Visit the BMR comments section throughout the day for updates and helpful information.

1. Spot Gold has traded between $1,789 and $1,807 so far today…as of 7:00 am Pacific the yellow metal is off $1 an ounce at $1,801…Silver, on track to soon top $20, is up a nickel at $19.06…Silver is looking at more gains going forward, says TD Securities, citing the metal’s safe-haven appeal as well as its industrial component…“Silver could continue to outperform – benefiting from both the positive precious metals environment and its industrial characteristics, at a time when its supply may remain constrained. In fact, we expect the Silver market to operate at full or even above full utilization as recent volatility in the EFP has created a disincentive for market participants to rid themselves of physical Silver,” TD Securities commodity strategists write…as prices head higher, continued CTA buying could lead to even more gains…“We see a fat right tail in Silver,” the strategists added…base metals, which have enjoyed a nice run recently, are under mild pressure in early trading with Copper, Nickel and Zinc at $2.93, $6.01 and 98 cents, respectively…Crude Oil has slipped 35 cents to $39.75 while the struggling U.S. Dollar Index has fallen another one-tenth of a point to 96.35…Prime Minister Boris Johnson has ordered Huawei equipment to be purged completely from Britain’s 5G network by 2027, risking the ire of China by signalling that the world’s biggest telecoms equipment maker is no longer welcome in the West…today’s decision is a significant blow to Huawei, which had been ramping up its investment into the U.K. with a new research and development center in Cambridge, and a push for developers at the start of the year to help it build an alternative to Google’s Play App Store…Huawei was cut off from licensed Google software last year due to U.S. trade measures…

2. JPMorgan Chase (JPM, NYSE) has reported 2nd-quarter profit that beat analysts’ expectations on record trading revenue bolstered by surging volatility and the Federal Reserve’s unprecedented actions to prop up credit markets…the bank posted earnings of $4.69 billion, or $1.38 a share, exceeding the $1.04 per share estimate of analysts surveyed by Refinitiv…revenue of $33 billion exceeded the $30.3 billion estimate…“Despite some recent positive macroeconomic data and significant, decisive government action, we still face much uncertainty regarding the future path of the economy,” CEO Jamie Dimon stated…“However, we are prepared for all eventualities as our fortress balance sheet allows us to remain a port in the storm”…Q2 was a disappointment for Wells Fargo (WFC, NYSE) which posted its first quarterly loss since the financial crisis as the bank set aside $8.4 billion in loan loss reserves tied to the pandemic…the bank had a net loss of $2.4 billion in the 2nd quarter, or a loss of 66 cents a share, worse than the 20 cents a share loss expected by analysts surveyed by Refinitiv…revenue of $17.8 billion was also weaker than analysts’ $18.4 billion estimate…“We are extremely disappointed in both our 2nd quarter results and our intent to reduce our dividend,” CEO Charlie Scharf stated…“Our view of the length and severity of the economic downturn has deteriorated considerably from the assumptions used last quarter, which drove the $8.4 billion addition to our credit loss reserve in Q2“…

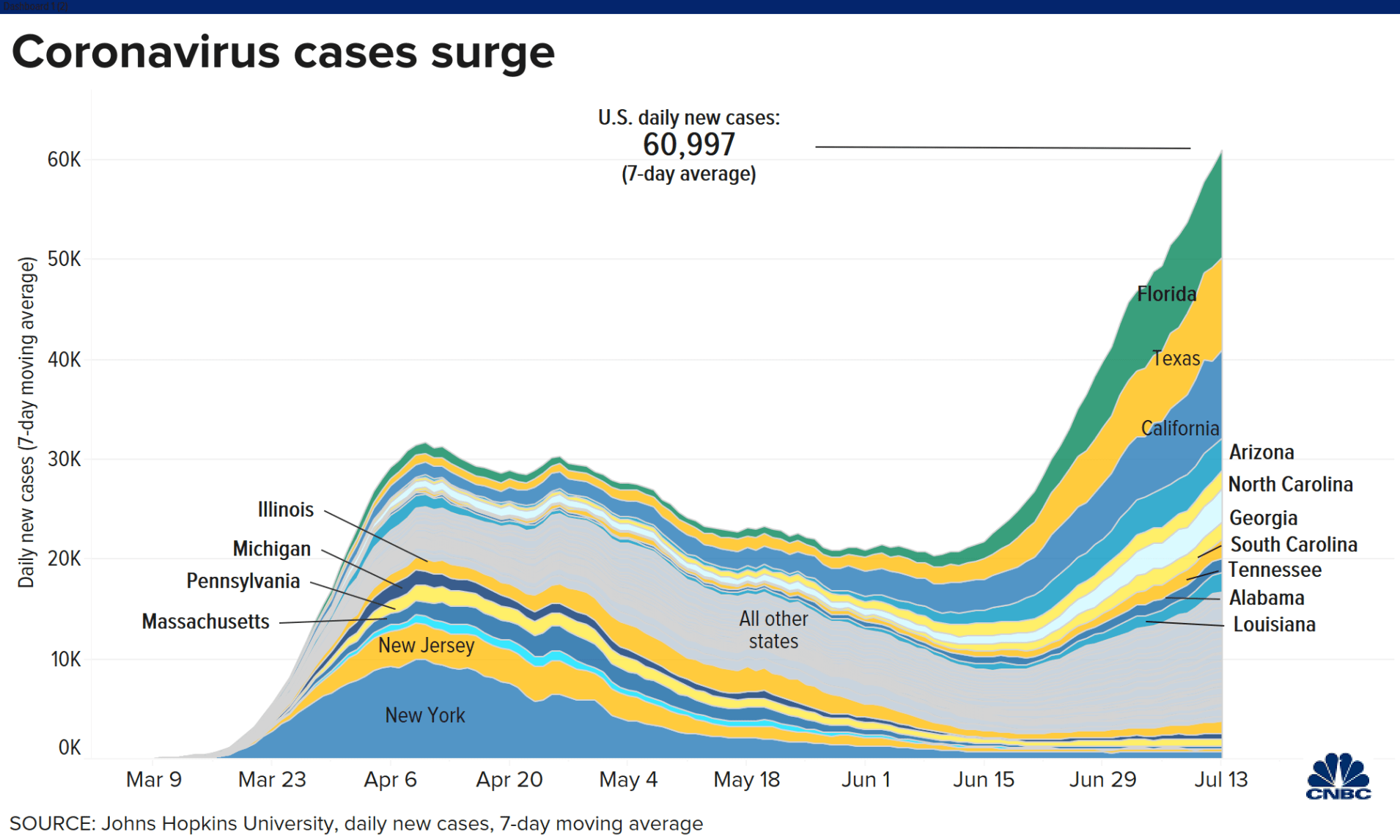

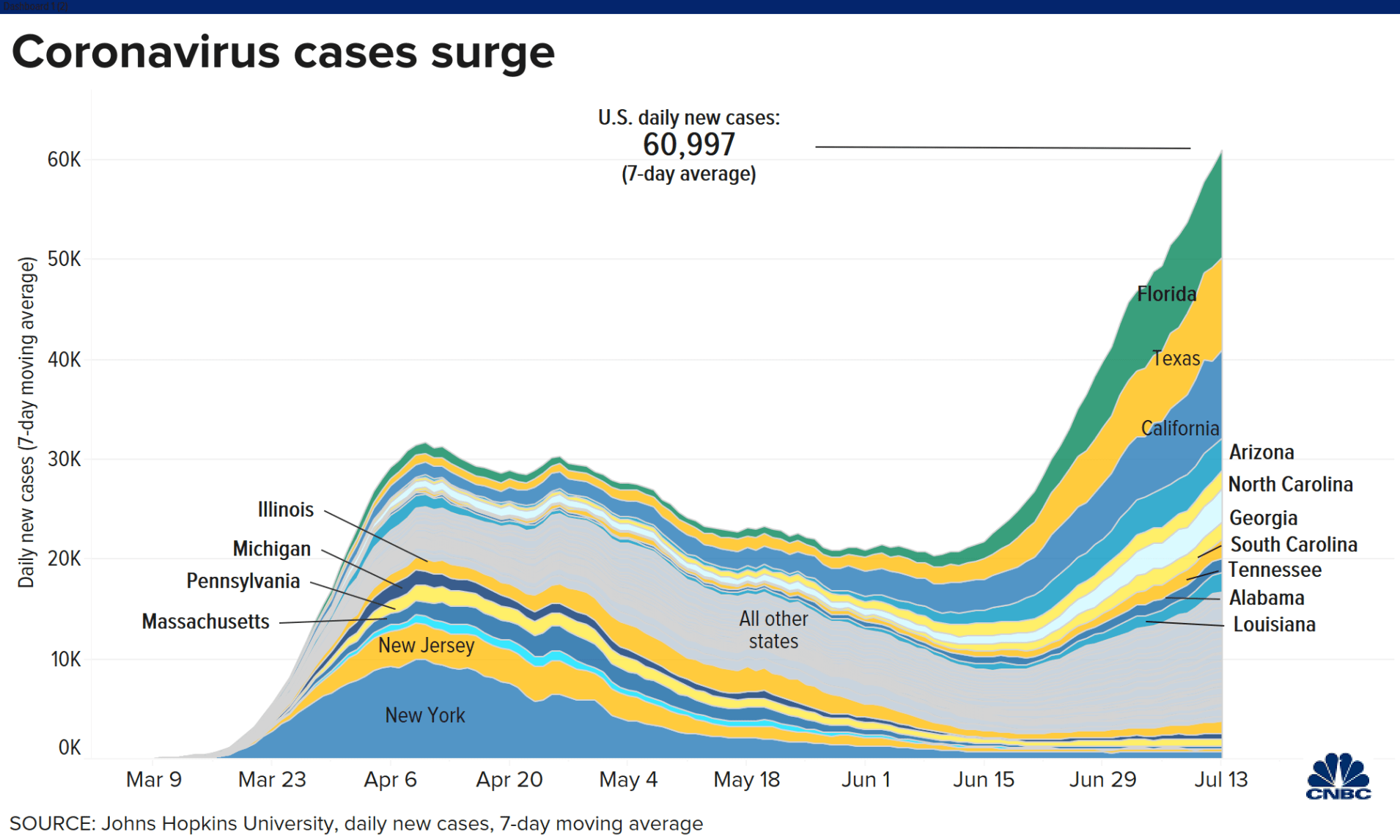

3. Wuhan COVID-19 cases in the U.S. continued to surge yesterday, with some states instituting new measures to stem transmission, while some countries where the virus once appeared to be contained imposed new restrictions to combat fresh outbreaks…more than 135,600 people have died from COVID-19 in the U.S., according to data compiled by Johns Hopkins University, and more than 3.36 million have been infected…world-wide, more than 573,000 have died and more than 13.1 million have been infected, according to Johns Hopkins data…California has imposed new restrictions including an immediate halt to indoor activities in restaurants, bars, museums, zoos and movie theaters…liberal Governor Gavin Newsom has set up “multi-agency strike teams” to make sure businesses across the state are adhering to his orders to close shop as cases of COVID-19 surge…the strike teams, which will consist of members from the state’s Alcohol Beverage Control, Occupational Safety and Health Administration, Highway Patrol and other departments, will target “non-compliant workplaces”…Big Brother is certainly on the march…the Los Angeles Unified School District, the nation’s 2nd-largest after New York, said yesterday that it would start the school year online…Oregon has banned most indoor social gatherings of more than 10 people with the Democrat-run state requiring people to wear masks outside when they can’t properly social distance…Florida, which saw daily new infections jump over the weekend, joined Arizona, Texas and Michigan in recently putting restrictions on bars…Florida Gov. Ron DeSantis, a Republican who said last week that he had no doubt schools could operate safely, said yesterday that parents should have the option of virtual schooling…Florida this morning reported a 3.3% increase in COVID-19 cases, below a 7-day average of 4.6%…

2.

4. Pascal Biosciences (PAS, TSX-V) announced this morning that it has discovered certain cannabinoids that block replication of SARS-CoV-2, the coronavirus that causes COVID-19…in a cell-based assay, the best cannabinoid had potency similar to remdesivir, a recently approved drug from Gilead (GILD, NASDAQ) that improves recovery time for COVID-19 patients…this suggests a Pascal-identified cannabinoid may have the potential to limit the severity and progression of the disease, according to the company…there are many efforts throughout the world to create a vaccine or therapeutic drug for COVID-19…most experts estimate it will take a year or more to produce, test, and manufacture sufficient quantities of an effective vaccine…the path to identifying COVID-19 therapeutics has been faster, leading to emergency authorization of remdesivir in the U.S. and approval in the UK for dexamethasone..both of these drugs have improved outcomes for hospitalized COVID-19 patients…typically, multiple drugs are required to provide effective antiviral therapy…other viral diseases such as HIV and Hepatitis C, for example, require 2 or 3 drugs for effective treatment…Pascal believes that based on its novel discovery, a cannabinoid may well become an essential component of an effective drug cocktail for the treatment of COVID-19…PAS has jumped 8 cents to 33 cents through the first 30 minutes of trading…PAS‘ 200-day SMA is reversing higher, ending a long decline…

5. Aux Resources (AUX, TSX-V), formerly Auramex Resource, has mobilized its geological field crew to its flagship high-grade Gold Georgia Project, including the past-producing Georgia River mine, located on tidewater 16 km south of the town of Stewart in the prolific Golden Triangle…the 2020 field program will be centred around drill testing the Georgia Project…fieldwork over the past few years has indicated the presence of a large mineralizing system, of which the past-producing Georgia River mine is situated just at the periphery…to test the system, more than 3,500 m of diamond drilling are planned, focusing on mineralization around the past-producing mine as well as targets within the adjacent Hume Creek Deformation Zone…“Fully funded, we are eager to drill test Dr. Metcalfe’s compelling geological model for the mineralization around the Georgia River mine”, stated CEO Ian Slater…“This is excellent timing to advance and expand an under-explored high-grade Gold system in the Golden Triangle”…in addition to drilling, the 2020 summer exploration program will include detailed geological mapping, geochemical sampling, and geophysics of key exploration targets on the Georgia Project, as well as other AUX claim blocks…11,750 m of drill core from previous operators of the Georgia River mine was only sampled for narrow high-grade intercepts, with the majority of the core not being sampled…this core is currently being relogged and sampled in its entirety…shoulder sampling between high-grade intervals has the potential to define broad intervals of economic mineralization that were previously undocumented…this additional data provides a cost-effective method to leverage the additional 3,500 m of drilling in 2020, rapidly advancing the project relative to the exploration expenditure…

6. The Dow has climbed 84 points in early trading…Bespoke Investment Group pointed out that yesterday marked only the 3rd time since 1985 that the NASDAQ hit an intra-day record before ending a session down more than 1%…in Toronto, the TSX is up 13 points as of 7:00 am Pacific…the Gold Index, looking very strong, has rebounded 3 points to 350 after yesterday’s pullback…in a note to analysts yesterday, Haywood Securities said B2Gold (BTO, TSX, NYSE) trades below its peers and believes the company has further to run…“We reiterate our positive thesis on BTO, and continue to highlight the name as a top pick within the senior Gold production equity sector, given our constructive view on projected FCF growth (FY21 FCF yield of ~11%), growing dividend yield, improving net debt position, execution history across a diverse asset base, and near-to mid-term organic growth catalysts”…the company said more cash is expected…based on current assumptions, including a Gold price of $1,700 per ounce for the balance of 2020, the company expects to generate cashflows from operating activities of approximately $850 million in 2020…the Venture reversed intra-day yesterday, ending an 11-session winning streak…however, the 7.8% drop from yesterday’s high of 703 to this morning’s low of 648 and the supporting EMA-8 was merely healthy profit taking and prepares the market for significantly higher levels…this is a bull market on steroids…

7. The loony left should love this: Burger King has apparently found a way to help “save the planet” by helping cows fart less…“According to the United Nations’ Food and Agriculture Organization,” Burger King (Restaurant Brands Interntional) stated in a new release this morning, “livestock is responsible for approximately 14.5% of global greenhouse gas emissions. Cows release methane, a greenhouse gas that traps the sun’s heat and warms the planet, as a byproduct of their digestion. To help tackle this environmental issue, Restaurant Brands International Inc.’s Burger King brand partnered with top scientists to develop and test a new diet for cows, which according to initial study results, reduces up to 33% per day, on average, of cows’ daily methane emissions during the last 3 to 4 months of their lives. The formula for this new diet is open source and fairly simple to implement. Preliminary tests suggest that adding 100 grams of lemongrass leaves to the cows’ daily veterinary prescribed diet during their last 4 months, helps them release less methane as they digest their food. This initiative is part of our Restaurant Brands for Good framework. At Burger King trademark, we believe that delicious, affordable, and convenient meals can also be sustainable,” stated Fernando Machado, Global Chief Marketing Officer for Restaurant Brands International…“We are making all our findings public,” Fernando added…“This an open source approach to a real problem. If the whole industry, from farmers, meat suppliers, and other brands join us, we can increase scale and collectively help reduce methane emissions that affect climate change”…

Rapid Response!

How This Pandemic Will Ultimately Help Copper

Wuhan COVID-19 Virus Update

The Cost Of Doing Business With China (The CCP)

“Silver Lining”: Innovative Vancouver Company Provides Help During Crisis

COVID-19 Update

Smithers Shakes Off Turmoil For A Major 3-Day Event Connecting Hockey And The Resource Sector

Turbocharged Nickel

Commodity Check!

The Nickel Mountain Magma Highway

The Dramatic New Chase For A Nickel-Copper-Rich Massive Sulphide Deposit In The Heart Of A Famous Gold Camp

BullMarketRun.com

BullMarketRun.com