8:00 pm Pacific

(Exclusive to BMR Pro subscribers – Not for Distribution or Posting on any Board).

Orford Mining (ORM, TSX-V)

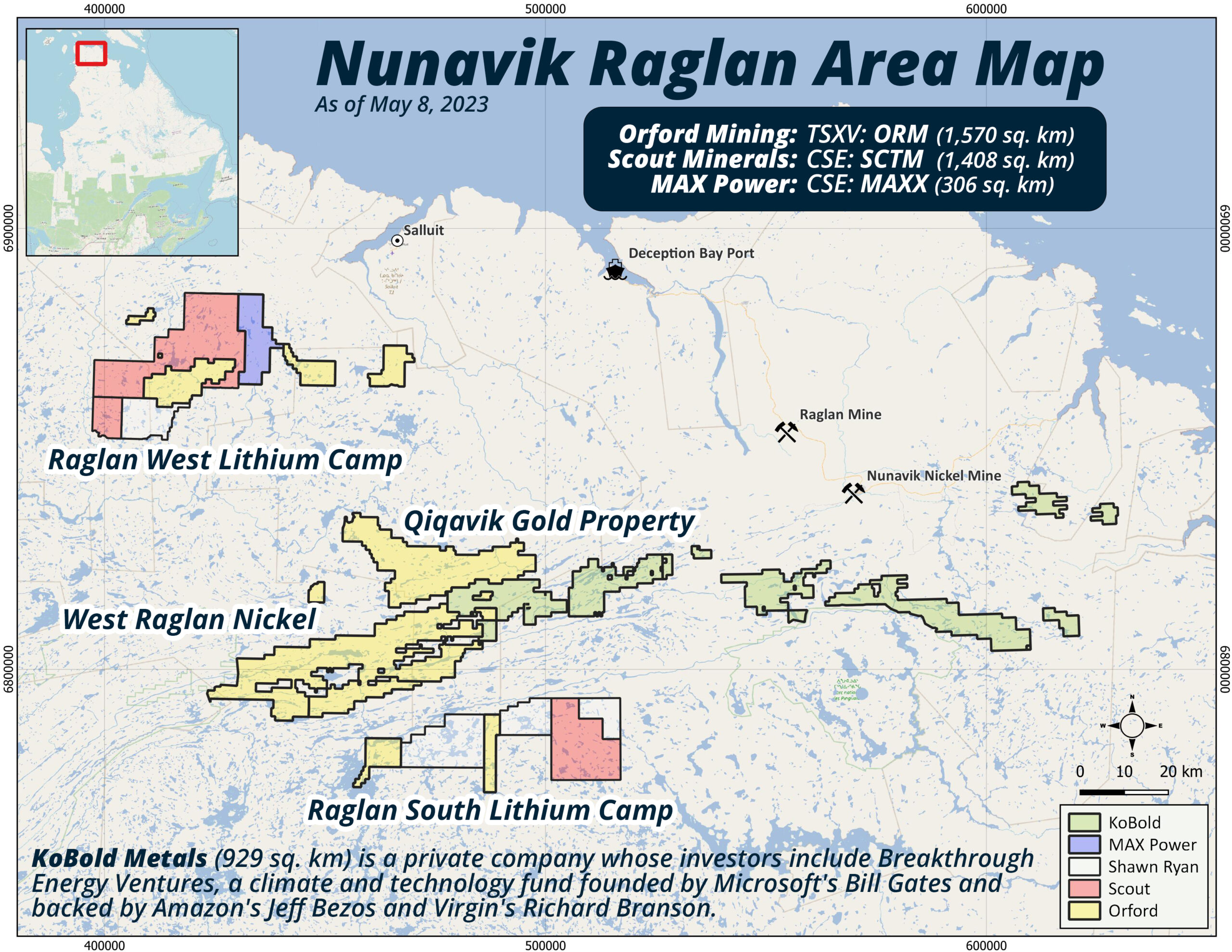

At a time when new high-grade Lithium, Nickel and Gold discoveries are desperately needed, there’s a blockbuster story developing in Nunavik – the top third of Quebec, nearly the size of Texas.

Orford Mining (ORM, TSX-V) is in the heart of it, and they’ve got an interesting neighbor in privately-held KoBold Metals who’s also in the heart of it.

Kobold’s last round of financing was $200 million (U.S.), and they’ve got unlimited amounts of potential cash given the backing of the likes of billionaires Bill Gates, Jeff Bezos, Michael Bloomberg and Richard Branson.

Follow the money, as the saying goes. They are bullish on Nunavik for many reasons, as we’ll detail in the days ahead.

KoBold, convinced it’s closing in on a big new Nickel-Cobalt discovery in Nunavik’s Raglan area, is gearing up for a MAJOR summer drill program while also keeping a sharp eye on developments at Orford’s West Raglan Nickel-Copper-PGE Project being funded by Wyloo Metals which has upped its interest in West Raglan to 51%.

Orford’s total landholdings comprise 1,570 sq. km vs. 929 for KoBold.

KoBold has also expanded its mineral interest across the globe beyond Nickel and Cobalt to Lithium, so it’s also paying close attention to the possibility that Nunavik could host fields of spodumene-bearing lithium pegmatites. Such a discovery would have huge implications for the Canadian resource sector and development of Quebec’s far north which already hosts 1 of the premier Nickel belts in the entire world and 1 of the planet’s lowest cost Nickel mines at Raglan.

A remote sensing program now being carried out by Orford, with results expected before the upcoming field season, could provide the proof that certain pegmatites in Nunavik are indeed highly mineralized.

Then it’s Game On.

The Gold story completes the Trifecta and helps explain Orford’s $6.2 million private placement announced Friday, about 30% of which will be taken by key shareholder Alamos Gold (AGI, TSX; NYSE).

Don’t you love it how these big companies are swirling around Orford?

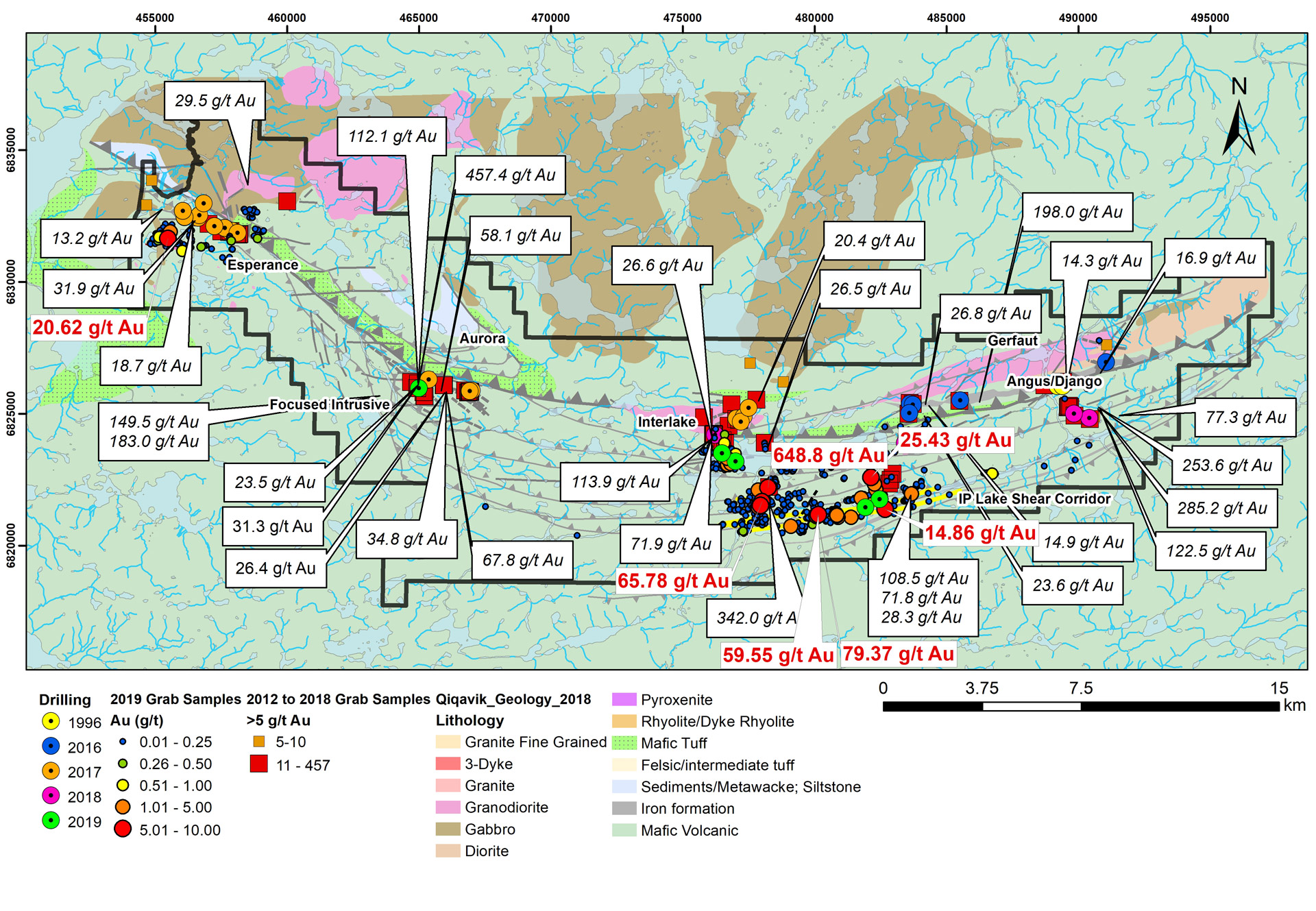

Orford’s Qiqavik Project is interpreted as a massive new district Gold discovery stretching east-west for at least 40 km.

It would be a shocker if there aren’t multiple deposits here, like pearls on a string. That’s what Alamos is thinking, so Orford – armed with new structural insights – is getting ready to spray this district with literally dozens of drill holes.

ORM Short-Term Chart

Orford is the type of stock, given its overall technical and fundamental momentum, that should display highly reliable support for an extended period at its rising 100-day EMA, currently 13 cents.

PP games wiped nearly 20% off Orford last week but smart money accumulated on the weakness.

There isn’t another stock in Canada that has Gold, Lithium and Nickel in its favor like Orford – it’s in a league by itself in terms of this kind of multi-mineral discovery potential, so investors just can’t go wrong here.

It’s going to be a very HOT summer for ORM and investors who prepare now will be handsomely rewarded.

- RSI(14) appears to be bottoming around 40%

- Current down channel is a bullish set-up – watch for a breakout above this channel

- Exceptional Fib. support between 12 and 13 cents in the immediate vicinity of the rising 100-day EMA

Patriot Battery Metals (PMET, TSX-V)

If you want a great example of how Orford should trade over the coming months, with respect to its 100-day EMA, look no further than Patriot Battery Metals (PMET, TSX-V).

Each major downtrend in PMET has found support at or in the immediate vicinity of the 100-day EMA.

Atlas Salt (SALT, TSX-V)

Speaking of the importance of embracing pullbacks…

Atlas Salt (SALT, TSX-V) finally bottomed and broke out aggressively above its 3-month downtrend at the end of April, racing as high as $1.57 May 5 (78% gain off its mid-April 88-cent low) before retracing about half of that advance by closing at $1.17 last Friday.

We called for support on an anticipated pullback between $1.17 and the low-to-mid-$1.20’s, so now’s the time to get aggressive on the accumulation side again.

Next measured Fib. on John’s 9-month daily chart is $3.27. That’s nearly a triple from current levels, so Pro subscribers can’t say they didn’t have a chance to hit big here – on multiple occasions as history repeats itself.

Selection of a new CEO should be soon.

Note: John, Jon and Daniel hold share positions in SALT. John and Jon hold share positions in ORM. Jon also holds share positions in AGI and PMET.

8 Comments

Hi Jon,

I always suspected a insider was driving the price of salt down. Any comments?

Filed 2023-05-12 13:25

Tx date 2023-05-08 $SALT

Atlas Salt Inc. Laracy, Patrick J.

4 – Director of Issuer, 5 – Senior Officer of Issuer

Direct Ownership

Common Shares

11 – Acquisition or disposition carried out privately $-289,590.03

-205,383 vol

$1.41 each 4,603,889

I have been quiet because you did not reply to my comment of incompetent people running Salt.

Cheers!

Hi Jon,

do you have any update from MUR? Your last post/review on MUR dates end of 2022, and was quite bullish. They have been quite silent on the news front. Are you as bullish on MUR as before? Do you question execution? Thanks for your feedback on this.

That aside, yep ORM looks great, thank for the heads-up on this one.

Richard

Hi Randd51, at least it was reported just a few days after he did it, AND it was done PRIVATELY, not dumping on the market.

randd51, are you kidding me? You’re complaining about a CEO adding a million shares of the company?

When directors exercise options in Canada, thanks to the Trudeau govt., they immediately have to pay tax on that move…so Laracy had to pay $120,000 for the options, plus look after our big spending, high tax socialist govt., hence the sale of 200,000 shares at $1.41 to pay for it all…note that it was a private sale, not a TSXV sale, so it was smart to do it that way, and I’m sure the buyer at $1.41 was strategic.

So everyone wins at the end of the day…not sure how that could be a bad thing…

More great grades at Corvette from PMET…

PATRIOT DRILLS 122.6 M AT 1.89% LI2O, INCLUDING 8.1 M AT 5.01% LI2O, AND EXTENDS HIGH-GRADE NOVA ZONE, AT THE CV5 PEGMATITE, CORVETTE PROPERTY, QUEBEC, CANADA

2023-05-16 18:42 ET – News Release

Highlights

Additional high-grade Zone discovered, marking interpreted western extension of the Nova Zone – drill holes CV23-130, 132, 134, and 138:

– 122.6 m at 1.89% Li2O (126.0 m to 248.5 m), including 8.1 m at 5.01% Li2O (CV23-138).

– 130.3 m at 1.56% Li2O (164.0 m to 294.3 m), including 52.7 m at 2.45% Li2O (CV23-132).

– 101.3 m at 1.44% Li2O (123.3 m to 224.6 m), including 28.1 m at 3.00% Li2O (CV23-134).

– 101.2 m at 1.08% Li2O (145.5 m to 246.7 m), including 10.1 m at 2.42% Li2O and 4.0 m at 4.13% Li2O (CV23-130).

Other significant intercepts:

– 101.2 m at 1.59% Li2O (240.3 m to 341.5 m), including 28.5 m at 4.14% Li2O or 8.8 m of 5.20% Li2O (CV23-141).

– 56.3 m at 2.34% Li2O (251.4 m to 307.6 m), including 11.1 m at 4.06% Li2O (CV23-114).

– 57.7 m at 1.46% Li2O (182.0 m to 239.7 m), including 13.3 m at 2.65% Li2O (CV23-168A).

– 43.5 m at 1.80% Li2O (239.5 m to 283.0 m), and24.0 m at 2.04% Li2O (372.9 m to 396.9 m) (CV23-127).

A continuous 93 m interval of dominantly spodumene-bearing pegmatite in most westerly drill hole completed to date at the CV5 Pegmatite – CV23-184 (assays pending).

A continuous 139 m interval of dominantly spodumene-bearing pegmatitein final drill hole of the 2023 winter program at the CV5 Pegmatite – CV23-190 (assays pending).

Core sample assay results for 27 drill holes completed during the 2023 winter drill program remain to be reported.

Blair Way, Company President and CEO, comments: “The drill bit continues to deliver for us as confirmed by the strong grades and wide widths of mineralized pegmatite reported herein. With our last hole providing the longest pegmatite intersection of the winter drill program (139 m), we are certainly primed for continued success as we approach the beginning of our summer-fall drill program, scheduled to commence later this month. With core sample assays for numerous drill holes remaining to be received, the Company’s geological team is steadfast focused on final validation of the CV5 Pegmatite’s geological model, inclusive of all drill holes completed to date, ahead of an initial mineral resource estimate.”

VANCOUVER, British Columbia and SYDNEY, Australia, May 16, 2023 (GLOBE NEWSWIRE) — Patriot Battery Metals Inc. (the “Company” or “Patriot”) (TSX-V: PMET) (ASX: PMT) (OTCQX: PMETF) (FSE: R9GA) is pleased to announce core assays for the next series of drill holes completed as part of the 2023 winter drill program, which recently concluded, at its wholly owned Corvette Property (the “Property”), located in the Eeyou Istchee James Bay region of Quebec. The winter phase of the 2023 drill campaign was focused on the CV5 Pegmatite, located approximately 13.5 km south of the regional and all-weather Trans-Taiga Road and powerline infrastructure.

Core assays, for the drill holes reported herein (Figure 1), cover the CV5 Pegmatite’s recently defined eastward extension (see news releases dated February 5 and March 23, 2023) (Figure 2), the east-central area proximal to the CV1 outcrop (Figure 2), and the recently defined westward extension (see news release dated May 1, 2023) (Figure 3).

The drill holes targeting the east-central area of the CV5 Pegmatite were completed during the winter program to take advantage of more practical and cost-effective ground access. These drill holes were highly successful with mineralized pegmatite intervals of 122.6 m at 1.89% Li2O, including 8.1 m at 5.01% Li2O (CV23-138), 130.3 m at 1.56% Li2O, including 52.7 m at 2.45% Li2O (CV23-132), 101.3 m at 1.44% Li2O, including 28.1 m at 3.00% Li2O (CV23-134), and 10.1 m at 2.42% Li2O and 4.0 m at 4.13% Li2O (CV23-130). These four (4) drill holes define a new high-grade zone, which is interpreted to represent a continuous 200+ m extension westward of the high-grade Nova Zone (see news release dated March 29, 2023). Drill holes CV23-181 (108 m of continuous pegmatite) and CV23-148 (95 m of continuous pegmatite) tested the connection of the zones (i.e., the area between), with assays pending for both. However, based on logged modal spodumene content, the high-grade Nova Zone is now interpreted to extend continuously from at least drill hole CV23-132 to CV23-108, a distance of approximately 1,100 m.

Assay results for two (2) drill holes completed over the recently discovered westward extension of the CV5 Pegmatite (see news released dated May 1, 2023) confirm strong lithium grades over moderate to wide intervals in this area – 38.4 m at 1.19% Li2O, 7.8 m at 3.01% Li2O, and 8.8 m at 1.29% Li2O (CV23-176), and 33.4 m at 0.87% Li2O and 12.8 m at 1.25% Li2O (CV23-161).

The CV5 Pegmatite remains open along strike westwardly in this area with the westernmost drill hole completed to date (CV23-184) returning a continuous 93 m interval of dominantly spodumene-bearing pegmatite. Additionally, the final hole of the winter program (CV23-190), also completed in this area, returned a continuous 139 m interval of dominantly spodumene-bearing pegmatite – the widest pegmatite intercept of the 2023 winter program at the CV5 Pegmatite. Core sample analysis for both CV23-184 and 190 have not yet been reported. These drill holes were also completed in opposite directions across the CV5 Pegmatite body, further attesting to the sizable blow-out (i.e., sizable width) of the pegmatite in this area.

The 2023 winter drill program recently concluded with a total of 89 drill holes and 32,367 m completed – drill holes CV23-105 through 190. Through the 2023 winter program, the CV5 Pegmatite has now been traced continuously by drilling (at approximately 50 to 150 m spacing) as a principally continuous spodumene-mineralized body over a lateral distance of at least 3.7 km (CV23-184 to CV23-125) and remains open along strike at both ends and to depth along most of its length.

Due to the continuity of the pegmatite confirmed by the 2023 winter drill program, all holes completed to date at the CV5 Pegmatite (through CV23-190) will be included in the forthcoming mineral resource estimate. The Company is targeting a July 2023 announcement and is dependent on timely receipt of all outstanding core sample assays from the laboratory, as well as final database and model validation.

The Company’s summer-fall drill exploration program is scheduled to re-commence in late May at the CV5 and CV13 pegmatites. The summer-fall surface program is scheduled to begin in early June and continue through late September.

More impressive results from NFG at Keats West…

NEW FOUND INTERCEPTS 5.16 G/T AU OVER 28.65M & 4.02 G/T AU OVER 14.65M AT KEATS WEST

New Found Gold Corp. has released the results from nine diamond drill holes that were completed as part of a drill program designed to test the newly discovered Keats West zone, a low-angle thrust fault that dips gently to the south-southwest and is located on the west side of the highly prospective Appleton fault zone (AFZ). New Found’s 100-per-cent-owned Queensway project comprises a 1,662-square-kilometre area, accessible via the Trans-Canada Highway, 15 km west of Gander, Nfld.

Keats West highlights:

– Keats West is a shallow zone of gold mineralization starting at surface, with all intercepts drilled to date occurring above 130m vertical depth. It is defined by continuous gold mineralization over an area spanning 305m long by 250m wide that averages 30m in thickness.

– Today’s highlight intervals continue to demonstrate excellent continuity of high-grade gold mineralization over considerable thicknesses as seen in NFGC-23-1171 grading 5.16 g/t Au over 28.65m and in NFGC-23-1189 grading 4.02 g/t Au over 14.65m. NFGC-23-1171 occurs 60m along strike of previously released interval of 10.1 g/t Au over 22.50m in NFGC-22-945 (March 21, 2023) and NFGC-23-1189 occurs 25m along strike of previously released interval of 17.2 g/t Au over 22.90m and 12.0 g/t Au over 18.40m in NFGC-22-1040 (April 25, 2023).

– Additional intervals released today such as 2.71 g/t Au over 10.15m and 1.71 g/t Au over 12.85m in NFGC-23-1158, 2.55 g/t Au over 17.05m in NFGC-23-1162, and 1.58 g/t Au over 13.10m in NFGC-23-1180 are characteristic of the broad domains of gold found at Keats West, with true widths of these intercepts estimated to be between 70-95%.

Melissa Render, vice-president of exploration, stated: “These are exceptional results from Keats West; with interval lengths near true width, occurring at or near surface, and impressive consistency of grade and thickness from hole to hole, this discovery west of the AFZ remains one of our greatest discovery achievements. With 64,000 meters pending assay results along both sides of the Appleton Fault Zone, we are eager to see what comes next at Queensway.”

Re: Triple point and the hydrogen boom in Newfoundland. Korean powerhouse conglomerate SK Ecoplant to invest $50 million USD for a 20% stake in World Energy GH2s wind-hydrogen project in Bay St. George Newfoundland https://www.koreaherald.com/view.php?ud=20230517000619

It’s safe to assume, Foz1971, that Fischell’s Brook was part of GH2’s proposal to the Newfoundland govt., with wind energy rights to be awarded fairly soon…GH2 should be a shoe-in for that…all adds to the value of what’s going on there…