2021 Starts With A Bang

We’re only 9 days into 2021, and already we’ve seen a shocking storming of the U.S. Capitol building, a fresh impeachment attempt against President Trump, a $100 drop in Gold after Democrat victories in Georgia Tuesday gave them control of the Senate (1-party liberal rule now in Washington), new highs on Wall Street, a major new surge in cryptocurrencies, and new attacks on free speech by the radical left and their allies in Big Tech and the corrupt mainstream media.

It goes on and on and on…

On the COVID-19 front, lockdown measures in many jurisdictions are intensifying, and Canada’s embarrassingly slow vaccine rollout (should we be surprised?) has just been bungled yet again with authorities vaccinating the first federal inmates inside facilities without any active cases (Global News) ahead, of course, of many other higher priority individuals among the law abiding populace. This country is governed so incredibly poorly at every level with effective real leadership virtually non-existent.

None of this is going to end well, but the hangover likely won’t come until this pandemic is essentially over (late 2021?). Liquidity should keep the market party going until that time, with occasional corrections along the way to ease temporary excesses. COVID-19 has been stupendous for the markets once the initial crash quickly ran its course.

The key takeaway for investors from Wednesday’s historic events is how the unfortunate, appalling violence at the Capitol, and the fallout from it, have further empowered Democrats and the liberal agenda in Washington, immediately following the Democrats’ capture of the U.S. Senate (conveniently, Democrats and the mainstream media downplayed last year’s violence carried out by leftist extremists in many American cities). For the immediate future this means Stimulus on Steroids, and that can only be positive for the primary direction of Gold and commodities (despite Friday’s surprising decline in precious metals). This reality was overshadowed in recent days by the media’s 100% focus on the “insurrection”, but President-elect Biden is expected to unveil a massive economic “aid” package late next week. There is a “dire” need to act immediately, Biden declared, and the price of the stimulus plan will be “high” (thanks for the warning). Republicans, divided in ways they haven’t been over the past 4 years, are on the defensive. When attention turns to the Dems’ ambitious fiscal plans, Gold will kick hard.

The Week In Commodities

Gold suffered its worst week since November, closing at support at $1,850. Momentum traders dumped Gold Friday as soon as it fell below its short-term uptrend channel around $1,890. A rally in the U.S. dollar, a rising 10-year Treasury yield, and apparent selling of bullion by institutional players chasing equities and cryptocurrencies were all factors that contributed to a Freaky Friday for the yellow metal. Further potential downside seems rather limited. Silver fell as much as 10% Friday before recovering modestly and closing at $25.40. Key nearest resistance remains in the $26.80’s while first support is at the EMA-50 at $25.25.

Platinum and Palladium were both under pressure Friday as well, closing at $1,058 and $2,258, while base metals have performed well to begin the New Year. Copper, Nickel and Zinc closed the week at $3.67, $7.98 and $1.27.

Cobalt, up more than 10% already this year, is at a new 52-week week high of $16.33.

Crude Oil prices hit their highest level in nearly a year, posting their 9th weekly gain out of 10. WTI finished Friday at $52.73, its highest price in nearly a year, supported by Saudi Arabia’s intention to cut output. The Saudis pledged extra, voluntary Oil output cuts of 1 million barrels per day (bpd) in February and March as part of a deal under which most OPEC+ producers will hold production steady during new lockdowns.

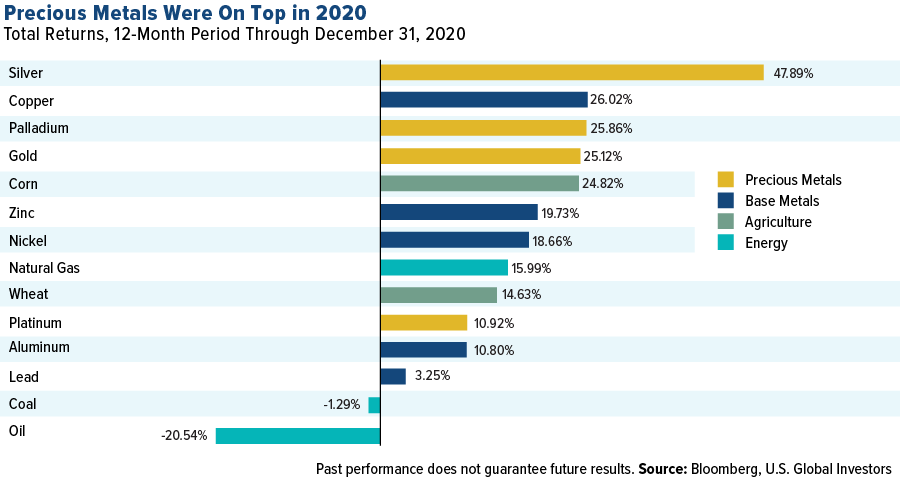

Silver Leads The Way In 2020

Silver by far was the top performer among metals and commodities in 2020, posting a 48% gain, and the 2021 outlook for Silver is brighter than ever given events of the past few days as the Biden “green agenda” will face less opposition in Congress. Copper was the #2 gainer in 2020, up 26%, and it too stands to benefit immensely from an acceleration of the green agenda and the world’s transition to renewable energy and electric vehicles. China has bounced back quicker than any country from the pandemic (the Communist Party strategized the Wuhan virus to its competitive advantage) and is gobbling up huge supplies of Copper and other commodities.

Copper and other industrial metals should also get support over the coming months from the strengthening manufacturing sector in the U.S. The ISM Manufacturing PMI registered 60.7 last month, marking its highest level since September 2018. December was also the 8th straight month that the gauge of manufacturing activity held above 50.0. All 6 of the biggest manufacturing industries expanded, including fabricated metal products.

Cryptocurrency Craze

Bitcoin enjoyed a fabulous start to the New Year – is it ready for a correction or will it continue to power higher?

Find out by reading the rest of today’s Week In Review And A Look Ahead!

If you’re a non-BMR subscriber at the moment, and would like a free eAlert highlighting one of our top opportunities, email us at: [email protected] (must include first name).

To read the rest of today’s Week In Review And A Look Ahead!, sign up NOW or login as a current subscriber with your username and password.

Questions for us? Email us at: [email protected].