We urge everyone to read this article very carefully – and read it at least twice – because an extremely interesting, unusual and potentially very profitable situation is shaping up with Kent Exploration (KEX, TSX-V). As regular BullMarketRun readers know, Kent has been a favorite of ours since last fall. It hasn’t exploded yet like some of the other stocks in our portfolio but mark our words: THAT DAY WILL COME. And the dividend that Kent shareholders will be receiving very soon in the form of shares in Archean Star Resources makes Kent an absolute no-brainer investment opportunity than even a Grade 3 student can appreciate. In this article, we’re going to walk you through all the dynamics at play here and present a potentially incredible scenario that we unfolding in the very near future.

Let’s begin by what’s been happening on the ground in the northern Murchison Province area of Western Australia where Kent’s Turnberry Prospect (the most advanced property in its massive Gnaweeda Gold Project) and Doray Minerals’ Andy Well Property are just 13 kilometres apart. Doray Minerals in an Australian-listed company – it just came on the market in early February – and reported a high grade gold discovery at Andy Well March 30. Intersections included 8 metres of 62.53 g/t Au, 12 m of 21.47 g/t, and 9 m of 42.97 g/t. The stock rocketed on massive volume from 30.5 cents to $1.10 within a matter of days. It’s currently trading around 80 cents (most investors in Doray, we’re sure, have not yet heard about Kent’s Turnberry Prospect).

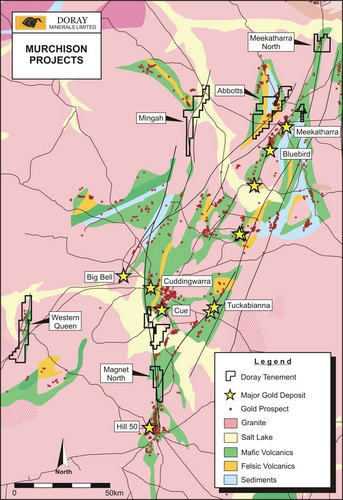

We’ll explore the geological similarities of Andy Well and Turnberry in much greater detail later on in this article. Andy Well is just northwest of Turnberry and is part of the prolific Meekatharra-Wydgee Greenstone Belt which is host to numerous large gold deposits. Turnberry is part of the underexplored Gnaweeda Greenstone Belt. Gnaweeda and Meekatharra-Wydgee are both part of the same Archean-age Luke Creek Group that hosts 83% of the gold deposits in the Murchison Province. The northeastern area of Murchison is particularly prolific. More on the geology a little later and why Dr. Gerry Gray, the author of Kent’s 43-101 Technical Report on Gnaweeda, states: “There is an excellent chance that further diamond drilling at Turnberry…will intersect significant gold mineralization.”

Immediately below is a map of Doray’s Murchison Province projects. Kent’s Turnberry Prospect is just to the right of the area identified as Meekatharra North near the top of the map:

Kent announced on Tuesday of this week that it has completed a Phase 1 drill program at Gnaweeda – 5 holes and 1,137 metres at Turnberry and another 3 holes and 440 metres at another target (Bunarra). Assay results from Turnberry are expected around the middle of May. The five holes at Turnberry targeted shear and alteration zones and were intersected as planned. The fact that GNAD-4 was extended to 276 metres (almost 40 metres more than originally planned) suggests the geologists saw something they liked.

A limited amount of historical drilling at Turnberry produced very encouraging results, much like historical drilling at Andy Well. Mineralization is open at depth and laterally in every direction at Turnberry.

We’ll return to the geological aspects of this story shortly, but let’s now examine the equally interesting market dynamics.

Kent’s Spinoff of Gnaweeda

Archean Star Resources’ listing date on the TSX Venture Exchange is expected to be within approximately one month by about the end of the first week of May. Approval of the spinoff by Kent shareholders is a mere formality and will occur at the company’s AGM April 30. For every four shares of Kent you own, you’ll receive one share of Archean Star Resources which will hold the Gnaweeda Gold Project (a joint venture with Teck) as its flagship property. The proposed financing price for Archean Star is 25 cents.

Let’s be conservative and assume Archean Star trades consistently around the 25 cent level in its early days (there’s an excellent chance it could go dramatically higher as we’ll explain shortly). Let’s say you currently own or will own (at month-end) 40,000 shares of Kent at an average price of 20 cents, just a little above the stock’s 100-day moving average.

The calendar turns over into May. You’re holding 40,000 shares of KEX at an average price of 20 cents for a total investment of $8,000. You receive 10,000 FREE shares of Archean Star. The value of that investment is $2,500. On paper you have an investment gain of 31% and potentially much more given the scenario we see unfolding with Archean Star.

Kent’s Value After The Spinoff

Some will argue that the value of Kent may decline with the spinoff. We think not, and here are the reasons why (not necessarily in the order of importance):

1. After the spinoff, the market’s focus with Kent will shift squarely to its undervalued Alexander River Gold Property in New Zealand (20 kilometres south of OceanaGold’s Globe Progress Mine) where drilling is likely to commence in May. We have gone into great deal on this site about the merits of Alexander River, so for reference purposes please refer to some of our previous articles. Bottom line: Alexander River has an historical resource (non-compliant) of 643,000 ounces of gold (four million tonnes grading more than five grams per tonne) and much of Alexander has yet to be systematically explored (the entire gold belt there stretches approximately 50 kilometres north to south and many mines have been in operation). Trench assays released by Kent in January confirmed the historical grades. The company, in our view, has an excellent chance of defining a one million+ ounce deposit with additional drilling at Alexander;

2. Kent should soon be ready to commence barite production at its Flagstaff Property in northeastern Washington State. We expect substantial news flow on this in the coming months. As far as we know, Kent is the only publicly-traded company with a production-ready high-grade baritie deposit. The company has already secured a buyer for its barite. Production for 2010 is expected to be a minimum of 20,000 tonnes (the plan is to eventually ramp it up to 100,000 tonnes annually) which would generate nearly $1 million in cash flow for Kent. This will help underpin the share price and keep dilution to a minimum;

3. Once May rolls around, warrant pressure on the Kent stock price – a major issue over the last few months – should ease off considerably. A total of 1.5 million 11 cent warrants were all exercised by the February 20 expiry date and another 6.7 million warrants at 15 cents expire June 25. A significant number of those 15 cent warrants have been exercised already but that has effectively “kept a lid” on the stock price, preventing it from advancing much beyond 20 or 21 cents. Just recently, the 15 cent warrant pressure seems to have subsided somewhat but we suspect it hasn’t ended completely just yet – in a way that’s a good thing for those who are looking to accumulate Kent by the end of the month to receive their Archean Star shares. A total of 3 million warrants at 30 cents expire June 25 and 2.7 warrants at 22.5 cents expire September 28;

4. In some way we expect Kent to acquire a position in Archean Star which will allow Kent shareholders to still benefit from any upside at Gnaweeda after the spinoff. One quick and obvious way this could be done is converting Kent’s expenditures to date on Gnaweeda into Archean Star stock.

The Outlook For Archean Star And Why Gnaweeda Is Such An Attractive Geological Target

Now that we’ve established the likelihood that Kent‘s share price will hold up and perhaps even be very strong after the spinoff, what’s the outlook for Archean Star which should have approximately 15 million shares outstanding? This is where things get really interesting with initial drill results from Gnaweeda pending within a couple of weeks after the spinoff. We expect considerable speculation, especially given the discovery nearby on Doray Minerals’ property. With such little stock outstanding, any major demand could have a dramatic impact on Archean Star’s share price. So The Perfect Storm could easily be forming for Archean Star Resources.

We believe the geology of Gnaweeda is such that it is going to ultimately deliver big-time for Archean Star shareholders. Gnaweeda is surrounded by excellent infrastucture and has all the makings of a Kirkland Lake-style major deposit. This deposit type (Archean Lode) has produced 60% of the world’s gold production.

As the 43-101 Gnaweeda Technical Report states, no less than “91% of the total gold production in the Murchison Province has come from, or within, one kilometre of major faults and shear zones. Gnaweeda is transected along much of its 28 kilometre length by a major fault-shear zone (possibly a major crustal boundary) and lies two to three kilometres from granite-greenstone contacts. Magnetic data also suggests the presence of post-folding mafic instrusive rocks beneath the regolith cover.

“Gold deposits generally occur within two or three kilometres of granite-greenstone contacts, and there appears to be a strong correlation between gold deposits and the location of post-folding granitoids. Seventy percent of gold production in the Murchison Province has come from within three kilometres of an exposed post-folding granitoid pluton contact.”

“Dr. Gerry Ray, who did our 43-101, is really excited about this project,” Kent President and CEO Graeme O’Neill told us in a recent interview. “He looks at a lot of projects and he thinks this one is one of the cream of the crop…Kirkland Lake-style. He says you find one deposit, they’re like bells on a string. There’s always more. Typically you get two or three within a 10-15 kilometre strike.”

The Turnberry Prospect, as we mentioned, is the most advanced in the Gnaweeda package and is defined by an approximately 2.5 kilometre long, 500-metre wide northeast trending drilled anomaly. The style of both the mineralization and the alteration suggests it could host in-situ gold similar to the large Archean deposits being mined in the neighboring Meekatharra-Wydgee Belt.

Teck conducted some limited reverse circulation drilling at Turnberry (less than 300 metres depth) in 2007 and seven out of 10 holes intersected significant mineralization including:

Four metres of 17.77 grams per tonne; five metres of 13.49 g/t; five metres of 11.64 g/t; three metres of 11.88 g/t; three metres of 4.53 g/t; three metres of 4.85 g/t; and three metres of 4.39 g/t.

Teck planned to complete further drilling but due to weather delays and lack of drill rig availability none was carried out before a decision was made to farm out their interest in the project (Kent’s option agreement allows it – Archean Star – to earn a 100% interest in Gnaweeda with Teck holding a back-in right to re-acquire 75%. Teck would likely only exercise that right if a major deposit were discovered at Gnaweeda, in which case Archean Star’s 25% interest would be a huge asset for a small junior mining company).

The Bottom Line

Kent’s Gnaweeda Gold Project, soon to be advanced through Archean Star Resources as a TSX Venture Exchange listed company, holds excellent exploration potential with almost identical geological features as the neighboring Meekatharra-Wydgee Greenstone Belt which hosts several million-plus ounce gold deposits. The recent major discovery by Doray Minerals, just 8 miles west of Kent’s recently drilled Turnberry Prospect, underscores the potential of Gnaweeda.

Kent is one of the best-run junior exploration companies we’ve ever come across which is a major reason we have been so bullish on this company’s prospects over the last six months at BullMarketRun. The opportunity to get free shares in soon-to-be-listed Archean Star Resources at this particular time makes Kent an extremely attractive investment opportunity.

2 Comments

Nice one!

Nice work on Gold Bullion also!

Will check out Kent Exploration.

Have seen it come by many many times but have as of yet to do due diligence on them.

Go long precious metals!

Keep up the good work.

YeOldGoldNugget

Your statement: “Kent (is) an absolute no-brainer investment opportunity that even a Grade 3 student can appreciate.”

I read your analysis, and I don’t agree. I think this is awful for Kent stockholders. Yes, we get a large dividend of 25% of our stock value as Archean Star stock (which gets Kent’s Gnaweeda project). But what’s left for Kent? You state a potential 1 million oz gold deposit in New Zealand. So what? What is a 1 million oz deposit worth? Now, if you combine that deposit with Gnaweeda you have a great stock.

This is very disappointing, and I see Kent shares languishing. Sure, Archean Star might take off, but that is only 25% of my investment.

I don’t see Kent as a great stock anymore. If Kent maintains an interest in Gnaweeda, I might hold both. Otherwise, I will likely bail. Or, I might sell my Kent stock and buy Archean Star.

Thanks,

Newager