April 23, 2022

April 17, 2022

April 10, 2022

April 3, 2022

March 27, 2022

The Week In Review And A Look Ahead!

March 13, 2022

Sunday Sizzler Report!

6:30 pm Pacific

(Exclusive to BMR Pro Subscribers – Not for Distribution or Posting on any Board!)

In tonight’s report…

1. Scintillating SALT Show on the way…

2. There’s Real Power in MAXX Power…

Editor’s note: Part 2 tomorrow covers Crude Oil including 2 cheap Oil stocks.

The Eskay Creek of Salt Deposits

Atlas Salt (SALT, TSX-V)

Rowland Howe, “Mr. Salt”

This is certain to be a fascinating week for Atlas Salt (SALT, TSX-V). High net worth investors are gathering Wednesday afternoon in London, Ontario, for the company’s first-ever “show and tell” event. BMR will be in attendance.

The timing and location are both conspicuous, to say the least, as drilling continues at Great Atlantic (investors have been expecting a progress report) while London just happens to be the closest city to Compass Minerals‘ (CMP, NYSE) Goderich mine.

How ironic!

Google says: “Goderich is known for its breathtaking shoreline and historic downtown area. Given the charm and character of Goderich, Queen Elizabeth has coined Goderich ‘the prettiest town in Canada’. Uniquely, Goderich is also home to the largest underground Salt mine in the world.”

Atlas‘ Great Atlantic is on track to become the shallowest underground Salt mine in the world, starting at a depth of just 600 feet vs. 1,800 feet at Goderich, and the lowest cost producer with enough of a resource entering current drilling to keep production going for 100 years. That means it’ll be “checkmate” very soon for Compass and Stone Canyon/Kissner, as neither of those 2 entities who dominate the North American Salt market can afford to have a “disrupter” like Atlas destroy their pricing models with ultra-cheap production from a state-of-the-art “Salt Factory” like Great Atlantic immediately adjacent to a deep water port.

It’s the perfect set-up for an old-fashioned bidding war that would make the recent battle for Noront Resources (NOT, TSX-V) – one we also correctly predicted – look like a tea party.

The North American high-grade Rock Salt market shares some similarities with the Oil and Gas sector, beyond the fact that both Goderich and Great Atlantic were both discovered through Oil and Gas exploration:

- Underinvestment in the Salt sector over the years has created a “security of supply” problem, just like with Oil – we need to produce more;

- The U.S. in particular relies heavily on imports – skyrocketing shipping costs from Chile and North Africa are putting those imports at risk;

- No new mines in the last 20 years and only 1 new discovery – Great Atlantic.

Shipping costs from Chile and North Africa are now believed to exceed what would be the combined production and shipping costs from Great Atlantic, so there’s no way those overseas markets are going to be able to compete.

And in this inflationary environment, the ageing mines in North America including Goderich are suffering disproportionately with respect to costs. Having said that, Goderich is still incredibly profitable. For fiscal 2021, which was just a 9-month period, Compass reported that its Salt segment generated $133.2 million (U.S.) in operating earnings and EBITDA of $186.5 million, increases of 14% and 13%, respectively, from comparable 2020 period results.

Under Rowland Howe’s mine management, Compass ran to $100 (U.S.) a share by 2011 for a gain of more than 650%. Under Rowland, SALT has jumped 138% so far (from 65 cents when he was named President last April to the latest closing price of $1.55).

With Atlas, we’ve got a thoroughbred like Secretariat (also known as “Big Red“) and the very best jockey in “Mr. Salt”. With Howe at the helm we’re going to see much higher SALT prices because, quite frankly, this asset is worth far more than $1.55 a share or $120 million.

Atlas started behaving like it should Friday when it jumped nearly 20% intra-day while the Dow came under more pressure due to higher Oil prices, inflation concerns, and war. Those are the reasons the Dow has been struggling for the past 5 weeks and they’re also reasons why the case for SALT is stronger than ever.

SALT Short-Term Chart

- RSI(14) has landed in a strong support area near 50% and should turn higher this week

- SS is in a favorable low position

- Ideal technical set-up for a near-term breakout above the EMA-50 (EMA-10 on this weekly chart) and the short-term downtrend line

- ADX indicator confirms a continuing bullish trend with plenty of room to strengthen

- Superb support around $1.30 and the rising EMA-200 (EMA-40 on this weekly chart) has held

Feds Take “Hydrogen High Road”

The Trudeau government is doubling down on its green agenda, even in the face of a lack of Oil supply and surging Oil prices. This is sure to have positive implications for Atlas Salt’s clean energy plans in Newfoundland through a green Hydrogen-wind power combination that takes advantage of world class Salt dome storage potential and an incredible wind resource along the prolific St. George Basin (~200 sq. km of which is owned by SALT).

With opposition at the cabinet table from Quebec, the Feds are holding up approval on a massive offshore Oil project led by Norwegian Oil giant Equinor.

Ottawa said Friday, March 4, in a news release that federal Environment Minister Steven Guilbeault has been granted another 40 days to review the “extensive information” about whether the proposed Bay du Nord Project off the coast of St. John’s will have significant environmental impacts. The project would open a 5th Oilfield in this area where some experts say there’s an estimated 800 million recoverable barrels. Recently, 118 environmental groups (where did all their funding come from?) and academics across Canada signed a letter calling for Ottawa to reject the project, saying it’s incompatible with Canada’s domestic and global climate commitments.

If the Trudeau Liberals do reject this project, which is very possible, you can be sure they will “make it up” to Newfoundland and Labrador with major investments in the green space to drive their Hydrogen strategy. No matter what they decide to do with Equinor’s project, they are going to fly the green flag more vigorously than ever.

Speaking last week at The Canadian Club in Toronto to promote the federal environmental strategy ahead of the release of Canada’s new road map for greenhouse Gas reductions coming at the end of the month, Guilbeault said Canada cannot realistically help Europe replace its Russian Oil imports with Canadian Crude or Natural Gas, but it can and is looking at ways to export renewable energy such as Hydrogen.

“European leaders want not only to reduce their reliance on Russian Oil, they want to reduce their reliance on Oil altogether,” Guilbeault said. “This is where Canada can really help.”

In particular, Guilbeault pointed to Hydrogen.

Hydrogen is still in the early stages as an energy industry in Canada – Canada is in the top 10 of Hydrogen producers globally but makes about 3 million tonnes of it for industrial use. China, the world’s top producer, makes more than 8 times that much.

But Hydrogen was a major part of the conversation between German Chancellor Olaf Scholz and Prime Minister Justin Trudeau when they met in Berlin last Wednesday.

“This is one aspect for a very long-term strategic co-operation between Canada and Germany, because we understand acutely that Canada is a country that can help us import Hydrogen, which will be produced in an environmentally friendly manner,” Scholz said in German.

On March 21, the International Energy Agency (IEA) is hosting a meeting in Paris to discuss options to help Europe. Natural Resources Minister Jonathan Wilkinson is to attend. At the CERAWeek energy conference in Houston last week, Wilkinson also pitched Canada’s Hydrogen potential. “Canada has huge opportunities associated with the production of ultralow carbon Hydrogen,” he said. “Hydrogen will be important for domestic use but can also enable huge international opportunities for supply to geographies including Europe and Japan.”

MAX Power (MAXX, CSE)

Our job is to find you low-risk, high-potential wealth building opportunities. We prefer quality over quantity, especially in more challenging market environments.

A couple of weeks ago we introduced newly-listed MAXX Power (MAXX, CSE) when it was trading in the upper 30’s. On Friday it closed at 51 cents, and that’s just the beginning of a powerful move that should take this stock well beyond its currently meagre $14 million market cap.

Grab anything you see in the 40’s and 50’s because MAXX has the “look and feel” of a stock that wants to hit triple digits in a hurry. There is little resistance in the way.

MAXX is living up to its name in its early days as a publicly traded junior resource company. In 17 sessions following its 25-cent IPO, MAXX has been the leading stock on the CSE in terms of percentage gains with minimum average daily volume of half a million shares.

While MAXX is currently drilling at Nicobat in Northwest Ontario for Nickel-Cobalt-PGE’s-Copper-Zinc, this is much different than your ordinary exploration opportunity. In this case, they could easily shoot blanks at Nicobat and the stock could still go through the roof.

What gives? Let us explain.

Structure and management are key when you buy a junior resource stock, or any speculative stock for that matter. It’s 1 thing to have a great project, which is what most investors focus on, but that project won’t go very far unless the right structure and management are in place. That, in turn, will drive a game plan and price action.

MAX Power Highlights

- Only 28 million shares outstanding, nearly 40% of which are currently escrowed;

- No warrants other than 1 million held by another company and 540,000 broker warrants from a small IPO;

- Strategic financings from Day 1 – only strong investors were permitted in this deal. They are buyers at current levels and have massive networks;

- CEO is Rav Mlait – he is solid, genuine and visionary, and took his #1 deal up more than 20-fold;

- The company’s listing property is the Nicobat Project in Northwest Ontario. Nicobat deserves to have some holes drilled into it, but we expect this property to only be a “sideshow”;

- MAXX has “mystery” written all over it at the moment, and that’s what can really drive a share price. With a powerful group behind this play, speculation is going to run rampant that MAXX may soon acquire something VERY SIGNIFICANT and SEXY;

Mlait from Feb. 18 NR: “Our immediate focus is the under-explored Nicobat Project in Northwest Ontario’s Rainy River district, host to New Gold’s Rainy River Gold mine. Nicobat is our listing property acquired from Sassy Resources which currently owns 18% of MAX Power. The company is also evaluating additional potential high impact opportunities in the broader resource space that could be a strategic fit for MAX Power during this commodity bull cycle.”

Pay particular attention to that last sentence: “The company is also evaluating additional potential high impact opportunities in the broader resource space that could be a strategic fit for MAX Power during this commodity bull cycle.”

Timing for this team couldn’t be better – we’re all seeing what’s unfolding in the commodity space from Oil and Gas to Lithium to Uranium to Nickel to Gold, just to name a few.

Mlait has resource sector experience but is more known for his technology expertise. Technology and the resource sector are a powerful combination. We’re speculating, of course, but MAXX could easily come up with something in this context that gives it incredible blue sky potential and a valuation that is multiples to the current share price.

Note: John, Jon and Daniel hold share positions in SALT. Jon also holds a share position in MAXX.

March 12, 2022

The Week In Review And A Look Ahead!

(Exclusive to BMR Subscribers – Not for Distribution or Posting on any Board!)

January 31, 2022

BMR Evening Alert!

January 31, 2022

SALTsATIONAL !!!

Today’s news from Atlas Salt (SALT, TSX-V) is just the tip of a Newfoundland iceberg (https://atlassalt.com/atlas-advances-great-atlantic-feasibility-study-drill-program-steps-out-500-meters-on-first-hole/).

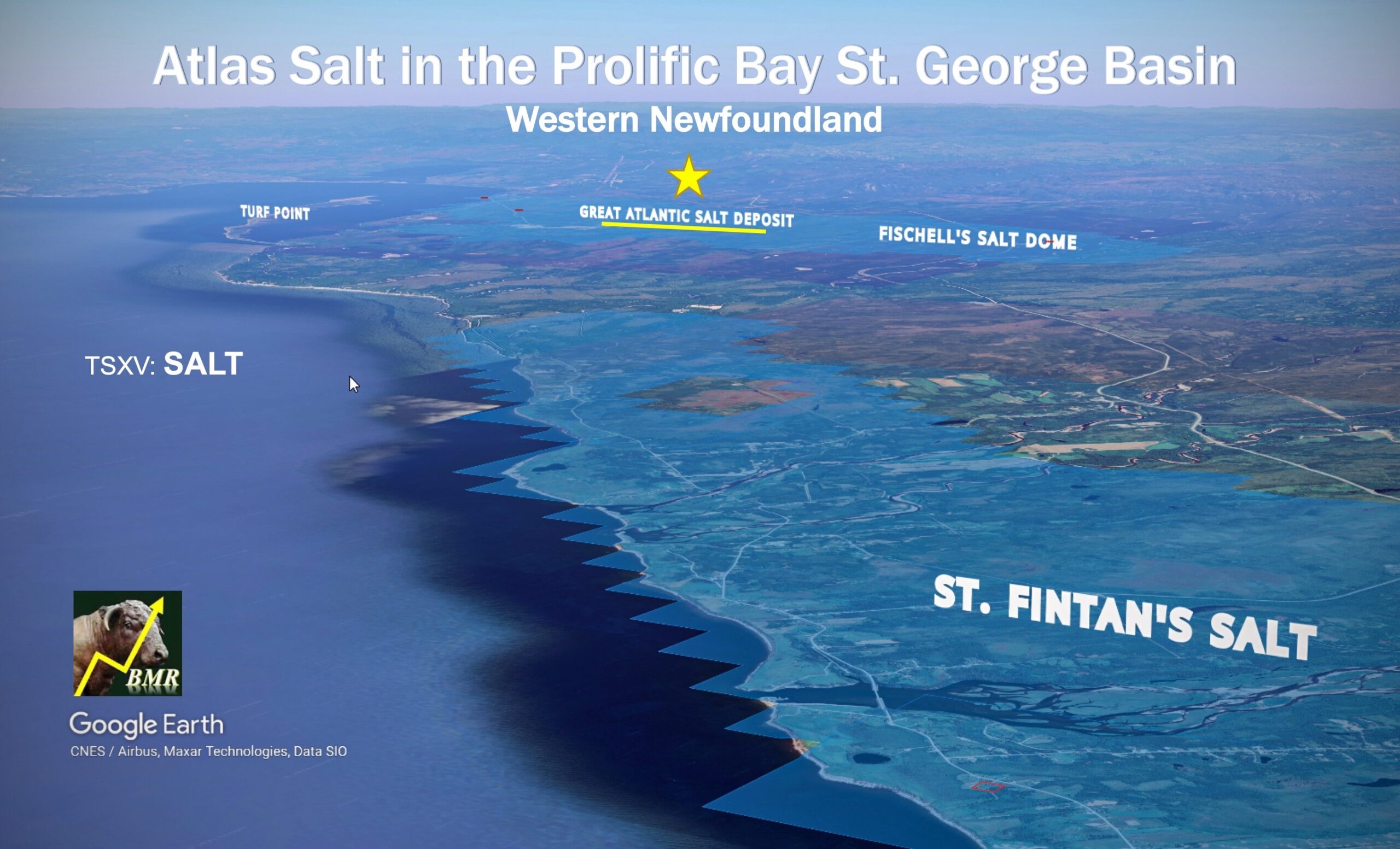

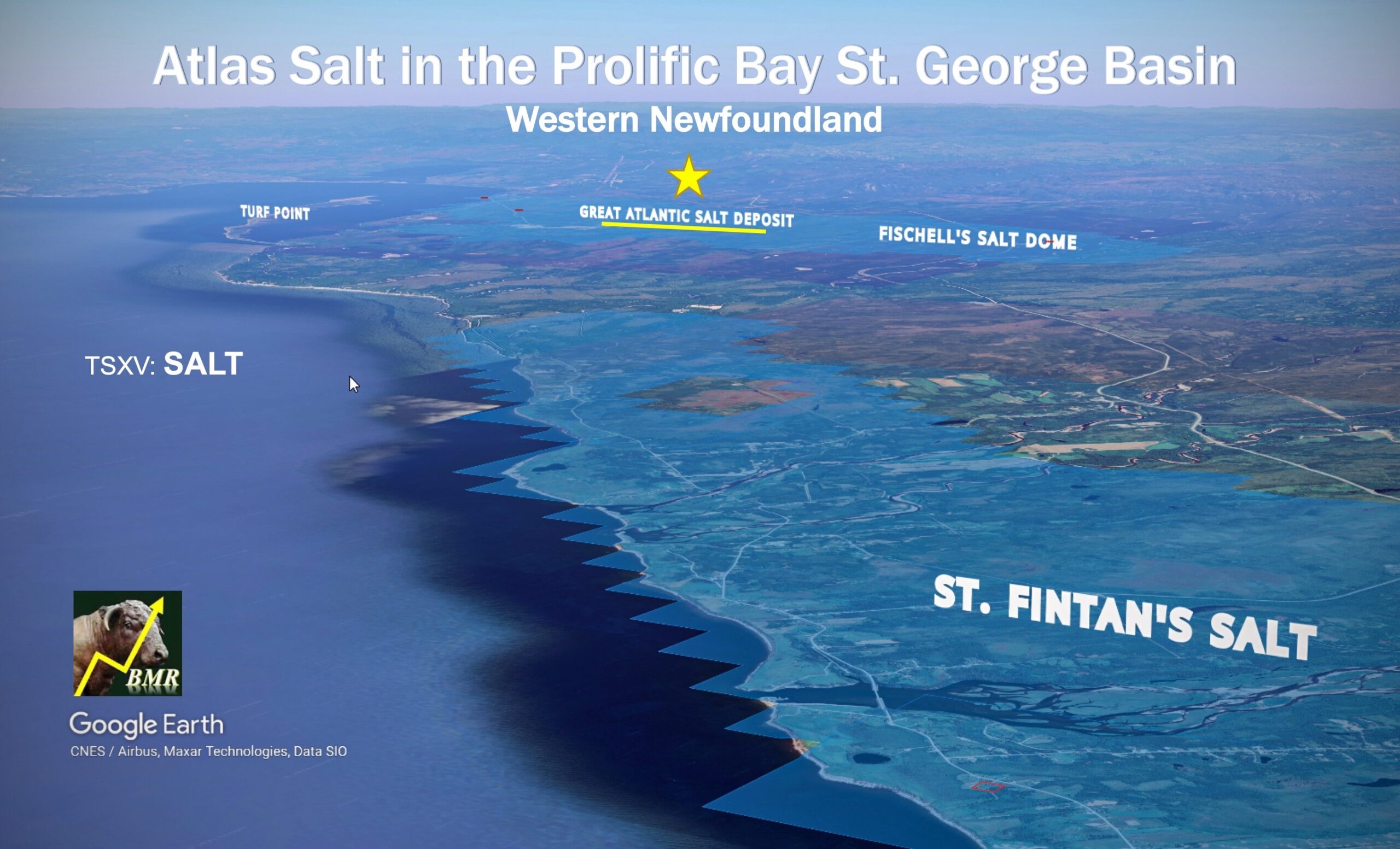

The Bay St. George Sedimentary Basin is truly SALTsATIONAL. It extends for about 100 km, and Atlas owns 100% of the best parts of it based on an incredible database comprising seismic and other data obtained from Oil and Gas exploration many years ago.

The jewel in this crown, the Cash Cow that’s going to be the gift that keeps on giving for decades, is of course the Great Atlantic Salt deposit.

Today we got ample fresh evidence that Great Atlantic is truly world class, the Eskay Creek of Salt deposits as we’ll elaborate on in another post.

The looming battle over who ultimately puts this unique resource into production, at a time when security of supply issues are haunting the road Salt sector, is going to make the Wyloo–BHP battle over Noront’s riches seem like a tea party.

Very special geological forces produced the shallowest Salt deposit in all of eastern North America immediately beside a deep water port in western Newfoundland.

Think for a minute about the implications of that.

Compass Minerals (CMP, NYSE) is currently the largest and lowest cost producer in the road Salt sector (thanks in part to Rowland Howe!) at $45 (CDN) per tonne (all-in, includes shipping). They are fetching $85 (CDN) per tonne for product.

Compass is mining very profitably from a depth of 1,800 feet. The top of the Great Atlantic deposit is 600 feet.

As Howe (“Mr. Salt”) confirmed today, Great Atlantic is on track (pending final geotechnical evaluations from current drilling) to become the first underground Salt mine in North America accessed through inclined ramps as opposed to vertical shafts.

A first in North America – another feather in the cap of “Mr. Salt”.

And in resource-friendly and infrastructure-rich Newfoundland where they cheer development and success like this.

The CAPEX and operational cost savings for this unique scenario are profound – so profound, we would argue, that privately held giant Stone Canyon, and publicly traded Compass, simply cannot afford to NOT get their hands on this deposit.

Call it The Battle For Great Atlantic. And it’s coming to a theatre near you, soon.

Below is a transcript of 2 key questions we asked Rowland in an interview late this afternoon:

BMR: “I’m sure you could easily put this deposit into production yourself, Rowland – I gather you’ve got lots of backers who would get behind you on this, no problem at all. Is it your thinking that you want to put this into production yourself? There are some potential suitors out there, obviously.”

Rowland Howe: “I think the answer is quite simple. Our focus has always been on shareholder value. And our plan will do whatever is required to maximize shareholder returns and get the best bang for the buck.”

BMR: “Okay, Great Atlantic is certainly shaping up to be a disruptive low cost producer, so my next question is, how could a Stone Canyon or a Compass or another player or two afford NOT to have this asset?”

Rowland Howe: “I guess that’s a question that they’re going to have to contemplate and ask themselves.”

Enough said.

Now, just when you thought you couldn’t handle even more great news, comes this…

Below is a Google Earth image we produced that really puts into perspective the scale of Atlas‘ holdings in the prolific Bay St. George Basin.

It would be a reasonable ballpark estimate (not NI-43–101 compliant, of course) that the total amount of Salt underlying Great Atlantic, Fischell’s Brook and St. Fintan’s easily exceeds a combined 10 billion tonnes.

The deposit at Great Atlantic, of course, is unique – it’s very high-grade, homogeneous and shallow. Enough at the current resource estimate to maintain production for 100 years at 4 million tonnes a year (Goderich has been producing for 60 years).

Fischell’s Brook and St. Fintan’s are different, but special in their own right. They are Salt caverns, ideal for the storage of renewable energy (potentially green hydrogen derived from a wind energy project as the wind resource in this part of Newfoundland is extraordinary). Fortescue Future Industries has already publicly disclosed its interest in Newfoundland & Labrador for potential green hydrogen projects, and they are well aware of the Bay St. George Basin and Atlas Salt.

- Fischell’s Brook, officially a “Salt Dome”, has a minimum surface footprint of 2.25 sq. km and a known vertical extent of at least 1,000 m in areas – this is a huge structure by Salt Dome standards, representing in the neighbourhood of 500 million cubic meters of potential storage space (actual storage capacity would be less, but this is a world class Salt Dome in terms of its size and strategic location). Upcoming gravity survey results will help define the boundaries of Fischell’s Brook;

- The claims (St. Fintan’s Salt) staked by Atlas last spring along the coast, based on historic seismic data, cover what’s interpreted to be a “Salt Ridge” extending for a whopping 20 km (west to east). At least half of this structure is considered prospective for Salt caverns;

- What you see below is unique in all of Canada – there’s nothing else like it.

Stay tuned!

Disclaimer: BullMarketRun.com is strictly reader/subscriber funded, independent of the companies it covers as we accept no advertising on our site and no fees or compensation for any of our coverage. Our material is for informational and entertainment purposes only and must not be viewed or interpreted as “buy”, “sell” or “hold” recommendations. No investment opinion or other advice is being rendered on any stock or company. We strongly recommend that you consult with a qualified investment adviser, one licensed by appropriate regulatory agencies in your legal jurisdiction, and perform your own due diligence and research before making any investment decisions. The stocks we cover, by definition. are highly speculative and potentially very volatile. Investors are cautioned that they may lose all or a portion of their investment if they make a purchase or short sale in these speculative stocks. We are not Registered Secuirites Advisers. Our opinions can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Adviser operating in accordance with the appropriate regulations in your area of jurisdiction. It should be assumed that BMR personnel, writers and associates may hold or dispose of or trade in positions in any securities mentioned herein at any time. BMR or its personnel were not compensated in any way for the creation or distribution of this article.

Note: John, Jon and Daniel hold share positions in SALT.

BullMarketRun.com

BullMarketRun.com