Trading Tips & Strategies

March, 2025

Timing is Everything – Know The Market You’re In!

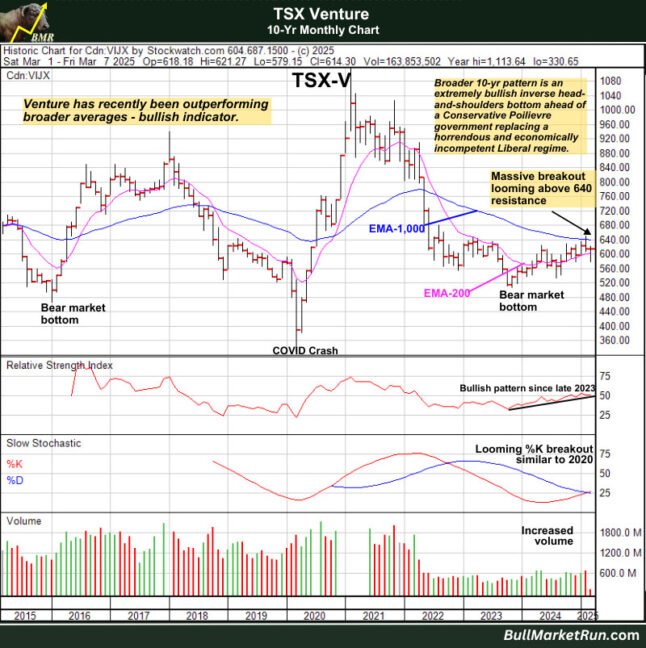

The Venture has been in a slow-paced bull market since bottoming out just above 500 in late November 2023. At some point during 2025, quite possibly by Q2, we’ll see an acceleration of this bull cycle when the Index conquers key resistance in the 640’s.

The 10-year pattern is rather phenomenal and points to an extraordinary opportunity for savvy investors right now.

Picking The Right Stocks

It’s easy in a hot market to get greedy and start chasing stocks while forgetting about the importance of “paying yourself” on occasion. This is 1 of the biggest mistakes speculative investors make. Pay close attention to TA and our charts – risk-reward ratios are defined through multiple indicators including key resistance and support levels. It’s astonishing how so many investors don’t believe TA applies to penny stocks. In reality, TA applies to anything that has volume. If you ignore TA, or don’t understand it very well, you are greatly reducing your odds of success in this business.

On the fundamental side, a company’s ability to communicate its message clearly is critical! Focus on companies who understand how to relate to investors, who can take something complicated and make it perfectly understandable for the layman! That’s one key ingredient we look for in companies we review and that helps explain our success ratio with stock selections.

Below is how we broadly look at Venture and CSE companies – we put a heavy weighting on the communication side and stock behavior. Less than 20% of companies will score really well on this test:

Management

Expertise and track records, ability to raise capital and execute, trustworthiness, skin in the game, market “friendliness”. Is this a “lifestyle” company, or a serious company that actually wants to accomplish something and has a plan and the ability to do it?

Finances

Working capital, monthly burn rate, transparency, outlook.

Share Structure

This is critical – who holds the paper and at what prices? Retail-dominated ownership or institutional or a mix? Is there any cheap free-trading paper hitting the market soon? Is there a big warrant overhang? You want a favorable share structure but you also want a stock with liquidity, that you can get in and out of with relative ease.

Resource Projects

Sector, jurisdiction, competitive advantages, scale, grade, conceptual strength, promotability, sizzle, anticipation/speculation potential, geological team, exploration flow – these are all key factors to assess.

Non-Resource

A little more challenging to interpret in the speculative sphere but proven management, cash position, potential debt, revenue growth potential, story strength and competitive advantages/niche opportunities – these factors are very important in any non-resource play.

Branding/Communications

Effectiveness of “story” and overall brand development, quality of news releases, web site and promotional materials, quality of investor relations/promotion, third party endorsement.

Stock Behavior

Liquidity, technical strength and posture, short and longer-term price potential. Are people interested in the story, excited about it?

Summary

As you can see above, we use a wide range of metrics to evaluate the prospects for any particular company but we do place a lot of emphasis on management teams that understand how investors think, how markets function, and what it takes to build shareholder value. It’s mystifying that so many CEO’s and management teams of companies listed on a publicly traded and speculative market like the Venture have no clue how to navigate within this sphere! In essence, they are destroyers of wealth, not creators of wealth. Those stocks are like landmines – they can blow up your portfolio in an instant if you’re not careful.

Rules of the Game!

It’s imperative to regularly review some basic but essential rules (ignore them at your peril!) about investing in speculative stocks on the Venture and CSE in order to greatly improve your odds of success:

- Always have cash on hand and maintain liquidity to take advantage of sudden pullbacks in the broader market or individual stocks, or great new opportunities that “pop out of nowhere” – that means selling some paper into strength on occasion;

- Never buy on margin or invest more than you can afford to lose;

- Let your winners run, but locking in some profits along the way is critical (as the saying goes, bulls and bears make money but pigs get slaughtered);

- For the Venture/CSE, an ideal diversified portfolio would consist of about 10 stocks across some different sectors. Keep it simple – a portfolio that is too big is too hard to manage for most retail investors;

- Always aim to make money serve you – not the other way around;

- Never allow yourself to lose big on one stock – that means don’t be afraid to cut your losses short on a deal if it’s not working out the way it’s supposed to (you will always have some losses, limiting them is key);

- Liquidity and the ability to quickly adapt to changing circumstances are really important;

- Long-term buy and hold strategies very seldom work in the junior market – stay on top of each stock in your portfolio, technically and fundamentally – you do need to trade!;

- Be aware of “sector rotation” – occurs regularly. If you can get in early on a particular sector that’s starting to heat up, profits can be extraordinary;

- The “Efficient-Market Hypothesis” (EMH) is a farce, certainly when it comes to juniors – a Venture/CSE stock is either undervalued or overvalued, and investors are making mistakes and overlooking things all the time. You can make a lot of money in this business through patience, discernment and “vision”, and when you remove emotion from your trading;

- Most Venture/CSE companies (at least 80%) aren’t worth investing in – focus on the top 5% or 10% of companies who have strong management teams, high quality and exciting projects, and the ability to communicate and promote to the market!;

- In a strong uptrend, always look for Venture support at the EMA(8) and EMA(20) – the same with many individual stocks (those short-term exponential moving averages, and the 50 and 100-day EMA’s, represent great buying opportunities on pullbacks as long as they continue to rise). Likewise, during a downtrend, the EMA(8) and EMA(20) will act as resistance on rallies.