Gold has traded in a narrow range between $1,265 and $1,270 so far today…as of 11:30 am Pacific, bullion is off slightly at $1,268 as it prepares to close a strong month of July…Silver is 5 cents higher at $16.79…Copper has edged up 2 cents to $2.87…Nickel has added a penny to $4.61…Crude Oil reversed higher from its morning lows, now within just 25 cents of $50 a barrel, while the U.S. Dollar Index has tumbled nearly half a point to 92.92…support at 93…

The bullish positioning in Gold futures by large speculative accounts surged 153% in the aftermath of scaled-back expectations for future monetary tightening by the U.S. Federal Reserve, based on the most recent data from the Commodity Futures Trading Commission…meanwhile, also for the week ending July 25, Silver speculators swung from net short to net long…

The price of Copper hit a new 2-year peak today on upbeat manufacturing data in top consumer China, while Nickel touched a near 4-month high on renewed supply worries and soaring steel prices…growth in China’s manufacturing sector cooled slightly in July, as foreign demand for Chinese goods slackened, but a government-led drive to develop infrastructure boosted growth in the construction sector…the data, combined with an environmental crackdown in China, sent Chinese steel prices to their highest since December 2013…Nickel of course is used to make stainless steel…

Crude Oil Update

July has been the strongest month for Crude Oil this year as news of a producers’ compliance meeting next week added to bullish sentiment driven by the threat of U.S. sanctions against OPEC-member Venezuela…the Trump administration is reportedly considering imposing sanctions on Venezuela’s Oil sector in response to yesterday’s election of a constitutional super-body which Washington has denounced as a “sham” vote…

Drilling for new U.S. production is also slowing, with just 10 rigs added in July, the fewest since May 2016…

Significantly, WTI has broken out of its downsloping channel pattern since the spring, pushing beyond strong resistance at $48 a barrel…next obvious target is $51.50…

Venture Long-Term “Big Picture”

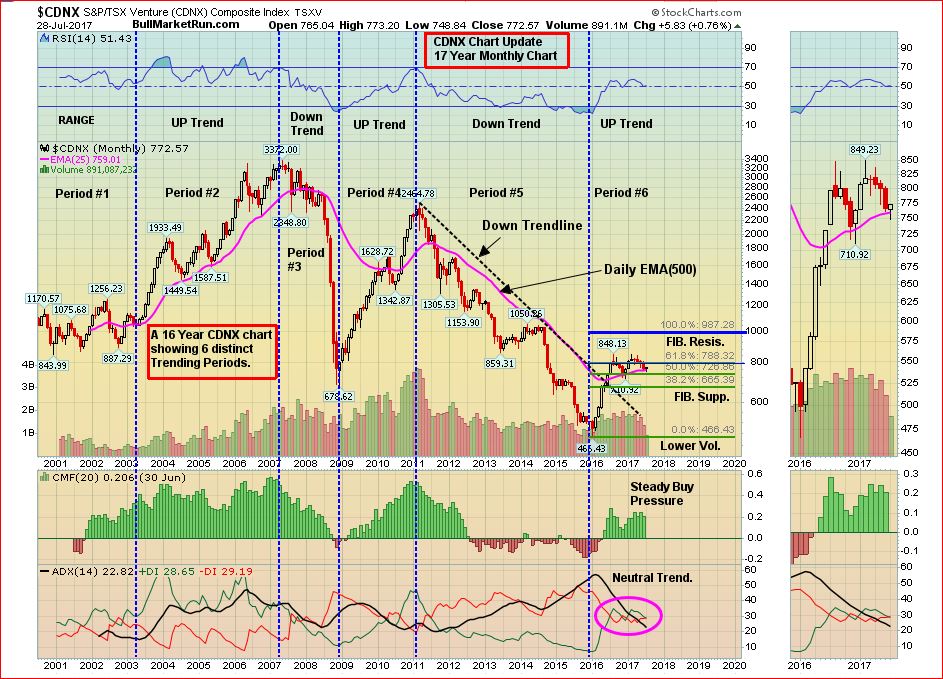

The consolidation in the Venture that started in August of last year ended, in our view, just over a couple of weeks ago when the Index touched a 2017 low of 749 – the rising 500-day exponential moving average (EMA-500) at the time…

Note in the long-term chart below how the EMA(500) has been the key moving average that has defined Venture bear and bull markets for the past 17 years; in other words, the EMA(500) is powerful resistance during bear cycles and powerful support during bull cycles…

No bull market has ever NOT retreated to its 500-day EMA, just like this one did earlier this month around 750…sudden big moves to the upside have consistently occurred almost immediately after the EMA(500) has been tested!…

RSI(14) appears to be finding new support at 50% and should start turning higher…buy pressure has remained steady on this long-term monthly chart during the consolidation phase since August of last year, meaning “smart money” has been accumulating on weakness…

Next major price target is near 1,000…

John has divided Venture history into 6 distinct trading periods…we’re now in “Period 6“ – a confirmed bull cycle that should last for at least a couple of years…

Period 1 (2001 into early 2003) is best described as “neutral” – mostly range trading as the Venture gauged developments including 9/11 and the war and recession that followed…

Period 2 (early 2003 to early 2007, a bull cycle) delivered a stellar return of 280%…

Period 3 (early 2007 to the end of 2008) was nasty – an 80% wipe-out thanks to the Great Crash…

The gain during Period 4 (2009 to early 2011, another bull cycle) was staggering, similar to Period 2 but over a shorter time frame, at 264%…

Period 5 (early 2011 to early 2016) was an ugly bear market as we all know, and the Venture declined a whopping 81% (same percentage decline but worse in many ways than Period 3 because it dragged on for 5 years)…

If Period 6 is similar to Periods 2 and 4, we can expect the Venture to make its way to at least 1700 during this cycle…

In today’s Morning Musings…

1. Eskay Heart of Gold Camp update…

2. More technical evidence of a Venture turnaround…

3. Gauging the next big move for the TSX Gold Index, and one of our favorite producers reports Q2 earnings Thursday…

4.Cannabix Technologies (BLO, CSE) unveils Beta 3.0 marijuana breathalyzer…

5.Daniel’s Den – how to win in the markets…

Did you know that for as little as just over $2 a day, you can be a BMR subscriber and tap into the best analysis and picks for the junior resource sector that you’ll find anywhere, including coverage of game-changing discoveries that have already made some of our subscribers fortunes?

Last year’s BMR Top 50 List returned a whopping 118% and we are delivering market-trouncing returns again in 2017. BMR was the first to call the new bull market in the Venture in early 2016, and our coverage of the commodities space gives you valuable daily insights into price movements and critical trends. BMR is daily information that puts you ahead of the crowd!

We also give first-time subscribers an industry-leading 100% money-back satisfaction guarantee. If you don’t believe BMR has helped you make money for your first 6-month subscription period, we’ll refund your subscription fee in full – no questions asked!

To read the rest of today’s Morning Musings, sign up NOW or login as a current subscriber with your username and password.

Questions for us? Email us at: [email protected].

33 Comments

Daniel

good stuff, thanks for sharing that today.

Great piece Daniel, thank you! GGI: like to see it close above 0.32, key chart point before next level on John’s chart

Everett Makela on Linkedln – he posted a couple of spectacular photos of rock and the hillside Anomoly A. His comments “All aboard for the drill of a lifetime! Post date July 27th.

The rock called Matts Rock looks to be heavily mineralized! And the hillside – Wow!

Actually it wasn’t his comment but it was a saying that he liked and it’s next to to pic of the rock and underneath the pics he copied the last NR so that’s why I believe the photos are from anomoly A.

Dan1

Unfortunaetly Makela didn’t make that comment, he liked that comment that was made regarding the article” The high-technology research drill ship JOIDES Resolution is visiting Townsville before it undertakes a two-month expedition that could help uncover the mysteries of the Pacific ÔRing of FireÕ and the submerged continent of Zealandia.

but thanks for bringing it to our attention that he is on linked in…and the pics..

Here is the link to Everett Makela linkedin page with the pics

https://www.linkedin.com/pulse/garibaldis-discovery-bc-golden-triangle-everett-f-makela-p-geo-

The pic on Makela’s linked in page of the outcrop does appear to look the same as the oxidized outcrop at the E&L and the polished sample appears to be identical too.. lets get that drill going GGI…

Maybe we see some photos on the GGI website tomorrow. Jon, you said early this week so just maybe tomorrow. Lots of possible news upcoming, some of which may be drilling, photos, results of chip and rock samples at anomoly A, and maybe news on Anomoly B and C.

Jon

do you know if Lightfoot actually goes on sight to the locations with the other Geo’s?

Yes, Greg, Dr. Lightfoot does go on site…as far as I know he’s crunching data at the moment and will be reviewing all drill core on site…great team of Nickel experts but he’s absolutely invaluable…

Can the Makela photos described by Dan1 be posted here?

drill of a lifetime quote is from a LIKE that Everett tagged.. from an article in OZ… the rock picture I have no idea what it shows.. wish EM would have made a note on it..

and yep the hillside… Holy F…… yikes:)

no disrespect Dan1… 🙂

Link is here: https://www.linkedin.com/pulse/garibaldis-discovery-bc-golden-triangle-everett-f-makela-p-geo-

Jon, to date GGI hasn’t released the detailed VTEM’s and modelling. Do you think they will release this info before the drill turns, or wait until after?

Depends if they want to get taken out now or later, Dan1 !

Dan, Everett’s comments on linkedin was actually a link to an article for offshore drilling.

Thanks Jon

and yes Dan1 no dis respect from me either, love all your posts here, good info and good questions

thanks again for the linkedin link

Yes, Gregh, Dan found that…I didn’t even know about it, so great work on his part…and it is the drill of a lifetime, regardless!

I actually corrected the comments in post # 4, but we all know what his intent was.

Jeremy, I echo your comments on the hillside! More than one rusty rock eh!!!!

Ditto Jon to Dan1

I’m sorry guys, but anybody else feel we are on the cusp of one of the greatest nickel discoveries in a long long time?

That’s the direction this is going IMHO, Dan1…the first 12 holes have been drilled from surface, thanks to Silver Standard, now (to use a football analogy) Lightfoot and the rest of the team will take the ball over the (conductor) line for a touchdown…

Dan1

I have been doing everything I can to not think about it, lol, ever since last Thursday when they released the NR that is all I have thought about, it’s consuming me sold other stocks to buy more of GGI, if they don’t hit this time my wife wont have to kill me, I will have already beat her to it, lol…

Jon, are you as surprised as I am that Makela would post some pictures on line before we got a NR from GGI? Just curious about your thoughts on this.

Yes and no, pole…quite honestly I think in this case his excitement just got to him which is understandable…that’s not what would be considered normal protocol…can’t wait to see what GGI reveals on its site…

well this is exciting:) I was in Noront from 1 to 7… still holding because I didnt sell… only had 5K shares tho.. my only concern here is the NDP morons…

Thanks for the good answer Jon. That’s kind of what I thought. GGI’s next NR should be a hum dinger!

Jon

I think Makela was showing off for his GEO buddies out there, saying “look what I found” nana nana na, lol

“My boulders are bigger than your boulders and carry more sulphides”…geologists wouldn’t be like that, gregh, would they?…lol…

Thanks so much for all your hard work Jon, John and Daniel!

CLIVE MAUND: https://www.streetwisereports.com/pub/na/17592

Thanks, Steven1…BMR has just confirmed Dr. Peter Lightfoot for an exclusive follow-up interview later this week – that will be a dandy!

ABN is breaking out on good volume, looks like it wants to run…drilling starting imminently at Forrest Kerr…