Gold has traded between $1,257 and $1,271 so far today…as of 12:20 pm Pacific, bullion is up $11 an ounce at $1,270…Silver has climbed 14 cents to $16.70…Copper is steady at $2.85…Nickel is 3 cents higher at $4.60…Crude Oil, at $49.76, has surged 76 cents a barrel while the U.S. Dollar Index has tumbled another half point to 93.33…

Gold got an extra boost this morning after the hideous regime of North Korea became even more provocative, test firing a missile that landed in the Sea of Japan, about 600 miles from the launch pad…the missile flew for 47 minutes and reached an altitude as high as 2,300 miles, South Korea military told Reuters…

Gold got an extra boost this morning after the hideous regime of North Korea became even more provocative, test firing a missile that landed in the Sea of Japan, about 600 miles from the launch pad…the missile flew for 47 minutes and reached an altitude as high as 2,300 miles, South Korea military told Reuters…

Analysts had estimated that North Korea’s first ICBM on July 4 could have reached Alaska, and said that today’s missile appeared to extend that range significantly…U.S. Presidents beginning with Clinton and other world leaders over the last couple of decades, not to mention the useless United Nations, have done nothing but kick the can down the road with North Korea…career politicians have failed miserably on this issue…now the rogue regime is Donald Trump’s problem to solve after such a “smooth” handover from Obama whose “red lines” were nothing more than a mirage…

Yesterday, Iran, another part of the original Axis of Evil, launched its own rocket – based off a North Korean design – towards space…the Islamic Republic said the launch was a success, but U.S. assessments pegged the Iranian posture as propaganda…officials believe the Iranian rocket suffered a “catastrophic failure” and likely blew up…

There have been diverging trends in the actions of futures speculators and exchange-traded-product investors in the Gold and Silver markets, according to an analysis by Societe Generale…speculators in the futures markets have scaled back bullish exposure to Gold in recent weeks and are net bearish in Silver…contrarians will take that as a bullish sign…ETP investment is being described as fairly stable or modestly rising in Gold and Silver…ETP holdings typically tend to be “stickier”, reflecting investor behavior beyond the near or short-term…

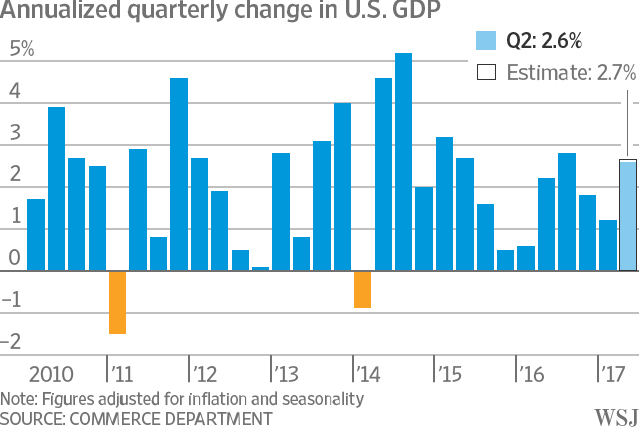

No Upside Surprise In U.S. Growth

The U.S. has entered the 9th year of economic expansion on a familiar path of steady but unspectacular growth, with few obvious indications it is near exhausting itself…GDP, the broad measure of goods and services produced, rose at a 2.6% annual rate in the April to June period, the Commerce Department reported this morning…figures are adjusted for inflation and seasonality…the Q2 advance marked a rebound after a lackluster start to the year when GDP grew at only a 1.2% clip…it’s possible the economy could be repeating a familiar pattern of weak winters followed by a stronger spring and summer…

Crude Oil Update

Significantly, Crude Oil has broken out of its downsloping channel pattern since the spring, pushing beyond strong resistance at $48 a barrel…next obvious target is $51.50 as you can see on John’s updated chart…

What was different about Oil’s downtrend during the first half of this year vs. the collapse in prices that began in late 2014 is that the Saudis have been working fervently to push prices back up…budget issues and a likely 2018 IPO of their state-run Oil company have given the Saudis all the incentive they need to try and push Oil prices higher…a declining U.S. dollar has been a contributing factor as well to a recovery in Crude prices, and there’s no sign the greenback is going to reverse anytime soon…

News just in a short while ago – Oil field services firm Baker Hughes has reported that the number of Oil rigs operating in the U.S. rose by just 2 to a total of 766 last week…the rig count has risen fairly steadily for more than a year but the growth has recently moderated…

Copper Update

What a great week for Copper!…

Now’s there’s a prediction from a major CEO that Copper prices could rise to boom time highs of more than $4 (U.S.) a pound thanks to unexpectedly low supply as global growth continues…the last time Copper was at $4 was in 2011 when it rose to an all-time high of $4.62…

The prediction, from Freeport McMoran chief Richard Adkerson, came as Copper prices jumped overnight to a new 2-year high on Chinese growth and tight supplies…

Speaking to investors after the release of Freeport’s Q2 earnings last night, Adkerson said global Copper supplies were only going to get tighter as growth spurred more demand for the industrial metal, which is often seen as a barometer for economic growth…

“You’re going to see a period of time where there’s going to be a shortage of Copper, and you’re not going to see the price (just) go to $3,” he told investors. “We just need to look over our shoulders and we can see at times we had Copper at $4, and we’re heading for a world of where that is, I believe, in the cards. There are some projects that are being completed and so forth, but the wall of Copper that was supposed to come about in 2016 didn’t show up,” he added…

The big turnaround for Copper came at the beginning of 2016 when the price touched the long-term uptrend line around $1.90 just as most investors were extremely bearish…at the same time, RSI(14) hit levels not seen the 2008 Crash and the 60-cent bottom in late 2001…

The Venture, a reliable leading indicator, took off before Copper did in 2016 but recently the metal has outperformed the Venture…we’d like to see that dynamic change during this 2nd half of the year with the Venture leading the way again which is a sign of a healthy, robust bull market…

In today’s Morning Musings…

1. Garibaldi Resources (GGI, TSX-V) wakes up the Eskay Heart of Gold Camp…

2. Aben Resources’ (ABN, TSX-V) update…

3. A must-own Gold producer keeps producing for shareholders…

4. Daniel’s Den – “Friday Footnotes”, how Amazon can’t knock out Teladoc, and record earnings for Mitek…

Did you know that for as little as just over $2 a day, you can be a BMR subscriber and tap into the best analysis and picks for the junior resource sector that you’ll find anywhere, including coverage of game-changing discoveries that have already made some of our subscribers fortunes?

Last year’s BMR Top 50 List returned a whopping 118% and we are delivering market-trouncing returns again in 2017. BMR was the first to call the new bull market in the Venture in early 2016, and our coverage of the commodities space gives you valuable daily insights into price movements and critical trends. BMR is daily information that puts you ahead of the crowd!

We also give first-time subscribers an industry-leading 100% money-back satisfaction guarantee. If you don’t believe BMR has helped you make money for your first 6-month subscription period, we’ll refund your subscription fee in full – no questions asked!

To read the rest of today’s Morning Musings, sign up NOW or login as a current subscriber with your username and password.

Questions for us? Email us at: [email protected].

4 Comments

Jon,

Any thoughts on Nevada Energy Resouces (BFF) and Lithium? Any progress between GGM and DRA to expect? Have a good weekend…

Arjan

Jon,

Any new Research on BCK?

Thanks, Maik

Soon, maikenders. Just waiting for the company to come out with some more news. Once the ball starts rolling with this one, it’ll be hard to stop given the Blend and Engineer projects and the tight share structure. They did a deal with Eagle Plains on a 3,000-ha Zinc property in the NWT the other day which adds to the portfolio depth, but I see Blende as the key first catalyst.

Jon don’t forget to tell everyone about the blue skies ahead for Cxo, congrats to the longs and Ggi, also Gtt wow