The junior exploration market is in dire need of a major grassroots discovery somewhere, yet most Venture resource companies are now like a deer caught in the headlights – “frozen” on a highway to nowhere, not sure which direction to move, or how to move.

So it’s refreshing to see any company in the midst of a drill program right now. Last Sunday, in our Week In Review And A Look Ahead feature, we highlighted a small list of explorers who are particularly active at the moment and have the potential to create tremendous shareholder value in 2016 with the right mix of expertise and good luck. They range from the well-known Integra Gold (ICG, TSX-V), conducting one of the most aggressive exploration programs on the entire planet at Lamaque South in Val d’Or, Quebec, to Bacanora Minerals (BCN, TSX-V) in central Sonora State with a massive Lithium discovery, to the very speculative tiny market cap Ashburton Ventures (ABR, TSX-V). Seemingly against all odds, ABR aims to become the Little Engine That Could as it drills the Buckingham Graphite Property in Quebec with some interesting early apparent success (the stock has doubled from a penny over the last 9 sessions on total volume of more than 22 million shares). ABR is sort of the “poster child” for unloved junior exploration companies. If it actually succeeds, well…that would restore a lot of hope throughout the industry.

“The junior resource market needs a big find. I mean, a really big find,” stated Steve Regoci, President and CEO of Garibaldi Resources (GGI, TSX-V), in a recent video interview with BMR that we’ll be posting in the coming days. “There’s a lot of money on the sidelines waiting to pile into a major new discovery somewhere. The limited number of companies who are active right now with quality projects and strong management can really stand out in this market and grab a disproportionate share of the attention, especially if sentiment begins to turn as it usually does around this time of the year. That gives shareholders of these companies a competitive advantage,” declared the former broker.

Regoci has hit the jackpot before during challenging market conditions. In February 2009, Garibaldi sold its option interest in the 54,000 hectare Temoris concessions in Chihuahua State, Mexico, by using cutting edge technology to correctly identify what would turn out to be a high-grade Silver/Gold deposit now being developed by Coeur Mining (CDE, NYSE).

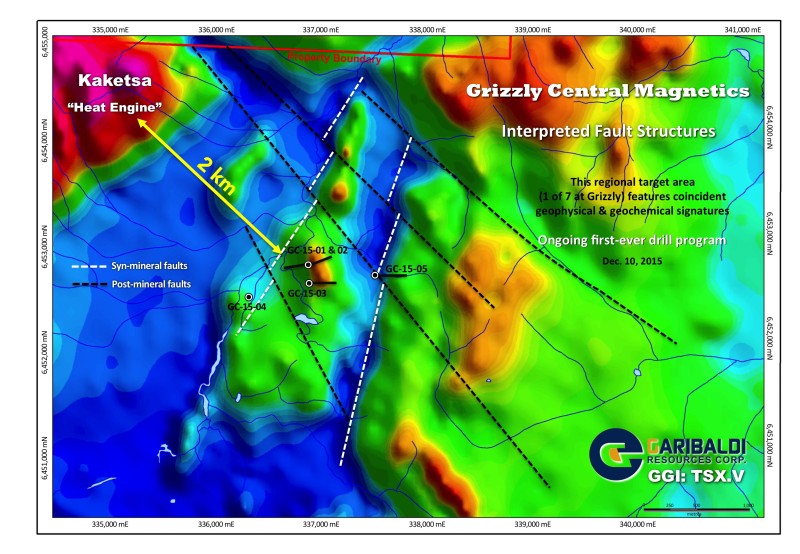

Earlier today, Garibaldi provided a fresh update on its first-ever drill program at Grizzly Central in the prolific Sheslay district of northwest British Columbia where Doubleview Capital (DBV, TSX-V) is also gearing up to resume drilling at its growing Hat deposit.

Something unique in this district appears to be emerging along what GGI is now calling the “Kaketsa Corridor” – a large area that trends west and northwest toward the fertile Kaketsa pluton. Historically, it was overlooked by prospectors due to what’s now known to be a thin layer (approximately 10 to 30 m) of widespread glacial till. Garibaldi’s proven knack for finding high-grade would be a game-changer in the Sheslay region if indeed 1 or more of these holes has discovered a Gold-rich core with a porphyry system surrounding it (various clues are pointing in that direction). The Grizzly has scale – and an all-important “heat engine”.

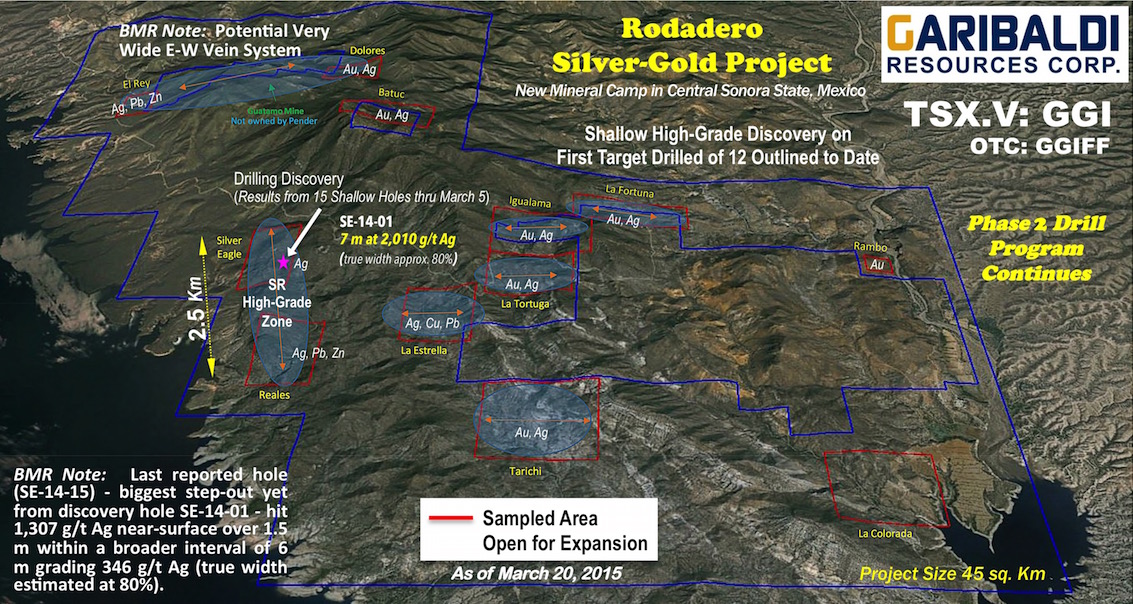

Meanwhile, down in central Sonora, Garibaldi has mobilized its company-owned drill rig to the Rodadero Project where an exciting shallow high-grade discovery was made last year (again, thanks to technology and proprietary data) in 15 holes completed at the Silver Eagle target. In addition, surface sampling throughout the 50 sq. project returned impressive high-grade Silver and Gold values that defined 11 other target areas, giving Rodadero district-scale potential and drawing the early attention of some majors.

Sonora seems to have it all, as evidenced by many producing high-grade mines and the huge discovery of Lithium in the central part of the state, just 30 miles or so northeast of Rodadero.

Don’t forget some producers who are also carrying out significant drill programs to expand their current high-grade resources. Those companies include Richmont Mines (RIC, TSX), Claude Resources (CRJ, TSX) and Kirkland Lake Gold (KGI, TSX), while emerging producer Pretium Resources (PVG, TSX) is carrying out exploratory drilling at its world class Brucejack deposit in northwest B.C.

Note: John and Jon both hold share positions in GGI. Jon also holds share positions in DBV, ABR and RIC.

12 Comments

CIA.TO halted.

Out of YFI at open…its looks like is going to take a breather….will get back in for the next leg up post consolidation.

Potentially important reversals in the Dollar Index and Gold this morning…interesting.

Venture 1 point away from seeing 400 series of points. Unreal!

All things considered, Tony, the Venture is holding up very well, outperforming certain other markets which signals an imminent turnaround…reversals happening in Gold and the dollar, bodes well…next week will be fascinating once Yellen pulls the trigger…

Dave- CYP- you probably saw the NR, only a slight upward market response as yet.

EQT- you were correct 2 wks ago, about no results, hope it is because

they have encountered some high assays they need to recheck??

Jon, do you really think Yellen will raise interest rates?

Yes, Phil, I do. I think the market is also telling us that’s what she’s going to do come Wed.

I beg to argue that the venture is not holding up well at all. This index is broken.

In a relative sense, Seamus, the Venture has interestingly out-performed several markets since the beginning of October, and that kind of divergence typically signals a near-term change in direction, and we’re now about to enter a period of historical seasonal strength…so it has held up very well in the face of some pretty extreme downward pressure on certain commodities including Gold’s sharpest 1-month drop in 2 years…and we all know what’s happening with Oil…like every December at this time, it’s best to look ahead at what will likely unfold and accumulate quality opportunities…

To be fair though Jon the only reason the Venture has held the 500 line so far is because it has been so extraordinarily bombed out compared to any other market on the planet.I think its down what 85 or 90% from its high. No other market on the planet has been hit as hard as this or even close I would have to say, so one would think we have reached the low here but there has been no confirmation of that yet it could still go a bit under the 500 mark and if it does then I would think we will see a big bounce up.

Jon – I have got to agree with everyone else. It might look like it has held up well the last few months, but looking at the chart, it looks like it is going into the 400’s. The DJIA and Nasdaq have a double top and “M” formation, very bearish. They are getting ready for a hard correction.

Bob – yes, good news on CYP, maybe it moves more after Christmas when things pick up steam again. EQT, no re-check of assays. My suspicion is a different analytical procedure done to add the the suite. Now is the time to decide if you want to trim your EQT postion or add to it. Any stock posses risk at assay time. It all depends on markets perception, but there have been more sell on the news scenarios than buy on the news the last 7 years. Your window is narrowing on decisions for EQT. NR very very soon.