The U.S. Dollar Index could be in for a rough or choppy 2nd quarter after some of the assumptions underlying its rapid ascent over the last 9 months are increasingly being cast into doubt, especially after this morning’s sharply weaker than expected March jobs report from the Labor Department – plus downward revisions for numbers reported in February and January. While the overall bull market in the greenback remains intact, after some critical breakouts, an extended correction is now likely to unfold after the Dollar Index spiked to a 12-year high of 100.71 in mid-March.

Dollar weakness is clearly positive for the Venture Exchange – there is such an obvious and proven inverse relationship between the two, going back many years, and we’ve seen this dynamic played out in dramatic fashion since last summer with the Venture tumbling by as much as nearly 40% while the greenback soared on expectations of an improving U.S. economy and a Fed rate hike during the first half of 2015. In our view, the Fed will be lucky if it can start the process of rate “normalization” by late this year.

Gold should get a boost next week and will have its first chance to react to this morning’s jobs report on Monday (keep in mind, North American equity markets reopen Monday but European markets will be closed until Tuesday).

March Jobs Report: Major Expectations Miss

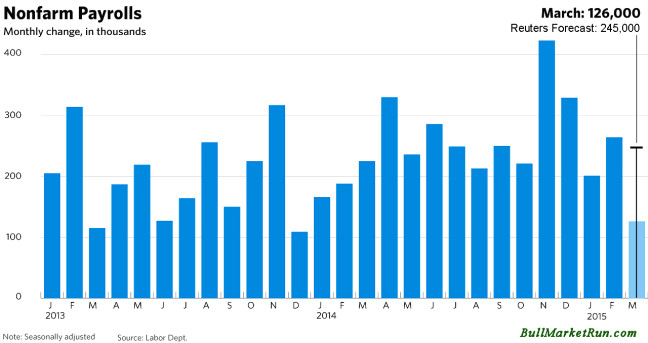

March’s report of just 126,000 non-farm payrolls was about half the total economists were expecting and the worst reading since December 2013, though the unemployment rate remained unchanged at 5.5%.

This morning’s report aligns with evidence in other data that points to a slowing in GDP growth in the 1st quarter (perhaps a pace of 1% or less). It also affirms market views that the Fed will move more cautiously than previously expected to raise interest rates, and September realistically remains the earliest time frame for the Fed to act in the minds of many traders. Today’s information also places a greater premium on the next few employment reports as the Fed looks for evidence that the current slowdown in economic growth and labor market momentum is just temporary.

In addition to the much weaker than expected March jobs number, the February and January numbers were both revised downward (February from 295,000 to 264,000, and January from 239,000 to 201,000). Over the past 3 months, job gains have averaged 197,000 per month. The trend has been weakening since late last year.

The service sector, as has been typical during the jobs recovery, led the way with 40,000 new positions. Retail added 26,000 and health care grew by 22,000.

Weaknesses came in mining, which lost 11,000 jobs, and nursing care, which shed 6,000 positions. The normally reliable bar and restaurant industry, which added 66,000 in February and had been averaging 33,000 a month, contributed just 9,000 in March. Manufacturing lost 1,000 jobs.

Despite the poor headline numbers, there were some signs of wage pressures. Average hourly earnings rose 7 cents an hour to $24.86, representing a 2.1% gain that gets closer to the Fed’s target. The average work week, though, declined one-tenth to 34.5 hours.

5 Comments

Jon

The bar and restaurant job totals say it all, people are not going out and spending money, where I live, a huge oil town, oil service companies have laid off 1200 oil service jobs , from Halliburton, schlumberger and Baker Hughes…this will trickle down to all types of businesses as those are all good paying jobs.. Personally I don’t think the fed will ever raise rates it’s just a game they play to try and control the stock market and every other financial market including the metals thru there puppet JPMorgan,,,

The Fed is caught between a rock and a hard place, Greg, and it will be difficult for them to raise rates anytime this year, I agree. Very accommodative monetary policy has tried to compensate for weak fiscal policy in the U.S., with some degree of success going back to 2008, but there’s only so much one can do with monetary policy.

The radical change needed in the fiscal approach won’t come until after we have a new President – we still have a while to wait for that. Obamacare slowed what would have been a more robust U.S. economic recovery – the President also took his eyes off the economy by getting bogged down in a risky health care overhaul that should have been dealt with later – and now he has created an overall foreign policy disaster through a number of missteps on that front including the Iran deal. Gold will respond well through the mess ahead.

Jon, the US economy will never recover as long as companies keep offshoring jobs and hiring H-1B visa workers back at home. This is the main problem before anything else. As Greg pointed out, the bar and restaurant jobs were down this time, and I believe the trend will continue. Waiter/bartending jobs saw the greatest increase these past few years. Once these jobs start declining, what is left? Nothing, absolutely nothing. And what you are going to get is melting pot of young/middle aged pissed-off individuals who will lose it. But I agree with you, gold will respond well, but not just yet. I just wish this nightmare would just end so we can get back to building a sound economy where everyone has the chance to make something out of their lives. Pilling debt on top of debt has not worked; time for politicians to change their game plan. But we as a society will also need to change.

Jon: do you see getting back to $1300 and then begin a new BULL run, or, is there some other level? thanks!

Steven, a chart that has proven to be a very useful guide with regard to Gold is John’s 2.5-year weekly chart which we last posted March 28 in our Week in Review. It shows bullion consolidating within a downsloping flag since 2013. The top of that flag is currently around $1,280; the bottom is around $1,100. We also know there’s excellent support for Gold around $1,150, chart resistance at $1,200, and 3 Fib. resistance levels between about $1,220 and $1,265. So that’s what we’re dealing with at the moment. Sooner or later, Gold will break out to the upside from this downsloping flag, or break down below it. If Gold is going to make another attempt at $1,300, the time for that might be now with the dollar cooling off, and physical buying picking up in India. How bullion responds this coming week will be important.