6:00 am Pacific

A week that began with a sharp gap down on the Venture during an extremely volatile Monday is ending on an encouraging note for the Index which has posted 3 consecutive winning sessions after declines in 23 out of the previous 28 trading days that wiped 21% in value off an already beaten-down market.

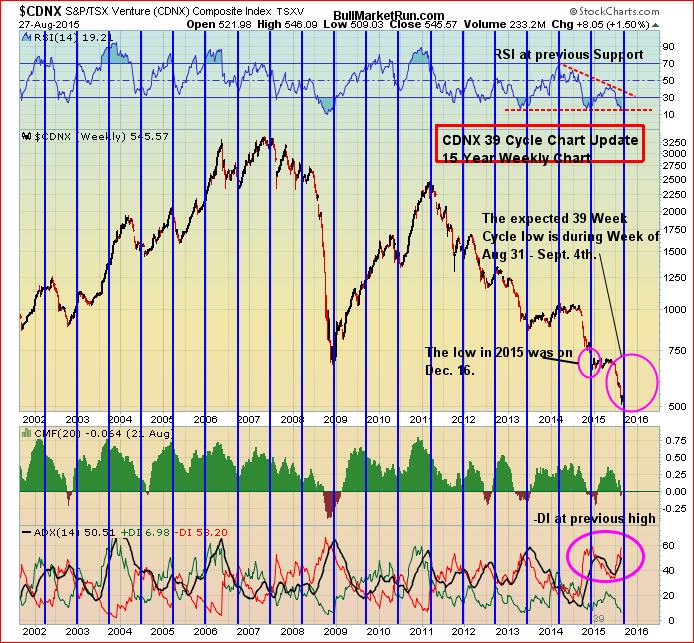

John’s reliable 39-week Venture cycle chart suggested a turnaround may occur around the end of August/early September, consistent with decisive market moves near the end of all previous 39-week periods, and indeed that’s what appears to be unfolding again. The Venture closed above its EMA(8) yesterday for the 1st time since the July-August rout began. Confirmation of that breakout is required today with the EMA(20), currently declining at 563, the next important resistance that must be overcome.

Before we examine 2 important charts, a few individual situations that should be watched closely leading into September:

Pure Energy Minerals (PE, TSX-V) hit a new multi-year high yesterday and closed at 48 cents, a penny above Fib. resistance. Pure Energy continues to make progress with its Clayton Valley South Lithium Brine Project in Nevada, and a confirmed breakout above the high 40’s resistance could really energize the bulls. You know that Pure Energy is onto something when the likes of Ashburton Ventures (ABR, TSX-V) announce, as it did pre-market today, that it’s “in the process of evaluating prospective lithium claims in the state of Nevada.”

Two Venture companies that reported profitable 2nd quarters yesterday made impressive moves. Both are looking strong fundamentally and technically, and are certainly worthy of our readers’ due diligence – Biorem Inc. (BRM, TSX-V), which has earned 9 cents per share through the 1st 6 months of 2015, and Lingo Media Corp. (LM, TSX-V) which enjoyed its highest volume day ever yesterday, closing up 6.5 cents at 34.5 cents, after announcing earnings of 4 cents per share for Q2.

Equitas Resources (EQT, TSX-V) continues to push closer toward drilling at its Garland Nickel Project in Labrador and will be a fascinating situation to watch next month with the potential for a grassroots discovery near Voisey’s Bay.

Speaking of possible discoveries, Garibaldi Resources‘ (GGI, TSX-V) crews are on the ground at the Grizzly in the prolific Sheslay district of northwest B.C., nailing down final drill targets in another key Canadian exploration region that could help rejuvenate the market. GGI continues to trade above its 50-day moving average (SMA) for the 1st time in 5 months – that SMA is also flattening out and threatening to reverse to the upside within days. Given the events in this district over the last few months, September/October could be dramatic for both Garibaldi and Doubleview Resources (DBV, TSX-V).

Interesting technical breakout in Simba Energy Inc. (SMB, TSX-V) after news late in the session yesterday (it closed at 8 cents) – we’ll have a chart in today’s Morning Musings.

Venture “Awareness” Chart

Several encouraging factors here:

1. RSI(14) has finally pushed above resistance at 30% after being stuck in oversold territory for 2 months;

2. Importantly, the Venture has also finally clawed above its EMA(8) – requires confirmation today. The EMA(8) is also now reversing to the upside;

3. Sell pressure (CMF) has consistently been declining since late July;

4. Bearish trend (ADX indicator) peaked on Monday;

5. Fib. support at 515 held – Monday’s trading activity was really encouraging, indicating a rally in the works.

Venture 39-Week Cycle Chart

Strangely enough, over the last 15 years, there has been a consistent pattern of trend reversals (in price and RSI) around the end of each 39-week period on the Venture – you can see it quite clearly on the fresh version below, through yesterday, which is important to look at and understand.

What this chart has been suggesting is that the Venture would stabilize by around the end of this month or early September which could mark the beginning of a significant rally/turnaround. That’s when the current 39-week period expires.

Keep in mind, also, that the Venture just experienced its 2nd-worst July on record. What we may have just witnessed is another important (or potentially final) low, especially considering that 85% has already been wiped off the value of this market since its all-time high of nearly 3400 in May 2007.

The vertical blue lines separate each 39-week period on the Venture.

Note: John and Jon both hold share positions in EQT, GGI and DBV. Jon also holds a share position in PE.

25 Comments

could be dramatic Jon for GGI and DBV you want to say phenomenal ?

If you look across Canada, Guy, there are only a handful of really high quality major discovery opportunities at the moment. And given what has occurred in the Sheslay district the last few months, all eyes could really become focused on this area, more than ever. Yes, this has the potential to get very dramatic.

I own GGI, PE, and EQT, loving it.

Equitas is a big buzz in Goose Bay. Some thought when Makela came through town there was already a discovery, now they know there’s still time to acquire a cheap position. With EQT drilling to start next in days or weeks I can’t imagine what Happy Valley will do if Equitas has a major Voisey Bay like discovery. The right technical team, right project and soon cashed up. Christ, they have Zijin’s Geo that vet all their billiondollar financings this year on Eqt board.. Hmmm. Too bad Ray Goldie can’t tell the investment committee on this little company he see’s great things with.

Indeed the potential for the Sheslay to ignite the market for explorers is very high but this seems like a never ending wait. The obstacle that DBV must over come seems to be a very big one and one that is wasting a lot of valuable time! Once we get through it I think things will move very quickly imo and hopefully it will make up for the long wait.

Pure Energy up .04 cents on early trading to .54 cents on 335,000 shares. Something must be brewing here, looks like it will be another high volume day.

After saying that, BCN has come out with news on a lithium supply agreement with Tesla. stockwatch.com/News/Item.aspx?bid=Z-C%3aBCN-2306721&symbol=BCN®ion=C

From what I read in this release (not all the details are provided), this does not sound like it will be too profitable(my speculation) . BCN up .60 to $1.88 this morning on low volume of 172,000 shares.

Some of the early thinking was that PE would be in the mix for an agreement with Tesla. Here’s hoping they will have more than one supplier!!

I know for sure the CEO of PE, Robert Mintak, is not going to give the lithium away, this mineral is in high demand in todays market. There are lots of supply deals that they are working on as they mentioned in the recent conference call, POSCO being a huge potential customer and Tesla could be still be a possibility.

Jon, welcome to the PE club!

maybe the curse of venture is over just intime for big Sept run

BMR , which sector is doing the heavy lifting on the CDNX .?

GGI .08’s getting hit. No sellers down here. As soon as we see some bigger support bids. Game on.

An update on EQT after market close. I have always mentioned the stocks that I am in and updated such. I have not made it a practice to tell people what to do with their money simply because it is up to all of you to make your own decisions. I will feel bad if in the fall I hear the words (I wish that I did more DD and bought EQT). I purchased more EQT just now.

RE: EQT, I’m seeing 920,000 shares traded over the counter on my Schwab Account, can that be correct, or is that showing all exchanges?

thanks

Greg – all exchanges

dave, your updates on EQT are much appreciated. And you are absolutely right, people need to make their own decisions. Information taken from boards like this should only be a starting point before doing your own research.

@goldstocktrades: @equitasresources Up 47% since 7-24 report in volatile #stockmarket $EQT.V drilling away and trading great volume. https://t.co/jfvxxiuSjs

Dave. I picked up more as well today. Good luck all!!!

Dave how confident are you there will be a release after market on EQT?

EQT – ground work is coming along exceptionally well. So well in fact that they will delay drilling for another week forward. This is not a bad thing, but a very very good thing. Goose Bay area lit up today. PP still day to day but the big money is in. I am wondering if Hardy will close the PP early. He may have a rough weekend deciding this.

Did anyone notice Freidland sold his mansion in California for 47 million.

Dan, I doubled my position today in EQT. I am very happy the way it is coming along and GGI, PE also. I bought LM at the open but sold it for a day trade. GGI, PE, and especially EQT are my keepers.

Remember, Voisey bay had one signature, Garland has nine. There is a site that gives all of the occurrences of spot price nickel going up in the 1900’s and Voisey bay was one of them as nickel doubled from that discovery. Nickel is trading higher than at that time in 1993. Now, you can say that the dollar is worth more now and you would be correct. But remember this: DFI went to $170 a share from pennies. So even with the value of the dollar, where do you think EQT can go if they discover. Makes one wonder. Have a great weekend to all. Expect a strong week next week.

Dan – Ref your post #17, I was referring to me commenting on progress, never mentioned one from company. Sorry if you misunderstood.

BCN – Re: supply agreement news release with Tesla. Looks like IIROC slapped their wrist as well with the same sort of retraction required.

stockwatch.com/News/Item.aspx?bid=Z-C%3aBCN-2307003&symbol=BCN®ion=C

No problem Dave.

Hi Dave – just began following EQT and really appreciate your views. May I ask where you get your info on ground work and drilling? Not trying to be a smart ass. Just wanting to understand your expertise etc. Thanks.

Dave. Can you elaborate? Goose Bay area lit up today?

Ted – NR’s dated 07-30 and 08-18. No secret here. They are doing the PP to raise the money to drill. Phase 2 exploration has been ongoing. The drilling delayed cause the closing of PP delayed. I suggest you do your proper DD this weekend if you just started following them. I would start with the presentation tab on their website along with googling every member on the board. Then google Voisey Bay and educate yourself with this amazing story. Draw the lines and connect the dots as they say. But I think you only have this weekend to do it. Good luck.