Gold has traded between $1,091 and $1,111 so far today…as of 10:00 am Pacific, bullion is up $19 an ounce at $1,106…Silver has jumped 13 cents to $14.15…Copper is flat at $1.99…Crude Oil has fallen another $2 a barrel cents to $26.42 while the U.S. Dollar Index is off more than one-tenth of a point to 98.92…

As we warned last week, the Dow and the broader indices were about to fall off a cliff, dragged down by increasingly weak technicals and other factors including a growing loss of confidence in governments and central banks around the world – from Canada to China…Gold is benefiting as a result and has a chance to really take off to the upside…there is safety in these markets in profitable Gold producers, and two of our favorites are giving investors shelter from today’s storm – Richmont Mines (RIC, TSX) and Claude Resources (CRJ, TSX)…in today’s Morning Musings, we have a chart that shows how spectacularly these two companies have outperformed the TSX Gold Index over the last couple of years…with a 60-cent Canadian dollar on the way in 2016, thanks in part to government policies, RIC and CRJ will each enjoy another banner year…

As we warned last week, the Dow and the broader indices were about to fall off a cliff, dragged down by increasingly weak technicals and other factors including a growing loss of confidence in governments and central banks around the world – from Canada to China…Gold is benefiting as a result and has a chance to really take off to the upside…there is safety in these markets in profitable Gold producers, and two of our favorites are giving investors shelter from today’s storm – Richmont Mines (RIC, TSX) and Claude Resources (CRJ, TSX)…in today’s Morning Musings, we have a chart that shows how spectacularly these two companies have outperformed the TSX Gold Index over the last couple of years…with a 60-cent Canadian dollar on the way in 2016, thanks in part to government policies, RIC and CRJ will each enjoy another banner year…

The U.S. Federal Reserve has become too focused on questionable jobs figures, not seeing the bigger picture of the Oil market, the problems brought on by a record run in the dollar including a manufacturing recession and increasing deflationary pressures, plus heightened equity market risks, U.S. political upheaval, and geopolitical dynamics…watch what happens – Janet Yellen and the Fed will have to backtrack on their plan to continue to raise interest rates, and the market will be asking: “What kind of ammunition do you have to fight a possible near-term recession?”

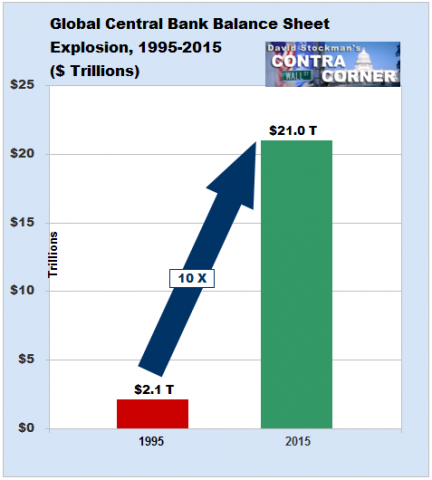

Are global central banks out of dry powder after a 20-year binge of balance sheet expansion, as David Stockman argues? (“It means there will be no printing press driven reflation of the financial markets this time around. And without more monetary juice it’s just a matter of time before a whole generation of punters and front-runners abandon the casino and head for the hills.”)

We don’t underestimate the capacity of central banks to become even more creative which could have a very positive impact on Gold…

Weak U.S. Economic Data Today

Consumer prices in the U.S. decreased by a seasonally adjusted 0.1% during December, the Labor Department reported this morning…the core index for CPI, excluding the volatile food and energy sectors, was up 0.1% – the smallest increase in this index since August…

Meanwhile, the Commerce Department announced that U.S. housing starts fell 2.5% to a seasonally adjusted annual rate of 1.15 million units during December…building permits – important as an indicator of future construction activity – fell 3.9%…

In today’s Morning Musings…

1. The level the S&P 500 must hold but probably won’t…

2. The Short Canada Trudeau Trade (HXD, TSX) jumps another 15%…

3. Searching for bargains – Columbus Gold (CGT, TSX-V) has plenty of fundamental strengths…

Plus more…to view the rest of today’s Morning Musings, login with your username and password, or click here to gain full access to this and other exclusive BMR content and features…

26 Comments

Nice bid for WRR !

I like it when I see Dundee buying WRR…this rise in Gold, and some high-grade intersections from Lapon Canyon, would be an excellent combination.

Robin – #37 from yesterday – which gold stock… I bet he would say RIC!!!!

Patricia.. it was $29:)

WRR has popped!

The poor guy who had to bail last week at 3 cents…this could really fly now.

WRR is the eighth most active today with a 25% increase

I bought a few more WRR this morning at 3.5c.

Jon

amazing how RIC is holding up so well with most gold stocks down today it was actually up…

RIC is an earnings machine, Greg – debt-free, tons of cash, expanding high-grade resources, solid management. They’re also benefiting a lot from the lower Canadian dollar, as well as low Oil prices of course. Any significant pullback in RIC has always been a buying opportunity the last 2 years. Has really outperformed both Gold and the TSX Gold Index.

WRR- I hope another good day tomorrow !

Good report today,Jon.It jives exactly with what I’ve been seeing the last few days on the talk shows.Much more of this to come.Gold,it appears is the only place to go.

Jon, could you draw us some scenario if GGI hit high grade gold in current market environment as describe above.

Damn, venture gets hammered on huge volume. I see a hammer did form, but i don’t see a reversal any time soon. Lots of $$ talk shows saying fed is going to have to pull a QE4 near end of year. Anyone have any thoughts on this? Could this be the venture’s savior?

A lot of the experts in the gold and financial fields have said when gold really takes off because of the collapse in the financial markets it will be a catch 22…. as those of us holding gold and gold stocks will be happy…. but we may not like the world we find ourselves living in…

there are a lot of people that made a lot of money over the last 4 yrs in the stock market, hopefully they are getting out with some of it and not listening to their brokers who are telling them the same old story to hold on… it is just a correction as they watch all their profits disappear…. the ones that do and have gotten out are going to be looking to put that money somewhere and I believe it will be gold and gold stocks…. we shall see

WRR is looking cleaner finally! closed at 5! hoping for a move thru this 5 level sooon in 2016! Good call Jon!

Jon… the link crap on the left hand side is back encroaching on the forum… just an FYI I am using Firefox:)

Re #3 … she was right:)

LOOKS LIKE WRR IS JUST PRIMED TO GO ‘UP’……NICE BIDDING….NEED TO CLEANUP THE 5’S NEXT!

It’s definitely looking, Steven1…we’ll have an updated chart this morning…

WRR – I like it !

WRR- .055 Yessssss

I don’t get it. WRR has 0 income 0 cash and negative earnings but it is being bid up?

This is the speculative junior resource market, David, not the Dow. They’re drilling with a decent chance for a high-grade Gold hit that could propel the stock higher. As beaten down as it is, and also because of that, certain situations in the exploration sector do offer tremendous potential leverage for investors.

ABR.v news out Ashburton completes first work program at Elon Lithium claims in Nev stockwatch.com/News/Item.aspx?bid=Z-C%3aABR-2341355&symbol=ABR®ion=C

WRR- Sorry David WRR as enough money for continuous drill !!!

WRR – Whoever said this had a “small” public float of 8,000,000 was way off as its traded over 3,000,000 and it’s up a whopping penny!!