.

The fundamental case for Gold remains incredibly strong – currency instability and an overall lack of confidence in fiat currencies, governments and world leaders in general, an environment of historically low interest rates and negative real interest rates that won’t end anytime soon (inflation is greater than the nominal interest rate even in parts of the world where rates are increasing), a Fed balance sheet now in excess of $3 trillion and expanding at $85 billion a month, money supply growth, massive government debt from the United States to Europe, central bank buying, flat mine supply, physical demand, investment demand, emerging market growth, geopolitical unrest and conflicts, and inflation concerns…the list goes on. In the current environment, it’s hard to imagine Gold dropping below key support around $1,500.

4 Comments

considering that BMR has made bullish undertones in their daily piece, that means that the venture will continue lower and gold will fall again – i.e the Dow will continue surging higher. What’s funny is that BMR during the past 2 years has not ONCE gotten this long-awaited “turnaround” in the ventures right. Every time you’ve predicted a possible bottom, the proverbial “$hit” has hit the fan even harder.

So….given that you are soooo bullish yet again, I will go long in equities for the near-term and check back with this board in a few weeks when the ventures are hovering around 940-950.

Later!

I have noticed BMR starting to incorporate a little more doubt in their musings. Instead of sticking their necks out and being super confident in their calls and charts, they are at least acknowledging that there could be more downside. I would love to see them saw that they have been wrong about their calls but I am not holding my breath on that one. Although I did gain a little respect for these guys when they said that this market has humbled them (at least that is a start).

http://finance.yahoo.com/news/greencastle-subsidiary-reports-silver-gold-150621463.html

In my opinion, not more waiting for GBB…. soon it becomes 2 -3 cents stock. This one is done.