8:00 am Pacific

(Exclusive to BMR subscribers – Not for Distribution or Posting on any Board).

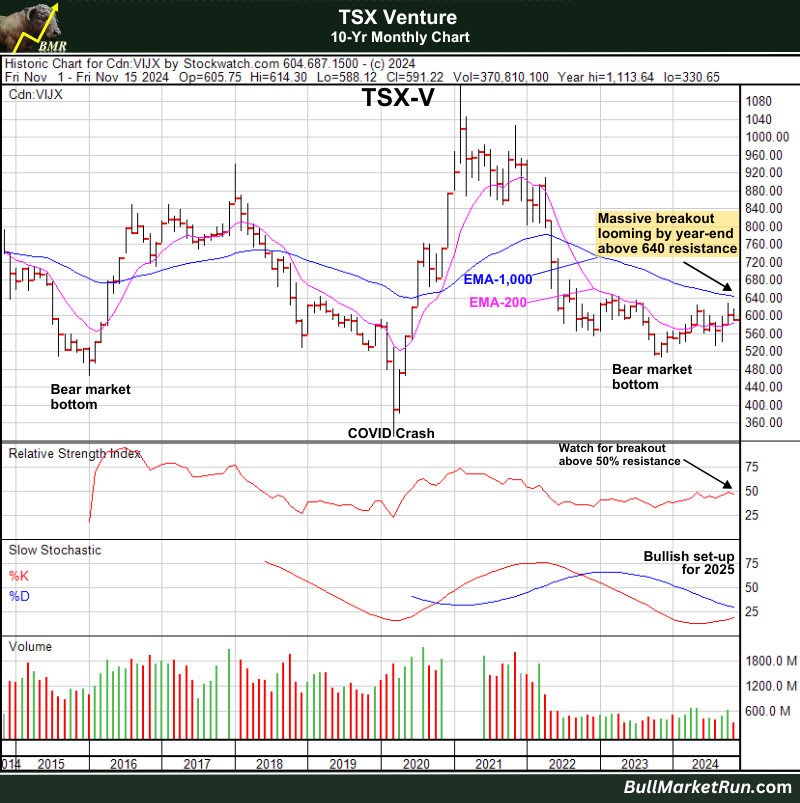

Get Ready For A Venture Explosion

Since touching a 15-month high of 627 October 22 (roaring back from an August bottom as predicted), the Venture has eased off 6.8% to around 590 in a healthy retreat driven mostly by weakness in Gold and Gold stocks.

We view the opportunity going into year-end as EXTRAORDINARY with a major breakout above key resistance a virtual certainty, propelled by a variety of sectors and factors including investor enthusiasm over the Trump legislative agenda and the spillover effect into Canada (Trudeau’s days are rapidly winding down, generating a lot of hope for the resource sector and the country in general).

Crypto and energy will be 2 key themes – money making opportunities abound in those areas, and we’ll update specific opportunities tomorrow morning. Gold stocks will become oversold this quarter, presenting favorable entry points, while certain Copper, Nickel and Uranium plays could enjoy big moves (not unlike what we’ve seen in American Eagle) in late 2024/early 2025.

The Venture has just 1 final hurdle to overcome before really taking off – the resistance band stretching from the upper 630’s to the mid-640’s which includes the 1,000-day EMA. Once that’s cleared, it’s off to the races in what should develop into an exceptionally strong finish to the year and an explosive start to 2025 (tax loss selling should be relatively subdued this year with December’s lows likely occurring very early in the month).

Algorithms which have holding this market down since its 2021 highs are going to have no choice but to flip positive – that’s already starting to happen. The banks make money playing both sides of the game, so you can be sure they are going to be on the winning side (riding the bull) through the balance of 2024 and in 2025 as the bull cycle becomes apparent to all investors.

Venture 10-Year Chart

A picture (chart) tells a thousand words.

The broader Venture pattern going back a decade is an inverted head-and-shoulders bottom, setting up a really powerful dynamic on a breakout above 640 and the 1,000-day EMA which has restrained this market since mid-2022.

The 200-day EMA, around 580, has reversed to the upside.